For obvious reasons, foreign citizens are not allowed to participate in US elections. But they can and do participate in our financial markets. Last week, they resoundingly voted “no” about recent policy developments.

Although the pressure has thankfully eased this morning, we saw an odd market occurrence. Treasury yields rose while the dollar fell against several important currencies. Normally, when yields rise in a country, we see its currency strengthen. The rationale is that passive investors can earn more by holding assets denominated in that currency.

This relationship is hardly etched in stone, and of course subject to daily fluctuations, but as a broad rule it works fairly well. The exception occurs when there is a credit crisis or some other event that causes global investors to flee from a country’s debt. In that situation we see yields rise abruptly and the currency sell off sharply at the same time. That is what we saw in US fixed income last week. Note the movement that we have seen since last Monday:

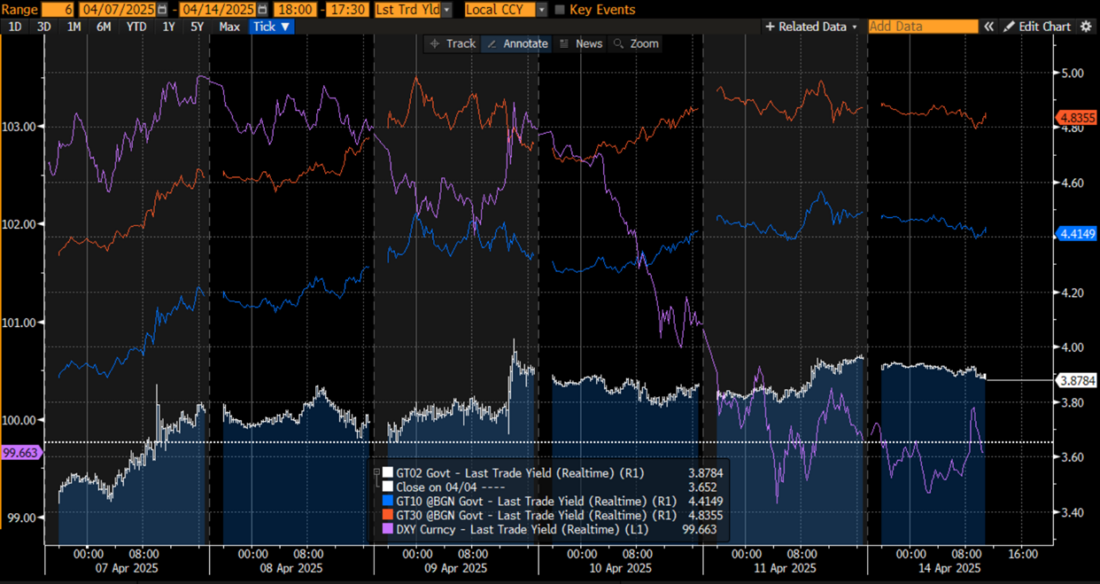

6-Day Chart: 2-Year (white, right scale), 10-Year (blue, right), 30-Year (red, right) UST Yields, DXY (purple, left scale)

Source: Bloomberg

We see 2-year yields jumping nearly 60 basis points from their “flight to safety” lows during Monday’s major stock selloff, reversing as the next two days wore on, leaping sharply as the worst of the tariffs were reversed on Wednesday, but then holding on to most of the yield reversal through this morning. We saw similar moves in 10- and 30-year yields, which moved roughly in parallel with each other ahead of and after the Treasury auctioned those securities on Wednesday and Thursday, respectively. Yet it is important to pay attention to the plunge in the US Dollar Index (DXY) – it fell about 4% in just two days!

We’ve noted before that if the market has a difficult time pricing relatively safe assets, like 2-year notes or currencies, it tends to have a difficult time with riskier assets, like stocks.

Some jitters around the recent auctions were to be expected, but those jitters metastasized into something worse. One notable exception to the general trend of stronger currencies against the USD was the Chinese Yuan, which hit a record low on Wednesday. That led to concerns that the Chinese might boycott one of the auctions, which also led to worries that there were major issues concerning the “basis trade”. In theory this should be a relatively risk-free trade, where investors attempt to arbitrage small differences between futures on Treasuries and the actual bonds. The concern was that because this trade can be leveraged 20X, or potentially 50X, some key players in the bond market could have been wiped out by the volatility. (For those with long memories or a sense of financial history, this was reminiscent of the Long Term Capital Management blowup in 1997.) The President’s comments while pausing most tariffs for 90 days referred to “yippy” bond markets. Stocks relished the changing tariff tack, but bonds seemed unimpressed, and the dollar plunged subsequently. With

Movements in US Treasuries and the dollar are telling us that international investors are concerned. At one point this morning we saw 10-year yields rise by as much as 16 basis points and the Euro rise by about 2 cents versus the dollar. Those trends abated at about 11am EDT, implying that European investors were actively selling US fixed income and stopped when it was time to go home for the weekend.

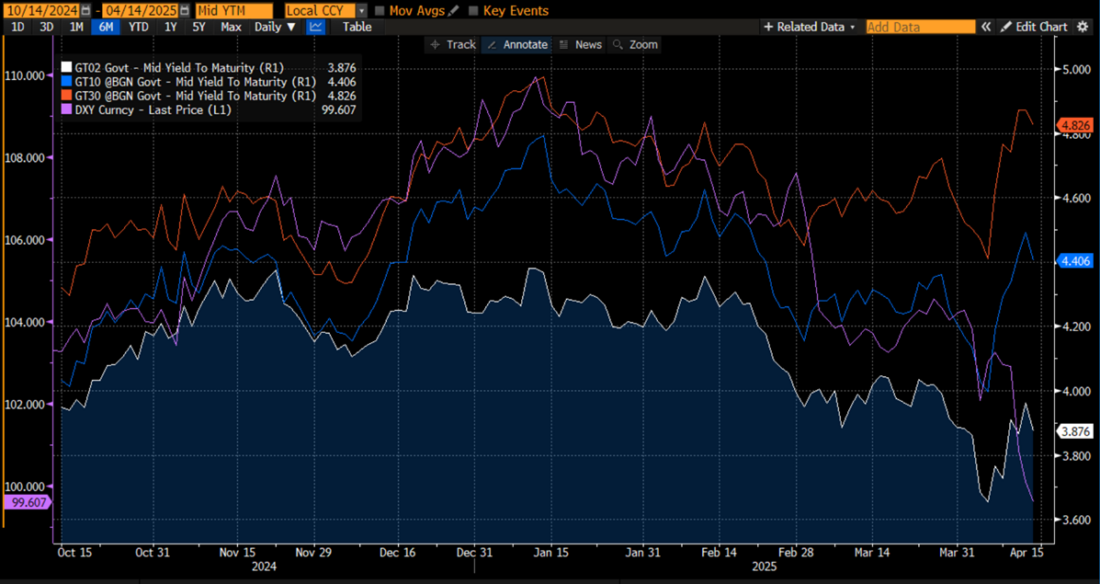

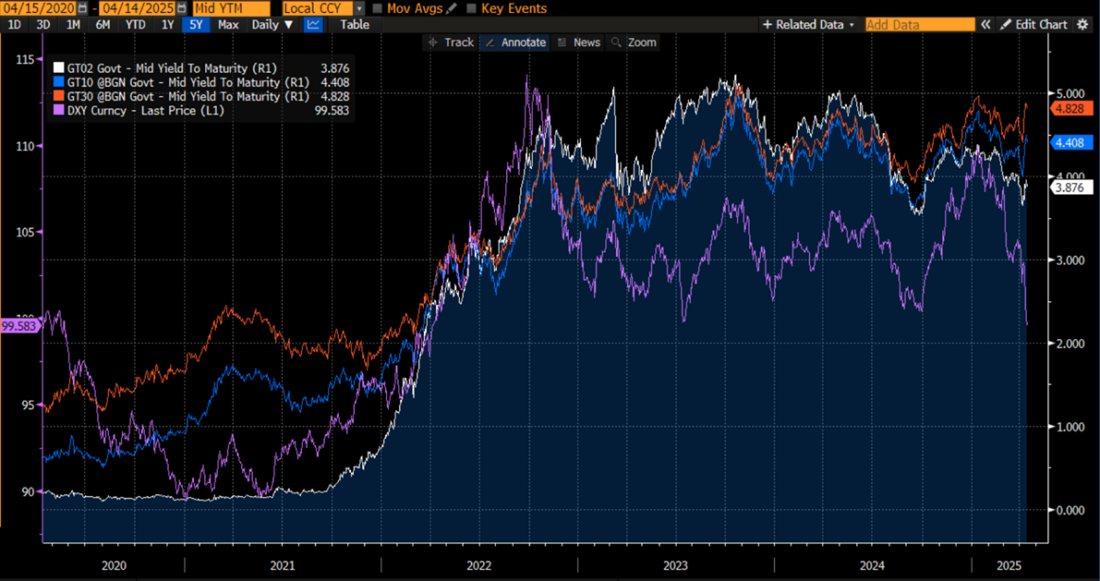

Fortunately for US bonds and stocks, European bond investors did not pick up today where they left off Friday. Yields are generally lower, and DXY is only down slightly. Perhaps some relative normalcy is returning to the global marketplace. But I’ll leave you with some longer-term perspective about the moves that we have been seeing recently. Yields approached but did not come particularly close to their highs of January, though the dollar index is at a multi-month low. DXY is now flirting with a post-2022 low. As we also noted on Friday:

One could certainly assert that the weaker USD should be a boon for US equities. The leading US companies are multinationals, with revenues in a wide range of currencies. A weaker dollar means that those foreign revenues are worth more when translated into USD.

All things being equal, the weaker dollar can be a tailwind for multinational stocks. The question is whether that tailwind will be sufficient to offset a potential tide out of US assets.

6-Month Chart: 2-Year (white, right scale), 10-Year (blue, right), 30-Year (red, right) UST Yields, DXY (purple, left scale)

Source: Bloomberg

5-Year Chart: 2-Year (white, right scale), 10-Year (blue, right), 30-Year (red, right) UST Yields, DXY (purple, left scale)

Source: Bloomberg

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.