Treasurys and equities are down for the third-consecutive day as election jitters are accompanied by nervousness on the corporate earnings front. Red sweep talk is occurring all over Wall Street and Washington, just ask our brand new IBKR Forecast Trader, which placed a fresh all-time high 66% probability of former President Trump reclaiming the Oval Office earlier this morning. Additionally, the GOP is projected to win the Senate handily at 85% while maintaining control of the House has flipped from a modest chance of 45% to the probable outcome of 52% in the past few days. Turning to profitability, investors are analyzing the extent to which firms can raise prices without sacrificing revenues, while next week’s big-tech results will focus on whether AI investments have been worth it and the degree to which they’ve bolstered top and bottom lines.

Source: ForecastEx

Earnings Reports Spark Sour Mood

Investors are spending the midweek assessing earnings results that underscore a challenging economy. Starbucks (SBUX) reported a third-consecutive quarter of declining sales and canceled its 2025 guidance, increasing pressure on its new chief executive officer, Brian Niccol. Meanwhile, Coca-Cola (KO) shares have dropped 2.25% on concerns about the company’s ability to continue hiking its prices and its margins. Hilton, (HLT) for its part, announced that the addition of new hotels globally didn’t offset the impact of slowing travel volumes and the company lowered its profit outlook, causing its shares to drop 2%. The revised outlook also weighed upon other hotel stocks.

Spirit Airlines’ (SAVE) an exception, with its shares jumping more than 38% after the Wall Street Journal reported that the company has made a renewed bid to acquire Frontier Airlines, an acquisition that is expected to receive less regulatory resistance if a red wave sweeps Washington.

Housing Faces Dim Outlook

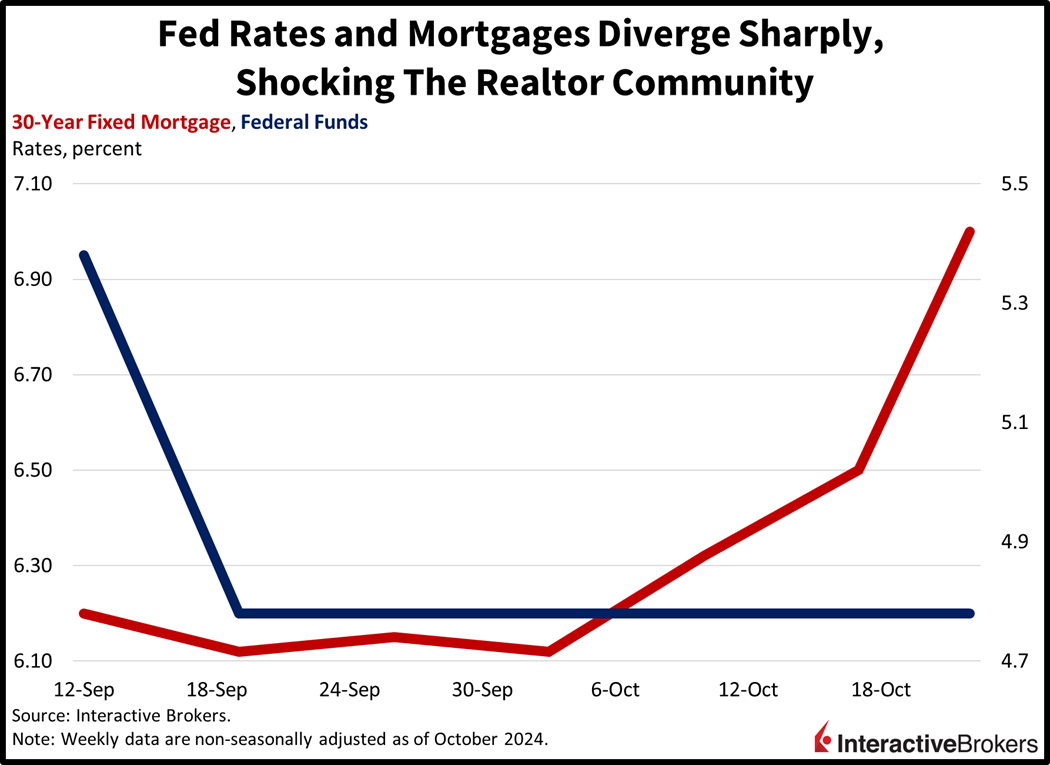

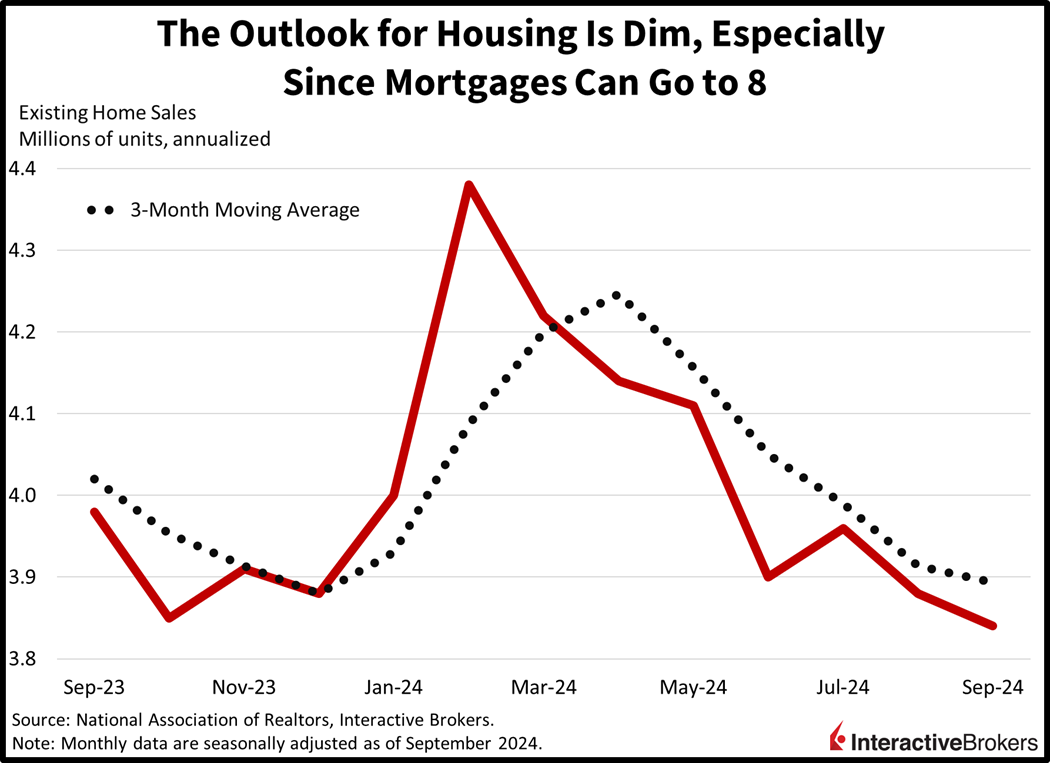

Existing home transactions fell 1% month over month (m/m) in September to 3.84 million seasonally adjusted annualized units, near the lowest level in 14-years, according to the National Association of Realtors. The number also missed the analyst consensus expectation for 3.88 million sets of keys to change hands, which would have matched August’s results. While elevated prices and soaring financing costs have resulted in low affordability, causing sales to slow significantly, many prospective buyers are waiting for interest rates to decline following the Fed’s jumbo 50-basis point (bps) cut to its key benchmark; however, borrowing costs have climbed following the central bank’s actions. Indeed, realtors have been frantically calling Torres, because the mortgage levels they see on their screens continue to rise. Jumping the gun on monetary policy accommodation has real estate sales professionals turning into yield curve analysts, after all, a jump at the long-end occurring after a fed funds trim is a significantly rare occurrence last seen in the 1990s. Sales offices were excited after the recent adjustment by the Fed, as they all called their potential buyers yelling that mortgages will soon be below 6%, bring their monthly payments in-line with their budget situation. The math is simple, they thought 30-year mortgages would go from 6.1% to 5.6%, serving to propel afffordaibility north, but their smiles have been turned upside down, with the gauge now sporting a 7-handle.

Shifting back to the data from a regional perspective, the West bucked the trend with the pace of closings increasing 4.1% while the Northeast, with a decline of 4.2%, was the weakest area, followed by the Midwest and South, where volumes sunk 2.2% and 5.0%, respectively. Single-family closings dropped 0.6% while the condominium and cooperative segment contracted by 5.1%. On a positive note, at a time the nation’s estimated 3-million-unit housing shortage has become a campaign issue in the rate of the Oval Office, inventory climbed 1.5% m/m to the equivalent of 4.3 months of sales. The median existing home price last month was $404,500, up 3.0% year over year (y/y), the 15th consecutive month of y/y increases.

Back-Loaded Seasonals Hit Markets

Stocks are on pace for their first losing week in seven, as back-loaded seasonal weakness is likely underway against the backdrop of a fresh monthly options expiration calendar that began on Monday. As for a red sweep, folks are concerned that Trump’s hawkishness on trade, geopolitics and the border will disturb corporate efficiency and weigh on profits. Against this backdrop, Trump isn’t a fiscal hawk either, with potential deficit and inflation dynamics pushing the 10-year to above 4 and a quarter today. The shift is weighing on the Trump trades, which benefit from domestically oriented policies and lighter regulations but happen to be more rate-sensitive than the Harris sectors.

Trump, Harris Trades Aren’t Working

All equity benchmarks are pointing lower on the session with the Russell 2000 and Dow Jones Industrial baskets weighing the most as they lose 1% and 0.9%. Meanwhile, the Nasdaq 100 and S&P 500 indices are down by 0.9% and 0.6%. Sectoral breadth is deeply negative with 9 out of 11 segments lower and being dragged south by consumer discretionary, healthcare and technology, which are down 1%, 1% and 0.8%. Utilities and real estate are the only gainers; they’re up 0.4% and 0.3%. Treasurys are also getting battered with the 2- and 10-year maturities changing hands at 4.07% and 4.25%, 3 and 4 bps heavier on the session. Taller borrowing costs are helping the greenback, with its gauge up 35 bps as the US currency appreciates relative to most of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Tighter financial conditions at the long-end are dinging commodities with silver, gold, copper and crude oil lower by 3.3%, 1.1%, 1% and 0.8%. Lumber is bucking the trend; however, it’s up 0.8%. WTI crude is trading at $70.79 per barrel as rising stateside inventories offset geopolitical pressures out of the Middle and Far East.

Torres Calls for Weak Period

The equity market is extremely fragile considering the headwinds that are lurking right around the corner. Earnings expectations are buoyant for next year, which increases the importance of forward guidance rather than past results. When considering that valuations are around 22 times next year’s profits, any disappointment in the outlook for the bottom line can significantly impact stock market performance. That makes the current backdrop particularly interesting, especially as the last sizable dip in the market occurred after a monthly expiration cycle shortly following the S&P 500 high of 5669 on July 16. I spoke with Interactive Brokers Chief Strategist Steve Sosnick this morning to examine whether my bearishness was warranted. Strategist Sosnick told me that similar to July, we’re coming into earnings season with high expectations. But with the market pricing in about 15% profit growth for 2025, guidance will once again be the key. ASML last week and MMM today show us that a company can beat on the bottom line but get hit for failing to deliver guidance. Finally, I believe that the bear-steepening across the yield curve is violent and ferocious against the backdrop of significant political uncertainty. I see a path to a 4.25% on 2s and 5% on 10s in short order. This market is ripe for volatility on back-loaded seasonals ladies and gentlemen.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.