The big tariff scare has proven to be far less concerning than feared. Yesterday morning we learned that 25% tariffs on Mexico will be delayed for another month, and after the close, we learned the same for Canada. Overnight, even though 10% tariffs were implemented against China, their retaliation is more targeted than our across-the-board approach. As a result, it is quite understandable why markets got off to a solid start this morning.

Yet this morning’s rally only closes yesterday’s opening gap in the S&P 500 (SPX). We are currently trading around last week’s close, but a bit more than 1% below where we were when the tariff implementation was confirmed on Friday afternoon:

SPX, 3-Days, 1-Minute Candles

Source: Interactive Brokers

The Nasdaq 100 (NDX) is doing a bit better, but also not yet back to Friday’s peak:

NDX, 3-Days, 1-Minute Candles

Source: Interactive Brokers

My interpretation is that investors have properly adjusted to the current reality about tariffs – better than feared, but not back to the pre-tariff status quo.

So, we can shift our focus to this afternoon’s big event, earnings from Alphabet (GOOGL, GOOG). The stock is up about +20% in the past three months, thanks not only to a solid market, but also to enthusiasm for its quantum computing advances. That raises the stakes somewhat for today’s report, since investors will likely be hoping not only for the usual earnings and revenue guidance – which GOOGL is notoriously sparse with – but also for more clues about when the company might be able to commercialize its Willow chip.

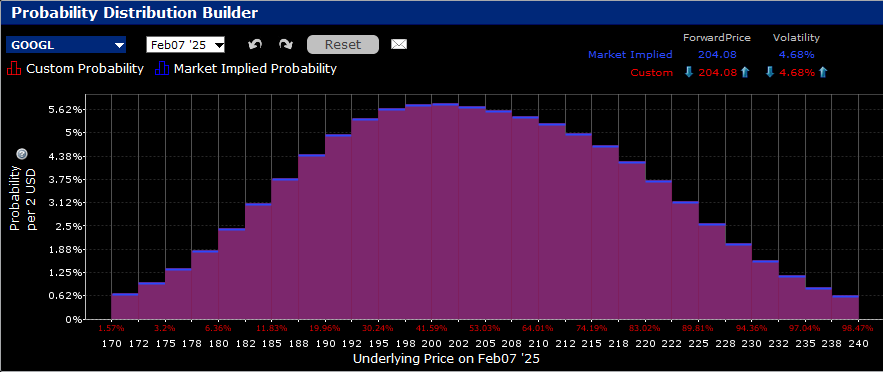

The IBKR Probability Lab shows modest risk aversion, with the peak outcome for GOOGL options expiring on Friday in the $198-$202 range, slightly below the current $204:

IBKR Probability Lab for GOOGL Options Expiring February 7th

Source: Interactive Brokers

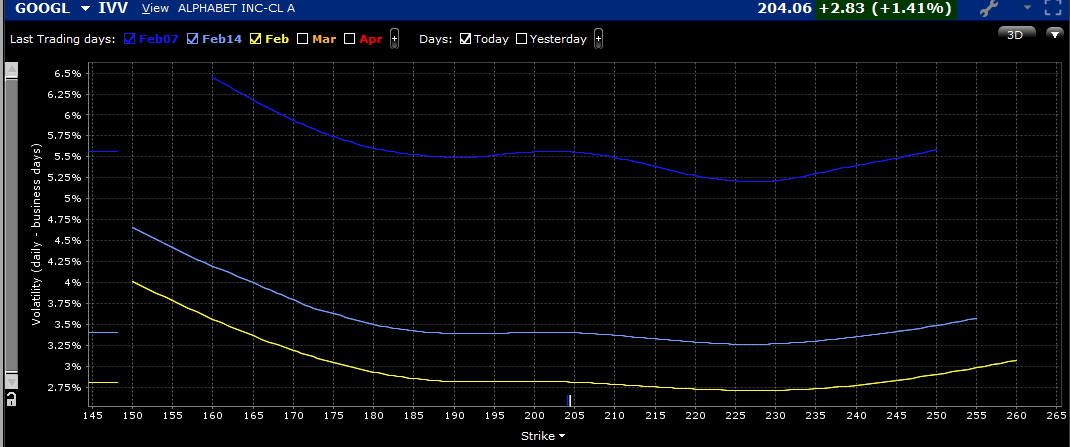

Skews are generally flattish, with only a modest bias to the downside. Interest in quantum computing remains strong, so it is clear that there are traders willing to speculate on an upside move. The daily implied volatility of 5.6% is a bit modest when compared to the average 6.8% move after the past six reports (+2.82%, -5.04%, +10.22%, -7.50%, -9.51%, +5.78%):

Skews for GOOGL Options Expiring February 7th (top), 14th (middle), 21st (bottom)

Source: Interactive Brokers

In general, traders feel relieved today. GOOGL earnings will help determine if that continues after today’s close.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

Disclosure: Options (with multiple legs)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking the link below. Multiple leg strategies, including spreads, will incur multiple transaction costs. “Characteristics and Risks of Standardized Options”