Franklin Templeton Fixed Income CIO Sonal Desai shares four key themes that she believes will shape economic and financial market developments in 2025 and beyond.

As 2025 gets underway, I want to highlight four key themes that I believe will shape economic and financial market developments over the next 12 months and beyond. These themes in part reiterate points that I stressed over a year ago—the fact that they have played out as I expected over the past 12 months bolsters my conviction that they will be even more relevant as we move forward into this new year.

1. My first theme for 2025 is once again a reality check on fiscal policy, and its implications for inflation and bond yields. Since 2007, the eve of the global financial crisis (GFC), government expenditures and public debt levels have risen substantially across Western economies. Debt-to-GDP ratios have doubled in the United States, more than doubled in the United Kingdom, and now surpass 100% in all G7 countries except Germany. In Europe, this heavy debt burden is beginning to severely constrain governments’ ambitions, including key priorities like the energy transition. In the United States, last year the deficit was close to US$2 trillion, and President Trump’s election promises would send it even higher. It seems most likely that those promises will need to be scaled back, but even so it will be difficult to reduce the deficit significantly without some very hard decisions on Social Security and health care.

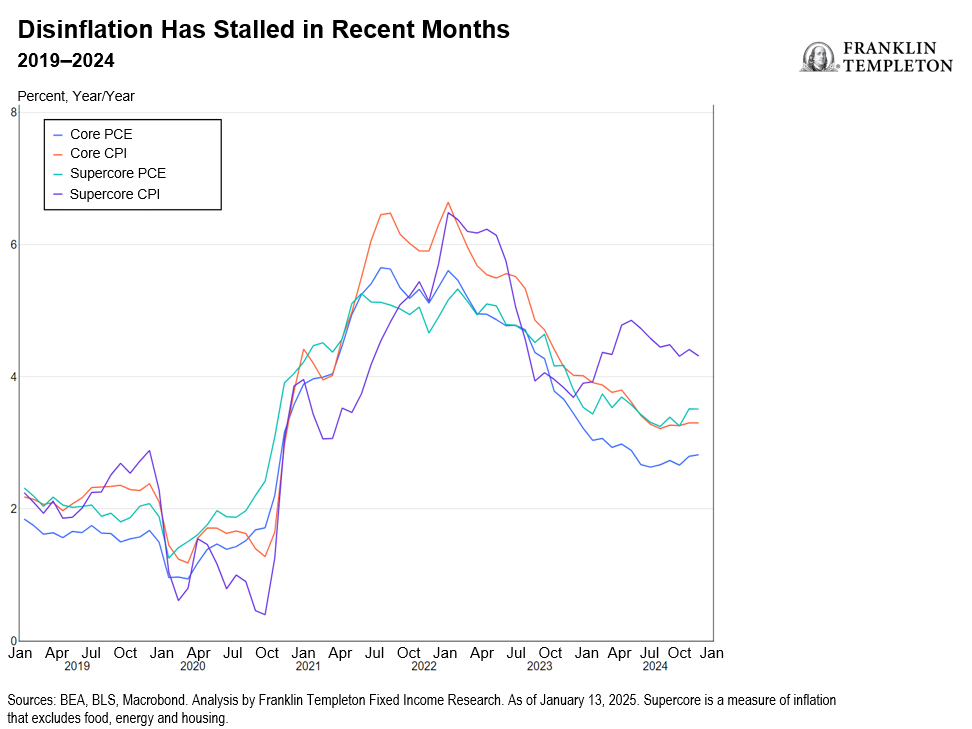

The incoming administration’s aim to improve government efficiency is laudable, but non-defense discretionary expenditures are already too small a share of the budget—they amount to less than US$1 trillion. High interest rates and a large debt stock imply that interest spending weighs heavier on the budget than just a few years ago (interest spending has doubled to 3% of GDP). Action on entitlements will sooner or later be necessary. For 2025, though, we’re most likely looking at a still very large deficit, and a fiscal policy so loose in an economy that’s already growing fast will keep inflationary pressures alive—I believe it’s a key reason why progress on disinflation has stalled over the last several months. Financial markets appear to be coming to terms with the fact that reducing deficits in the coming years is going to be very hard—which implies more upward pressure on government bond yields, coming both from stubborn inflation and from large issuance needs.

2. My second theme is a reality check on monetary policy normalization. At the start of last year, I argued the Federal Reserve (Fed) easing cycle would be short and shallow, with at most 125-150 basis points in easing. I now believe it might be even less. The Fed last month signaled it expects just two more rate cuts this year, but I feel this easing cycle increasingly looks like it might be set for an extended pause if not an outright end. The just-released December jobs report showed that the labor market remains strong. Nonfarm payrolls again beat expectations at 256,000; the unemployment rate ticked down to 4.1% with unchanged participation; and wage growth momentum remains robust, at about 4% over the past three and six months. We’ll see how fiscal policy and inflation developments shape up, but if we keep seeing these kinds of numbers, the Fed will be in an increasingly difficult position.

This also bolsters my long-held conviction that neither policy interest rates nor bond yields are going back to the exceptionally low levels that we’ve experienced between the GFC and the pandemic. Those very low rates were not the new normal but a historical anomaly, and we should be looking instead at the decades preceding the GFC. This would imply that the neutral policy rate—as I have argued before—is probably around 4% and that 10-year US Treasury yields (UST), in normal circumstances, would be at least 5%.

3. My third theme for the year is productivity growth and sorting the substance from the hype in technology innovation, particularly in artificial intelligence (AI). The hype on generative AI (GenAI) has run so far ahead of reality that a resetting of expectations now seems inevitable. It’s going to take a lot more progress before GenAI can move the needle on productivity at the macro level—progress in addressing the hallucinations problem will be especially important.

Meanwhile, though, it does look like companies’ efforts to adopt prior waves of digital innovation and AI, including machine learning, and robotics, are beginning to bear fruit. US productivity growth averaged 2.5% over the five quarters ending in the third quarter 2024, compared to 1.5% over the previous ten years. Faster productivity might help put the US economy on a stronger growth path going forward—and that in turn implies higher real interest rates.

4. My fourth theme is greater uncertainty and volatility. There are many difficult tradeoffs that need to be resolved in 2025. Start with the policies of the incoming US administration: some of Trump’s election promises on fiscal policy and tariffs are hard to reconcile with the goals of stronger growth and lower prices. The same holds for immigration; I think mass deportations are unlikely, but if they were implemented, they would have an adverse impact on both growth and inflation. On the global scene, the resurgence of protectionism and nationalism continues, but is now clashing against the costs of de-globalization. Companies will need to continue the hard work of restructuring their supply chains, to strike a better balance between the efficiency benefits of globalization and the risks that come from multiple potential disruptions. How these tradeoffs will be resolved is a source of significant uncertainty. All this is occurring against a background of still-elevated geopolitical tensions, from Ukraine to Taiwan to the Middle East. This overlaps with the resetting balance of global economic power: I think the United States will continue to dominate global economic growth in 2025, while Europe will struggle, India can continue its strong run while China is likely to keep grappling with significant hurdles.

In conclusion, I expect the US economy to grow above potential, at 2.5% or higher—significantly above consensus—with core personal consumption expenditures (PCE) and Consumer Price Index (CPI) both likely to end 2025 at levels similar to end-2024, also significantly higher than consensus, and with upside risks. The Fed’s easing cycle, as I mentioned above, might well be over, especially if we keep seeing these strong numbers on jobs, wages and inflation. This would leave the fed funds rate in line with the level I have been calling for, that is somewhat above 4%+, which is my estimate of the neutral rate. By the end of 2025, 10-Year UST yields are likely to be trading in a new range somewhat north of 5%—how far above they go will depend on how loose fiscal policy turns out to be.

—

Originally Posted January 13, 2025 – On My Mind: 2025 themes in focus—fiscal headaches, monetary prudence, productivity and volatility

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default. Active management does not ensure gains or protect against market declines. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Brazil: Issued by Franklin Templeton Investimentos (Brasil) Ltda., authorized to render investment management services by CVM per Declaratory Act n. 6.534, issued on October 1, 2001. Canada: Issued by Franklin Templeton Investments Corp., 200 King Street West, Suite 1500 Toronto, ON, M5H3T4, Fax: (416) 364-1163, (800) 387-0830, http://www.franklintempleton.ca. Offshore Americas: In the U.S., this publication is made available by Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906. Tel: (800) 239-3894 (USA Toll-Free), (877) 389-0076 (Canada Toll-Free), and Fax: (727) 299-8736. U.S.: Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Issued in Europe by: Franklin Templeton International Services S.à r.l. – Supervised by the Commission de Surveillance du Secteur Financier – 8A, rue Albert Borschette, L-1246 Luxembourg. Tel: +352-46 66 67-1 Fax: +352-46 66 76. Poland: Issued by Templeton Asset Management (Poland) TFI S.A.; Rondo ONZ 1; 00-124 Warsaw. Saudi Arabia: Franklin Templeton Financial Company, Unit 209, Rubeen Plaza, Northern Ring Rd, Hittin District 13512, Riyadh, Saudi Arabia. Regulated by CMA. License no. 23265-22. Tel: +966-112542570. All investments entail risks including loss of principal investment amount. South Africa: Issued by Franklin Templeton Investments SA (PTY) Ltd, which is an authorised Financial Services Provider. Tel: +27 (21) 831 7400 Fax: +27 (21) 831 7422. Switzerland: Issued by Franklin Templeton Switzerland Ltd, Stockerstrasse 38, CH-8002 Zurich. United Arab Emirates: Issued by Franklin Templeton Investments (ME) Limited, authorized and regulated by the Dubai Financial Services Authority. Dubai office: Franklin Templeton, The Gate, East Wing, Level 2, Dubai International Financial Centre, P.O. Box 506613, Dubai, U.A.E. Tel: +9714-4284100 Fax: +9714-4284140. UK: Issued by Franklin Templeton Investment Management Limited (FTIML), registered office: Cannon Place, 78 Cannon Street, London EC4N 6HL. Tel: +44 (0)20 7073 8500. Authorized and regulated in the United Kingdom by the Financial Conduct Authority.

Australia: Issued by Franklin Templeton Australia Limited (ABN 76 004 835 849) (Australian Financial Services License Holder No. 240827), Level 47, 120 Collins Street, Melbourne, Victoria 3000. Hong Kong: Issued by Franklin Templeton Investments (Asia) Limited, 62/F, Two IFC, 8 Finance Street, Central, Hong Kong. Japan: Issued by Franklin Templeton Investments Japan Limited. Korea: Issued by Franklin Templeton Investment Advisors Korea Co., Ltd., 3rd fl., CCMM Building, 101 Yeouigongwon-ro, Yeongdeungpo-gu, Seoul, Korea 07241. Malaysia: Issued by Franklin Templeton Asset Management (Malaysia) Sdn. Bhd. & Franklin Templeton GSC Asset Management Sdn. Bhd. This document has not been reviewed by Securities Commission Malaysia. Singapore: Issued by Templeton Asset Management Ltd. Registration No. (UEN) 199205211E, 7 Temasek Boulevard, #38-03 Suntec Tower One, 038987, Singapore.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

Disclosure: Franklin Templeton

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Franklin Templeton and is being posted with its permission. The views expressed in this material are solely those of the author and/or Franklin Templeton and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.