Investors are patiently awaiting this afternoon’s interest rate decision from the Fed with folks divided on whether the central bank will deliver a quarter or a half. The historical disaccord occurs as economists are firmly in the 25 camp, but anecdotal evidence suggests that floor traders are throwing up glaring signs with the number 50. The confrontation is also materializing across markets and exchanges, as Fed Funds futures favor a super-sized reduction with a probability of 59%, while the IBKR Forecast Trader carries superior odds for the quintessential trim. Either way, I think risk assets sell off in the afternoon during this weak seasonal period, as a lighter cut will weigh on stocks via valuations and rates, while a heavier one will spark earnings and unemployment worries.

Can Housing Recover Without Inflation?

This morning’s economic calendar provided stronger-than-anticipated results from the real estate sector, which sent yields and lumber futures north while dialing down the likelihood of a 50 this afternoon. The reaction to the Fed’s easing cycle from the housing market is a pivotal dynamic when considering inflationary risks. We’re already seeing that relief in mortgage rates are bringing folks off of the sidelines and into realtor offices. Rents and home prices are likely to accelerate further if the central bank accommodates too aggressively, once again threatening the institution’s hope for a sustainable 2-handle on price pressures.

Starts & Permits Beat Estimates

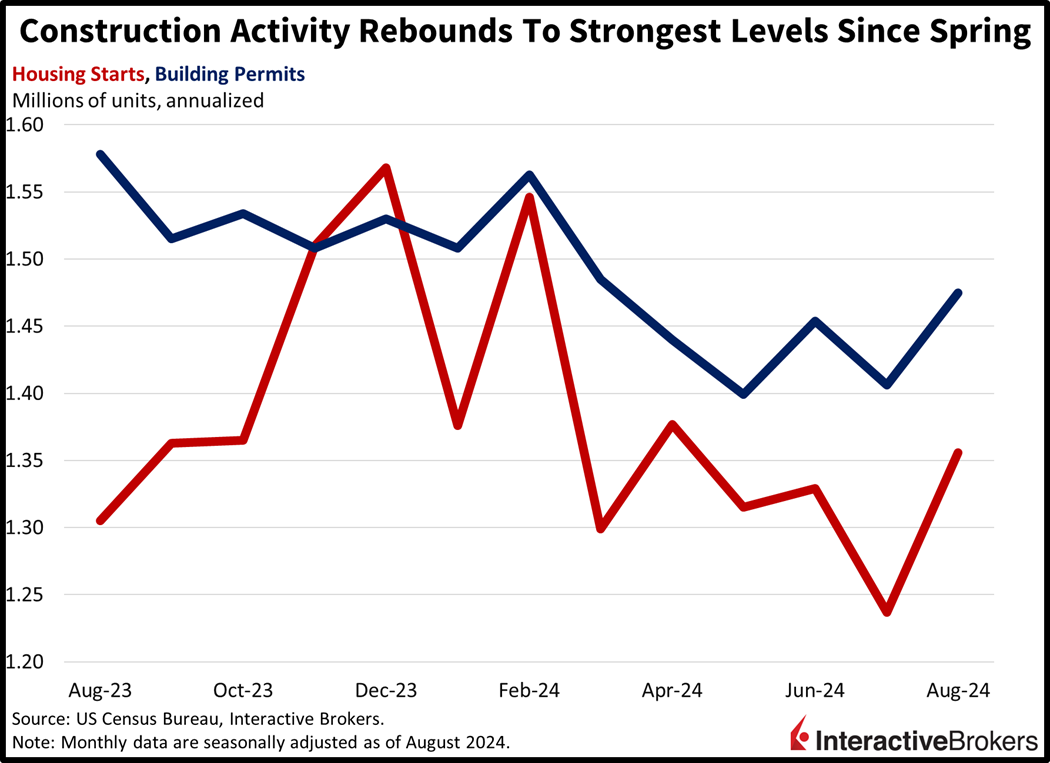

Last month’s residential construction activity picked up from July and recovered to the strongest levels since spring. The ailing industry is likely to continue recovering on the back of underbuilt conditions, fear of missing out, lighter mortgage rates and substantial immigration flows. Potential Washington, D.C., developments, such as first-time homebuyer tax credits proposed by presidential candidate Kamala Harris, may also boost housing demand. The pace of August housing starts and building permits climbed to 1.356 million and 1.475 million seasonally adjusted annualized units, surpassing the median estimates of 1.310 million and 1.410 million. August starts and permit figures climbed from July’s revised results of 1.237 million and 1.406 million, respectively, representing monthly gains of 9.6% and 4.9%.

Among starts, single-family increased 15.8% month over month (m/m) while apartment buildings fell 6.7%. Overall, starts faced the headwind of the Northeast dropping 27.3% m/m, but the Midwest, South and West experienced bumps of 29.6%, 15.5% and 5.9%. Permits, which are issued prior to breaking ground, were the strongest among two-to-four unit projects, with activity jumping 16.3%, followed by larger apartment complexes, which moved north by 8.4%. Single-family permits climbed 2.8%. Permitting activity was the strongest in the Midwest, which posted a 12.5% increase, followed by the South, up 6.0%, and the Northeast, up 3.5%. Gains were partially stymied in the West, where activity declined 1.6%.

Light Volume Until the P.M.

Markets are quiet as expected heading into the afternoon, but Treasurys are experiencing modest selling on the back of the morning’s firmer construction numbers. The Dow Jones Industrial, Russell 2000, Nasdaq Composite and S&P 500 benchmarks are all near the flatline amidst split sector participation. Indeed, 5 out of 11 segments are higher with the winners being led by communication services, consumer discretionary and real estate, which are sporting gains of 0.2%, 0.2% and 0.1%. The laggards are comprised of financials, materials and technology; they are losing by 0.5%, 0.4% and 0.3%. Turning to fixed-income, currencies and commodities, the 2- and 10-year Treasury maturities are changing hands at 3.66% and 3.69%, 5 and 4 basis points (bps) loftier on the session. The gauge of the dollar is down a modest 13 bps as the greenback depreciates relative to all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Commodities are neutral with copper, lumber and gold higher by 0.4%, 0.3% and 0.1%, while silver and crude oil lose 0.8% and 0.1%. WTI crude is trading at $69.75 per barrel as an increase in stateside inventories offset heightening Middle and Far East tensions.

Did the Bulls Get Head-Faked?

Who would have known that the last two weeks of September are the weakest period on the calendar for equities given that we reached fresh all-time highs for the S&P 500 and the Dow Jones yesterday. An important consideration, however, is that yesterday’s morning rally, which exceeded the July 16 peak by literally one point (5669 vs. 5670), was quickly erased as the benchmark closed nearly unchanged. My concern is that the confusion leading up to this Fed meeting will lay the groundwork for a regime change heading into election day. Another worry is that the Bank of Japan may deliver a hawkish message this Friday by letting investors know that the institution is committed to continue hiking borrowing yields on the back of persistent wage and cost pressures. The unfortunate combination could produce a perfect storm for markets amidst front-loaded gains, narrowing interest rate differentials and a vulnerable time of month.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.