Cyclical stocks are rallying as this morning’s tempered inflation figures were followed by an upward revision to UMich Consumer Sentiment. The favorable prints are offering credence to investors who are hopeful the Fed can walk down the monetary policy stairs while skirting an economic downturn. However, one thing market bulls aren’t focusing on is that households flipped the spending switch south last month, as folks took a break from July’s purchasing momentum, in efforts to recover and replenish cash levels. The detail is significant because the number must remain positive for a soft landing to occur. Yields are moving south as a result, as the odds of further consumption weakness increase. Meanwhile, tech shares aren’t benefiting from this morning’s econ data, as selling pressure on AI leader and semiconductor juggernaut Nvidia follows yesterday’s regulatory headwinds affecting its third-largest customer, Super Micro Computer Inc.

Folks Took a Break in August

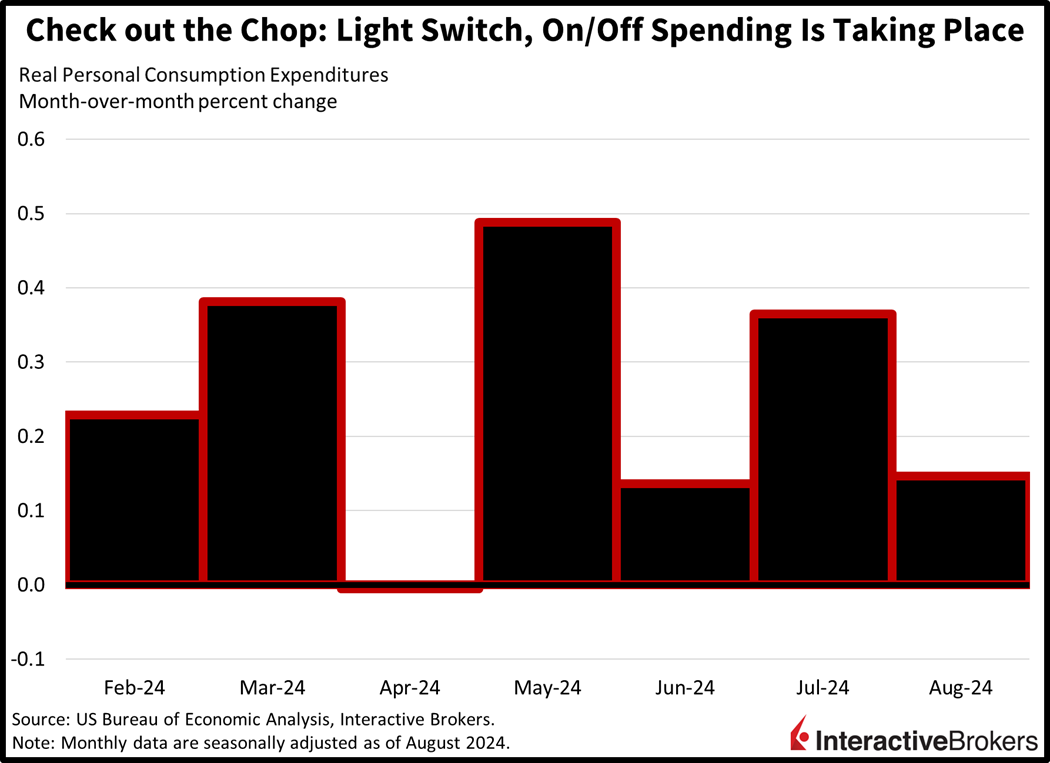

One theme I’ve been explaining lately is that households are managing their budgets like light switches to cope with the pressures of elevated prices, tall financing costs, and rising job uncertainty. Following a ferocious July, whose strength was partially derived from a weak June; consumers took yet another break in August. The pace of real consumer spending rose just 0.1% month over month (m/m) last month, missing the median estimate by 0.1% and declining from July’s 0.4% growth rate. Interestingly enough, June and April also offered weak figures of 0.1% and 0%, but May and March were robust at 0.5% and 0.4%, providing further evidence of the stop-and-go dynamics characterizing today’s consumer. Against this backdrop, the personal savings rate declined to 4.8% from 4.9% during the period, despite decelerating outlays. Furthermore, August consumption was motivated by services, which rose 0.2% m/m in real terms while durable and non-durable volumes were unchanged.

Soft Inflation Alongside Deflation

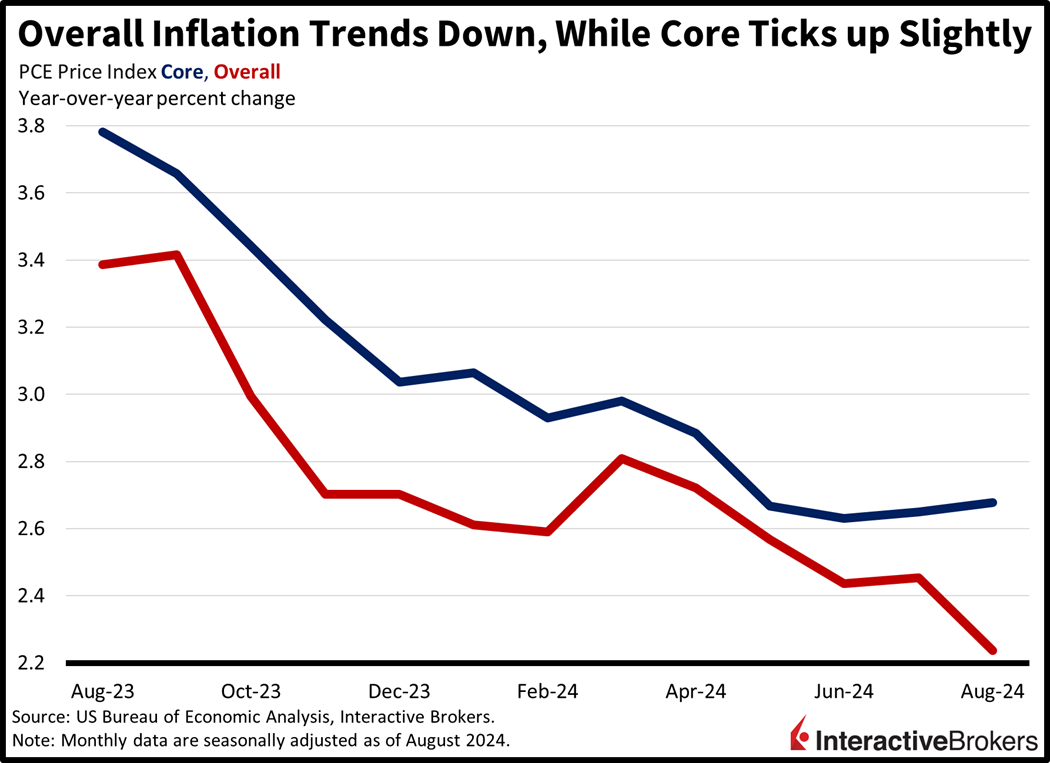

Price pressures within the Personal Income & Outlays report arrived below expectations in aggregate. The headline Personal Consumption Expenditures (PCE) price index rose 0.1% m/m and 2.2% year over year (y/y), in-line with the former but a tenth below projections for the latter. Similarly, the core PCE price index, which excludes food and energy, increased 0.1% m/m and 2.7% y/y, 10 basis points (bps) lighter than expectations for the monthly figure and matching anticipations on the annualized number. Inflation was soft throughout the publication, with charges for services and food leading to a loftier figure; they rose 0.2% and 0.1% m/m. But evidence of deflation was present as well, considering that stickers for energy products and services, as well as durable and non-durable goods declined by 0.8%, 0.2% and 0.1% during the month.

Consumer Sentiment Upgraded

In other economic news, September’s consumer sentiment figure was upwardly revised by the University of Michigan from 69 to 70.1. However, inflation expectations remained steady at 2.7% and 3.1% over a 1- and 5-year period.

Cyclical Stocks Lead the Way

Markets are trading with a bullish bias as equities are benefitting from broad-based support, which is excluding the critical technology sector on the back of semiconductor nervousness. However, cyclical stocks are on a tear with the Russell 2000 up 1.4% and the Dow Jones Industrial higher by 1.1%, while the latter index hits fresh all-time highs every hour or so. The benchmarks reliant on technology aren’t participating, though, with the Nasdaq 100 index down 0.4% while the S&P 500 is near the flatline. Sectoral breadth is positive with 10 out of 11 components gaining and piloted higher by energy, utilities, and financials, which are adding 1.6%, 1% and 0.9%. Technology, the sole laggard, is losing 0.8% on the session. Yields are dwindling on softer consumer spending figures and lighter price pressure figures. The 2- and 10-year Treasury maturities are changing hands at 3.59% and 3.77%, down 4 and 3 bps on the day. Downbeat economic data and sinking borrowing costs are weighing on the US dollar, with its gauge dropping 12 bps as the greenback depreciates relative to the yen, franc, and Aussie tender. The US currency is appreciating against the euro, pound sterling, yuan, and Canadian dollar, though. Commodities are tilted bearishly, which once again points to market suspicion regarding Beijing’s aggressive monetary and fiscal stimulus packages. Copper, silver, gold, and crude are lower by 1.1%, 1%, 0.8% and 0.1%, but rate-sensitive lumber is up by 1%. WTI crude is changing hands at $69.06 per barrel as incoming supply from Riyadh contains the potential for price increases.

A Lot of Labor Data Next Week

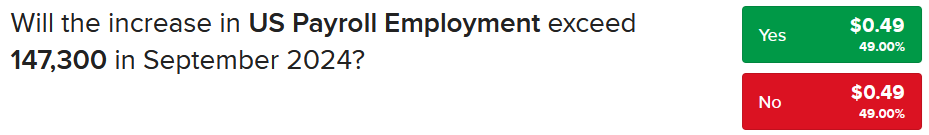

With the Federal Reserve squarely focused on the labor market and pushing inflation to the back burner, next week’s labor data will be crucial to analyze. While Monday will feature a Chair Powell speech and some regional Fed surveys, Tuesday will bring ISM-Manufacturing and the Job Openings and Labor Turnover Survey (JOLTS). The prints will offer us a fresh look into labor conditions within the capital-intensive goods-producing sector, while JOLTS will inform us about corporate appetite for hiring as well as the confidence of workplace leavers. On Wednesday’s list is ADP-Employment and ISM-Services, which will present non-governmental evidence of the pace of headcount additions, wage pressures, and the momentum of the largest segment of the US economy. Thursday’s economic calendar will hand out weekly unemployment claims, which have been elevated in importance due to the shift in the Fed’s focus. Finally, the main event will be Jobs Friday, as usual, ladies and gentlemen, with the Wall Street median consensus expecting a number near 145,000, and IBKR Forecast Trader participants equally split at 147,300. A sizable miss can certainly lead to a narrative shift in markets of an upcoming downturn, but a sharp gain could push rate reductions further out on the curve. The ideal scenario for bullish investors is a figure close to projections, as it won’t disturb current monetary policy easing expectations.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.