Editor’s note: “How the Medical Industry Could Produce the Biggest AI Stock Winners” was previously published in November 2023. It has since been updated to include the most relevant information available.

For the past few months, most AI headlines grabbing Wall Street’s attention have been centered around companies like Nvidia (NVDA) and Microsoft (MSFT). But the biggest AI stock boom is happening in an entirely different sector. And it’s going unnoticed by the mainstream media.

I’m talking about biotech stocks.

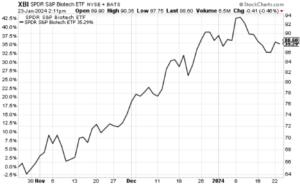

In about two months, the SPDR S&P Biotech ETF (XBI) has soared more than 45% from its October 2023 lows.

Why? AI.

The application of AI in biology holds the potential to unlock enormous economic value for one simple reason – data.

The more data, the better the AI.

It’s that simple.

And when it comes to the human body, there is no dearth of quality data. In fact, there is more high-quality data than anywhere else on Earth.

Humans – like computers – are really nothing more than a bunch of data strung together.

At their core, computers are just a bunch of 1s and 0s coded in sequence, with each number corresponding to a certain action for the computer to perform. Humans, similarly, are a bunch of As, Gs, Cs, and Ts strung together – or the four base types found in human DNA molecules – with each determining a person’s characteristics, traits, and even actions.

Humans are full of data.

Apply AI to all that data, and you will change the world.

The AI Revolution Applied to Medicine

The human body is the greatest mystery of the modern world. AI can solve that mystery, and in so doing, solve myriad problems that plague all humans.

Consider this: It takes about $900 million and 13.5 years to develop a new successful drug.

The drug development process is so expensive and time-consuming that firms cannot afford to push that many drugs forward. This creates a huge shortage in drug candidates and programs relative to what is possible given all the permutations of human biological data.

But AI can significantly shorten and cheapen this process.

Why does it take so long to find new drugs? Because the universe of biological data is enormous. It takes scientists great effort to sort through all the data, uncover the root causes of diseases, and formulate compounds to fight those diseases.

But AI can automate that entire process. It can map out genetic data, identify mutations, and run simulations to find the right compounds and combat those mutations – all almost instantly.

Essentially, researchers can use AI to find new drug candidates much faster than is currently possible.

And this is already happening.

Last year, Japanese pharma giant Takeda Pharmaceutical bought an experimental psoriasis drug for $4 billion – a drug that was created in only six months by using AI.

It isn’t alone.

Other pharma giants like Bayer, Roche, Sanofi, and AstraZeneca are actively using AI technology for drug discovery purposes.

The future of AI-powered drug discovery starts now.

The Final Word

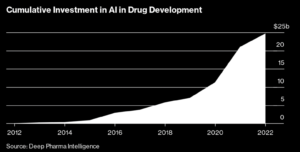

Research firm Deep Pharma Intelligence estimates that investments in the field of AI-powered drug discovery have tripled over the past four years to nearly $25 billion. Morgan Stanley believes this tech will lead to an additional 50 novel therapies being brought to market over the next decade, with annual sales in excess of $50 billion!

In other words, a $50 billion AI drug discovery revolution starts now.

Is your portfolio positioned for it?

If not, check out a few of the top AI biotech stocks that we are watching right now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.