Market participants are paying no mind to this morning’s hot PPI and are instead focusing on meme mania, with names like GameStop and AMC Entertainment rising around 100% in volatile trading. Fed Chair Powell, meanwhile, reiterated his wait-and-see approach on inflation during a speech to the Foreign Bankers’ Association in Amsterdam. Powell kept a rate hike off the table, despite meme mania pointing to relaxed financial conditions amidst painfully stubborn inflation. Animal spirits alongside a patient and accommodative central bank are pushing markets higher, with stocks up as yields and the dollar provide relief to the downside.

Inflation Just Won’t Quit

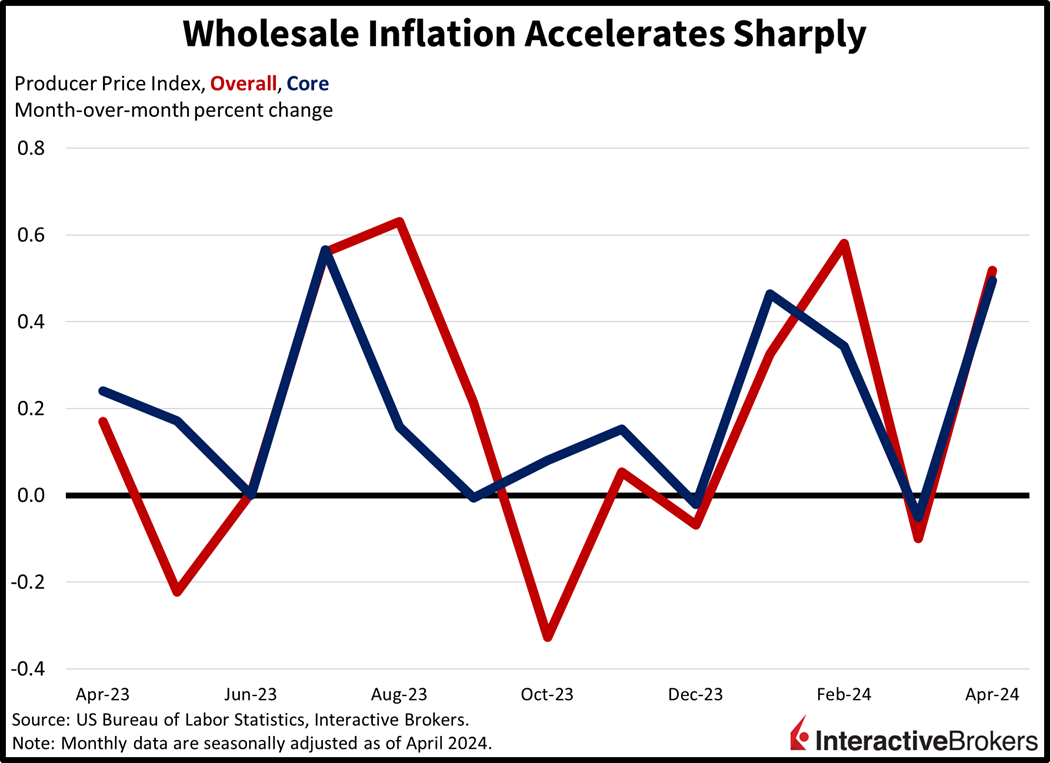

Wholesale prices rose sharply last month amidst broad-based inflation across goods, energy and services, according to this morning’s Producer Price Index (PPI). The April PPI rose 0.5% month over month (m/m) and 2.4% year over year (y/y), trouncing projections of 0.3% m/m. Similarly, the core PPI, which excludes food and energy, increased 0.5% m/m and 2.4% y/y, well ahead of estimates calling for 0.2% m/m. Additionally, March’s figures were revised lower.

While this month’s fiery publication was supported by most of the PPI components, some segments experienced relief, with prices for the food group and transportation/warehousing services category declining 0.7% and 0.6% m/m, respectively. Leading the charge higher, however, were the energy, services and goods categories with prices gaining 2%, 0.6% and 0.4%. Among services, trade and the other components group saw prices increase 0.8% and 0.6%. The most significant driver within services was a 3.9% m/m increase in portfolio management charges.

Consumers Tighten Spending, but Advertising Grows in Asia

Today’s earnings wrap up illustrates how US and foreign consumers are becoming more selective in their spending. In an encouraging development, however, Chinese marketers are increasing their advertising. The following are highlights from recent earnings calls:

- Home Depot’s revenue missed the analyst consensus expectation with high interest rates causing homeowners to refrain from major remodeling projects. In a CNBC interview, Chief Financial Officer Richard McPhail said he believes consumers still have strong spending clout as they haven’t downgraded to lower-cost tools or other items, but they are waiting for costs of capital to decline before undertaking discretionary projects and buying big ticket items. Elevated borrowing expenses are also discouraging individuals with cheap mortgages from moving to new homes, because doing so would entail more expensive financing. A significant portion of the company’s sales results from consumers splurging on remodeling projects and furnishings shortly after buying homes. For the most recent quarter, Home Depot’s same-store sales metric, which strips out the impact of new stores and store closures, declined 3.2% in the US. The company expects its 2024 revenue growth to be marginally positive this year. Shares of Home Depot declined slightly in early trading.

- Sony posted fiscal-year 2023 profits that declined 7% y/y, a result of weak results for its financial services division and PlayStation 5 gaming console. For the recent quarter, revenue beat the analyst consensus expectation. Despite climbing y/y, it declined from the prior quarter. While its quarterly operating profit jumped y/y, it declined for the full year. Its financial services division, which provides online banking, credit card settlement, various forms of insurance and other services, was the largest contributor for the decline in full-year results. Additionally, PlayStation 5 sales missed the company’s downwardly revised guidance.

In China, quarterly reports illustrate that revenue from consumers remains weak while businesses are increasing their advertising. Alibaba reported a 4% increase in consumer spending within its China market, a q/q increase of 2 percentage points, but its overall profits dropped due to declines in the company’s ownership stakes in other businesses. Alibaba also generated increased revenue from marketing services that it provides to merchants on its ecommerce platforms such as Taobao and Tmall. Alibaba’s international revenue also increased 45% y/y, a result of the company’s efforts to expand its footprint in other countries. Shares of Alibaba declined 5% in premarket trading. Also this morning, Chinese tech company Tencent reported a modest 3% y/y increase in revenues from its videogaming division but said advertising revenue jumped 26% y/y and accelerated from the final three months of 2024.

Investors Shrug Off Inflation

Markets are bullish, driven by speculative fevers despite evidence of mounting inflationary pressures. All major US equity indices are higher with the 0.7% gain of the small-cap Russell 2000 benchmark leading. The Nasdaq Composite, Dow Jones Industrial and S&P 500 baskets are up 0.2%, 0.1% and 0.1%. Sectoral breadth is positive with eight out of eleven segments moving north on the session as real estate, communication services and utilities gain 0.7%, 0.3% and 0.2%. Energy, consumer staples and consumer discretionary are offsetting progress, however, with the components trading south by 0.5%, 0.3% and 0.1%. In fixed-income and currency land, yields and the dollar are moving lower as Powell keeps an additional rate hike out of the deck. The 2- and 10-year Treasury maturities are trading at 4.83% and 4.47%, 4 and 2 basis points lighter (bps) in today’s session. The Dollar Index is lower by 18 bps and is trading at 105.02. The greenback is down relative to most of its major counterparts including the euro, pound sterling, franc, yuan and Aussie and Canadian dollar. The US currency is gaining versus the yen, however. Oil traders are calling a bluff on an OPEC + forecast for steady demand amidst the cartel potentially greenlighting production increases from some of its members. WTI crude is down a sharp 1.4%, or $1.12, to $78.02 per barrel. Copper and gold are higher by 2.5% and 0.7%, meanwhile, as softer rates propel manufacturing prospects while investors maintain an appetite for safe havens.

Meme Mania Thrives off Relaxed Financial Conditions

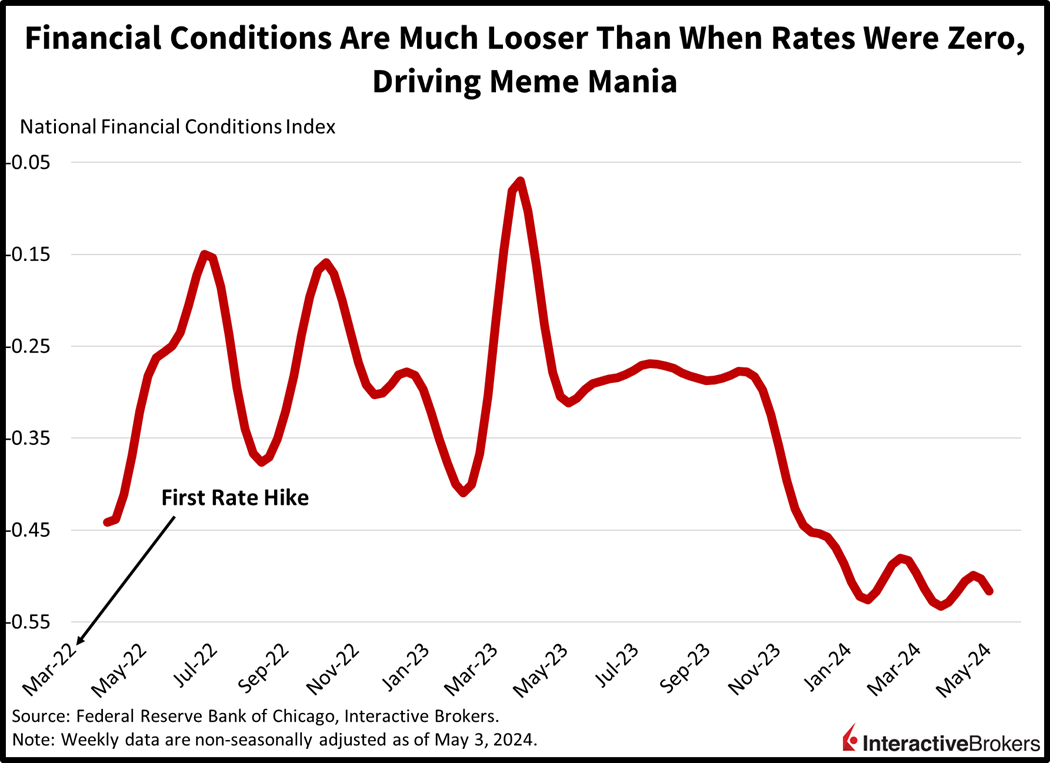

Financial conditions were quite loose in 2021 when meme stocks became the hot thing. At the time, the federal funds rate was 0%, the Fed was pumping $120 billion into the economy on a monthly basis, the majority of the population was on couches due to lockdowns, and stimmy checks/PPP loans were circulating alongside enhanced unemployment benefits. The environment was prime for speculative excesses and liquidity made its way to some of the riskiest segments of the equity market. But today’s central bank rate is 5.5% and the Fed is shrinking its balance sheet while direct fiscal support to households has abated on a relative basis; how can investors shift their seat on the Titanic and now dance on the upper deck of meme stocks with such a financially restrictive landscape?

The answer is that the stimulus from 2020 and 2021 was so abundant that the tightening in 2022, 2023 and 2024 hasn’t been enough to counter it. For context, the Fed added $4.8 trillion to its balance sheet during the pandemic but has only allowed $1.6 trillion to come off since its 2022 peak. Another consideration is the speed at which the central bank comes to the rescue when volatility emerges, with March 2023 featuring a $400 billion addition to the Fed’s assets during a time in which quantitative tightening was interrupted as a result of regional bank trouble. Its bloated balance sheet, perceptions of the Fed helping as soon as there’s trouble and patience on the inflation front are large drivers of today’s easy financial conditions which lay the foundation for Meme Mania 2.0. Indeed, financial conditions today are much looser than in 2022, when rates were at zero. The late folk singer Harry Chapin once sang “the iceberg’s on the starboard bow, won’t you dance with me” and today we could be sailing to an icy hazard with the Fed once again making the mistake of waiting too long for inflation to reach its target. Former Fed Chair Paul Volcker remarked that the real danger of monetary policy comes from “encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets.”

Visit Traders’ Academy to Learn More About the Producer Price Index and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.