Ask yourself honestly: had you ever heard of Rigetti Computing (RGTI) or IONQ Inc. (IONQ) just two months ago? I know that I hadn’t. Yet for the past two weeks, RGTI was the third most active stock on the IBKR platform; IONQ and similar stocks were not far behind. They had a tremendous, rapid run-up before a few comments from a highly influential source squelched the enthusiasm yesterday.

On Tuesday, Jensen Huang, Nvidia’s (NVDA) CEO, made the following comment to Wall Street analysts:

“And so if you kind of said 15 years for very useful quantum computers, that’d probably be on the early side. If you said 30 is probably on the late side. But if you picked 20, I think a whole bunch of us would believe it,”

With the possible exceptions of Elon Musk and Warren Buffett, there is no one whose pronouncements are currently more influential for investors than Huang’s. Frankly, all of them have made a lot of money for their investors, and it’s no coincidence that Tesla (TSLA) and NVDA continually vie for the top slot on our most actives list. And when it comes to anything that involves computing power, artificial intelligence, and anything involving semiconductors, Huang’s voice is by far the most important. Just this week were reminded of it when NVDA ran up 10% in the two sessions prior to Huang’s address to the Consumer Electronic Show, then helped drag the market lower when it turned out to be a bit of a “sell the news” event.

The recent frenzy in quantum computing shares began exactly one month ago on December 9th, 2024, when Alphabet (GOOG, GOOGL) announced Willow, it’s new quantum computing chip. The chip certainly appears to be a major breakthrough, but even the press release offers no guidance about when it might become commercially viable, specifically stating:

The next challenge for the field is to demonstrate a first “useful, beyond-classical” computation on today’s quantum chips that is relevant to a real-world application.

The announcement understandably boosted GOOGL shares, and the stock is now about 10% above where it traded prior to the announcement. But having seen the returns that could have been garnered by those who invested in anything involving artificial intelligence, many investors leapt onto the quantum computing bandwagon quickly and aggressively. It’s quite understandable, especially in a market environment that has favored speculation and momentum strategies. Quite frankly, fundamentals can be foregone if a breakthrough technology might be imminent.

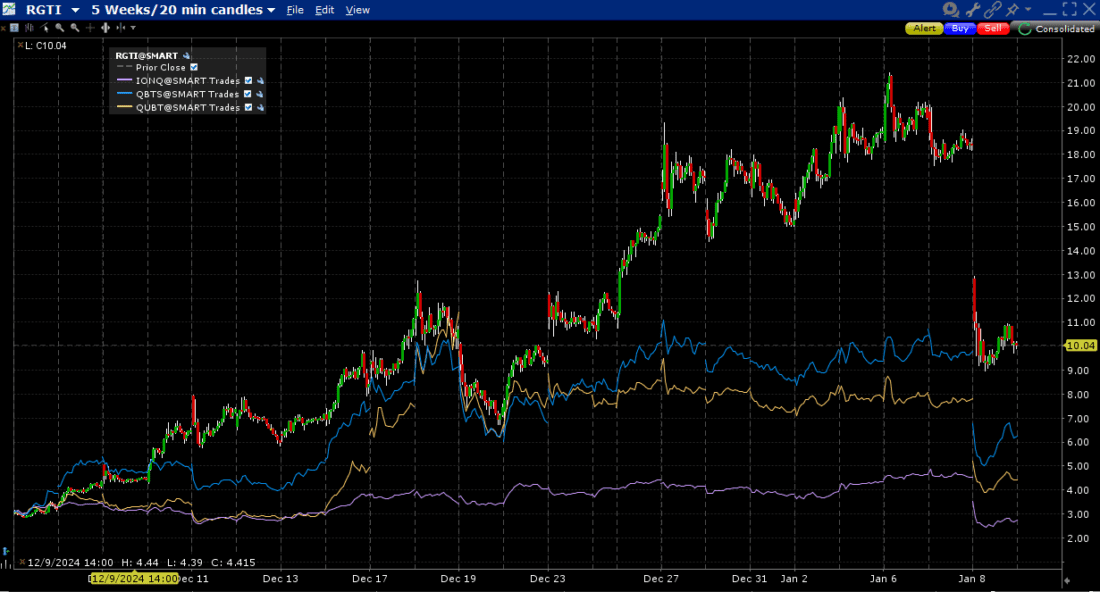

But we were reminded yesterday that the implementation might be anything but imminent. Several smaller but popular quantum plays gave back most, if not all, of their post-December 9th gains:

5 Week Chart, RGTI (20-minute candles), IONQ (lilac line), QBTS (blue line), QUBT (yellow line)

Source: Interactive Brokers

A drop of that magnitude is painful for anyone with a long position in any of those names, especially if one is utilizing margin borrowing. That is likely why declines appeared to spread into a wide range of speculative stocks. That included many of the most heavily shorted names, which had been among the market’s best performers of late. Heavily shorted stocks often rally when speculation, or at least momentum trading, is rampant. Short sellers usually establish their positions after doing fundamental research that leads them to the conclusion that a stock’s valuation far outpaces its valuation, while momentum traders are focused upon a stock’s movement, not valuation. For better or worse, yesterday’s move was about fundamentals crashing a speculative party.

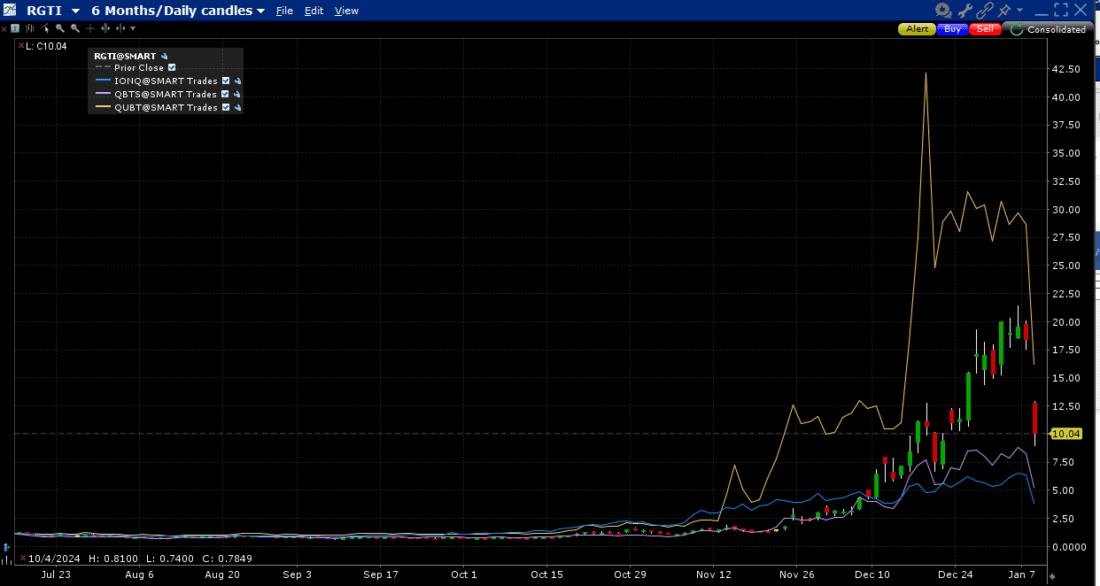

That said, those who truly were early to the quantum computing story are still doing OK – or quite well – as evidenced by the graph below:

6-Month Chart, RGTI (20-minute candles), IONQ (lilac line), QBTS (blue line), QUBT (yellow line)

Source: Interactive Brokers

It may indeed turn out that quantum computing will turn out to be as consequential of a market theme as artificial intelligence – if not more so! But in the short-term, I prefer to think of these smaller quantum stocks like biotechnology stocks. Just as biotechs are the ones doing make-or-break cutting edge research in hopes of a major breakthrough while GOOGL plays the role of a major drugmaker like Eli Lilly (LLY), one or more of these companies could at some point become an amazing tech leader. But for now, they are highly speculative with an uncertain future. Trade and invest accordingly.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.