The Facebook parent’s metamorphosis from a social media platform for olds, wasting billions chasing a metaverse dream, to a lean, mean, AI machine ended with the share price climbing back to new all-time highs. The results have generally matched that share price rise, too, with advertising growth recovering to an impressive 20% in the third quarter, and profit margins almost doubling to more than 50%.

Recently, Meta’s CEO has been hinting about loosening some purse strings, with the firm snapping up high-powered chips and aiming to get itself in among the AI elite. So investors won’t be expecting anything like another doubling of margins (which would be mathematically impossible from this level, of course), but they would hope for steady progress from here. The firm’s record earnings before interest and tax (EBIT) margin was 56%, incidentally, reached back in the fourth quarter of 2017.

From a revenue perspective, it’s unlikely that the third quarter’s 22% growth will be repeated, but investors will want to see healthy revenue growth in the mid-teens (or better), as further proof that the firm’s initiatives – think: reels – are holding their own in the face of fierce competition from TikTok.

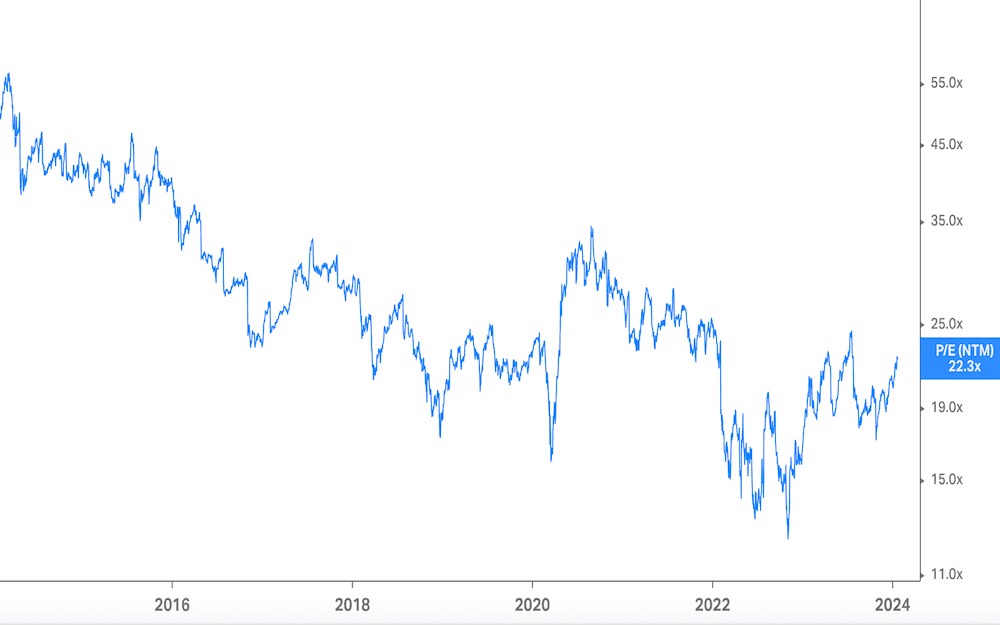

Meta is the least expensive of all the Magnificent Seven firms, with a price-to-earnings (P/E) ratio of just 22x – so continued financial performance momentum could see that valuation expand.

Meta’s forward price-to-earnings (P/E) ratio, over time. Source: Koyfin.

–Meta is expected to announce earnings on Thursday, February 1st, after the close of trading.

—

Originally Posted January 26, 2024 – Earnings Season Preview: Here’s What Matters For Meta

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.