Part One of this series examines the concept of the Wisdom of Crowdsourcing

In support of his crowd-sourced market intelligence model, Vinesh Jha, founder and CEO of ExtractAlpha and Estimize, cites Galton’s ox theory, the foundational experiment that established the concept of the ‘wisdom of crowds.’ In 1907, England’s Sir Francis Galton asked 787 villagers to guess the weight of an ox. None of them got the right answer, but when Galton averaged their guesses, the estimate was nearly perfect.

“It’s really like that. If you average out everyone’s viewpoints – including non-professionals — you get to something better than you would if you just took a small group of professionals.”

Estimize uses what Jha calls a “give-to-get” model.

“You don’t get to see what the rest of the crowd thinks about a company until you give your own estimate. You say 65 cents, hit submit, then see what the rest of the crowd thinks. Then you can rethink and revise your estimate as much as you like.”

Jha says the database has had roughly 120,000 contributors over the company’s full history, though in a given quarter the count is anywhere from three to five thousand.

“We do a lot of data quality assessments, so we don’t have people putting in random numbers. We also measure everyone’s track record. If you’ve been contributing estimates for, say, Apple for the last eight years, we know if you’re good or not, and we put more weight on your numbers. That gives us a smarter estimate, what we call the ‘Select Consensus.’ That’s another incentive: if you want to be part of it, you can’t be lazy. You have to do your homework. When people feel they’re part of something, it’s self-affirming. It encourages them.”

On average, the Select Consensus has been closer to reported company results roughly 70% of the time compared to sell-side-only estimates.

“It’s even better in the quarters with more contributors.”

The company monetizes its research by selling refined sets to quant hedge funds, who use it as part of their own research.

Contributors get to decide whether or not to reveal their backgrounds, but Estimize believes that, in addition to traders and investors, they have a healthy number of professionals – buy and sell-side – along with independent researchers who contribute prices on companies in industries they’re particularly familiar with. There are also students and academics who want the numbers for their studies.

“When contributors sign up, we give them various categories they can fill in. We get anonymous analysts from buy and sell-side firms who don’t want to bother getting their participation cleared through compliance. We don’t formally check their backgrounds, but when you aggregate that much data, you look at averages and get a fairly clear sense of the composition. Combining all these different sources is a big part of our value.”

In terms of reach and business development, Interactive Brokers is Estimize’s most significant partner.

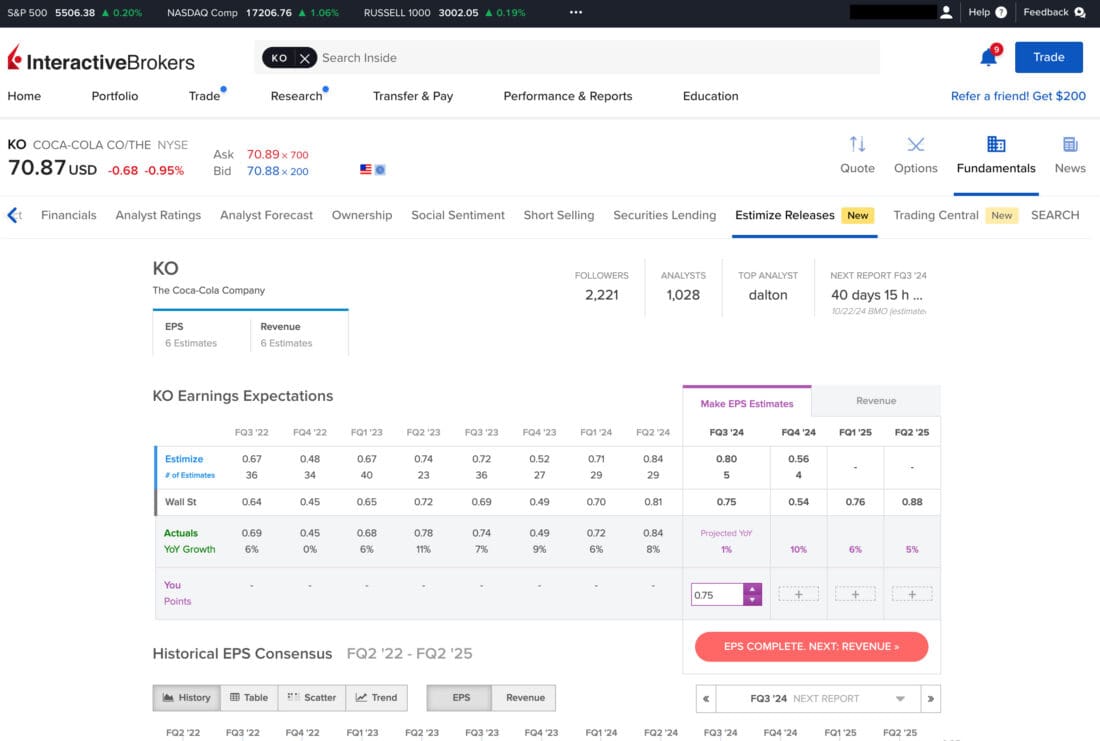

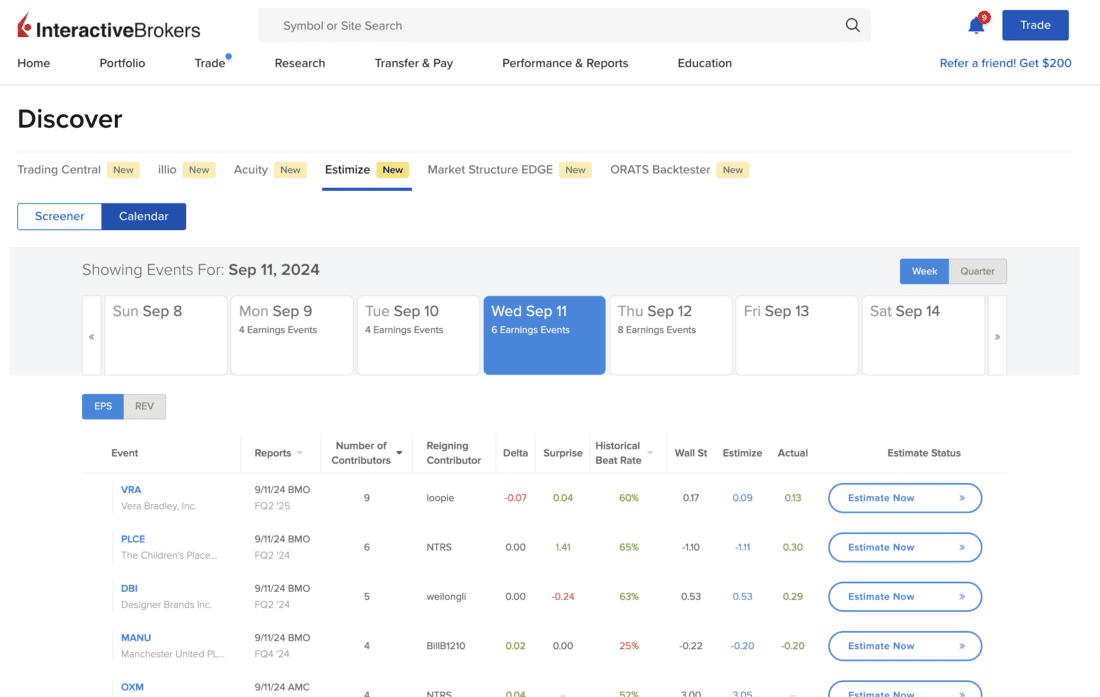

“Initially, we just delivered a data feed, which IBKR clients could subscribe to, to get our consensus estimates. But now, with your Discovery area, it’s a much more substantial integration. The most valuable parts of our website are integrated entirely into your portal.”

IBKR clients can add their own estimates from within the platform.

“That data gets pulled into our backend through an API and added to our estimate pool. The advantage for IBKR clients is they’re not part of our give-to-get model. Anyone on the platform can see our estimates without giving their own.

But our special value to institutions and active traders is the premium content we offer by subscription.”

Source: Estimize screenshots from Discovery

Source: Estimize screenshots from Discovery

Stay tuned for Part III: Jha on the impact and potential of AI.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: API Examples Discussed

Throughout the lesson, please keep in mind that the examples discussed are purely for technical demonstration purposes, and do not constitute trading advice. Also, it is important to remember that placing trades in a paper account is recommended before any live trading.