Vinesh Jha, CEO of Estimize, founder of its parent company ExtractAlpha, and a pioneer of crowd-sourced earnings estimates, began his career 30 years ago after earning a graduate degree in pure math. In the late nineties he changed direction and moved into sell-side quant research, building asset allocation models for buy-side clients. After his firm completed a merger, he left to join the founding team at StarMine, an early fintech startup that used quant methods to measure the accuracy of sell-side equity research analysts.

In 2005 he moved on to a prop trading group at Merrill Lynch, where he managed several internal portfolios, then went on to develop quant strategies for Morgan Stanley’s Process Driven Trading (PDT).

“Right after I joined Morgan Stanley in August 2007, we had what was called at the time the ‘quant quake.’ A lot of strategies, including ours, blew up without warning. When the dust cleared, it turned out we were all trading similar assets and using similar strategies.”

That got Vinesh’s attention.

“The trouble was that nearly all of us were using the same data – price, earnings estimates, and balance sheet/income statements. Because of that, when someone started liquidating, it blew up pretty much everyone else’s book. The positive was that it opened our eyes to the world of untapped data sitting out there ready to be explored, to inform more diverse strategies.”

Vinesh left PDT to start ExtractAlpha. And some years later, in 2021, ExtractAlpha acquired the firm that is our subject here: Estimize.

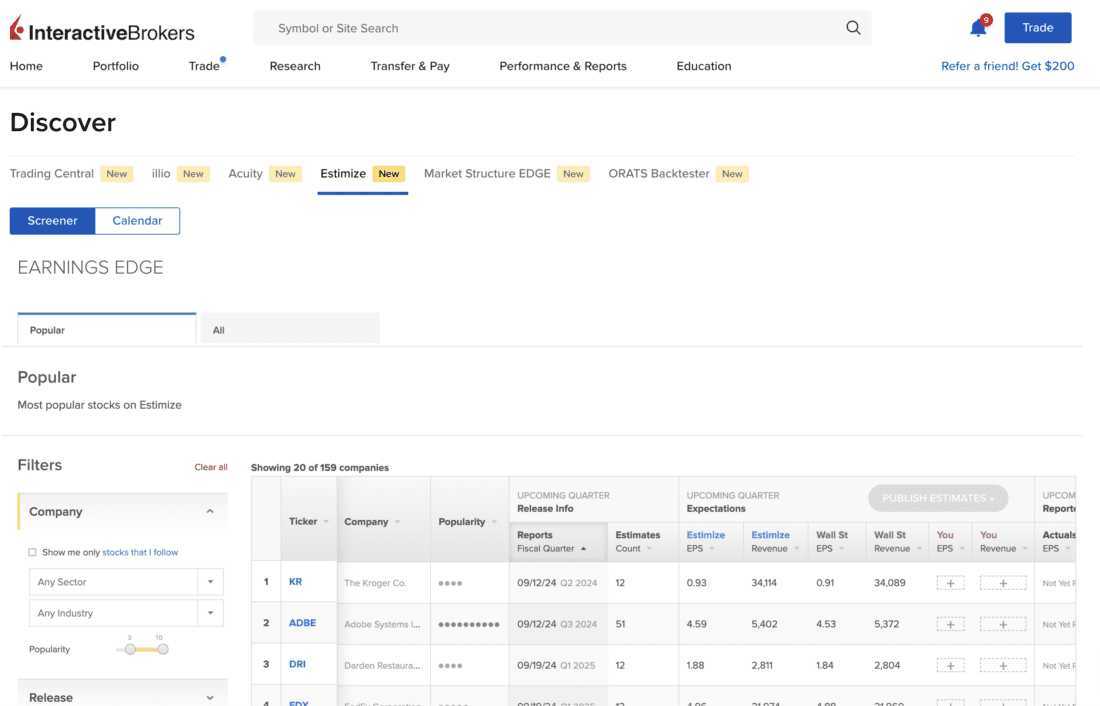

“The Estimize model applies the conceptual framework of crowdsourcing to earnings estimates. The structure is that you, me, or anyone else can come up with an estimate for a company’s results and contribute it to our database. Our job is to aggregate it, compare it to what the Street analysts are saying, and report that out.”

Jha cites Galton’s ox, the foundational experiment that established the concept of the ‘wisdom of crowds.’ In 1907, England’s Sir Francis Galton asked 787 villagers to guess the weight of an ox. None of them got the right answer, but when Galton averaged their guesses, the estimate was nearly perfect.

“It’s really like that. If you average out everyone’s viewpoints – including non-professionals – you get to something better than you would if you just took a small group of professionals.”

But collecting estimates from non-professionals is a very different game from getting a data feed from a well-regarded broker. Non-professionals need encouragement.

“Buy-side investors and portfolio managers have always had a community. They huddle together, call each other privately, exchange estimates – ‘I think the sell side is too low on this, what do you think,’ and so on. With non-professionals, we had to build a new community within the platform, starting from the ground up. So, we used incentives and gamification.”

One of the more innovative examples of gamification is what Jha calls “the shaming algorithm.”

“It was a little controversial in-house,” he says, smiling, “but it works. It doesn’t stop anyone from putting in a safe estimate, but it’ll be, like, you sure you don’t want to be a little different here? Take a bolder view? It discourages people from being lazy, discourages them from staying on the platform unless they’re committed. As expected, when we put it in a lot of contributors dropped off. But that was a good thing because the ones who stayed were the ones we wanted: they were engaged.

“Our estimates are more accurate than the professionals. That’s been confirmed by academics.” (Herding the crowds: how sentiment affects crowdsourced earnings estimates | Financial Markets and Portfolio Management).

Source: Estimize screenshots from Discovery

Next, Part Two: The Wisdom of Give-to-Get

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.