Use the Securities Lending Dashboard to analyze short sale metrics for these and other stocks.

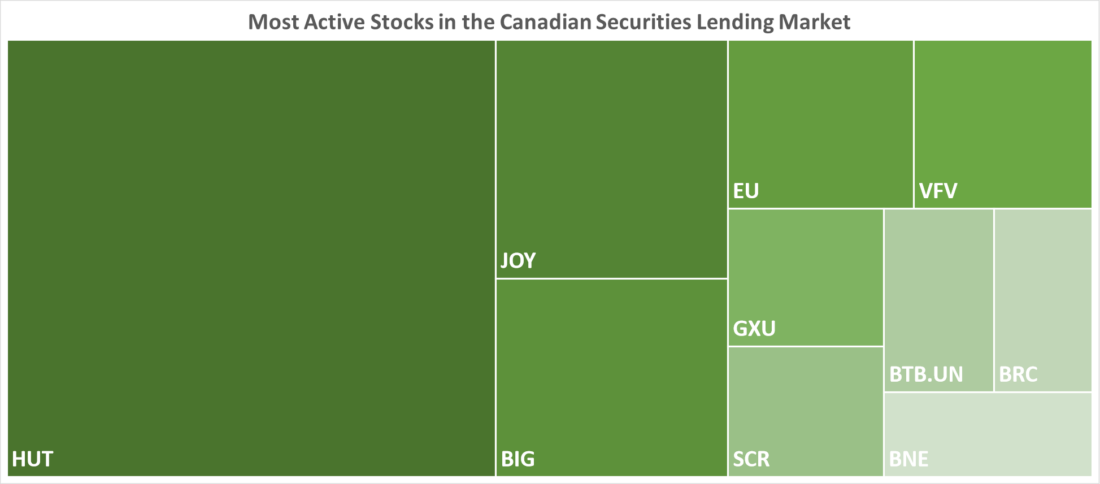

Most Active Stocks in the Canadian Securities Lending Market

| Rank | Stocks | Description |

| 1 | HUT | HUT 8 CORP |

| 2 | JOY | JOURNEY ENERGY INC |

| 3 | BIG | HERCULES SILVER CORP |

| 4 | EU | ENCORE ENERGY CORP |

| 5 | VFV | VANGUARD S&P 500 INDEX ETF |

| 6 | GXU | GOVIEX URANIUM INC |

| 7 | SCR | STRATHCONA RESOURCES LTD |

| 8 | BTB.UN | BTB REAL ESTATE INVESTMENT T |

| 9 | BRC | BLACKROCK SILVER CORP |

| 10 | BNE | BONTERRA ENERGY CORP |

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.