Today’s theme song: “You’re a Mean One, Mr. Grinch”[i]

You’re a mean one, Mr. Grinch,

You really are a heel,

You’re as cuddly as a cactus, you’re as charming as an eel, Mr. Grinch,

You’re a bad banana with a greasy black peel!

Frequent readers of these pieces – thank you – have repeatedly seen me refer to Fed Chair Jerome Powell as “Goldilocks in a Suit” because of his remarkable ability to maintain an even keel during his press conferences and offset worrisome monetary concerns with a positive spin. That skill was not in evidence yesterday.

On the surface, yesterday’s FOMC announcement should have provided little surprise. We noted yesterday that market expectations were for a “hawkish cut,” writing:

In theory, the committee will allow the expected cut today but then signal that cuts will be slow to arrive in 2025. The signal could come through the Summary of Economic Projections (aka the “dot plot”) and/or via Chair Powell’s rhetoric during the post-decision press conference. Bear in mind that the last dot plot was offered in September, and it indicated a median projection for the end of 2025 of 3.4%, down from 4.1% in June. Fed Funds Futures for December 2025 now center around a rate of 3.75-4%. That would imply two rate cuts during 2025 (assuming one today) …

So, what’s the problem? The Fed did not disappoint regarding the 25-basis point cut that was firmly priced in yesterday. Furthermore, the SEP showed a 3.9% median expectation for 2025’s Fed Funds target, which seemed to be right in line with market projections. Considering that the current target is now 4.25-4.5%, with a midpoint of 4.375%, or 4.4% when rounded to the one digit used in the SEP table, 3.9% implies a 3.75-4% target, or two more 25 bp cuts. The issue was with the messaging, both by the other items in the SEP and by the Chair himself.

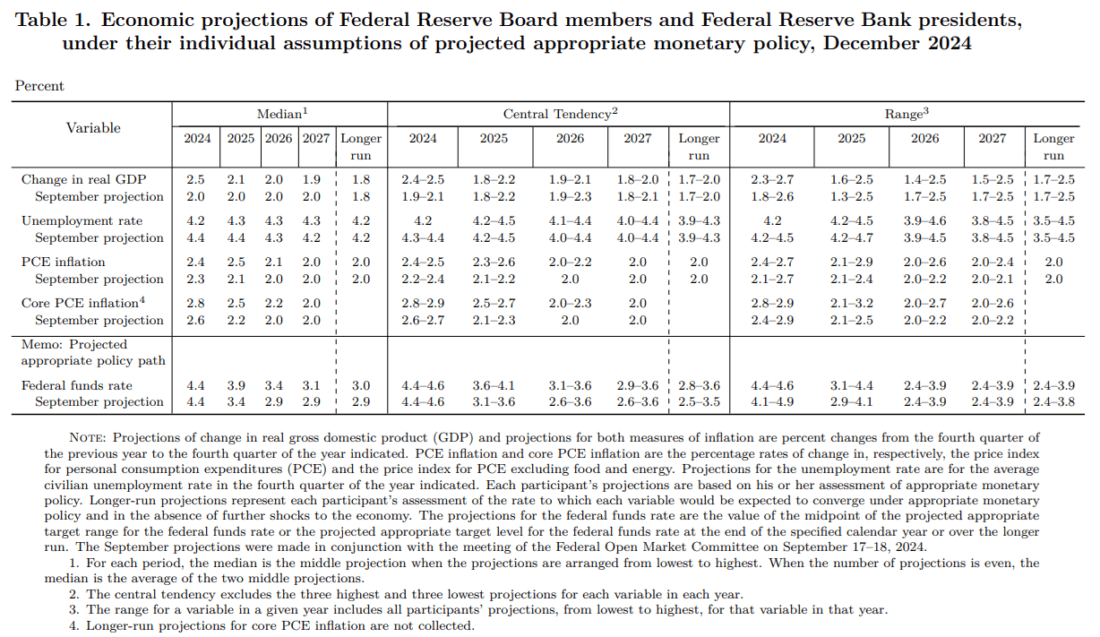

Let’s take a look at the SEP itself. None of the new projections are particularly helpful for those seeking rate accommodation.

Source: Federal Reserve

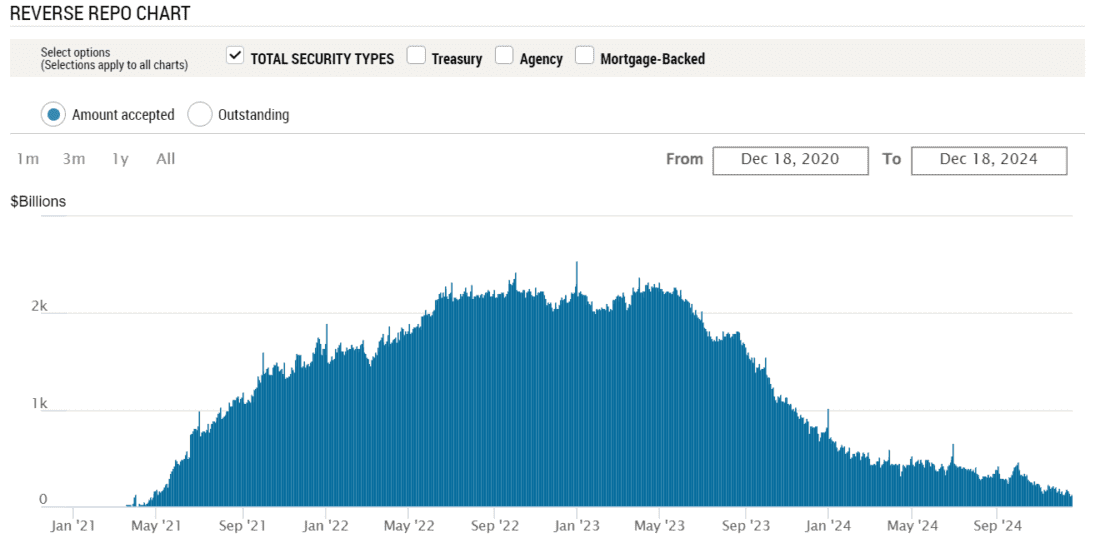

Since the September SEP, we see median GDP projections for 2025 rising slightly from 2.0 to 2.1; the Unemployment Rate dipping from 4.4% to 4.3%; and headline and Core PCE Inflation rising to 2.5% from the prior 2.1% and 2.2% projections, respectively. A central bank that expects a combination of a stronger economy, a better than feared labor market, and higher inflation expectations is not a central bank that is likely to aggressively cut rates anytime soon. Further complicating the matter, Chair Powell’s comments about potential tariffs during the press conference seemed quite uncertain. And for the icing on the cake, the FOMC lowered the rate on reverse repos to match the lower end of the funds target. It had been set 5 bp above that number. This seems to be an attempt to lower the appeal for money market funds to park money at the Fed. In theory, that could push money out of money-market funds and into the stock market, but most of that effect has already been felt.–

Source: New York Federal Reserve Bank

As a result, even though we came into the meeting with markets expecting fewer rate cuts than the prior dot plot implied, we still find ourselves in that situation. The peak expectation for December implied by Fed Funds futures is in the 4-4.25% range, implying only one cut next year. And yesterday’s 11bp rise in 2-year yields implied that short-term fixed income traders were indeed changing their views despite a seemingly unsurprising set of moves by the FOMC. The higher bond yields led to a stronger dollar, the stronger dollar pressured multinationals, and we ended up with a VIX (Cboe Volatility Index) that leapt from under 16 to over 27, a sign that traders were suddenly scrambling for protection, and they wanted it NOW!

Today we see a bit of a knee-jerk “buy the dip” reaction. Yesterday’s moves could easily have been overdone, and it is quite normal to see traders hunt for bargains – particularly after sizeable drops in some of their favorite names. The initial reaction was perhaps a bit exuberant, though. S&P Index Futures (ES) were up about 17 points when I woke up, but up about 50 when the market opened. There was nothing to change sentiment that quickly other than fear of missed out on the kneejerk rally. We’ve since seen the initial rally fade, though at midday we remain higher. Quite tellingly, though, VIX remains at an elevated 22.37, while January VIX futures trade just under 20. That backwardation implies that there is still an imbalance of demand for short-term volatility protection. And thus, we don’t know yet if the Grinch stole the widely hoped-for Santa Claus rally.

—

[i] A few fun facts about what is probably my favorite holiday song. The lyrics were co-written by Theodore Geisel (aka Dr. Seuss, of course) and Albert Hague. Fans of the move Fame know the latter as an elderly music teacher. The vocals were provided, originally uncredited, by the wonderfully named Thurl Ravenscroft, whose voice is best recognized as “Tony the Tiger” saying of Kellogg’s Frosted Flakes “They’re Great!”

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.