Shares of leading cybersecurity pure-play Fortinet (FTNT 0.87%) closed out 2023 on a sour note. Management downgraded its prior financial guidance, and left the door open for a significant slowdown in business growth in 2024. Investors were mighty displeased, although it’s worth noting that Fortinet stock still managed to rise 20% in 2023 thanks to a year-end rally.

Nevertheless, the cybersecurity market is still riding massive demand as cloud computing growth continues unabated. Is it time to buy Fortinet to kick off 2024?

A standout cybersecurity leader entering a rough patch

Fortinet is a leader in firewalls, physical devices used in network security. Next-gen firewalls (NGFW) have evolved from the devices of yesteryear that kept a simple physical location like an office building on lockdown. Today, NGFWs are used in data centers, wireless networks, and internet infrastructure, and are even virtualized (software-based firewalls that can protect apps and software code).

Fortinet often touts the “security and networking convergence” (security hardware being embedded into IT infrastructure itself, rather than acting as a stand-alone segment of a computing network) as a long-term growth driver for its hardware. This played out in grand fashion in the last few years. In the third quarter of 2023, Fortinet’s product revenue totaled $466 million, up dramatically from just $197 million in the same period four years ago (2019) before the pandemic began.

Of the NGFW leaders — Fortinet, Palo Alto Networks, and Check Point Software Technologies — Fortinet has enjoyed the biggest boom in networking hardware and security growth during the pandemic era. During the comparable period to Fortinet’s Q3 2023, Palo Alto Networks’ product sales were $341 million (up 48% from four years ago), and Check Point’s were $114 million (down 3%).

But as is the case with all hardware-based sales, the growth cycle has come to an end — at least for the time being. Fortinet is expecting a decline in product sales (driven by NGFWs) to last into 2024, with many customers favoring service- and subscription-based revenue rather than spending on new networking hardware to manage their cash in a slowing economy.

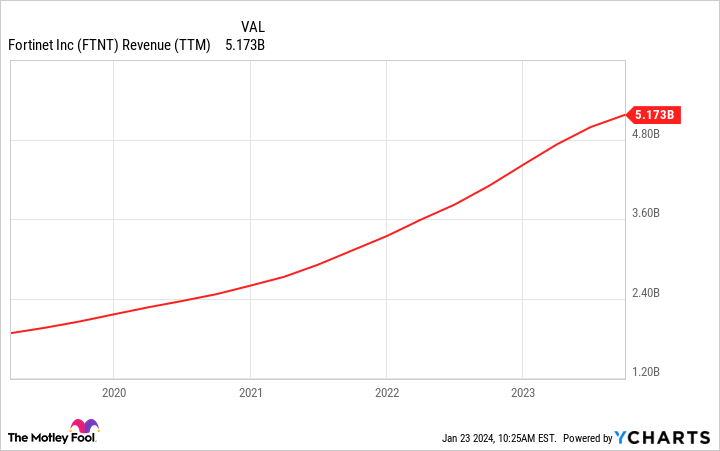

Fortinet’s billings growth (invoices that haven’t been paid by customers yet) implies overall revenue will slow to as little as a high-single-digit percentage from fourth-quarter 2023 and into 2024, down from the rapid expansion of the last few years.

Data by YCharts.

Fortinet stock isn’t for the faint of heart

Given uncertainty around its NGFW and hardware business this year, I expect Fortinet stock to be highly volatile. Adding to the uncertainty around near-term performance, shares trade for a high premium of 43 times trailing 12-month earnings per share, or 24 times trailing 12-month free cash flow. A high premium is bound to cause some bumpiness, especially if Fortinet gives any further indication of near-term business weakness.

However, some optimism is still warranted. Fortinet is a leader in cybersecurity. It has weathered past cyclical downturns in its business before, and it has the financial wherewithal to plow lots of cash into research and development to foster future growth (operating profit margins were over 23% in the last reported 12-month stretch).

And along the way, management repurchases ample amounts of stock to return excess cash to shareholders. Cash and short-term investments totaled $3.17 billion, offset by debt of only $992 million, as of September 2023. In other words, this company is in tip-top shape and has the resources at its disposal to ride out the storm.

At any rate, the cybersecurity industry — including Fortinet — isn’t for the faint of heart. For investors who want to bet on the long-term trend toward more advanced security needs, consider a dollar-cost averaging plan at this point to build a position in Fortinet and other top cybersecurity stocks over time.

Nicholas Rossolillo and his clients have positions in Fortinet and Palo Alto Networks. The Motley Fool has positions in and recommends Check Point Software Technologies, Fortinet, and Palo Alto Networks. The Motley Fool has a disclosure policy.