Stocks rallied in 2024, delivering a second consecutive year of gains exceeding 20%, as investors embraced cooling inflation, falling interest rates and the prospect of lower corporate taxes under a second Trump administration. The last time the S&P 500 achieved two or more straight years of +20% growth was during the late 1990s, when the internet boom fueled market optimism.

Much like those high-flying days, 2024 saw tech stocks capture investors’ imaginations. This time, though, it was the promise of artificial intelligence (AI) that drove enthusiasm.

Among the top five best-performing S&P 500 stocks, two (Palantir and NVIDIA) are directly tied to AI, while two others (Vistra and GE Vernova) benefit indirectly through increased energy demand. United Airlines, the fifth-best stock, is reportedly integrating AI to streamline operations like notifications and pilot rebooking, but investor excitement appears largely centered on the recent travel boom and United’s $1.5 billion share buyback program.

Palantir and NVIDIA Ride the AI Wave to Historic Gains

AI dominated headlines and the stock market in 2024, pushing companies like Palantir and NVIDIA to triple-digit growth. Palantir, which specializes in data analytics and AI platforms, saw a massive 340% surge in its stock price, making it the best performing S&P 500 stock of 2024.

Palantir’s work with the Department of Defense has been particularly impactful. Major contracts, such as a $480 million deal for its Maven Smart System and a $401 million follow-on contract for its data-gathering Vantage platform, highlight Palantir’s expanding role in military applications.

Meanwhile, NVIDIA benefited immensely from its position as the dominant supplier of GPUs (graphics processing units). The Santa Clara-based company—whose technology powers data centers around the globe, enabling AI applications and Bitcoin mining—generated a jaw-dropping $35 billion in revenue in the third quarter alone as demand for its hardware has soared. As of January 6, 2025, NVIDIA is the world’s second-largest company by market cap, valued at $3.7 trillion.

Data Centers Boost Demand for Energy

Utilities, the lowest-performing S&P 500 sector in 2023, rebounded strongly in 2024, reflecting a major shift in electricity consumption as AI, electrification and decarbonization drive demand. The Energy Information Agency (EIA) predicts that global electricity use could rise as much as 75% by 2050.

This is good news for providers like Vistra and GE Vernova, the number two and number four best performing S&P 500 stocks of 2024.

Vistra, which joined the S&P 500 in May of last year, saw its stock price skyrocket by 261% in 2024. The company’s natural gas and nuclear power plants are well-suited to meet the reliability and scalability needs of data centers. Strategic agreements with cloud computing giants like Amazon and Microsoft to supply power at premium prices further bolstered its financial performance.

GE Vernova, General Electric’s energy spinoff, also saw remarkable growth in 2024, with its stock rising 150% after going public in April. The company’s gas turbines have seen strong demand as providers seek to address the growing energy needs of data centers. The company’s involvement in renewable energy projects—such as the $2.75 billion wind energy agreement in Australia, signed a year ago—further cements its position as a leader in the sector. GE Vernova has projected sales of $45 billion in 2028, up from previous estimates of $43 billion.

United Airlines Soars with Record-Breaking Performance

United Airlines represented a different investment narrative in 2024: the resurgence of post-pandemic air travel. Shares of the Chicago-based airline soared 135% last year, marking the carrier’s best year ever since going public in 2006.

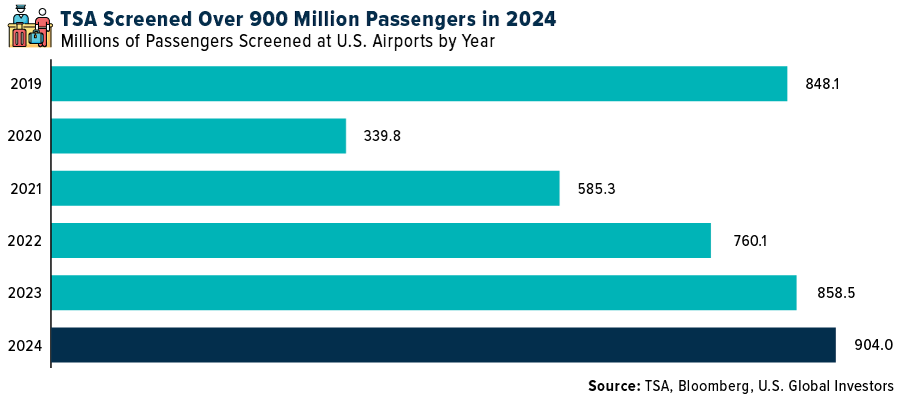

Air travel surged in 2024, with the Transportation Security Administration (TSA) reporting screening a combined 900 million+ passengers at U.S. airports, the most on record. United capitalized on this trend in 2024 by operating its largest-ever domestic schedule and greatly expanding international routes.

Eye-popping passenger volume certainly turned heads, but it was the company’s massive $1.5 billion share buyback program, announced in October, that truly boosted investor sentiment.

Gold and the S&P 500’s Unusual Correlation in 2024

On a slightly different note, the correlation between gold and the S&P 500 reached an unprecedented 0.91 in 2024, meaning that the two assets moved in tandem almost 100% of the time throughout the year.

As many of you are aware, gold has historically shared an inverse, or low, correlation with stocks. That’s precisely why many investors favor gold. Take a look at the period from the mid-80s to early-90s. Gold prices were largely agnostic to what equity prices were doing, making the metal an ideal diversifier.

Granted, we’ve also seen periods of sustained positive correlation (check out the entire 2000s decade), but we’ve never seen such a strong relationship between the two asset classes as we did in 2024.

So what gives?

First, global central banks have begun a coordinated monetary easing cycle, cutting interest rates to stimulate economic growth. This has created a favorable environment for both stocks (as borrowing costs declined) and gold, which, as a non-yielding asset, has historically thrived when interest rates were low.

Second, geopolitical tensions and economic uncertainty have persisted, driving investor demand for safe-haven assets like gold while also supporting equity markets through increased government spending on defense, cybersecurity and infrastructure.

Third, shifts in asset allocation strategies appear to have played a role. Investors increasingly sought diversified portfolios, blending traditional assets like stocks and bonds with alternative investments such as gold and Bitcoin to hedge against inflation (which, despite falling, remained elevated in 2024). I believe this likely contributed to the tighter correlation between gold and S&P 500 stocks.

—

Originally January 6, 2025 – Data Center Energy Demand Fueled Massive Gains for Utility Stocks in 2024

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024): United Airlines Holdings Inc.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.