Stocks are reaching to break all-time highs this morning following in-line inflation figures from the Fed’s preferred price pressure gauges. But while cost forces arrived as expected, consumer spending numbers flew past projections in today’s PCE report from the Census Bureau. Some of that consumption buoyancy is thanks to robust capital markets and a declining savings rate while another contributor stems from powerful wage growth. Indeed, a separate report from a distinct federal agency known as the BLS’s ECI depicted accelerating compensation expenses on behalf of employers. Meanwhile, heightening trade tensions are already hampering economic performance in the US’s northern and southern neighbors, with Mexico City reporting a contraction in GDP last quarter while Ottawa’s results reflected a decline in November. The decrease in consumption and business activity are emblematic of the nervousness amongst households and corporates ahead of Trump tariffs scheduled to be enacted tomorrow. The 25% duty on imports, however, may be reduced or quelled altogether if both nations follow Bogota’s lead and acquiesce to Washington’s demands.

Households Save Less, Spend More

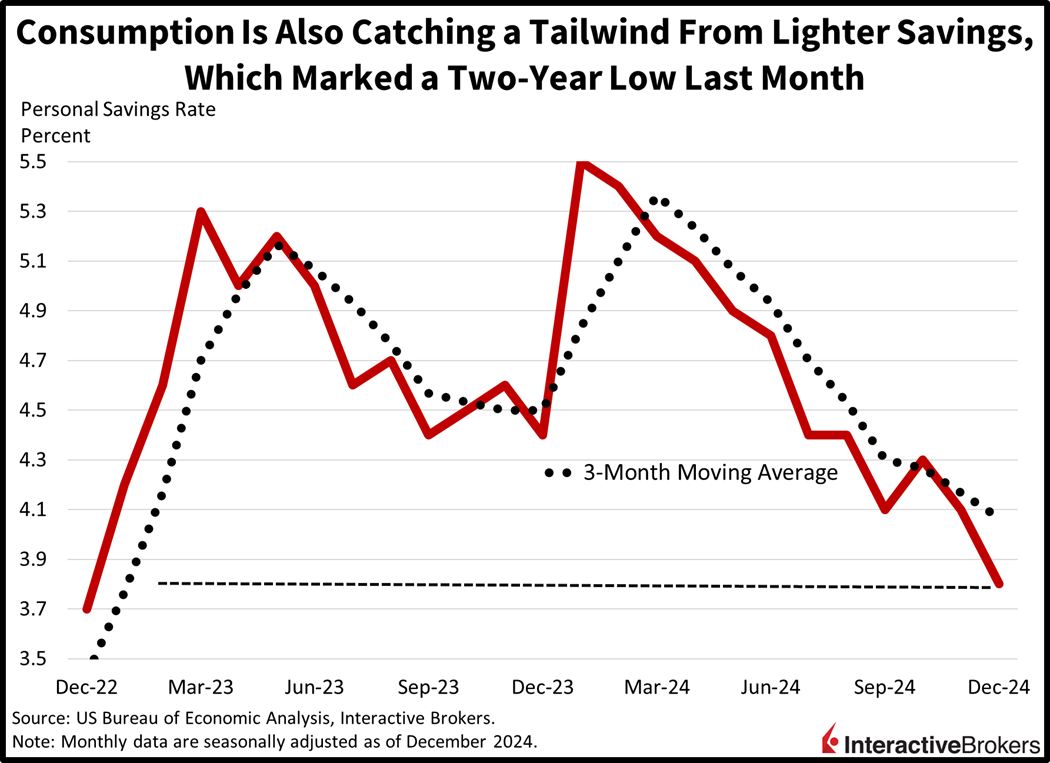

US consumers finished the year off with a bang, with this morning’s personal income and outlays report pointing to continued resilience amongst households. The pace of personal spending and income rose 0.7% and 0.4% month over month (m/m) in December, 2 tenths of a percent hotter on the former and in-line with estimates on the latter. While both figures accelerated by 0.1% from November’s results, outlays exceeded earnings, causing the personal savings rate to fall from 4.1% to 3.8% during the period, a 2-year low. Driving expenditures were real m/m increases, or volume gains, of 1.1%, 0.5% and 0.3% across durable goods, nondurables and services.

Prices Accelerate Modestly

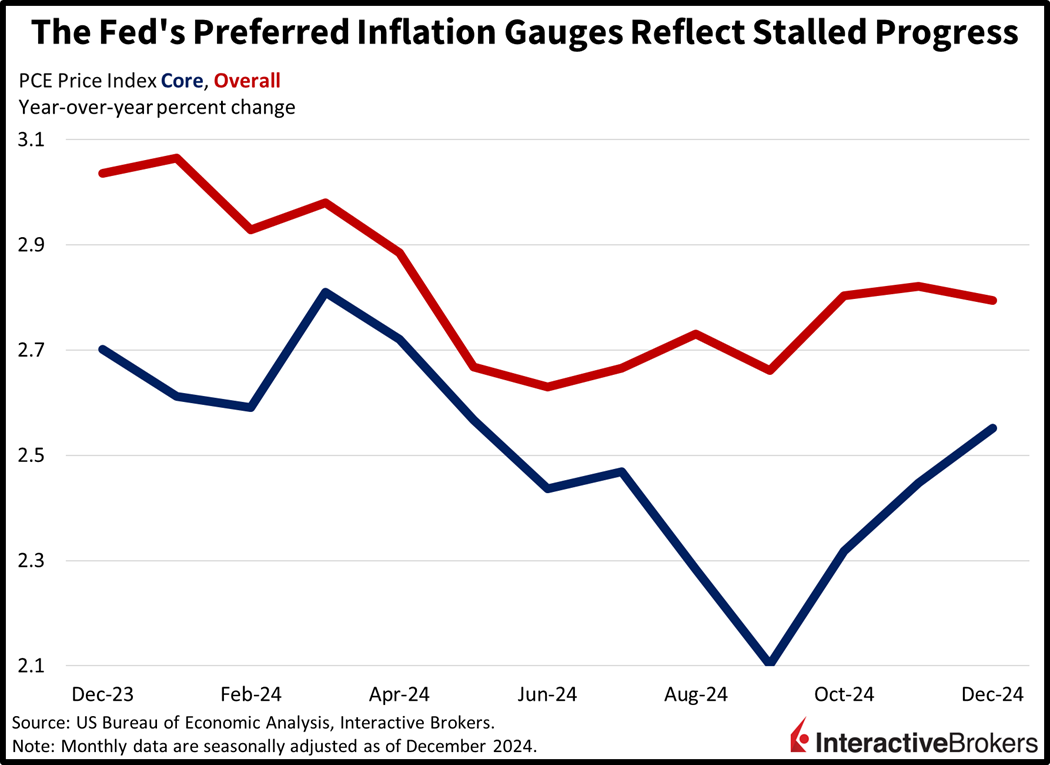

The Fed’s preferred inflation figures arrived exactly as expected but they picked up steam on a monthly basis. The Personal Consumption Expenditures (PCE) price index increased 0.3% m/m and 2.6% year over year (y/y), exceeding the 0.1% and 2.4% from the prior month. Similarly, the core version of the indicator advanced 0.2% m/m and 2.8% y/y, accelerating from 0.1% in November while the annualized number was unchanged. Costs for energy, nondurable goods, services and food rose 2.7%, 0.5%, 0.3% and 0.2% m/m while charges for durables slipped 0.4%.

Workers Get Fatter Paychecks

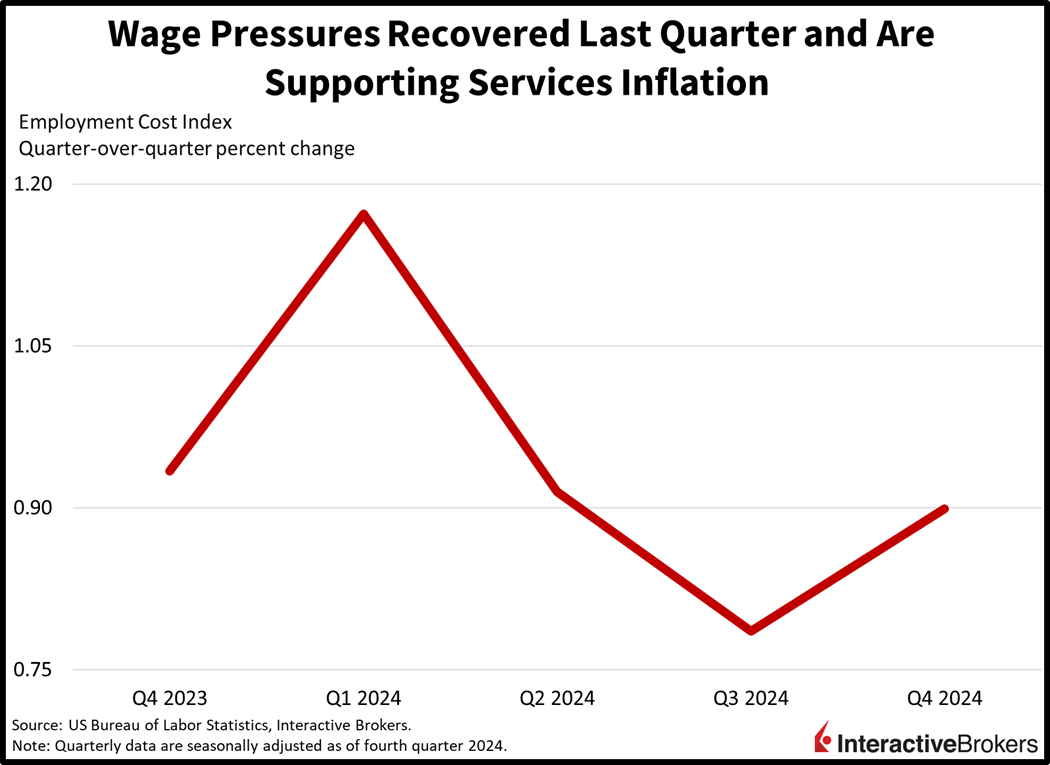

Economic growth last quarter didn’t exclude workers, ladies and gentlemen, with the employment cost index accelerating its pace of gains. The critical indicator covering both wages and benefits rose 0.9% quarter over quarter (q/q) to finish off 2024, meeting the median estimate but ramping up from 0.8% in the prior three-month period. Employer charges were led by wages rising 0.9% while benefits ticked higher by 0.8%.

Windy City Reports Calm in Manufacturing

Manufacturing conditions in the Chicago area remain subdued this month, according to the city’s chapter of the Institute for Supply Management (ISM). The Chicago Purchasing Managers’ Index for Manufacturing rose from 36.9 to 39.5 in January, narrowly missing the projected 40. While the headline figure achieved its first uptick since October, it’s the 14th consecutive monthly result under the contraction-expansion threshold of 50. The shallower rate of decline, meanwhile, was driven by stronger new orders, which drove up production levels but relative positivity was countered by reduced headcounts, falls in supplier deliveries, contracting backlogs and softer charges.

Canada’s Economy Contracts

Canada’s economy contracted in November as both services and goods-producing sectors declined. The 0.2% m/m fall was worse than expectations calling for half that number and compares to the positive 0.3% rate in the month prior. The nation is expected to enter a more significant economic downturn if 25% tariffs are placed on exports to its top trade partner, the US.

Industry Expands Marginally

Turning to the Asia-Pacific region, Japan’s industrial production figures posted a modest improvement while retail sales slipped. Industrial production rose 0.3% m/m while retail sales declined 0.7% m/m in December, the former met estimates while the latter slipped by a tenth of a percent less than anticipated. Manufacturing activity was led by the production machinery category and electronic parts and devices segment, but the automobile, electrical machinery and communication electronics equipment areas were a drag. Separate reports issued on the real estate sector reflected an 8.1% y/y increase in construction orders amidst a 2.5% y/y decline in housing starts, compared to the previous month’s -10.2% and -1.8%.

The price gauge for the country’s city-capital arrived exactly as expected with the headline and core Tokyo CPI coming in at 3.4% and 2.5% for this month compared to the December’s 3% and 2.4%.

The unemployment rate ticked down to 2.4% in December, while economists were expecting an unchanged 2.5%.

Singapore Business Sentiment Improves

In Singapore, business confidence improved in the manufacturing sector, rising to 16 in the fourth quarter from 10 in the prior three-month period. Upbeat sentiment regarding electronics, semiconductors, chemicals and general manufacturing offset some associated with for precision and transportation engineering.

Australia Input Price Increases Ease

Australia wrapped up 2024 with input prices climbing 0.8% during the fourth quarter, according to the Producer Price Index. The result was lower than the economist expectation of 1% and the third quarter’s 0.9% increase. For the full year, prices climbed 3.7% compared to 3.0% in 2023. Price gains eased in most sectors expect for accommodation, with strong demand causing an 8.3% q/q jump.

In the country’s housing market, credit to acquire shelter grew 0.5% last month, matching rates of October and November. Debt for owner occupied housing increased 0.4% while investor debt was up 0.6%. Total private debt increased 0.6%, the same rate as in November.

Consumer Splurge on Streaming Contents

Sales of smartphones are moderating but consumers are increasingly splurging on streaming content and other services. Households are also boosting credit card use, including for international travel. In other matters, high inventory levels of computer chips are creating headwinds for Intel (INTC). Those are a few conclusions from the following earnings highlights:

- Apple (AAPL) offset weakening sales of iPhones by aggressively growing its services, which include payments, advertising, content subscriptions, and AppleCare, which is a tech support offering. Weakness in China caused iPhone sales to dip 1% y/y, but total revenue and profits climbed 4% and 7%. Sales barley surpassed estimates but profits beat the consensus expectation. Shares of Apple gained after the earnings report in response to the company offering strong-than expected guidance that included an increase in iPhone sales.

- Intel’s top- and bottom-line expectations exceeded expectations but provided guidance that fell below Wall Street estimates. Revenue fell 7% y/y while Intel’s net loss moderated from $0.63 per share to $0.03. Intel’s guidance to break even this quarter and generate as much as $12.7 billion in revenue missed expectations for earnings per share of $0.09 and $12.87 billion. CEO Pat Gelsinger says seasonality, the economy and high levels of inventory among clients are weighing on the company’s outlook.

- Visa (V) revenue and profits climbed 10% and 5% y/y. Both results were above analysts’ estimates. For the fourth quarter, the number of transactions Visa processed grew 11% while cross border transactions, which are influence by international travel, jumped 16%. CEO Ryan McInerney says the volume gains are being driven by an increase in digital payments. Visa expects current-quarter net revenue to grow in the range of high-single digits to low-double digits.

Energy Companies Push Ahead with Capacity Increases

Energy companies generated mixed results while Baker Hughes (BKR), which provides technology and services to petroleum companies posted record high results. Exxon Mobil (XOM) and Chevron (CVX) said earnings fell 33% and 40% y/y while revenues were flat and up more than 10% at both companies. The firms reported multi-year high levels of oil production and combined returned more than $63 billion to shareholders throughout 2024. Energy companies appear to be plowing ahead with plans to increase oil production, with Baker Hughes reporting that it has a $33.1 billion order backlog.

Equities Stage Broad Rally

Markets are finishing up the month in stride with stocks and bonds starting off the year with gains. Today’s action, meanwhile, features every major domestic equity benchmark in the green, lighter interest rates and a stronger greenback. Technology is leading the way so far this morning with the Nasdaq 100 up 1.5% while the S&P 500, Russell 2000 and Dow Jones Industrial counterparts are up by more modest amounts of 0.7%, 0.4% and 0.1%. Sector breadth is strongly positive with technology, communication services and consumer discretionary driving the train; they’re gaining 1.4%, 1.1% and 0.8%. Energy and consumer staples are the only industries lower out of the major 11 and are losing 1.2% and 0.4%. Turning to Treasurys, the 2- and 10-year maturities are changing hands at 4.2% and 4.51%, a basis point (bp) softer on each. The greenback’s index is up 10 bps against the backdrop, with the US dollar appreciating against the euro, franc, yen and yuan, but it is depreciating relative to the pound sterling and Aussie and Canadian tenders. Commodities are mixed as lumber and gold gain 5.4% and 0.5%, while copper, silver and crude oil slip 0.9%, 0.7% and 0.4%. Lumber, a top exporter for Ottawa, is gaining strongly on worries that the critical material may enter the crosshairs of US-Canada trade tensions.

Trade Tensions Under the Spotlight

This weekend’s developments will be crucial as leaders in Washington, Mexico City and Ottawa negotiate ways to coexist without 25% import tariffs. The levy threatens to severely impact the Canadian and Mexican economies while it may lead to an inflationary uptick here in the states. Moreover, goods drove the entire disinflation train from 2022 and supply chain disruptions and reduced efficiencies may very well generate an uptick in US price pressures. But President Trump also wants lower interest rates immediately while he’s apparently willing to accept higher charges for goods in the short term. Can Washington have its cake and eat it too? Perhaps, considering that similar conflicts during Trump 1.0 didn’t generate inflationary pressures. But the path toward non-inflationary growth this time around is especially narrow absent trade acquiescence from major trade partners.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.