Heightening tensions in the Middle East are leading to risk-off sentiments on Wall Street, with investors largely ignoring decent economic data. News that Tehran is planning to launch a ballistic missile against Tel Aviv as soon as today is prompting defensive positioning as traders scoop up stocks in the utilities and energy sectors, while commodities, Treasurys, the greenback, index put options, and volatility call options are also catching fierce bids. Conflict wasn’t limited to foreign land during the first day of October; however, almost 50,000 members of the International Longshoremen Association walked off the job at midnight due to compensation plan disagreements between the labor union and the US Maritime Alliance. The strike is driving uncertainty concerning the availability of goods and their prices in the near term, with ILA President Harold Daggett issuing dramatic statements related to the damage a prolonged standoff will cause. Meanwhile, the economic calendar featured lighter-than-expected European price pressures and loftier-than-projected job openings that were largely ignored but may have otherwise been interpreted as bullish for equities.

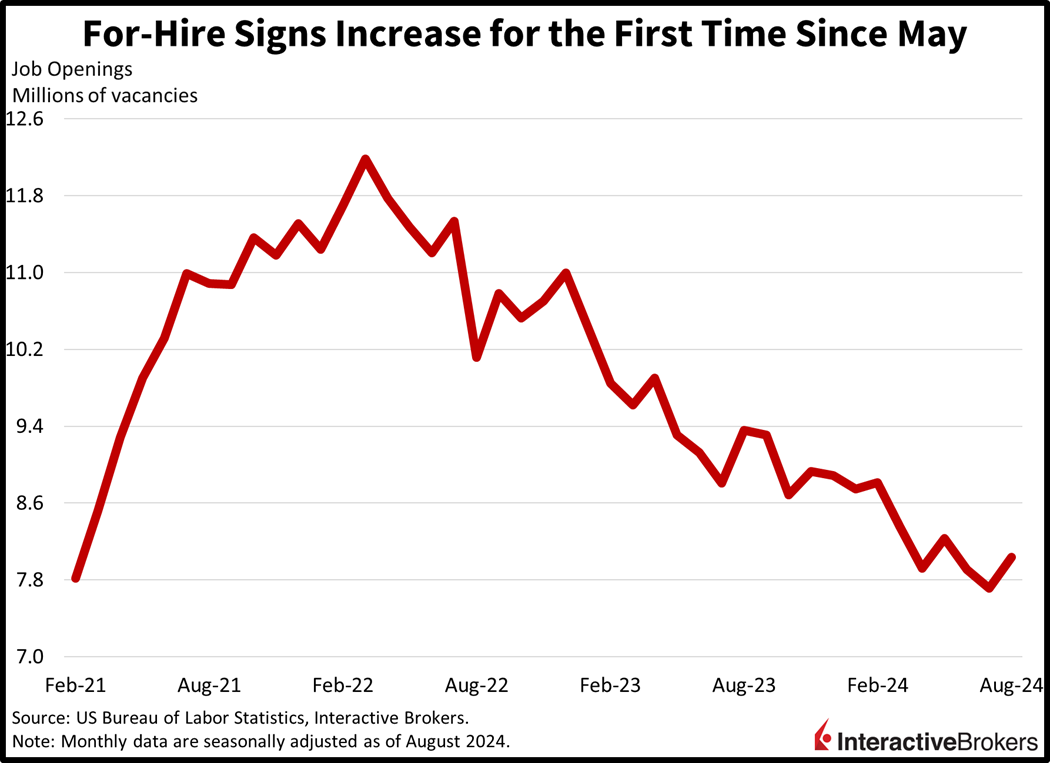

For-Hire Signs Increase

This morning’s Job Openings and Labor Turnover Survey failed to quell volatility on Wall Street, but it did indicate that employers maintain an appetite for workers. August job openings rose for the first time since May, with the 8.04 million figure exceeding expectations of 7.655 million and the prior month’s 7.711 million. Quits did decline from 3.243 million to 3.084 million, though, pointing to reduced confidence in the ability of workers to replace their employers. However, the report is generally pushing back against the notion that the employment market is deteriorating rapidly, as some concerned members of the Fed are supporting rapid and deep cuts to the central bank’s benchmark rate. Of course, ADP Employment, Unemployment Claims and Nonfarm Payrolls in the next few days will provide us with further evidence of current labor conditions.

Little Hope in Manufacturing

The pressures of elevated prices, tall financing costs, and reduced credit availability continue to weigh on the US manufacturing sector, with the industry contracting for the sixth month in a row and in 22 of the last 23 months. This morning’s Purchasing Managers’ Index from the Institute for Supply Management arrived at 47.2, matching August’s score and near the median estimate of 47.5. Results were dismal across the board as inventories, employment, new orders, prices and production came in at 43.9, 43.9, 46.1 and 49.8. The weakness did lead to delivery times speeding up as order backlogs contracted.

Similar Challenges in Real Estate

Similar headwinds are also facing the domestic real estate sector, with construction spending falling for the third consecutive month. Outlays stumbled 0.1% m/m in August, worse than forecasts of a positive 0.1%, but a shallower contraction than July’s 0.5%. The commercial and the single- and multi-family housing segments weighed the most, with investments falling 0.5%, 1.5% and 0.4% m/m.

Recessions Cure Inflation

Across the Atlantic in Europe, the region saw prices decline last month on the back of waning momentum following the Paris Olympics as well as falling energy costs. Cratering oil prices have mainly been a result of recessionary conditions in China and weak demand in the eurozone. Overall, prices fell 0.1% m/m, while core charges rose by the same amount. Energy and services drove the deflation, seeing charges slip 1.6% and 1.1% m/m. However, goods and unprocessed foods did see costs rise 2.1% and 0.9%, which was also partially offset by a 0.1% m/m drop in the processed food, alcohol and tobacco category. Year over year figures came in at 2.7% for core and 1.8% for headline, below the previous month’s 2.8% and 2.2%, and a tenth of a percent lower than estimates on both fronts.

War & Trade Worries Hamper Stocks

Stocks are being pounded as rising geopolitical and port uncertainties weigh on the earnings outlook and financial stability. Investors are certainly looking to secure gains, considering the S&P 500 is up 20% year-to-date. September’s upside was rare, marking its first occurrence since 2019, and some participants are wondering if unfriendly volatility is due this month. For now though, all major equity indices are trading south with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial benchmarks losing 1.7%, 1.4%, 1% and 0.4%. Sectoral breadth is negative with 9 out of 11 segments lower, but excluding energy and utilities; they’re up 2.2% and 0.7%. Leading to the downside are technology, consumer discretionary and real estate, which are down 2.3%, 1% and 0.6%. Action in fixed-income, currencies and commodities has been a different story, however, with market players clamoring for protective areas of the investing universe. Treasurys across the 2- and 10-year maturities are changing hands at 3.61% and 3.73%, 3 and 5 basis points (bps) lighter on the session. The Dollar Index is up 50 bps, with the greenback appreciating against most of its major counterparts including the euro, pound sterling, franc, yen, and Aussie tender, but it is depreciating versus the Canadian currency. Commodities ex-lumber are trading bullishly with crude oil, silver, gold and copper traveling north by 3.8%, 1.3%, 1% and 0.9% while the critical real estate material experiences downside of 0.2%.

Events Difficult to Quantify

The beginning of the month has brought unfortunate events that are difficult to measure in terms of their impact on our investments. The length of delays and damage at the ports, as well as in the Middle East, could last a few hours or days, but hopefully not weeks or months; longer-duration developments are likely to impair economic and financial performance. Meanwhile, the upcoming election and congressional makeup also offer a heavy degree of confusion, with investors thinking about important policy decisions related to taxes, spending, regulations, tariffs, immigration, housing and more. But a reason to be jolly is that central banks around the world are accommodating monetary policies and pointing to cheaper money down the road, further empowering investors as stocks are on track for gains in excess of 20% for two consecutive years. Finally, labor data this week was expected to take the main stage, but its importance has been countered by conflicts at the ports and in the Middle East.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.