Stocks are stalling near record highs as investors digest wide-ranging corporate earnings and economic data that can fuel optimism or pessimism, depending on the eye of the beholder. Indeed, big beats stemming from Alphabet, the ADP Jobs print, pending home sales and EU GDP were countered by misses in AMD’s revenue guidance, Eli Lilly’s profits and US GDP. Yields are back on the upswing, however, led by the short end, as rate watchers pare back expectations regarding the speed of the Fed’s descent down the monetary policy stairs. And while Fed Funds Futures players see a low chance of a pause at the central bank’s meeting on Thursday following election day next Tuesday, IBKR Forecast Contract participants are increasingly hawkish, pricing out a 16% probability that policymakers will maintain the current benchmark rate.

Source: ForecastEx

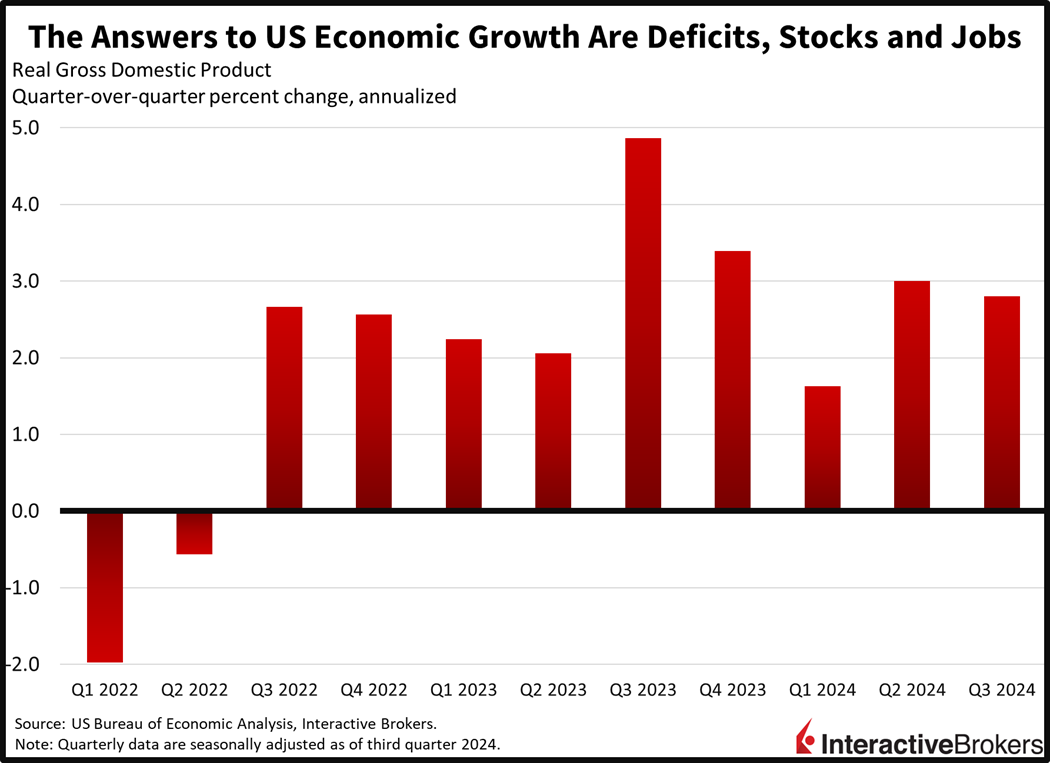

Deficits, Stocks, Jobs Propel US Economy

The US economy advanced at a 2.8% annualized pace in the third quarter, according to this morning’s Gross Domestic Product (GDP) release from the Commerce Department. The inflation-adjusted figure fell short of the median projection of 3%, which would have been unchanged from the prior quarter. Driving the growth were momentum in goods spending, government expenditures, business investment and services outlays, which rose 6%, 5%, 3.3% and 2.6%. Meanwhile, residential capital expenditures declined 5.1% while net exports and inventory adjustments dragged down the headline by 0.6% and 0.2%, respectively.

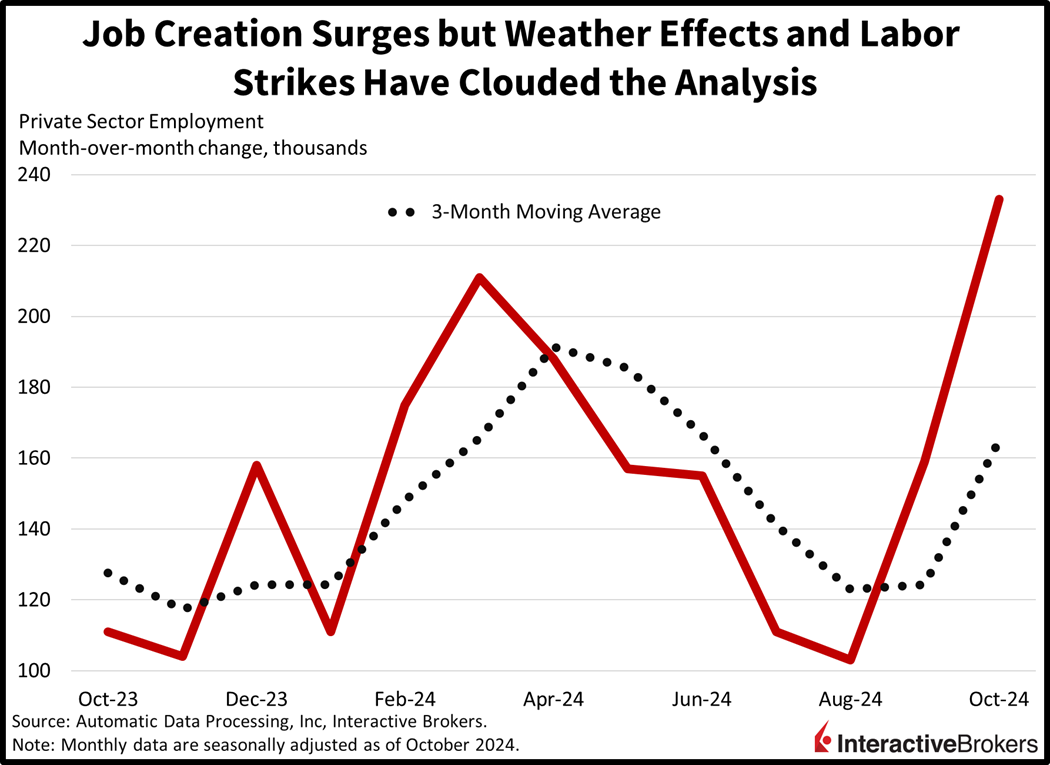

Hiring Jumps, but Confirmation Is Needed

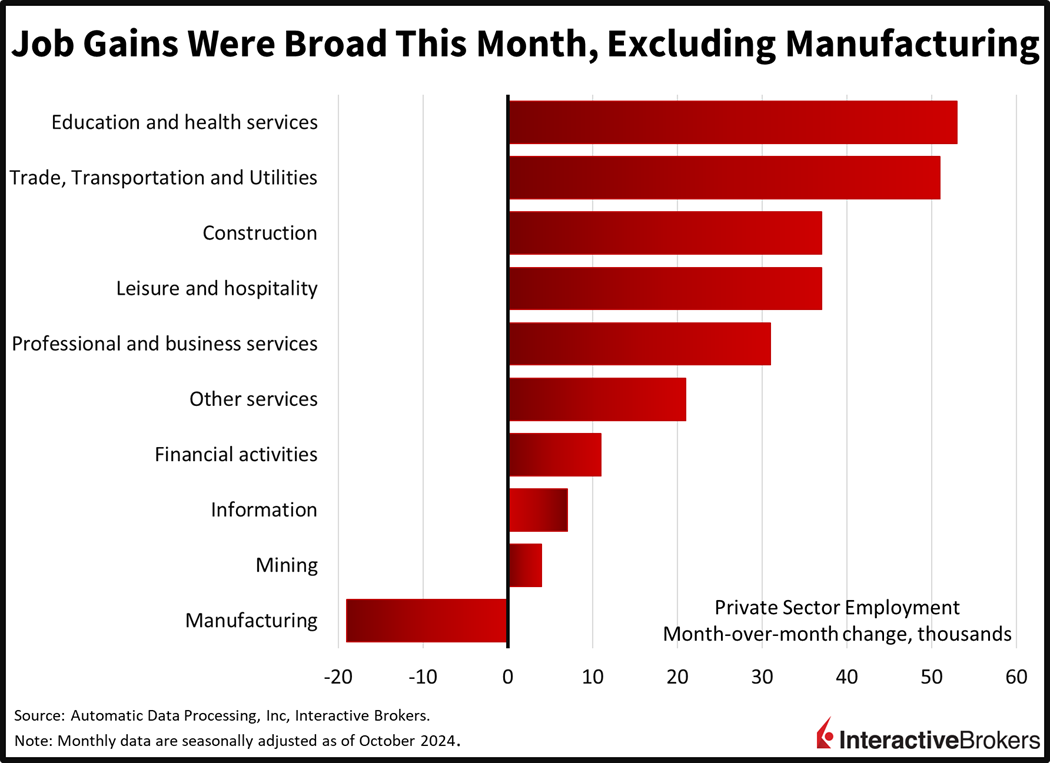

Private sector hiring in October jumped to its highest level since July 2023, but hurricanes Milton and Helene alongside labor strikes may have affected the clarity of the figures. Employers added 233,000 jobs during the month, up from 159,000 in September and well above the forecast of 110,000. Gains were broad based with manufacturing being the only sector to contract.

The following size firms added the stated number of positions:

- Small, 4,000

- Mid, 86,000

- Large, 140,000

Among industries, the education and health services category and the trade, transportation and utilities group led with 53,000 and 51,000 positions filled. Other gainers and the number of hires were as follows:

- Construction, 37,000

- Leisure and hospitality, 37,000

- Professional and business services, 31,000

- Other services, 21,000

- Financial activities, 11,000

- Information, 7,000

- Natural resources and mining, 4,000

Manufacturing was the sole laggard, posting a decline of 19,000. While hiring increased during the month, employers slowed down their pace of pay increases. On a year over year (y/y) basis, wage increases for job changers and job stayers slowed from 6.7% and 4.7% to 6.2% and 4.6%, respectively.

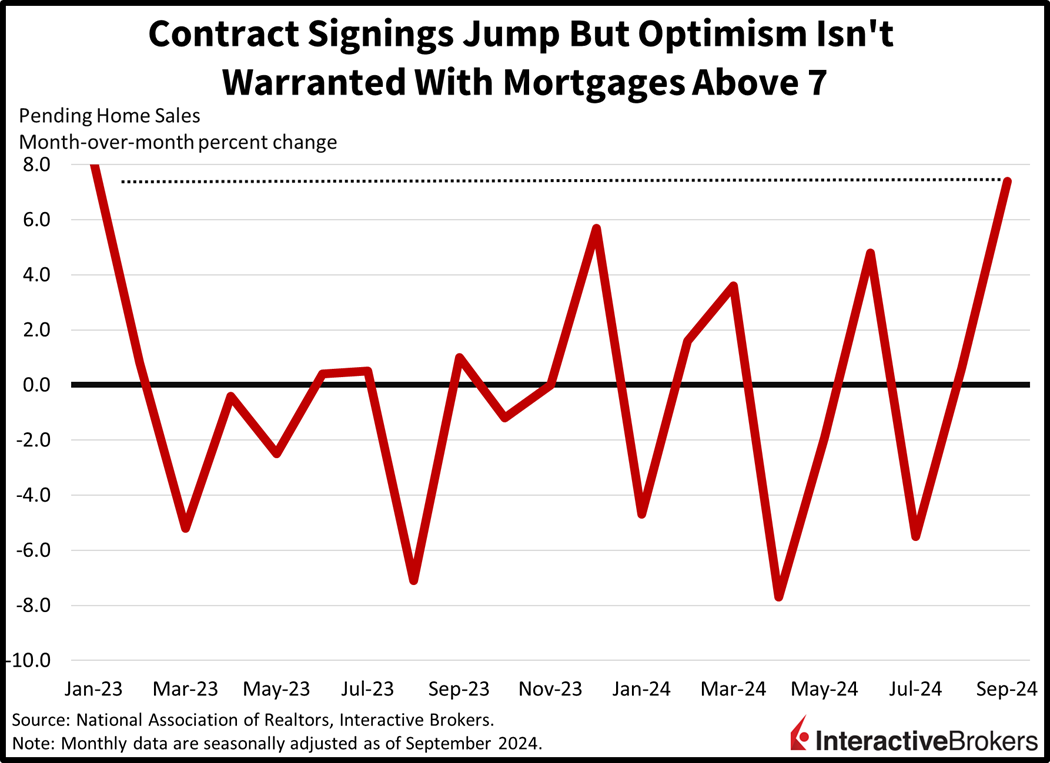

Contract Signings Jump, but Not for Long

Pending home sales climbed 7.4% month over month (m/m) in September, exceeding the forecast for a 1.1% increase and the prior month’s 0.6% rate. On a y/y basis, the headline result grew 2.6% compared to an 3% decline in August. Contract signings lead to closings, as financing agreements, inspection visits, and other considerations occur between the two pivotal dates. Optimism isn’t warranted, however, as prospective buyers were blindsided by a jump in long-term rates following the Fed’s super-sized reduction. Real-time data and channel checks point to transactions once again retreating sharply.

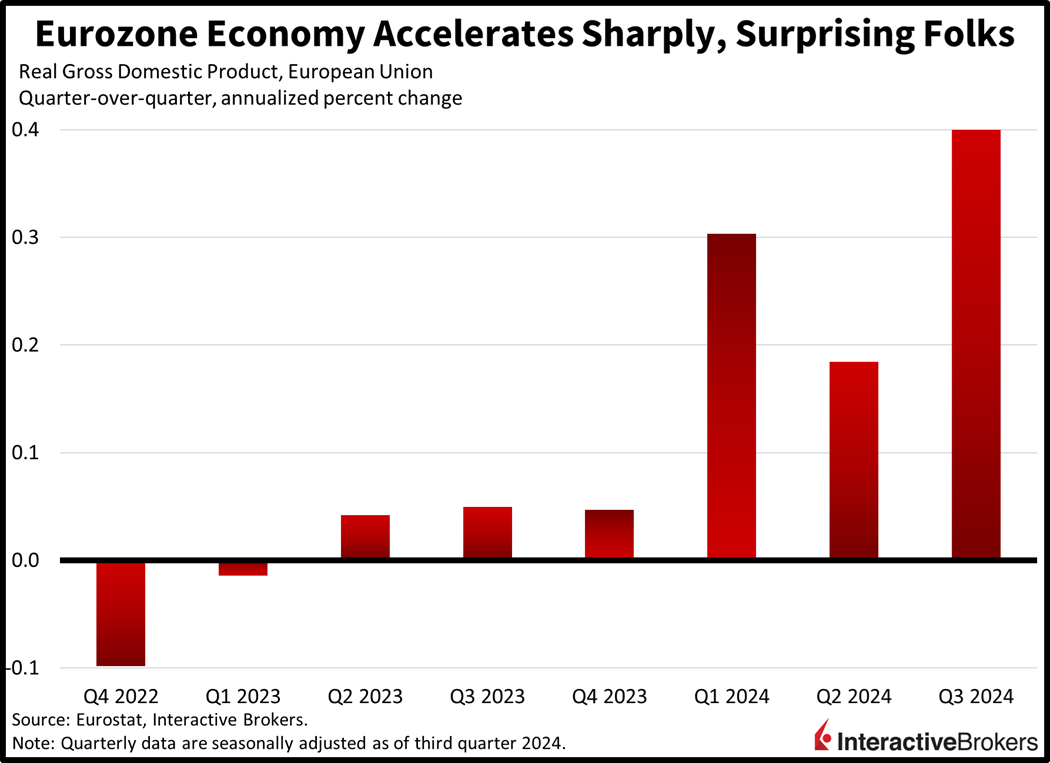

Europe Posts Shocking Surprise

Across the Atlantic in Europe, third quarter real GDP increased 0.4% on an annualized basis, beating the median estimate of 0.2%, which would’ve been unchanged from the previous period. Among European Union members, Germany, which was feared to be entering recession, experienced a 0.2% growth rate, exceeding expectations for a 0.1% decline. For the quarter ended in June, the country’s economy fell 0.3%. France posted a 0.4% increase, up from 0.2% for the second quarter. Italy, however, recorded no growth while analysts anticipated the same 0.2% result of the second quarter.

AI Supports Earnings Results

AI continued to drive growth for tech companies during the third quarter while other companies reported resilient consumer spending. In the construction and agriculture industries, however, purchases of heavy equipment have softened.

Google parent Alphabet (GOOGL) said its investments in AI helped it grow its cloud business by 35% y/y and the company reported earnings and revenue that exceeded analyst consensus expectations. The company has been pumping money into AI, including improving its Gemini AI chatbot and AI-enhanced search engine. Its future investments in AI will result in capital expenditures in 2025 exceeding outlays this year. Advanced Micro Devices (AMD), which has a commanding portion of the artificial intelligence chips market, beat earnings and sales expectations with revenue that more than doubled y/y. In a statement, CEO Lisa Su noted that opportunities for growing sales are plentiful, a result of “the insatiable demand for more compute.” However, the lower half of the company’s revenue guidance range for this year fell below the analyst consensus estimate, causing its share to decline in early trading.

In other earnings news, Visa (V) and Chipotle (CMG) posted results that point to steady consumer spending. Visa reported a 12% y/y revenue increase, illustrating that households are continuing to open their wallets despite higher living costs due to inflation, but slightly after its earnings call, the Wall Street Journal reported that the company will lay off 1,400 employees. The firings would occur primarily in Visa’s technology area. Visa currently has approximately 30,000 workers. However, a company spokesperson said the payment processor expects to increase the size of its employee base next year. Chipotle posted revenue that met expectations and earnings that exceeded forecasts, but its same-store sales growth guidance for the current year for a mid-to-upper single digit growth rate implies the company could miss Wall Street’s target of 7.5%. The company said traffic to its stores was lukewarm early in the quarter but then picked up in October.

Looking beyond consumer spending, Caterpillar (CAT) said dealers cut back on orders during the September period y/y, contributing to its earnings and revenue missing analyst consensus expectations. Broadly speaking, dealers are concerned that declining farm incomes and inflation may crimp sales of equipment. Additionally, sales fell 7% in Asia with China having a glut of housing. On a positive note, Caterpillar maintained its adjusted operating profit margin because price increases have offset the impact of a decline in unit sales.

Among drug manufacturers, Eli Lilly and Co. (LLY) earnings and revenue fell short of expectations, a result of disappointing sales of Zepbound, a weight loss drug, and Mounjaro, a diabetes treatment. It also trimmed its full-year profit guidance. Eli Lilly CEO David Ricks told CNBC that the sales shortfall was a result of inventory decreases by wholesalers. Nevertheless, the company expects its production in this half of the year to be 50% higher than during the second half of 2023.

Traders Hesitate to Add Risk, Duration

Markets are mixed today but tilted bearishly on this morning’s news of Super Micro Computer (SMCI) facing additional accounting and regulatory challenges, with audit firm Ernst & Young dropping the company due to bookkeeping and integrity irregularities. The developments are weighing on the technology sector and semiconductors as a result, serving to dampen some of the recent artificial intelligence enthusiasm. Indeed, the Nasdaq 100 is leading benchmarks south alongside the S&P 500, with the gauges lower by 0.5% and 0.1%. The Russell 2000 and Dow Jones Industrial indices are bucking the trend, however, by sporting gains of 0.5% and 0.2% on the session. Sectoral breadth is positive against this backdrop with 8 out of 11 segments higher as communication services, materials and financials are up 1%, 0.7% and 0.6%. Technology, healthcare and utilities are weighing upon the market though, with those components down 1.2%, 0.4% and 0.1%. Treasury yields are climbing higher in response to strong economic data, generally speaking, with the 2- and 10-year maturities changing hands at 4.15% and 4.26%, 5 and 1 basis point (bps) loftier on the session. Nevertheless, the dollar is moving south in response to the surprise acceleration in European economic performance. The greenback’s index is down 27 bps as the US currency depreciates relative to most of its major counterparts, including the euro, franc, yen, yuan, and Aussie and Canadian tenders. It is appreciating versus the pound sterling, though, on the back of UK Chancellor of the Exchequer Rachel Reeves serving a major tax hike on employers and other parties, which points to higher bond issuance in the medium term to support loftier governmental spending. Commodities are mixed, with silver and copper lower by 1.5% and 0.2% but crude oil, lumber and gold higher by 1.8%, 1.5% and 0.5%. WTI crude is being offered at $69.04 per barrel as stateside inventories tick south while OPEC+ considers implementing planned production increases later than previously anticipated.

Jam Packed Days Coming Up

As we await important earnings reports from Microsoft (MSFT) and Meta (META) this afternoon, investors are also thinking about tomorrow’s data, which include unemployment claims, personal income and outlays, the Employment Cost Index, the Fed’s preferred inflation gauge and the EU’s price pressures for this month. Meanwhile, the main event for earnings and economics arrives Thursday after the bell, with results from Apple (APPL) and Amazon (AMZN) expected to be critically examined for additional clues on the path of artificial intelligence. The next morning includes Jobs Friday, ISM-Manufacturing and construction spending. Furthermore, as we enter a strong seasonal period for markets, this upcoming weekend is the last one before election day, and market participants are rushing to the IBKR Forecast Trader platform to invest, speculate and hedge on pivotal political outcomes. Top of mind, of course, is the Oval Office, and while control of the Senate is essentially in the bag for the GOP, I’m stuck focusing on the House race, which has been near a coin flip. As we stand now, ladies and gentleman, Trump’s odds of victory are 63%, while Republican probabilities for majorities in the Senate and House hover at 87% and 49%.

Source: ForecastEx

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.