Ouch.

Global markets are in freefall in response to President Donald Trump’s universal 10% tariff on all goods being imported into the U.S., with as many as 60 countries facing “reciprocal” tariffs on top of that.

When we combine all new tariffs in 2025 so far, including the raft of reciprocal tariffs announced last Wednesday, we’re looking at an average effective rate of 22.5%, according to Yale’s Budget Lab. That’s the highest such rate since 1909—the same year that President Howard Taft proposed the idea of an income tax to Congress.

History Shows Tariffs Often Backfire

As I pointed out to you last month, tariffs are a type of tax paid for by domestic import-export companies, who often pass the additional cost on to consumers. This can turbocharge domestic inflation.

Tariffs can also lead to full-blown trade wars, as we saw in the federal government’s previous attempts to raise revenue through the taxation of imported goods.

The Smoot-Hawley Tariff Act, enacted in 1930, is widely believed to have exacerbated the effects of the Great Depression, as global trade tanked a whopping 65%. A few decades prior, then-Representative William McKinley’s tariff act triggered retaliation from other nations, leading to higher prices for U.S. consumers. (If you need to brush up on your Smoot-Hawley history, I recommend the famous “Anyone? Anyone?” scene in 1986’s Ferris Bueller’s Day Off, which you can watch here.)

As was the case then, we’re already seeing retaliatory tariffs. China announced today that it will impose a 34% duty on all goods imported from the U.S.

Tesla Could Benefit From Its Domestic Supply Chain Advantage

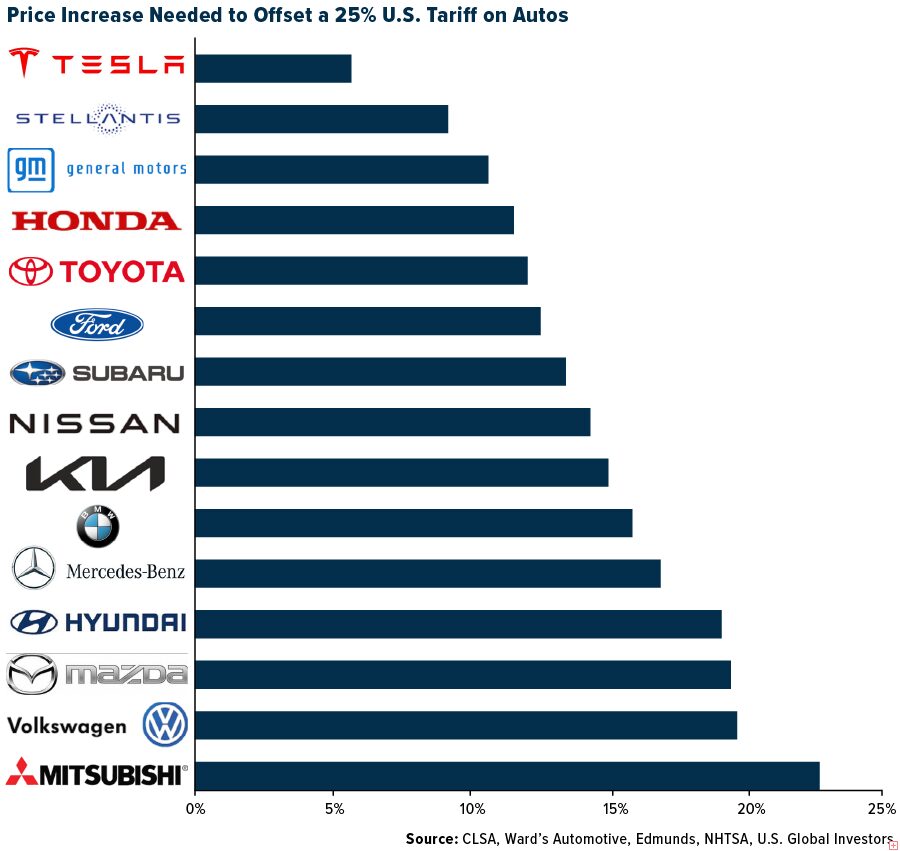

If this weren’t enough, automobile imports face a steep 25% tariff. Trump claims he “couldn’t care less” if foreign manufacturers raise prices for U.S. consumers, and from the looks of it, they may need to—and significantly so, in some cases. Mitsubishi, for instance, will need to increase the price of its vehicles by more than 20% here in the U.S. to offset the new levy, according to estimates by CLSA.

The manufacturer expected to fare the best under this tariff regime is Tesla, whose supply chain is well-integrated in the U.S. More than 62% of the company’s facilities are located domestically, with approximately a quarter of its suppliers also based in the U.S., according to Bloomberg data. By comparison, fewer than half of Ford’s facilities worldwide are currently located in the U.S.

This could be constructive for Tesla, whose stock has lost over half of its value since its peak in mid-December, making it one of the worst performers of the year so far. The carmaker’s quarterly sales fell a significant 13% in the first quarter compared to the same period last year, due mainly to political backlash against CEO Elon Musk.

Why Falling Yields Could Help Homebuyers

When it comes to new home purchases, bad economic news could be good news. Mortgage rates generally track the yield on the 10-year Treasury, which dropped below 4% on Friday due to concerns about the trade war. Bond yields generally fall when prices rise.

Granted, home prices in the U.S. are still hovering near record highs, but current homeowners may be able to refinance sooner than expected.

Gold Has Historically Shined When Real Yields Turn Negative

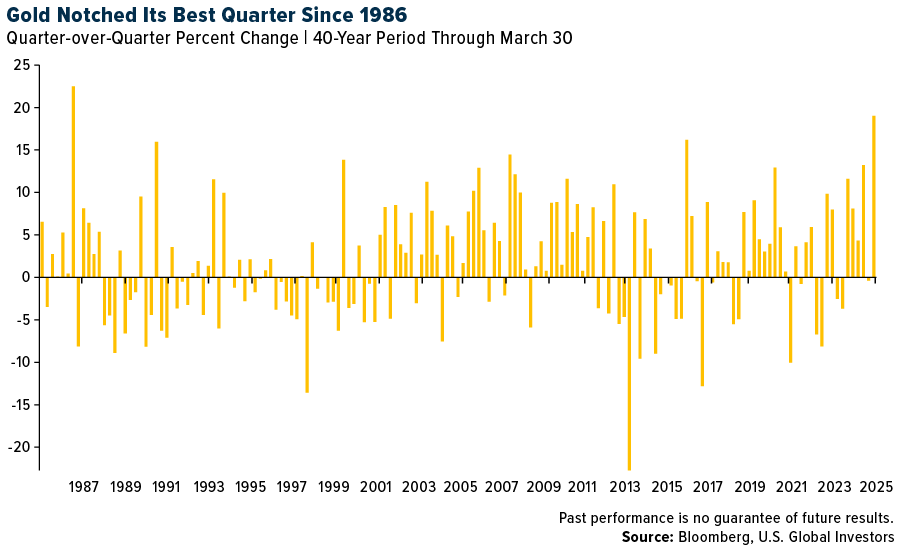

Lower yields are also good for gold. Because it’s a non-interest-bearing asset, gold starts to look more attractive as yields fall, especially when inflation remains historically elevated, as it is now. The 10-year yield is nominally 4.1% right now, but when you factor in the 2.8% headline inflation rate from February, the real yield is closer to 1.3%.

If yields fall further or if inflation jumps higher due to tariffs, we may end up with negative real yields, which have historically been bullish for gold prices.

The yellow metal is trading down as it’s swept up in the broader selloff, and I believe investors should strongly consider buying these dips. Gold just notched its best quarter since 1986, ending the March quarter at $3,123 per ounce, and there could be further upside momentum.

Insights From The Oxford Club’s Investment U Conference

I believe the number one thing investors can do at this moment is to remain calm and not panic.

Last week, I attended and spoke at the Oxford Club’s Investment U conference in Florida, where many presenters offered their own advice to those who may be worried right now, especially those nearing retirement age. Dr. Nomi Prins, founder of Prinsights Global, told the audience that now may not be the time to obsess over your 401(k). No need to check it every minute.

My favorite piece of advice came from my friend Alexander Green, the chief investment strategist of the Oxford Club. Alex reminded the audience of America’s exceptionalism, which is no less true today than it was before markets started crashing. “If we’re no different from other Western democracies,” Alex said, “why were transformative companies like Apple, Alphabet, Facebook, Amazon, Microsoft, Twitter, Netflix, Snapchat, Instagram, Tesla, Uber, Crispr and NVIDIA—to name just a few—all found here?”

Alex is currently working on a book on America’s exceptionalism, which I’ll be sure to pick up once it’s released. You can read my two-part interview with him from 2017 here and here.

Warren Buffett, the perennial optimist, has always urged investors to look beyond the current crisis and to follow the trendlines, not the headlines. In his 2017 letter to Berkshire Hathaway shareholders, he wrote that “major declines” can “offer extraordinary opportunities to those who are not handicapped by debt.” He also paraphrased lines from the British poet Rudyard Kipling’s famous poem “If,” which I’ll end with today:

If you can keep your head when all about you are losing theirs…

If you can wait and not be tired by waiting…

If you can think—and not make thoughts your aim…

If you can trust yourself when all men doubt you…

Yours is the Earth and everything that’s in it.

You can listen to Oscar-winning actor Sir Michael Caine read Kipling’s poem by clicking here.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2025): Tesla Inc., Mercedes-Benz Group AG, Volkswagen AG, Alphabet Inc., Microsoft Corp., NVIDIA Corp.

—

Originally Posted on April 7, 2025 – Effective Tariff Rate Hits 1909 Levels As Global Trade War Explodes

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: IBKR Spot Gold

U.S. Spot Gold trading through IB LLC accounts is only available to legal residents of the United States that do not reside in Arizona, Montana, New Hampshire, and Rhode Island.