With forecasts for power demand growth seemingly increasing every month, it’s clear that part of the solution will be “behind the meter”, meaning new natural gas power plants directly connected to their data center customers without the need to connect to the grid.

This also sidesteps potential complaints that existing electricity customers are subsidizing the new ones because the cost of added infrastructure is broadly shared across a network. Although adding data centers is a vital step in developing AI capabilities, they don’t add many jobs.

Once constructed, oversight of a warehouse of servers is not labor-intensive. Like bitcoin miners, they don’t have much political clout, so operating independently of the grid is likely to become more widespread.

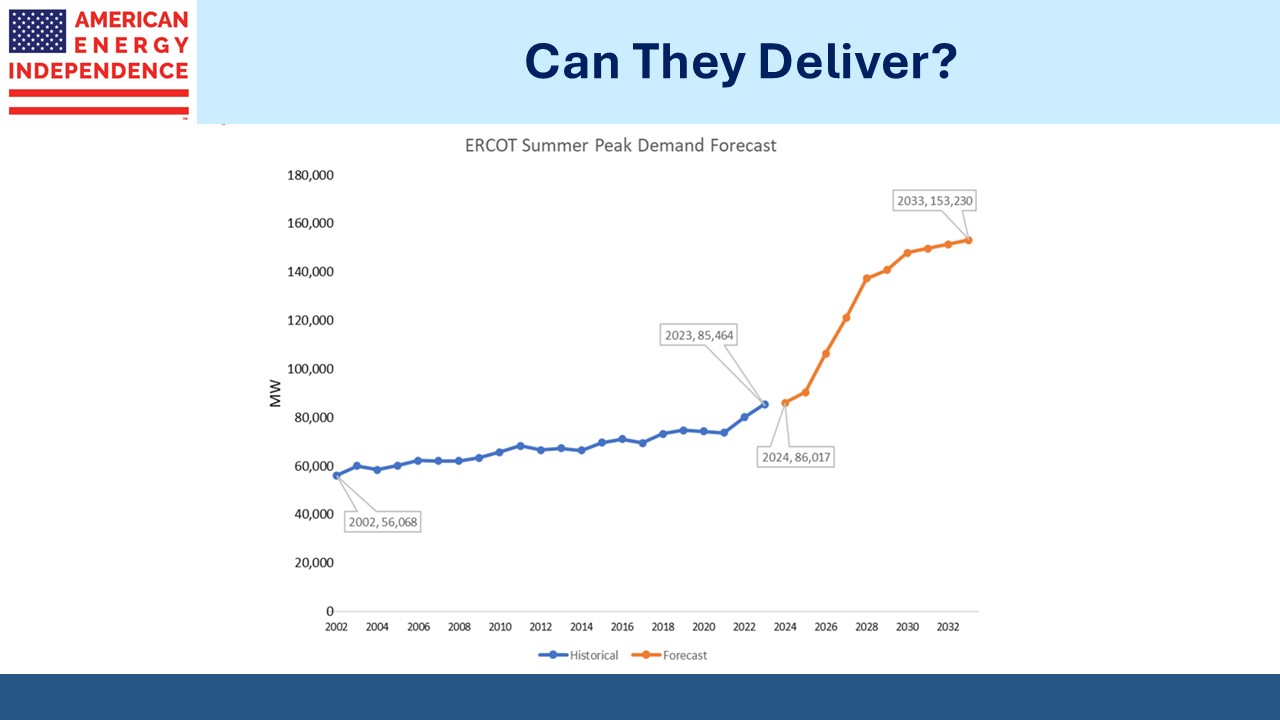

Texas has its own grid that operates without any meaningful connections to other states. Their forecast growth in peak summer illustrates the problem. Having increased at 2% pa for the past couple of decades, they now expect a tripling of that growth rate over the next nine years. Nobody knows if the power infrastructure to support this can be built on such a schedule. We’re adding 148 new gas power plants across the country, up from 133 in April, according to S&P.

Renewables are too unreliable to receive serious consideration because data centers need to run all the time, not just when it’s sunny or windy. Several nuclear projects are being pursued but none are likely to be operational before the 2030s. So natural gas is the only remaining solution. Williams Companies has discussed offering co-located gas generation as a complete solution for data centers.

Because the technology companies building these new facilities care about their carbon footprint, Carbon Capture and Sequestration (CCS) is often part of the package. Exxon Mobil thinks data centers could be 20% of the total CCS market by 2050.

Too few people in America appreciate how significantly the energy sector has boosted our economy. The casual observer contemplating equity markets sees technology stocks and anything linked to AI driving returns. While true, this view doesn’t give sufficient credit to the energy sector and how our access to cheap, reliable hydrocarbons has let the US leap ahead of other developed countries.

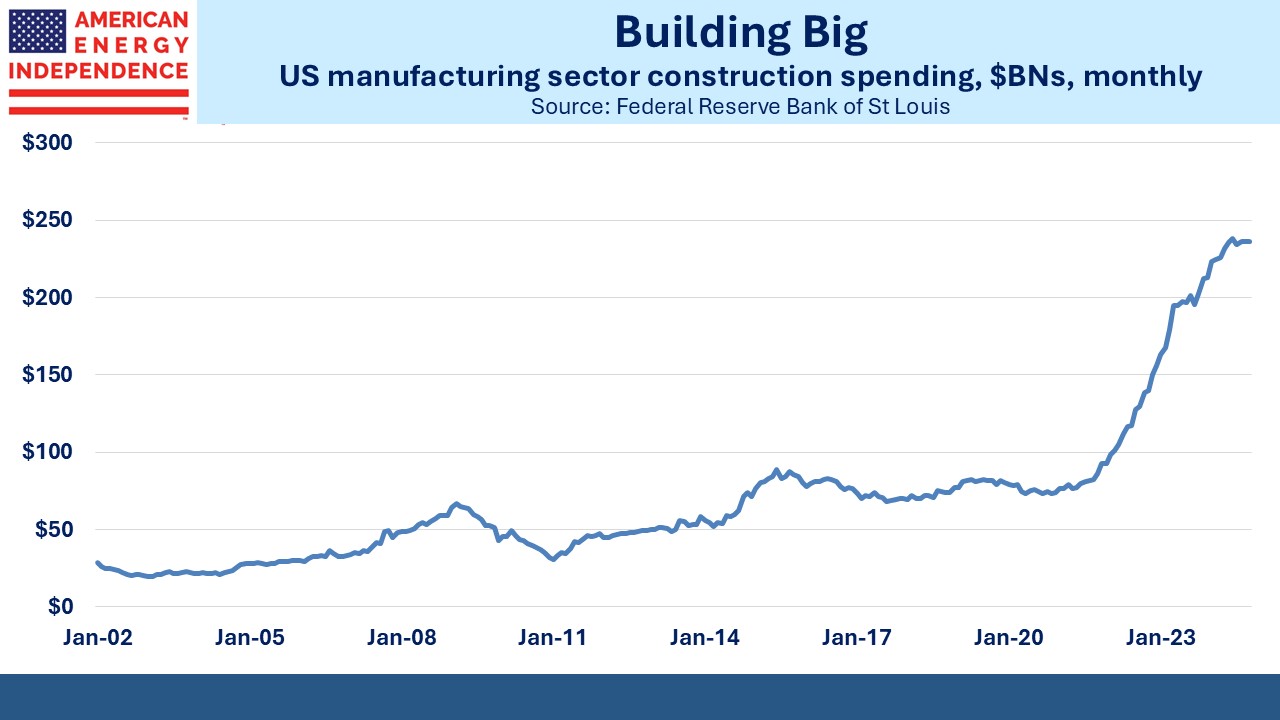

Construction of manufacturing plants has tripled from pre-pandemic levels. Part of this is the result of all the fiscal stimulus the Biden administration pumped into the economy, from spending to offset the drag caused by covid lockdowns to the Inflation Reduction Act. But there can be little doubt that access to cheap, reliable energy has played an important role. Manufacturing employment has stopped its multi-decade decline.

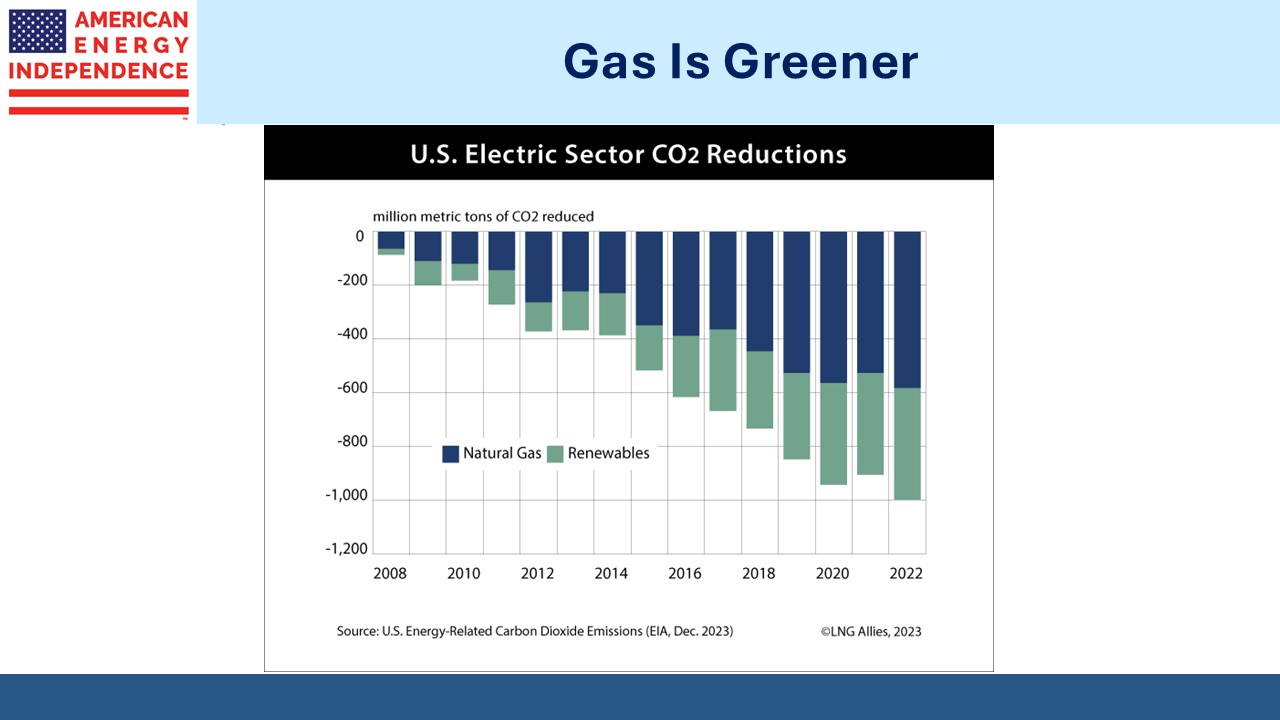

Natural gas is in demand for data centers and to power new manufacturing. But it’s also the biggest source of reduced CO2 emissions by displacing coal. Roughly two thirds of the million metric tonnes we’ve cut is down to natural gas. This has happened with little fanfare and scant support from environmental extremists. Yet it’s been more important than all the solar and wind we’ve built.

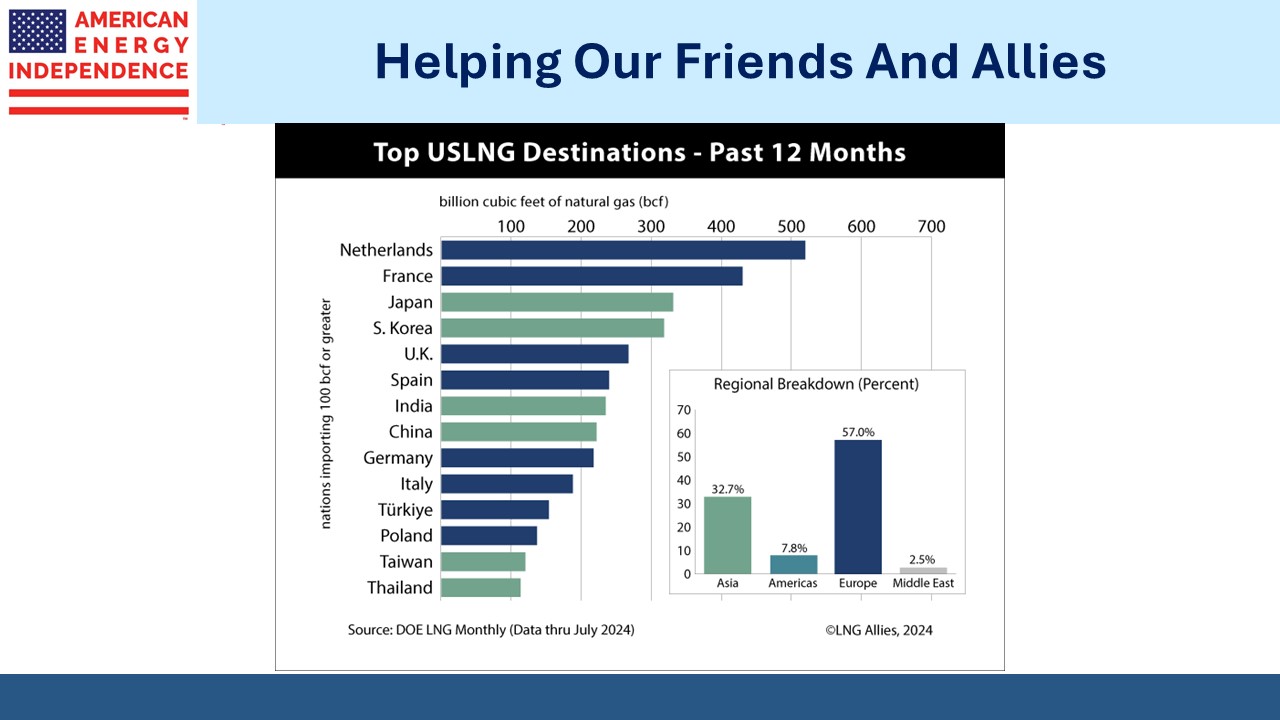

America has come to Europe’s aid with exports of LNG, with over half of our volumes sent there to replace lost Russian imports. The widely criticized LNG permit pause, an ineffective sop to progressives, injected uncertainty into our willingness to continue with long term supplies. Fortunately, that will be lifted next month.

The US Department of Energy (DoE) is expected to release the environmental study whose preparation the pause was intended to allow – apparently it wasn’t possible to keep approving permits while doing research.

In a letter obtained by the NYTimes, outgoing DoE head Jennifer Granholm said increased exports would drive domestic gas prices higher, by as much as 30%. Even if true, US natural gas is around $3.25 per Million BTUs versus over $12 in Europe and Asia. It would still be very cheap compared to global prices.

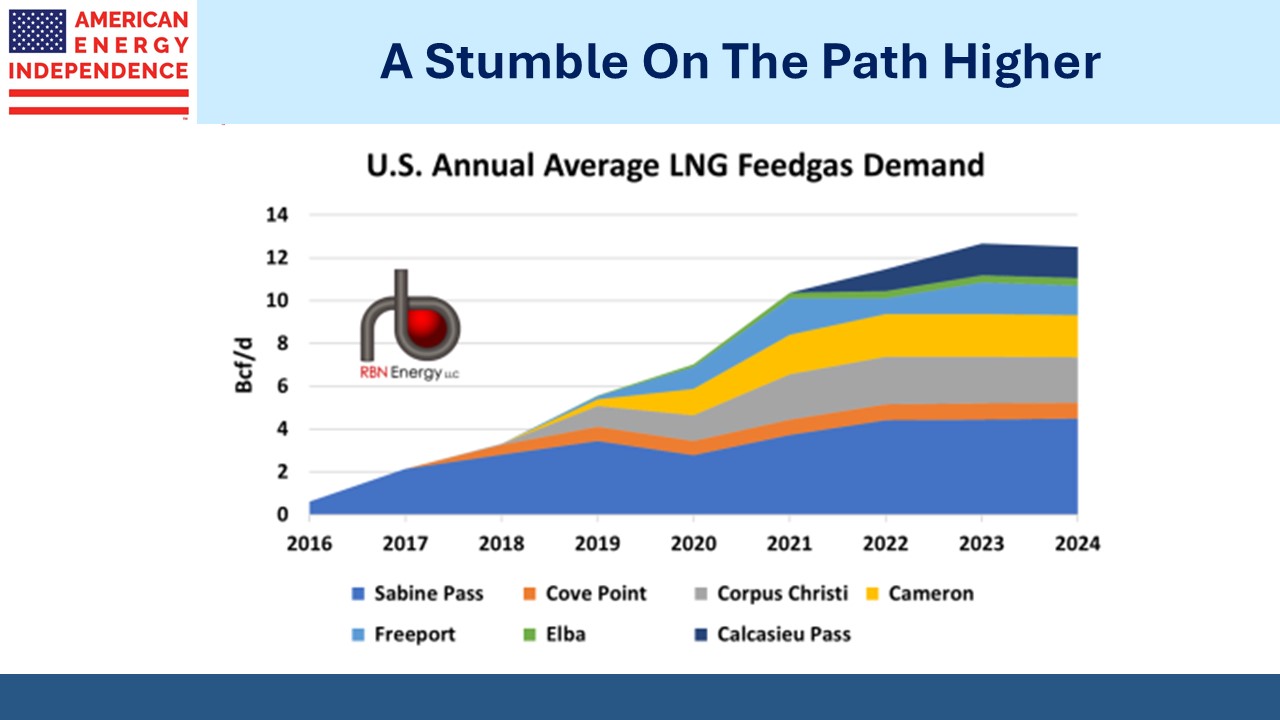

We often use a chart showing growing LNG export capacity as new terminals are completed. Surprisingly, this year volumes are down. It’s not the permit pause, which had no impact on existing projects, but is the result of slower than expected completion at a couple of expansion projects and downtime for maintenance elsewhere.

In some cases, FERC has been slow to issue approvals – whether this was politically motivated or simply the result of diligent regulators depends on your perspective. But the net result has been that feedgas demand from all our LNG terminals averaged 12.53 Billion Cubic Feet per Day (BCF/D) this year, down slightly from 2023 and the first drop since we began exporting LNG in 2016.

There’s every reason to expect higher volumes next year. For many energy challenges, natural gas is the solution.

—

Originally Posted December 18, 2024 – Natural Gas Is The Solution

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.