Read about the Impact of High-Frequency Trading in Part I.

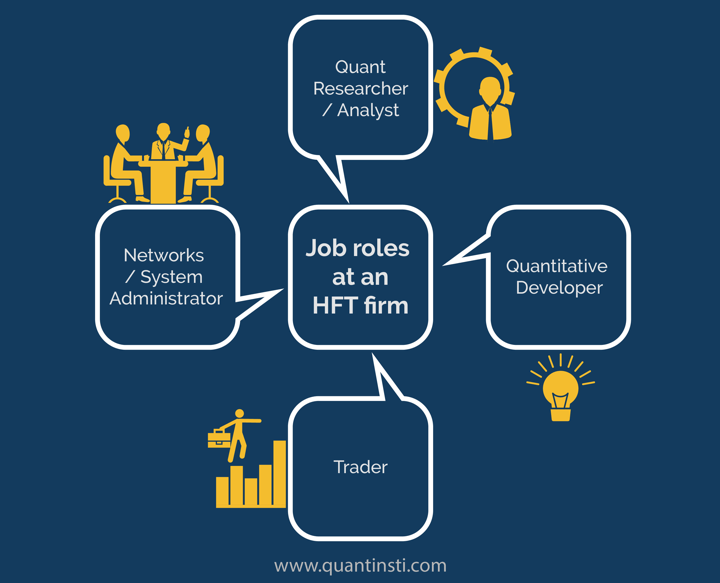

Job roles at HFT firm

Before trying for a job at a high-frequency trading firm, you must be familiar with the various job roles available. With this knowledge of all the roles, you can target the job that suits you best.

Mainly there are the following four job roles at an HFT firm:

Quant Researcher/ Analyst

As a Quantitative Researcher or Analyst, your primary responsibilities include developing mathematical models and strategies to guide trading decisions. This involves creating and refining algorithms that aim to execute trades and optimise trading performance. In this role, you are also responsible for analysing market data to identify patterns and uncover trading opportunities, which requires a deep understanding of financial markets and statistical techniques. Additionally, you must backtest strategies to evaluate their effectiveness and make necessary adjustments based on performance results. This process ensures that your models are robust and reliable before they are implemented in live trading environments.

Market Microstructure Analyst is one of the roles you can take up under the category of quant analyst. A market microstructure analyst studies the microstructure of financial markets to improve trading strategies. Also, this role expects the analysis of order flow, market depth, and other aspects of market behaviour. Moreover, this role needs to provide insights to quant researchers and traders in order to help them create the strategies on the basis of analysis.

If you are interested in building algorithmic models yourself and want to apply for a quant job, such as a quant analyst/ researcher role, pick up quantitative skills with working knowledge of using quant tools such as R, Matlab, and Python.

Skills required: Strong foundation in mathematics, statistics, programming (especially C++ and Python), and financial modelling.

Quantitative Developer

For the quantitative developer role, you would be expected to implement or modify the strategies and/or infrastructure developed by the research team. Most likely you would be working with a quant analyst who would have developed the trading model and you would be required to code the strategy into an execution platform.

Also, the quant developer works to ensure that the systems on which the strategies are being executed and modified are robust and efficient.

There are certain roles that fall under this category. Below you will see each role and the responsibilities mentioned and these are:

Software Engineer

- Develop and maintain the trading platform.

- Work on low-latency systems, optimising for speed and efficiency.

- Collaborate with quant developers and traders to integrate new strategies.

Infrastructure Engineer

- Manage and optimise the firm’s IT infrastructure.

- Ensure the availability and performance of trading systems.

- Handle network architecture, data centers, and hardware optimisation.

Network Engineer

- Optimise network performance for low-latency trading.

- Manage connections to exchanges and other trading venues.

- Troubleshoot network issues and ensure minimal downtime.

Data Scientist/Data Engineer

- Manage and analyse large datasets used for trading.

- Develop tools and processes for data extraction, transformation, and loading (ETL).

- Work on machine learning models to improve trading strategies.

Skills required: Deep understanding of financial markets, quantitative analysis skills, experience with back-testing and optimisation techniques.

Trader

For the trading role, your knowledge of finance would be crucial along with your problem-solving abilities. If you are good at puzzles and problem-solving, you will enjoy the intricacies and complexities of the financial world.

Skills required: Strong understanding of financial markets, risk management expertise, ability to work under pressure and make quick decisions.

Networks / System Administrator

Core development work which involves maintaining the high-frequency trading platform and coding strategies needs a programming language such as C++ or Java.

Skills required: Expertise in network infrastructure, system administration, and knowledge of low-latency networking technologies.

Understanding what it takes to meet High-Frequency trading job requirements is crucial for anyone eyeing a career in high-frequency trading. It’s a blend of specific skills and know-how that can make all the difference in landing your dream job.

Each role holds due importance concerning the specialisation in the particular field. As an aspiring HFT firm employee, you must find your niche and then apply for the job accordingly.

But, what knowledge should you have to get into HFT?

Let us take a look at the qualifications aspect of an HFT firm employee further.

Qualifications required to get a job at an HFT firm

High-frequency trading jobs are extremely technical disciplines and they attract the very best candidates from varied areas of science and engineering – mathematics, physics, computer science and electronic engineering. ⁽³⁾

- In the developed countries, you need a PhD in CS or Physics or Maths or an MFE degree to become a quant.

- In developing economies, an engineering degree in CS, or Maths, or an MBA in finance from a reputed college.

- An advanced degree (Master’s or PhD) in a quantitative field like Mathematics, Physics, Computer Science, or Electronic Engineering or an MFE in finance from a reputed institution is generally preferred.

Some firms might consider applicants with a strong Bachelor’s degree in a relevant field, particularly if coupled with relevant work experience. Along with that, you surely need a zeal for problem-solving and coding. All this put together, you have a great chance to land up as a quant analyst or a quant developer in a High-Frequency Trading firm.

Key takeaways:

- While the degree makes the resume presentable, do not consider it a barrier in case you don’t have one.

- With a lot of practical work to show in your resume, you can be recognised by the industry as a potential employee.

- However one thing is for sure, you need to be mentally prepared to invest a significant amount of time in studies (a bookworm? Probably Yes!) and need to make really good practical efforts as a quant trader or a quant developer.

Now that we are through with the qualifications part, let us get to the know-how of the skills required for working at an HFT firm.

Skills needed to work at an HFT firm

High-frequency trading (HFT) firms thrive on a meritocratic approach, offering significant autonomy in projects. While breaking into HFT is challenging, it provides an opportunity to work with exceptionally smart and capable individuals in a self-starting environment. If this excites you, HFT could be your ideal career path.

Take, for instance, iRage, an HFT firm where you’ll tackle complex engineering problems and help shape the future of this lucrative industry. You’ll collaborate with top-tier programmers, quants, and traders, making every day intellectually stimulating and rewarding.

Note: iRage is a known associate of QuantInsti.

Here are some of the key skills needed for landing a High-Frequency trading job.

- Ready to Evolve at a Fast Pace: HFT roles are highly competitive and demand the constant evolution of your systems. While the rewards are substantial, there are times when months of hard work and research may be rendered obsolete by changes in exchange architecture or new regulatory environments. Being mentally prepared to quickly adapt to such challenges is crucial.

- Entrepreneurial and Meritocratic Approach: Most HFT firms are relatively small, often with fewer than 100 employees, fostering a strong entrepreneurial culture and meritocratic mindset. In these environments, bonuses are often a multiple of your base pay, directly tied to your ability to generate revenue. This means you have the opportunity to “create your own role” within the firm, driving your success through innovation and performance.

- Adaptation to Long Working Hours: Be prepared for longer working hours for a higher success rate.

- Industrial Expertise: Expertise in low-latency software development, big data, or machine learning is highly valued. These skills can provide a strong entry point into the HFT domain.

- Networking and Market Awareness: To land a job at an HFT firm, networking effectively, staying ahead of market trends, and showcasing your expertise are essential. Demonstrating a solid grasp of algorithms, the programming languages, and the ability to thrive in a high-pressure environment will make you an irresistible candidate to employers.

- Technical Skills: Getting hired as a quant trader in an HFT firm requires extensive technical skills, typically derived from fields such as mathematics, physics, computer science, or electronic engineering.

Tip: If you’re eyeing a job at an HFT firm, network like a pro, stay ahead of market trends, and showcase your expertise to make yourself irresistible to employers.

Stay tuned for Part II to learn about the resources for learning High-Frequency trading.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.