Markets are advancing cautiously ahead of the FOMC’s final interest rate decision of the year this afternoon and the updated Summary of Economic Projections. IBKR ForecastTrader participants and rate watchers alike are confident that the Fed will reduce its key benchmark by 25-bps but are uncertain regarding the policy path next year, making the central bank’s dot plot top of mind. Asset prices are likely to respond positively if the committee envisions 75-100 bps of easing in 2025 but will react neutrally to 50 bps and negatively to an outlook for 25-bps or less. Plans for balance sheet reduction are also paramount, especially as concerns regarding fiscal imbalances, extended bond issuance and goods reinflation mount. Meanwhile, a lack of progress on British price pressures has sent UK gilts to a fresh 34-year high relative to German bunds, reflecting a much slower projected walk down the monetary policy stairs for the BoE relative to the ECB and the Fed. Investors aren’t just expecting a pause from the BoE tomorrow, they’re also projecting one from the BoJ tonight. Expectations for next year are the predominant reservations among market participants at this juncture.

Real Estate Picks Up

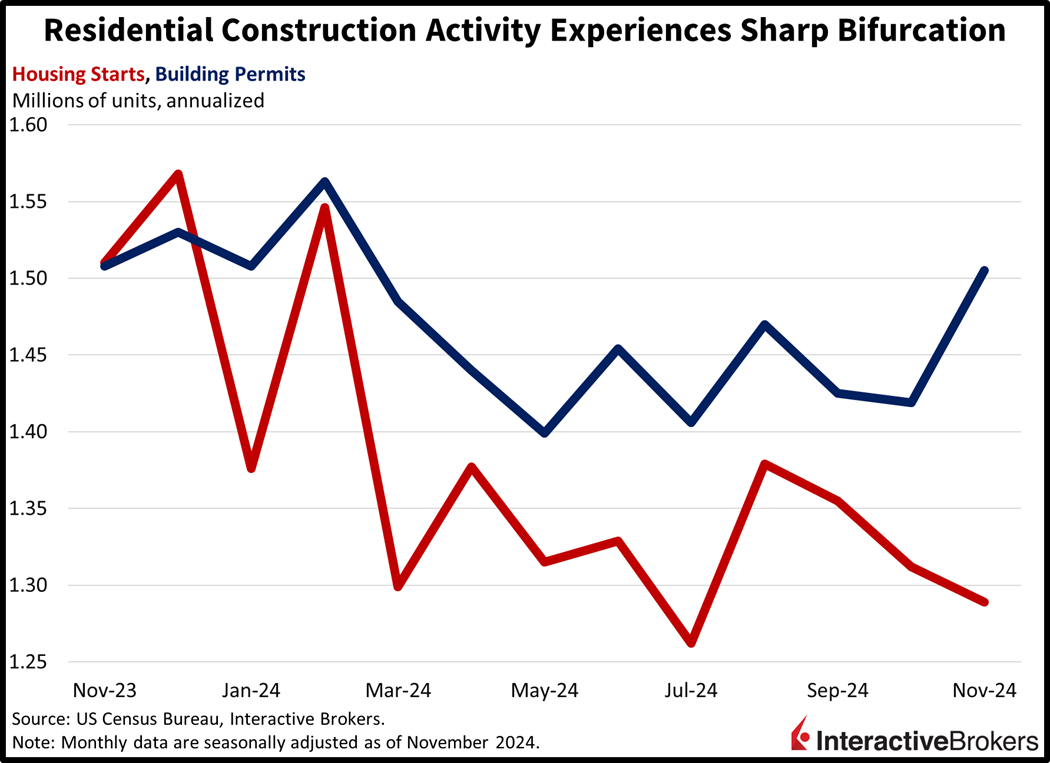

Turning to the economic calendar, real estate activity expanded last month amidst a bifurcation across permits and starts. The pace of building permits increased 6.1% month over month (m/m) in November to 1.505 million seasonally adjusted annualized units, while housing starts contracted 1.8% to 1.289 million. The difference in performance was also present within asset classes, as multi-family was strong in permits but weak in starts, whereas single-family results were just the opposite. Indeed, the rate of permits for single- and multi-family rose 0.1% and 22.1% m/m; however, in starts, the figures came in at 6.4% and -24.1% m/m. Geographical differences were also evident; all regions expanded their permitting volumes with the Northeast, Midwest, South and West sporting increases of 11.3%, 10.7%, 5.7% and 1.8%. Starts, meanwhile, saw the Midwest and West decline 28.2% and 11.9%, but the Northeast and South countered some of the weakness, seeing filings rise 10.6% and 10.2%.

Japan Exports Increase

Across the pacific in Tokyo, the recent weakening of the Japanese yen helped exporters push volumes last month. Indeed, the balance of trade shrunk to ¥117.6 billion in November compared to the median estimate of ¥688.9 billion and the prior month’s ¥461.2 billion. Exports rose 3.8% year over year (y/y) while imports contracted by the same amount. Projections called for exports and imports to grow 2.8% and 1%, which compares to October’s results of 3.1% and 0.4%. Semiconductor equipment and non-ferrous metals drove the increase in exports while automobiles weighed upon results. Imports were hampered by a reduction in crude oil shipments.

Chinese CEO Sentiment Weakens

Also in Asia, confidence among Chinese chief executive officers is dwindling as senior business leaders cite three major risks: intense local competition, weak consumption and geopolitical tensions. Government officials and company leaders alike have been preparing early for a possible trade war with the US. With the incoming Trump administration appearing as hawkish as ever regarding international commerce, China is looking to cushion its economy from a lot more of the same types of headwinds it experienced during Trump 1.0. The Trump overhang is massive and is being blamed locally for obstructing President Xi Jinping’s goals and delaying its ambitious progress.

Retailers Report Mixed Results

Birkenstock’s (BIRK) recent earnings and revenues exceeded analyst consensus expectations with sales growing 22% y/y, sending its share price up more than 7% in early trading. Sales benefited from the company, which is well known for its open-toe sandals, introducing new footwear products. Among regions, the slowest sales increase occurred in Europe, with a 19% growth rate while the Americas category and the Asia Pacific, Middle East, and Africa zone grew 21% and 38%, respectively. Sales were strong in both direct-to-customer and wholesale channels. The company expects to generate 2025 revenue growth in the mid-to-high teens. While Birkenstock is on solid footing, General Mills (GIS) is a little less stable after lowering its outlook this morning, causing its share price to drop approximately 2.8%. Net sales climbed 2% y/y, which along with earnings surpassed expectations. The company guided for its fiscal-year adjusted earnings to decline as much as 4% compared to its earlier outlook for the metric to range from being flat to dropping only 2%. It cited an “uncertain macroeconomic backdrop for consumers” when it revised its guidance.

Equity Markets Turn Bullish

Trading action is bullish ahead of the Fed’s final meeting of the year, with equity indices moving north while borrowing costs tick south. All major domestic, equity benchmarks are gaining with the Dow Jones Industrial, Russell 2000, S&P 500 and Nasdaq 100 gauges increasing by 0.5%, 0.4%, 0.3% and 0.1%. Sectoral breadth is positive; 9 out of 11 segments are higher, led by healthcare, technology and communication services, which are up 0.5%, 0.4% and 0.4%. Energy and consumer staples are representing the laggards, however; they’re losing 0.4% and 0.2%. In fixed-income, Treasurys are getting bid with the 2- and 10-year maturities changing hands at 4.22%, and 4.39%, the former lighter by 2 basis points (bps) while the latter is near the flatline. The Dollar Index is gaining 20 basis points as the greenback appreciates versus all of its major counterparts, including the euro, pound sterling, franc yen, yuan and Aussie and Canadian tenders. Commodities are mixed against this backdrop, with lumber, crude oil and copper increasing 3.7%, 1.1% and 0.2%, but copper and silver are decreasing 1% and 0.3%. WTI crude is trading at $70.51 per barrel as the intraday Department of Energy publication reported a draw in overall stateside inventories.

The Fed is Boxed In

Chair Powell faces a tough balancing act this afternoon as the FOMC’s attention shifted from labor market concerns during September to price pressure worries this month. The FOMC decided to enact a super-sized 50-bp cut to its benchmark in the former month citing mildly deteriorating employment conditions but is now nearing the end of its easing cycle in the latter month. Additionally, there was one dissenter in September’s meeting, Governor Michelle “Miki” Bowman, and I believe we may have skeptics this time around too. But how will the central bank look by rushing in September and then holding in December? Jumping the gun in September is leading to a policy error today, especially with risks that the economy and labor market may accelerate while goods inflation reignites on the back of trade disagreements. Look at the market? Does this feel restrictive?

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.