Stocks were deadcat bouncing before falling back into the red following heavy losses to start the month yesterday. Lending support to early equity gains were plunging interest rates, which are still flying south on the back of a substantial downside JOLTS miss. This softening of labor conditions has yield watchers dialing up the odds of a half percentage point reduction at the Fed’s next meeting, which is only 14 days away. The main event for this week, however, will be this Friday’s nonfarm payrolls, as Wall Street shifts its focus from inflation risk to growth fears.

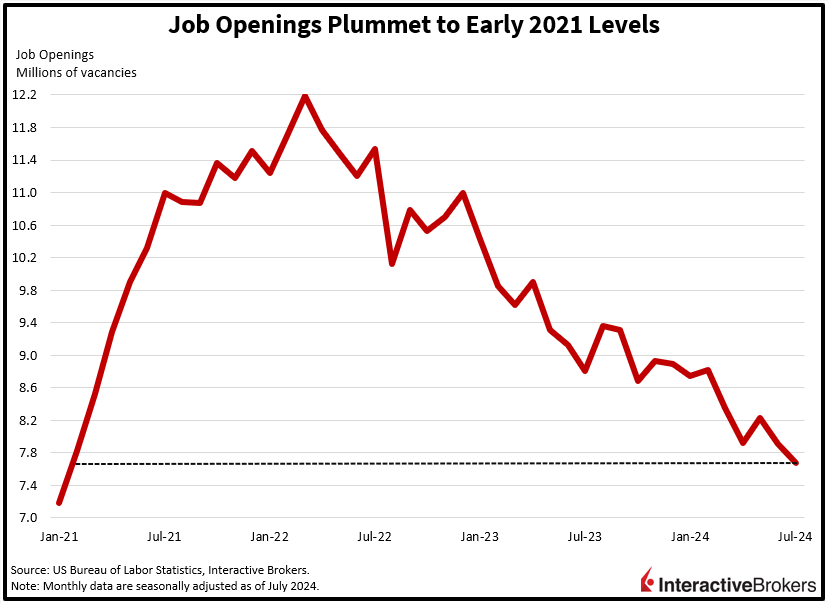

Job Openings Drop to 42-Month Low

Adding further evidence of a decelerating US labor market, for-hire signs sunk to their most anemic level in 42 months. July job openings declined to 7.673 million, well below the median estimate of 8.09 million and June’s 7.91 million. The figure, the lightest since January 2021, is generating optimism that the Fed will provide liquidity relief, but such exuberance is being countered by pessimism concerning economic growth.

Canada Enacts Third Rate Cut

Diving further into monetary policy accommodation, the Bank of Canada delivered its third consecutive trim of its key benchmark this morning. The institution reduced its interbank borrowing cost to 4.25% on the back of slowing inflation, weakened conditions and tempered economic activity.

Bulls Have Mixed Success

Markets this morning were recovering from yesterday’s selloff, but investors remained on high alert as indicated by elevated volatility, a brief de-inversion across 2s and 10s, plunging oil prices, a strengthening yen and a weakening greenback. Major stock indices were uniformly green but are now mixed with the Russell 2000 and Dow Jones Industrial benchmarks up 0.2% and 0.1%, while both the Nasdaq Composite and S&P 500 gauges are down 0.1%. Sectoral breadth is still brightly positive, though, with 9 out of 11 segments moving north amidst a defensive tilt. Upside gains are being led by utilities, communication services and consumer staples, which are up 1%, 0.5% and 0.4%. The laggards are comprised of energy and healthcare, which are lower by 0.3% and 0.1%. Treasurys are catching a bid once again as the curve shifts in bull steepening fashion, with the 2- and 10-year maturities changing hands at 3.801% and 3.795%, 6 and 4 basis points (bps) softer on the session. Lighter yields and aggressive Fed easing expectations are weighing on the greenback, however, as Japanese monetary authorities are open to further hikes. The Dollar gauge is down 41 bps as the US currency depreciates relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Commodities are also losing ground for the most part, with lumber, crude oil, copper and gold down 1%, 0.3%, 0.2% and 0.1%, but silver is up 0.4%. WTI crude is trading at $69.95 per barrel even as OPEC+ discusses delays to its planned supply increase slated for October. Market participants are sniffing out this flip-flop as an indication of weakening demand conditions and are selling the critical liquid in response.

Retailers Bemoan Weak Household Finances

Retailers are warning of weakening consumer spending as household finances are stretched due to inflation and lofty financing costs, but Dick’s Sporting Goods has bucked the trend of declining sales. Those are a few points from the following earnings highlights:

- Dick’s Sporting Goods (DKS) exceeded analysts’ expectations for both sales and revenue, but its upward revision to full-year earnings guidance and decision to maintain its revenue outlook both disappointed investors, causing its shares to fall more than 10% this morning. Its overall sales climbed 8% y/y while comparable sales increased at more than half that rate and exceeded the Wall Street median forecast. In a statement, CEO Lauren Hobart said the company’s locations are experiencing increased traffic and larger cash register transactions.

- Sportsman’s Warehouse (SPWH) revenue surpassed the analyst consensus estimate, but total cash register activity fell 6.7% y/y while same-store sales dropped 9.8%. Meanwhile, the company’s negative earnings per share (EPS) fall was worse than both Wall Street expectations and the year-ago period. Sportsman’s Warehouse experienced strong demand for fishing products, unlike other categories. Store traffic also declined in the recent quarter despite the company increasing its promotions. During its earnings call last night, the company lowered its guidance for the full year and second half of this year. CEO Paul Stone noted, “Our core customer remains firmly under pressure due to the difficult macroenvironment and pullback in discretionary spending.” SPWH dropped more than 11% this morning.

- Dollar Tree (DLTR) same-store sales gained only 0.7% y/y during the recent quarter and the company cut its full-year outlook, causing its shares to fall more than 19% in early trading. Additionally, its earnings and revenue fell short of analyst consensus expectations. Chief Financial Officer Jeff Davis said the disappointing results reflect the “effects of macro pressures on the purchasing behavior of Dollar Tree’s middle-and higher-income customers.” For the full year, Dollar Tree expects consolidated net sales to range between $30.6 billion and $30.9 billion, down from its earlier guidance range of $31 billion to $32 billion. The company also lowered its EPS forecast.

- Hormel Foods (HRL) earnings and revenue fell short of estimates with the company struggling with lower whole-bird turkey prices and the shutdown of its facility that produces Planters peanuts. The company, which has other brands such as Skippy, Spam and Dinty Moore, generated $2.898 billion in sales, down from $2.951 billion y/y. During the quarter, retail sales fell 9% y/y, although certain brands, such as Black Label bacon, Applegate, Jennie-O and Skippy, experienced increased consumer demand. Hormel now expects its full-fiscal year sales to range from $11.8 billion to $12.1 billion compared to its previous guidance of $12.2 billion to $12.5 billion.

Much More Data Coming This Week

This week’s data buffet continues tomorrow, with investors wondering whether incoming reports will offer crosscurrents or further evidence of an economic slowdown. Tomorrow’s data include ADP employment, unemployment claims and ISM-services, providing market participants with pre-market and intraday trading opportunities, since ISM’s print arrives at 10:00 am Eastern. Friday’s nonfarm payrolls will be the main event, however, with the Street expecting job growth of 164,000 and an unemployment rate of 4.2%. Strong data is likely to pare back projections of Fed accommodation and be friendly to market bulls, while weaker figures are likely to support equity bears, which would really put into question rosy 2025 sell-side earnings estimates. Meanwhile, IBKR Forecast Traders are placing wagers ahead of the event, with the overs, or Yes contracts, priced at $0.65 and $0.64 for employment gains above 147,300 and an unemployment rate exceeding 4.2%.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.