Market players are watching yields soar as another hotter-than-expected inflation figure hits the tape. While yesterday morning’s hot price pressure report came from Canada, last night’s numbers arrived from across the Pacific in Australia. These two prints occur at a time when the Fed appears reluctant to accommodate policy just yet as a controversial presidential election is approaching quickly. Meanwhile, new home sales reflect the pressure that lofty mortgage rates and tighter credit conditions are having on the real estate sector.

Aussie Prices Ramp Up

Australian price pressures picked up last month, as costs for housing, financial services and alcohol/tobacco products weighed on household budgets. May inflation accelerated to 4% on a year-over-year (y/y) basis from 3.6% in April and surprised to the upside considering that the median estimate was 3.8%.

Real Estate Weakness Persists

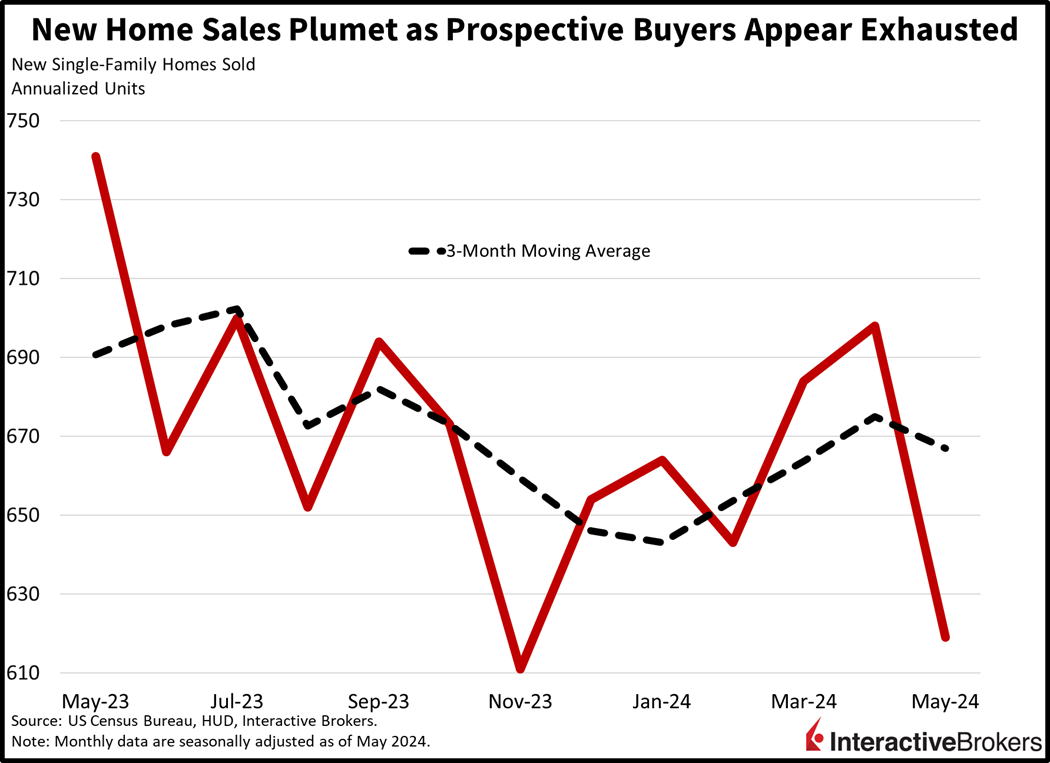

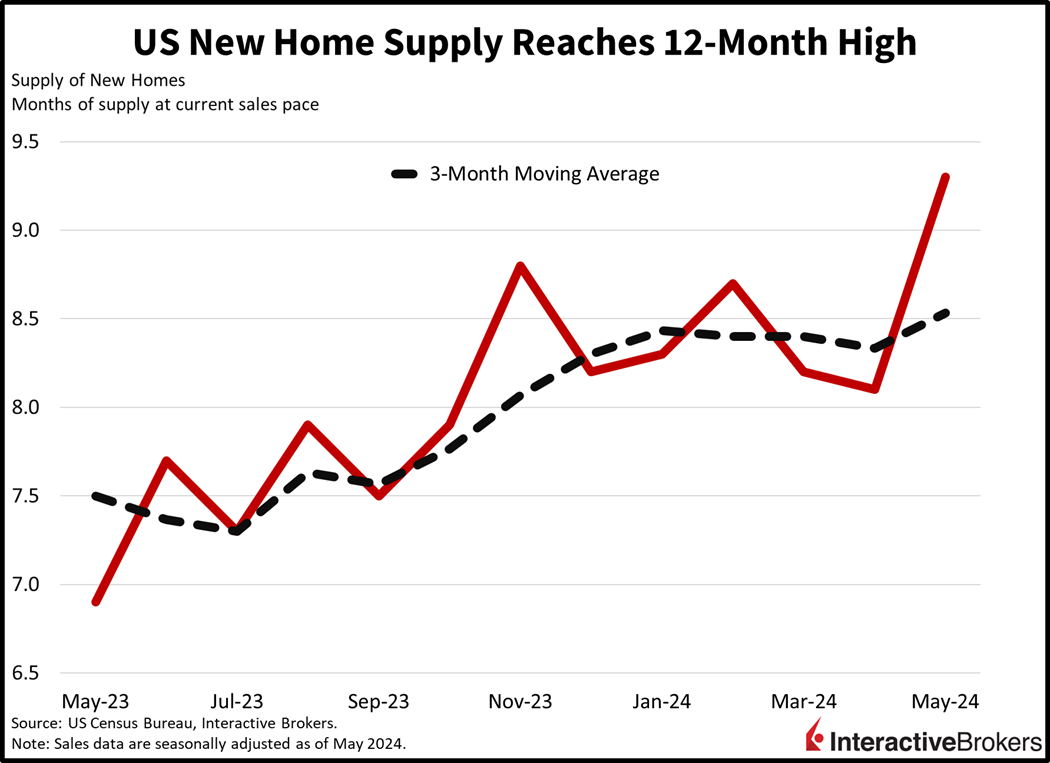

The annualized pace of new home sales fell from 698,000 to 619,00 last month, a sizable 11.3% month over month (m/m) decline as high prices and soaring mortgage rates keep potential buyers on the sidelines. Total sales fell substantially below the 636,000 anticipated by analysts. The Northeast led the decline, with the pace of transactions dropping 43% m/m, followed by the South, Midwest and West which plummeted 12%, 8.6% and 4.5% during the period. On a year-over-year basis, the pace of national new home sales fell 16.5%. Meanwhile, the median home sales price and inventory both increased m/m. For May, the median price was $520,000, up from $503,000 m/m, while the months of inventory available based on the current sales pace increased from 8.1 to 9.3, the highest number since November 2022.

Yen Hits a 38-Year Low

Despite Japanese authorities plowing $62 billion into shoring up its currency this spring, the country’s currency has declined even further with the US greenback trading at 160.39 to the yen. It is the lowest yen value since 1986. Japan’s low key-interest range of zero to 0.1% has caused investors to dump the currency in favor of the US dollar, a nation which sports much higher short-end yields. The recent yen plunge has market participants watching carefully for additional intervention from the country. Earlier this week, Japan’s currency diplomat, Masato Kanda, maintained that Japan has always been ready to shore up its currency. Investors placed little or no credence in his remarks after the spring attempt to bailout the currency failed. At this point, it appears only an interest rate hike by the Bank of Japan, which meets next month, or a rate cut by the Fed will help turnaround the ailing currency.

FedEx Shares Rally on Cost Cutting

FedEx shares popped approximately 15% last night after the company reported revenue and earnings for the period ended May 31 that beat analyst consensus expectations. Additionally, the company’s progress toward cutting $4 billion in expenses helped support investor enthusiasm for the transportation firm. In the recent quarter, revenue increased to $22.1 billion, up from $21.9 billion in the year-ago quarter. Chief Customer Officer Brie Carere provided a mixed view of the economy. The decline in shipping volume has moderated, but demand has yet to improve, although the company believes revenue will increase in the low to mid-single-digit range during its current fiscal year, which started June 1. Ecommerce and low inventory levels are likely to help support demand for shipping. The company’s increased base fees and addition of a fuel surcharge will also support revenue.

Inflation Fears Push Investors Out

Bearish action is dominating markets today as investors unload stocks, bonds and commodities on the back of global inflation worries. All major US equity indices are pointing south with the Russell 2000, Dow Jones Industrial, S&P 500 and Nasdaq Composite benchmarks losing 0.3%, 0.1%, 0.1% and 0.1%. Sectoral breadth is deeply negative, with every segment lower except for consumer discretionary, which is higher by 0.9%. Leading the charge south are the energy, financials and technology components, which are lower by 1.2%, 0.8% and 0.4%. Treasurys are suffering as well, with rate watchers concerned that there may be bumps concerning central bank rate reductions. The 2- and 10-year maturities are being offered at 4.75% and 4.31%, 6 and 8 basis points (bps) north on the session. The greenback is benefiting from central bank discipline on a relative basis, with the Dollar Index up 36 bps to 106.01 as it appreciates versus all of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Commodity land is getting punished as demand concerns mount due to the prospect of incrementally tighter central banks and rising energy supplies stateside, according to this morning’s Department of Energy report. Gold, lumber, crude oil, silver and copper are lower by 0.8%, 0.5%, 0.1%, 0.1% and 0.1% as a result.

Higher Yields Could Trigger Market Decline

With rates back on the upswing due to international price pressure concerns, an important consideration going forward will be if government debt, deficits and issuance will begin to matter again. Indeed, the last 10% correction in equities occurred as the 10-year yield touched 5% and the S&P 500 was trading at around 4100 in October. That run-up in borrowing costs occurred on the back of lackluster Treasury auctions and booming commodities, two ingredients that are absent today. But if just one of those two dynamics occurs in tandem with price pressures returning because of sticky services costs, then the path back to 5% opens up.

Visit Traders’ Academy to Learn More About New Home Sales and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.