- Borrowers face significant challenges, so says the CFO of one major auto lender

- Record profits are seen in another niche of the Financials group, and we’ll get a mid-quarter update this week

- Despite soft dealmaking activity on Wall Street in 2024, there remains hope for M&A and IPO trends in the quarters ahead

Conference season brings about its own set of volatility catalysts. Portfolio managers and traders must keep their ears out for clues on the state of the broad economy, specific industries, and individual companies. That’s not a bunch of fluff – just take a look at what happened to shares of Ally Financial (ALLY) last week. On September 10, the $10 billion market cap Consumer Finance industry stock endured its worst session since March 2020.1

Cautious comments from its CFO Russ Hutchinson at the Barclays 22nd Global Financial Services Conference resulted in intense selling pressure on ALLY as fears rose that auto borrowers are more pinched than previously thought.2 He noted that credit challenges had intensified as Q3 progressed and that its customer base is having trouble handling elevated inflation and a weaker employment situation.

Conference Drama Unfolding

ALLY is a cautionary tale that, even though we are smack in the middle of the earnings offseason, news can break at any time. A number of major conferences are ongoing and on tap through the end of the quarter that could have material impacts on the global stock market. Among the standouts is the Bank of America Securities 29th Annual Financials CEO Conference next week which could shed further light on households’ financial health.

Wall Street Bankers Cooling Their Heels

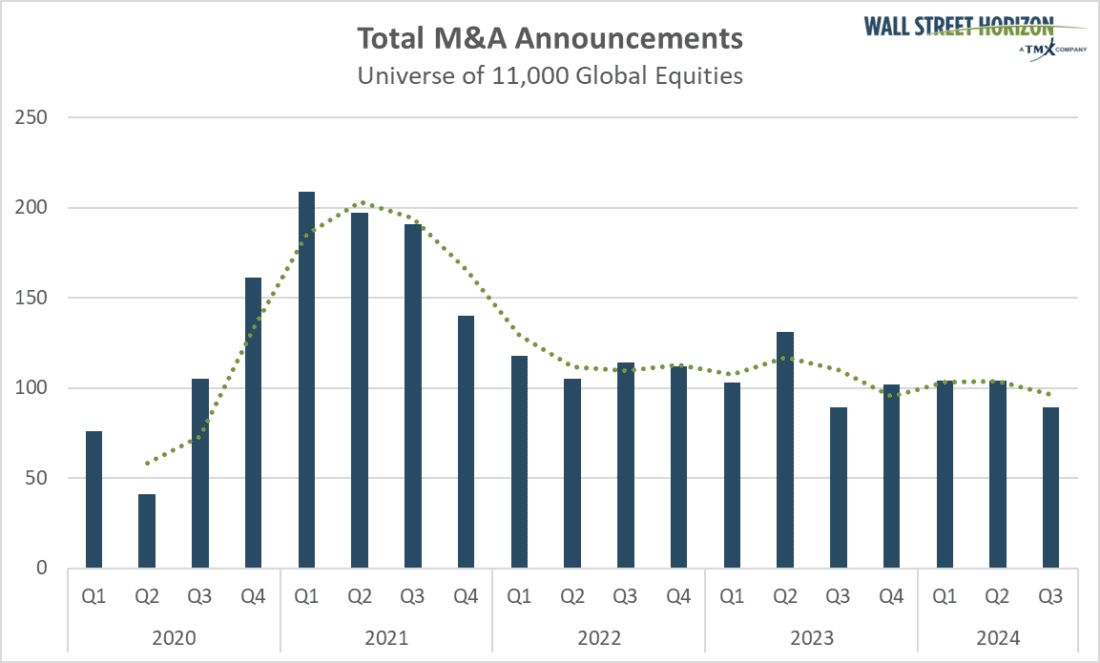

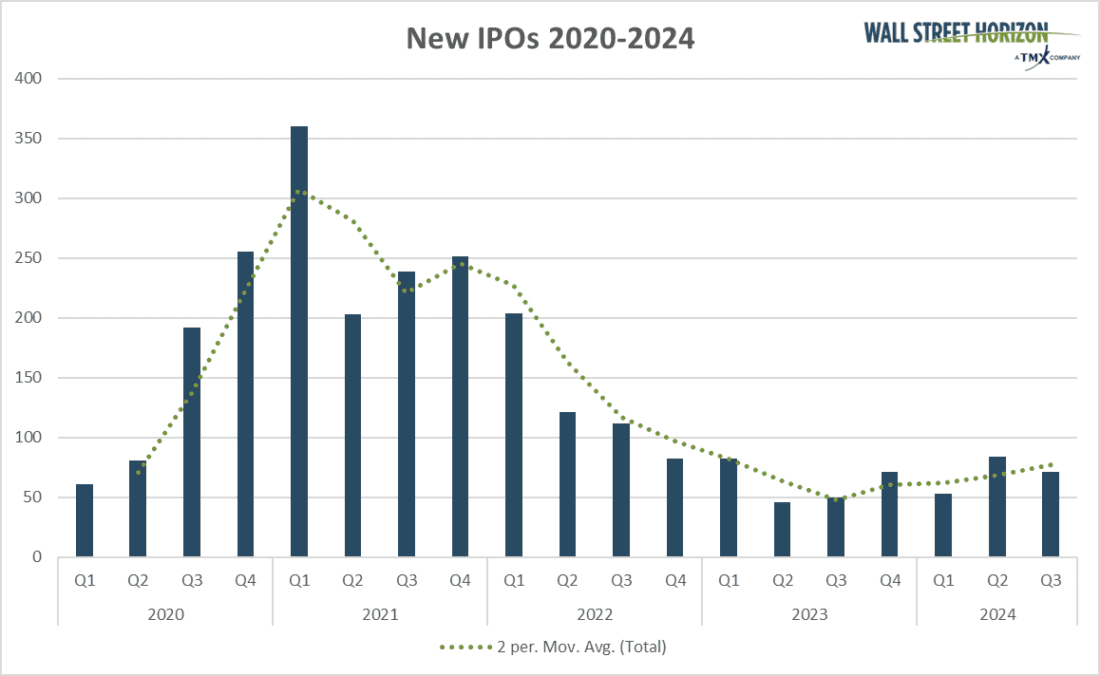

It’s not just the consumer that may be facing uphill battles. Our data show that larger, more institutional, banks might not be so sad to flip the calendar to 2025. Trends in M&A and IPOs remain light despite the occasional deal and go-public story sparking optimism that corporate dealmaking is on the mend.

We’ve highlighted a few such narratives while underscoring that much depends on how the economic situation unfolds. Adding to the frustration is uncertainty on Capitol Hill and what the legislative framework might be like next year. Always the optimists, perhaps now that the Fed has started its rate-cutting campaign, there will be a tailwind for Wall Street banking activities.

That’s also the hope of Goldman Sachs CEO David Solomon. Speaking at Goldman’s Communacopia & Technology Conference in San Francisco last week, Solomon described the economy as “still in pretty good shape” despite some softness in capital markets so far in 2024.3 He outlined a bullish trajectory in M&A trends lately as certain areas of underwriting and banking “continue to chug along.”

Global M&A Announcement Count Remains Subdued

Source: Wall Street Horizon

A Tick Up in IPOs, But the Window Seems Barely Open

Source: Wall Street Horizon

How’s Q3 Shaping Up?

News breaks on the conference stage during fireside chats as well as via less-engaging corporate press releases. This week, asset manager KKR (KKR) reports its Intra-Quarter Monetization Activity update. While it may not be a market-rattling set of interim data, Thursday night’s (unconfirmed) figures could provide timely breadcrumbs as to what moves institutional investors are making during what has been a strong year for the stock and bond markets.

KKR Enjoying the Market’s Tailwinds

Back in June, KKR reported mid-quarter monetization activity for the April 1 to June 20 period. Through half of its Q2, the New York-based company announced that it had earned more than $500 million in realized performance income, including realized incentive fees, and total realized investment income.4 KKR, a newly minted S&P 500® component, noted a combination of secondary sales and strategic transactions that had closed as being drivers of its earnings.5 Shares were little changed the following session, but the stock rose 2.9% after its full Q2 profit report on the morning of July 17, according to data from Option Research & Technology Services (ORATS).6

KKR’s second-quarter non-GAAP EPS of $1.09 topped the Wall Street consensus forecast by $0.02 while revenue of $4.17 billion, up 14.9% from the same period a year earlier, was a modest beat.7 The company has been in a growth mode, evidenced by its per-share profits rising 49% over the last 12 months. Record fee-related earnings and robust fundraising momentum underpinned its fundamental strength in the three months ending June 30.8

Many Financials-Sector Crosscurrents

Last week, we profiled bullish price action among a handful of US insurance stocks, and similar charts going up and to the right are found among shares of asset managers. While we don’t know if these uptrends will persist, it’s at least a hopeful indicator that segments of the financials-sector are in their own mini bull markets, even with a subset of consumers who may be on edge.

With such bifurcation in the S&P 500’s second-biggest sector, the upcoming reporting period will be particularly interesting to parse.9 The action gets going, as usual, with JPMorgan Chase (JPM) on Friday, October 11. Ally Financial is slated to post its third-quarter numbers on Wednesday, October 16, while KKR’s earnings report won’t come until Tuesday, November 5 (US Election Day).

The Bottom Line

Financials-sector stocks have been at the forefront of major news lately. Between conferences and firm-specific fundamental updates, there’s plenty for investors to digest with earnings season still a few weeks away. Macro challenges are apparent, and uncertainty lies ahead with the election coming closer into view. Keeping up to speed with these corporate events is crucial to navigating the often-challenging month of September.

—

Originally Posted September 18, 2024 – Financials-Sector Fallout: Macro Clues from Conferences and Interim Data

1 Ally Financial warns of ‘intensifying’ credit challenges, shares slump, Reuters, Arasu Kannagi Basil, September 10, 2024, https://www.reuters.com

2 Ally Financial CFO comments on credit challenges, stock sinks, Yahoo Finance, Julie Hyman, Josh Lipton, September 10, 2024, https://finance.yahoo.com

3 Goldman Sachs CEO David Solomon says the economy is in pretty good shape, CNBC, September 11, 2024, https://www.cnbc.com

4 KKR Announces Intra-Quarter Monetization Activity Update for the Second Quarter, KKR, June 20, 2024, https://media.kkr.com

5 KKR Announces Intra-Quarter Monetization Activity Update for the Second Quarter, KKR, June 20, 2024, https://media.kkr.com

6 KKR, ORATS, September 13, 2024, https://dashboard.orats.com

7 KKR & Co. Inc. Reports Second Quarter 2024 Results, KKR & Co Inc., July 31, 2024, https://media.kkr.com

8 KKR & Co. Inc. Reports Second Quarter 2024 Results, KKR & Co Inc., July 31, 2024, https://media.kkr.com

9 SPDR® S&P 500® ETF Trust, State Street Global Advisors, September 12, 2024, https://www.ssga.com

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.