It seems that after most major political events, the stock market always steals the spotlight. And few events are as impactful as a U.S. presidential election.

From deregulation to tax reform, Donald Trump promises to reshape the U.S.’ economic priorities. And following the news that he will be returning to the White House, investors’ optimism about his pro-growth policies sent the market surging higher.

Indeed, once the election results became clear, the market was off to the races. Between Nov. 6 and 11, the S&P 500 rallied 3.78%, and the Nasdaq popped 4.66%. And while stocks began sliding a bit in recent days, it seems they may be regaining their footing once again.

So… does that mean they will keep soaring over the next year?

Not necessarily.

Historically speaking, how stocks perform in the weeks after Election Day actually has no correlation with how they perform over the following year.

Post-Election Performance: Why Recent Gains Aren’t a Guide

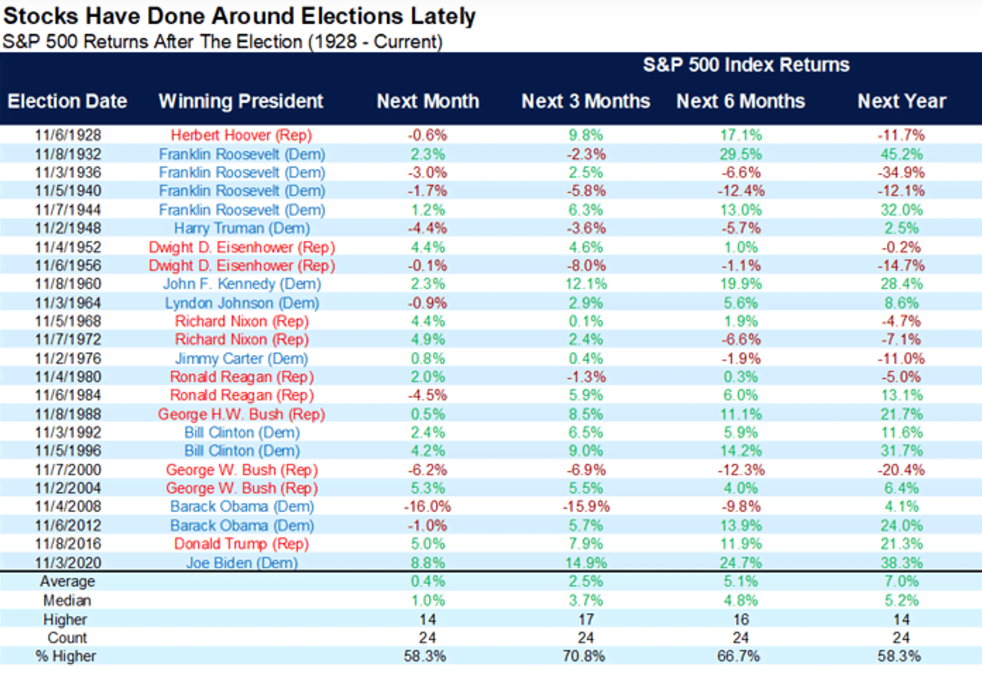

Just look at the following chart from Morningstar, which details the S&P 500’s performance after Election Day. The data is all over the place. There is no clear trend. It seems random.

For example, in the weeks following the 2008 election, stocks crashed about 16%. Then, they rallied more than 20% throughout the next year.

Meanwhile, after the 1976 election, stocks only rallied about 1%. Then, they dropped more than 10% over the following year.

Of course, there have also been times when stocks rallied both immediately after the election and over the next year. In fact, that happened very recently – in 2020. Stocks rallied about 8% in the two weeks after that election, then surged another ~30% over the next year.

And similarly, there have been instances when stocks crashed both immediately after the election and over the next year. The 2000 election is a great example. Stocks dropped a little over 5% in the weeks after that election. Then they went on to fall another ~20% over the following year.

Point being: Post-election stock market performance is practically meaningless.

So – don’t put too much stock in the market’s recent post-election rally. It is exciting. But it likely doesn’t mean anything when it comes to what’s in store for the market over the next 12 months.

The Final Word on Stocks Following the Presidential Election

Though, of course, having said all that… we are still very bullish on the S&P 500 for 2025.

We think the combination of pro-growth policies, still-low inflation, continuing rate cuts, and AI-driven economic tailwinds will propel stocks broadly higher in 2025.

And if stocks do continue to push higher as we expect, then we think it could be a particularly good year for Elon Musk.

After all, Musk has attached himself to Donald Trump, and it seems that Trump is ready to return the favor with favorable legislation. For example, reports are already leaking that Trump plans to ease federal laws surrounding autonomous vehicles, which would likely benefit Tesla (TSLA) and Musk’s robotaxi vision.

But the Musk company that could win the most in 2025 may not be Tesla… SpaceX… or even his brain implant firm, Neuralink.

Rather, xAI – Musk’s newest startup – could become his ‘golden goose’ this year.

Learn more about why we think that firm could be on the launching pad – and how to profit from it.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.