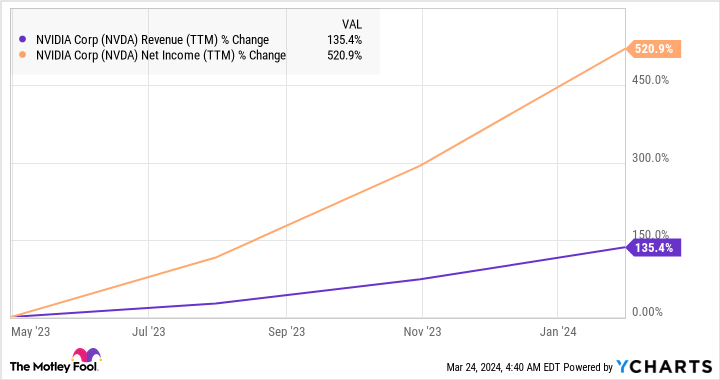

Nvidia is the pioneer in the market for artificial intelligence (AI) chips as its graphics processing units have been playing a central role in helping cloud service providers train large language models. This explains just why the semiconductor giant’s revenue, earnings, and stock price have simply taken off in the past year.

NVDA Revenue (TTM) data by YCharts

The good part is that Nvidia’s estimated market share of more than 90% in AI chips indicates that it could very well sustain its eye-popping growth in the future. After all, the market for AI chips is expected to exceed $304 billion in annual revenue by 2030 as per third-party estimates, and there are a few Wall Street analysts who believe Nvidia could end up sitting on the lion’s share of this opportunity in the long run.

However, Nvidia’s rapid growth means that it is now trading at a rich valuation. At 75 times trailing earnings and 36 times sales, Nvidia is not a value play. Of course, the company’s forward multiples indicate that it could justify its rich valuation by delivering outstanding growth in the future, but not everyone may be comfortable paying the rich multiples to buy this AI stock.

Qualcomm (QCOM 1.23%), however, is an incredibly cheap semiconductor stock one can buy right now to capitalize on the proliferation of AI. Its growth may not be anywhere close to Nvidia’s currently, but it seems on track to benefit from two fast-growing AI-related markets that could supercharge its growth in the long run.

AI-powered smartphones and PCs could give Qualcomm a nice shot in the arm

Qualcomm is the second-largest manufacturer of smartphone application processors in the world. According to Counterpoint Research, the company controlled 23% of this market at the end of 2023. It is worth noting that Qualcomm’s growth has been nothing to write home about over the past year or so thanks to the slowdown in the smartphone market.

However, in the first quarter of fiscal 2024 (for the three months ended Dec. 24, 2023), Qualcomm’s handset revenue increased 16% year over year to $6.69 billion. The company’s overall revenue, meanwhile, was up 5% year over year to $9.92 billion. So, Qualcomm gets just over two-thirds of its total revenue from selling smartphone chips.

The good news for Qualcomm is that the smartphone market is set to recover from 2024. Market research firm IDC is predicting a 2.8% increase in smartphone sales this year to 1.2 billion units. Sales of AI smartphones, however, are expected to more than triple this year to 170 million units from 51 million units last year, accounting for 15% of the overall market in 2024.

According to another estimate from Counterpoint Research, AI smartphone shipments could increase at an annual pace of 83% through 2027, with annual shipments set to exceed 500 million units at the end of the forecast period. Also, AI smartphones are predicted to account for 40% of the overall smartphone market in 2027, indicating that their sales could keep heading higher.

Counterpoint estimates that Qualcomm could capture more than 80% of the market for generative AI-powered smartphones over the next couple of years. This could help the company sustain the newly found momentum of its handset business. Qualcomm is looking to capitalize on this lucrative opportunity with its latest product development moves.

Its Snapdragon 8 Gen 3 mobile processor platform can run generative AI models locally on smartphones, including voice-enabled AI assistants and the Stable Diffusion image generation model. And now, the company is looking to push the envelope further with the new Snapdragon 8S Gen 3 smartphone processor that it claims will help run generative AI models locally on mid-range smartphones.

Qualcomm claims that this new chip can run over 30 AI models on smartphones, including Llama 2 and Google Gemini. The company’s flagship Snapdragon 8 Gen 3 processor is already in use by Samsung to power AI features in the latest Galaxy S24 models, and this new addition is expected to help Qualcomm tap mid-range Android OEMs (original equipment manufacturers) such as Xiaomi and Honor.

Qualcomm, therefore, is pulling the right strings to ensure that it remains in a solid position to tap the AI-powered smartphone market. On the other hand, Qualcomm has also set its sights on the AI personal computer (PC) market as well. PCs powered by Qualcomm’s AI-focused Snapdragon X Elite system-on-a-chip (SoC) are set for launch in mid-2024.

Qualcomm’s management remarked on the company’s January earnings conference call that Snapdragon X Elite’s “design win traction continues to increase since the platform was announced last October.” Samsung is reportedly going to deploy this SoC in a new notebook and rumors suggest that it could be more powerful than rival offerings from Intel, AMD, and Apple.

Management also expects “Snapdragon X Elite to set the industry benchmark for on-device gen AI and copilot experiences in addition to leading performance and battery life for next-generation Windows PCs.” If Qualcomm can translate these claims into real-life performance, it won’t be surprising to see the company making a dent in the AI PC market.

With the market for AI PCs forecast to increase at an annual pace of 50% through 2030, Qualcomm’s entry into this market could unlock a solid growth opportunity for the company. So, the company could capitalize on AI adoption in two lucrative markets, which is why it may be a good idea to buy it while it is still cheap.

An attractive valuation is another reason to buy the stock

Qualcomm is currently trading at 24 times trailing earnings and 18 times forward earnings. Both these multiples represent a discount to the Nasdaq-100 index’s trailing earnings of 31 and forward earnings of 28 (using the index as a proxy for tech stocks).

However, Qualcomm may not be available at such cheap multiples once AI starts moving the needle in a bigger way for the company. We have already seen that its handset business is picking up and the prospects of the AI smartphone market suggest that it could keep getting better. AI PCs, on the other hand, will help Qualcomm move into a new niche, thereby allowing the company to start growing at a faster pace than the market’s expectations.

Once that starts happening, Qualcomm stock could start soaring like other chipmakers that are flying on the back of growing AI-driven sales, which is why investors would do well to buy it while it is still cheap.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Qualcomm. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.