Rates are climbing today following a pair of hotter-than-expected stateside economic reports as well as international developments that are pushing up the cost of capital. Indeed, US construction spending and ISM-manufacturing arrived ahead of estimates just as market participants brace for potential Trump tariffs against BRICS nations due to the group’s motivation for seeking new currency solutions that some worry will incrementally reduce the greenback’s influence. Meanwhile in Tokyo, BoJ Governor Ueda disclosed that another hike is around the corner following strengthening economic data and firmer inflation. Concurrently, in Paris, fears that the French budget wouldn’t be passed were replaced by concerns of a government overhaul following the expectation of no-confidence votes against the country’s leadership this afternoon from both the left and right factions of Parliament. And as the rise in yields is partially linked to global uncertainties, the move hasn’t derailed stocks, with the S&P 500 reaching another fresh all-time high this morning.

Manufacturing Downturn Eases

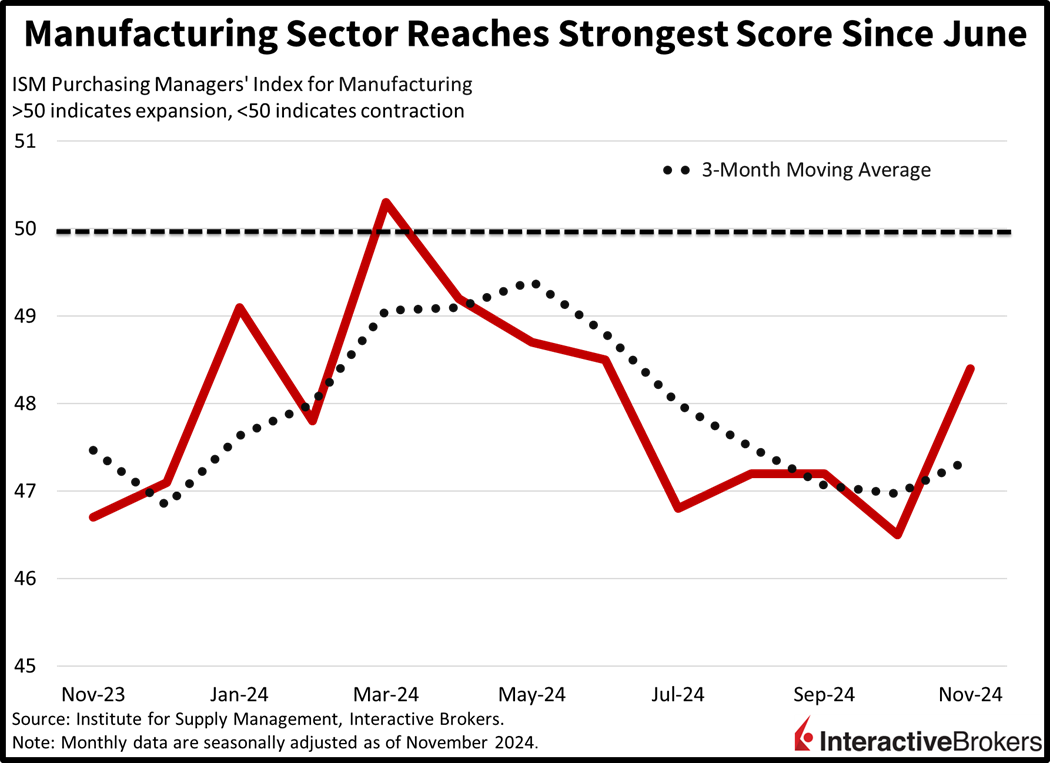

The manufacturing sector contracted for the eighth consecutive month in November, but the painful freefall slowed slightly, according to the Institute of Supply Management’s (ISM) Purchasing Managers’ Index. November’s ISM of 48.4 was well below the expansion-contraction threshold of 50 but slightly above the median estimate of 47.7. Encouragingly, conditions deteriorated at a slightly slower pace than October’s 46.5 result and reached the highest score since June. Additionally, the prices paid component fell from 54.8 to 50.3 month over month (m/m) and substantially missed the forecast of 56. Despite the cost pressure slowdown, the overall index inched higher due to the employment component and new orders category moving north from 44.4 and 47.1 to 48.1 and 50.4, respectively. Within the index, the following three categories were the only expansionary groups while the other eight contracted:

- Food, beverage and tobacco products

- Computer and electronic products

- Electrical equipment, appliances and components

Builders Shrug Off Higher Rates

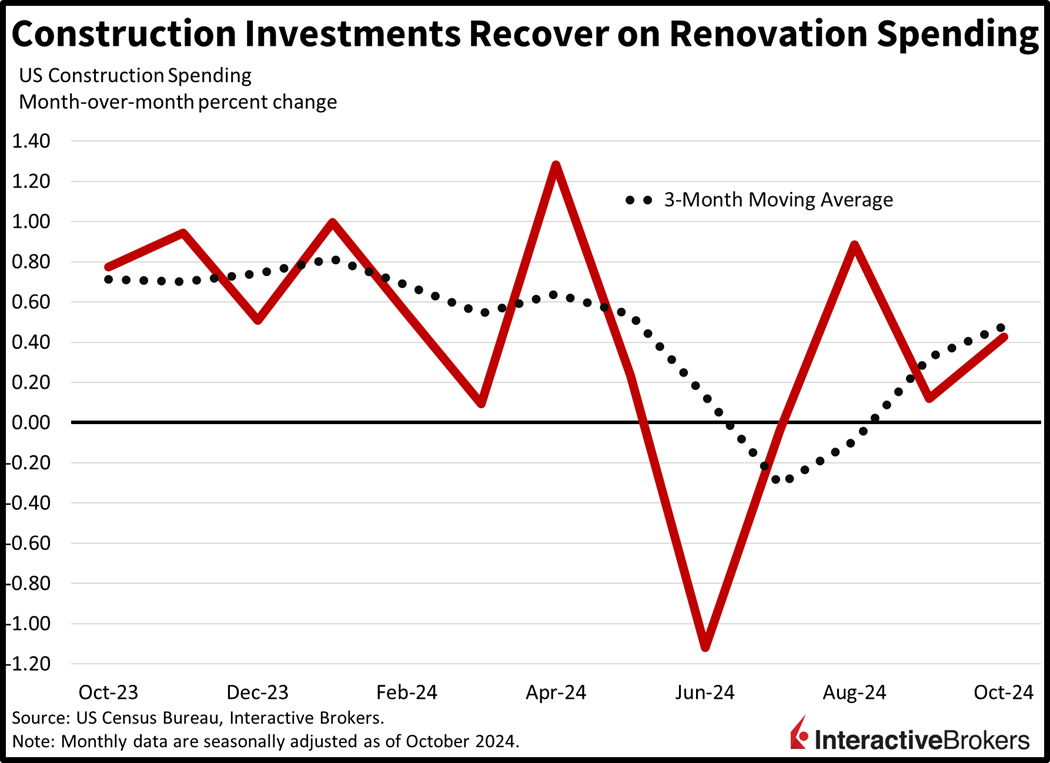

The quick end to relief from elevated financing costs hasn’t deterred homebuilders from deploying their assets into projects with construction spending climbing 0.4% in October, up from the 0.1% increase in the preceding month and above the consensus forecast of 0.2%. In late September, the Fed cut its key benchmark 50 basis points (bps), causing 30-year mortgages rates to fall to slightly above 6%, but the rate quickly climbed to approximately 7% on loftier economic growth projections, taller deficit expectations and price pressure uncertainty. In October, however, contractors increasingly pounded nails at future religious facilities with the category increasing 4% followed by residential, which gained 1.5%. Other categories that expanded along with the amount of their increases were as follows:

- Public safety, 1.3%

- New Single family, 0.8%

- Office, 0.7%

- New Multifamily, 0.2%

The amusement and recreation category and power segment were flat while construction spending for the transportation, communication and manufacturing categories descended by 0.1%. Other categories that weakened and the extent of their declines were as follows:

- Nonresidential, 0.3%

- Lodging, 0.4%

- Water supply, 0.5%

- Educational, 0.6%

- Highway and street, 0.8%

- Commercial, 1%

- Health care, 1.1%

- Sewage and waste disposal, 1.6%

- Conservation and development, 3.2%

Cyclical Stocks Decline

Markets are mixed with the dollar and stocks stronger amidst weak equity sector breadth, softer bonds and bearish commodities. Major stateside benchmarks are experiencing split performance as the Nasdaq 100 and S&P 500 indices gain 0.8% and 0.1%, but the cyclically-tilted Russell 2000 and Dow Jones Industrial baskets are falling 0.5% and 0.4%. Sector breadth is deeply negative; however, with 8 out of 11 segments losing, while technology, consumer discretionary and communication services lead; they’re up 0.9%, 0.7% and 0.5%. The laggards are represented by utilities, energy and financials, which are trimming 1.9%, 1.7% and 1.2%. Treasurys are getting incrementally sold with the 2- and 10-year maturities changing hands at 4.21% and 4.21%, 5 and 3 bps heavier on the session. The Dollar Index is up 87 bps as the greenback appreciates relative to almost all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are tilted bearishly with silver, copper, gold and crude oil lower by 0.8%, 0.6%, 0.4% and 0.1% while lumber bucks the trend; it’s up 1.1%. WTI crude is trading at $68.01 per barrel as investors await results from this Thursday’s OPEC+ virtual meeting, which was postponed from last Sunday. Folks largely expect the coalition to suspend its production increases to a later time in consideration of ample supplies in the market.

A Record Rally Could be in the Making

Despite the uncertainties that arose after the long Thanksgiving weekend, strong seasonals are managing to push stocks higher. This year’s gain of 27.3% is the best so far this decade, and if the run continues, it could be one of the most robust rallies in history when considering that only a few 12-month periods have posted returns in excess of 30%. Heading into 2025, however, expect more two-way action from equities, especially since valuations are priced near perfection amidst the potential for more turbulence. The president-elect has pro-business policies featuring reduced regulation, lighter taxes and an onshoring push, all of which are good for stocks but not without Trump bumps along the way.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.