Market sentiment is mixed today as asset prices fluctuate across the investing universe. Today’s trading has been highly influenced by last night’s earnings results from semiconductor and AI leader Nvidia, but investors are also paying attention to heightening geopolitical tensions in the Far East. Against this backdrop, folks are snatching up bitcoins, value names, cyclical stocks, small cap equities, gold bars and barrels of crude oil. Meanwhile, this morning’s economic calendar was largely ignored, as existing home sales, unemployment claims, the leading economic index and Philly manufacturing didn’t affect participant confidence much.

AI and Security Fears Boost Earnings Results

Chipmaker Nvidia (NVDA) posted a 94% year over year (y/y) increase in revenues, a notable deceleration from recent reporting periods in which sales grew no less than 122% and as much as 265%. Nvidia founder, President and CEO Jensen Huang disputed claims that the buildout of artificial intelligence technology is moderating and said manufacturing capacity, not demand, is limiting sales as the company is struggling to fulfill orders. Snowflake (SNOW), which provides software for aggregating, organizing and analyzing data, provided a better-than-anticipated sales outlook, suggesting that customers are embracing its new artificial intelligence products. Snowflake’s third-quarter earnings and revenue easily surpassed analyst consensus estimates. In the cybersecurity arena, Palo Alto Networks (PANW) produced earnings and revenue that surpassed expectations for its fiscal first quarter. Its current-quarter revenue guidance and the mid-point of its earnings guidance met analyst forecasts. The company said an increase in cyberthreats has supported demand for its products.

In other earnings, John Deere (DE) posted a 28% y/y revenue decline, but still beat the analyst consensus. Financial services revenue increased, but agriculture, construction and forestry product sales all weakened. In the retail sector, BJ’s Wholesale Club (BJ) said third-quarter sales climbed slightly more than 3%, a result of comparable store sales increasing and higher revenue from membership fees.

Slow Hiring and Lack of Layoffs

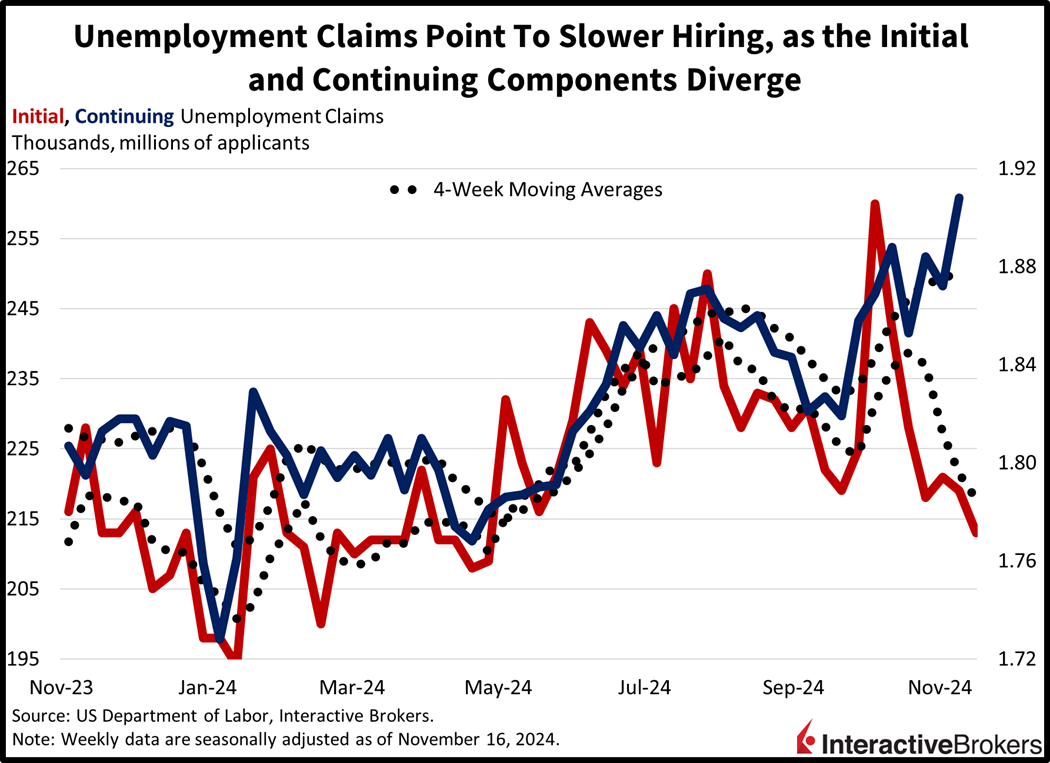

Initial unemployment claims hit a seven-month low during the week ended Nov. 16; however, continuing unemployment filings in the preceding week increased to 1.908 million, a three-year high, according to this morning’s Labor Department report. This divergence in the two metrics illustrates how employers are apprehensive about laying off workers in a tight labor market but are also cautious about bringing on new recruits due to uncertainty about the economy.

Initial benefit requests fell from 219,000 to 213,000, well below Wall Street’s expectation of 220,000. Meanwhile, for the week ended Nov. 9, continuing claims rose from 1.872 million to 1.908 million, surpassing the analyst consensus estimate of 1.870 million. Continuing claims represent individuals who are already receiving benefits and provide insight into the ease with which individuals can find work. On a longer-term basis, the four-week moving average for initial benefit requests declined from 221,500 to 217,750, whereas the metric for insured claims climbed from 1.874 million to 1.879 million.

Housing Sales Rose Last Month

The pace of existing home sales rose 3.4% month over month (m/m) in October to 3.96 million seasonally adjusted annualized units but lingered near a 14-year low, according to the National Association of Realtors. Encouragingly, the number exceeded the analyst consensus expectation for 3.95 million sets of keys to change hands. In September, closings totaled 3.83 million, which was a 1.3% m/m decline. Many prospective buyers spent September waiting for interest rates to moderate following the Fed’s jumbo 50-basis point (bps) cut to its key benchmark; however, longer-term borrowing costs climbed. After seeing rates escalate, these potential home buyers may have entered the market after giving up hope for mortgage costs to ease. In the meantime, elevated prices and expensive mortgages are creating a headwind to sales. Finaly, October saw a m/m inventory increase of 0.7% while prices rose to another all-time high amidst broad participation in transaction growth from single-family, condominiums and cooperatives as well as within all 4 regions except for the Northeast.

Other Economic Indicators Retreat

In other economic news, the Conference Board’s Leading Economic Index declined 0.4% m/m in October, as the steepening yield curve and sluggish construction investment coincide with a manufacturing sector that is experiencing fewer orders and is trimming work hours as a result. The weakness in the goods sector was also on display in the Philly Fed’s Manufacturing Index, which printed -5.5 this month, missing projections of 8 and slipping from October’s 10.3.

Wall Street Hosts a Tug of War

Markets have already seen some wild swings during the day as bulls and bears engage in a tug of war. At the moment, however, most major equity benchmarks are in the green, with the Russell 2000, Dow Jones Industrial and S&P 500 indices up 1.2%, 0.8% and 0.2%. The Nasdaq 100 is down 0.2% though, as Nvidia retreated from an all-time high and began to weigh on growth sentiment. Sectoral breadth is green, with 9 out of 11 segments up on the session and being led by energy, industrial and financials; they’re up 1.5%, 1.4% and 1.2%. Communication services and consumer discretionary represent the day’s laggards and are lower by 1.1% and 0.1%. Treasurys are near the flatline, with the 2- and 10-year maturities changing hands at 4.32% and 4.41%. The dollar is gaining strongly, but its gauge is up 33 bps as it appreciates relative to the euro, pound sterling, franc and Aussie currency while depreciating versus the yen, yuan and Canadian tender. Commodities are mixed with crude oil and gold up 1.5% and 0.6%, but lumber, copper and silver are down 1.8%, 0.8% and 0.3%. WTI crude is trading at $70.08 per barrel on rising hostilities between Kyiv and Moscow.

Conditions Ripe for a Santa Claus Rally

While Nvidia’s guidance fell short of some investor expectations, we are witnessing seasonal strength in stocks that traditionally continues into year-end. This is also the time on the calendar when folks aren’t as receptive to negative developments, opting for glass half-full perspectives instead. With nerves calmed following the last magnificent 7 earnings report of 2024, another significant overhang, along with rate cuts and the election, has been overcome by this market. Finally, the road looks clear for a Santa Claus rally, but modest caution is warranted while we move toward inauguration day, as the GOP’s upcoming majority control in Washington coincides with upticks in policy uncertainty and geopolitical turbulence.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.