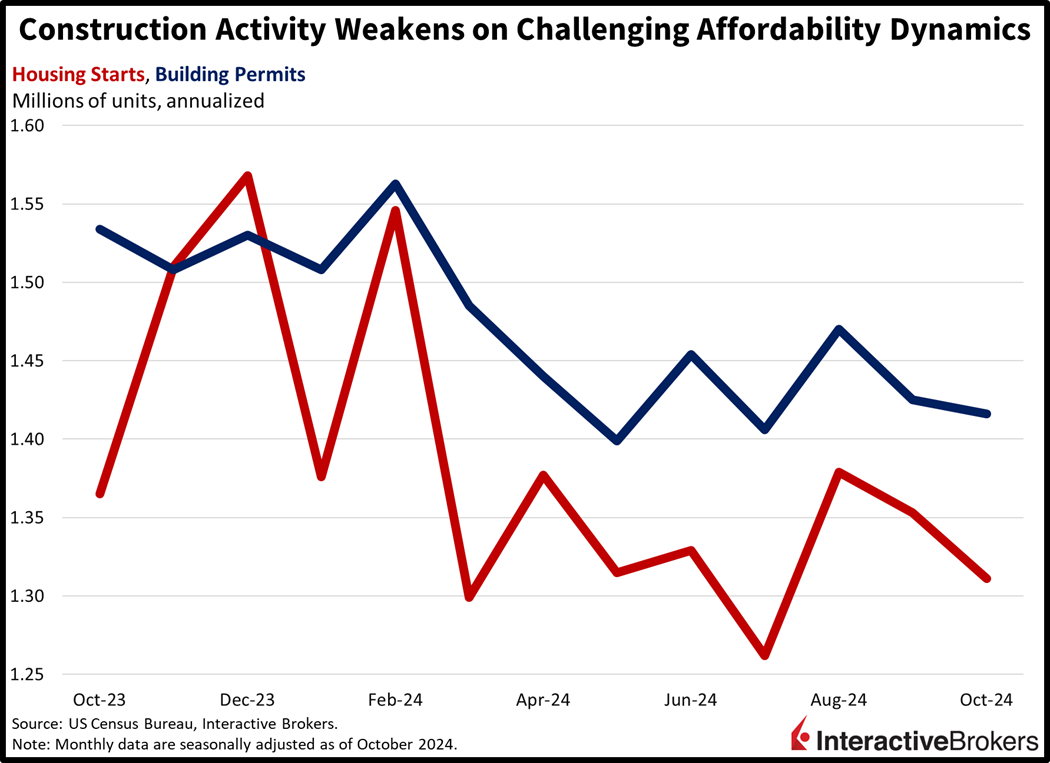

Heightening geopolitical tensions between Kyiv and Moscow are generating hesitation among market participants as Russia’s rhetoric regarding using nuclear weapons intensifies and both sides launch attacks. But despite investors embracing the risk-off playbook and scooping up Treasurys, gold bars, Swiss francs, equity index put spreads and volatility call options, stocks have climbed into the green after suffering from some early morning selling. Declining yields are certainly a motivator to buy the dip, while this morning’s weaker-than-expected real estate data has also served to subdue borrowing costs. Indeed, construction activity continues to weaken as prospective buyer affordability remains pressured by an unfavorable mix of elevated costs and lofty mortgage rates.

Putin Steps Up Nuclear Retaliation Threats

Geopolitical angst spiked today after Russian President Vladimir Putin approved a policy stating that the country may launch a nuclear strike if it or ally Belarus are threatened by any attack using conventional weapons. The policy is more aggressive than past Moscow warnings that it may retaliate with nuclear weapons if the White House allows Ukraine to fire western made missiles deep into Russia. More recently, President Joe Biden has responded to North Korea sending troops to aid Moscow by authorizing Ukraine to target Russia with ATACM tactical missiles, which have a 190-mile range. Ukraine wasted no time in responding with the struggling country launching six of the missiles into Russia’s Bryansk region.

Despite Improving Sentiment, Construction Falters

A seven-month-high level of sentiment among homebuilders hasn’t offset a decline in the number of swinging hammers and visits to local building permit offices. Yesterday’s NAHB/Wells Fargo Homebuilder Sentiment Index climbed significantly month over month (m/m), but today’s Commerce data release shows that housing starts and building permits contracted in October to 1.311 million and 1.416 million seasonally adjusted annualized units, respectively. Starts fell short of the median estimate of 1.340 million and dropped 3.1% from the 1.353 million September pace. Permits, which are issued before breaking ground, also disappointed with the monthly result missing the analyst consensus expectation of 1.440 million and declining 0.6% from a rate of 1.425 million in the preceding month.

Single-Family Weakness Persists

For single-family projects, the pace of construction starts fell 6.9% while permits increased 0.5% m/m. Conversely, apartment building starts climbed 9.8% from October, but during the same period, permits contracted 3%. In the South, vast areas experienced disruptions from Hurricanes Helene and Milton, contributing to the region experiencing 8.8% and 1.8% declines in starts and permits. The Northeast region, meanwhile, experienced a 32.9% m/m drop in groundbreaking last month but a 13.4% increase in permitting. The West and Midwest fared well in the starts departments with advances of 21.1% and 9.4% but saw permitting volumes slip 1.2% and 4% during the period.

Retailers Produce Stronger-Than-Expected Sales

Walmart (WMT) and Lowes (LOW) posted third-quarter sales and earnings that surpassed analyst expectations and both companies upgraded their revenue and earnings guidance for the current year. Walmart now estimates a year-over-year net sales increase ranging from 4.8% to 5.1% compared to its early guidance of 3.7% to 4.75%. Lowes, for its part, said it expects full-year sales of between $83 billion and $83.5 billion, up from its previous forecast of $82.7 billion. However, even after a strong third quarter, Lowes expects same-store sales to decline as much as 3.5%. It previously said the decline could be as large as 4%. Regarding consumer spending, Walmart Chief Financial Officer John David Rainey told CNBC that general merchandise sales have improved for the second quarter after 11 quarters of declines. However, customers are holding out for bargains. Lowes CEO Marvin Ellison said many consumers are still holding off on big projects. In the meantime, the company is working to shore up online sales and upgrade its stores.

Investors Buy the Dip

Stocks have recovered from this morning’s geopolitical worries as rates continue declining, with most domestic equity benchmarks gaining on the session. Still, the upside is modest, but notable considering the volatility spike earlier in the day. The Nasdaq 100, S&P 500 and Russell 2000 indices are higher by 0.2%, 0.1% and 0.1% while the Dow Jones Industrial Average remains down 0.3%. Sectoral breadth is mixed with 5 out of 11 sectors higher and led by real estate, technology and consumer staples, which are higher by 0.3%, 0.3% and 0.2%. Meanwhile, the laggards are represented by materials, energy and healthcare. They are lower by 0.6%, 0.6% and 0.5%. Treasurys and the greenback are benefiting from safe-haven demand with the 2- and 10-year maturities changing hands at 4.27% and 4.38%, 2 and 3 basis points (bps) lighter on the session. Meanwhile, the Dollar Index is up 3 bps as it appreciates versus the euro, yuan and pound sterling but depreciates versus the yen, franc and Aussie and Canadian tenders. Commodities are marginally bullish, with gold, copper, lumber and silver higher by 0.5%, 0.1%, 0.1% but crude oil is down 0.3%. WTI crude is trading at $68.80 per barrel as softening economic prospects out of Beijing and dwindling tensions in the Middle East offset rising hostilities in the Far East.

Brace For Trump Bumps

Today’s trading underscores the turbulence we’re likely to experience as the GOP takes control of Washington. The major changes proposed by the party are already generating substantial uncertainty and the aggressive styles of the new batch of leaders are likely to keep geopolitics a pronounced risk for markets. Plans for fiscal spending cuts, tax reductions, tariffs, deregulation and immigration could lead to significant economic shifts that are challenging to quantify. While many of the propositions are structurally positive, the wide range of potential outcomes leads to a backdrop that is ripe for volatility. The new administration may be positive for risk assets but not without Trump bumps along the way.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.