Rhea-AI Impact

Rhea-AI Sentiment

Rhea-AI Summary

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) has acquired a portfolio of properties in the Matheson area, east of Timmins, Ontario, expanding its Munro-Croesus Property by 12% to 10,411 ha. The acquisition includes four properties (Highway, Tax, Hewitt, and Munro) with multiple high-grade and bulk-tonnage gold occurrences. Key highlights:

1. The Highway property features two gold-bearing structures with historic drilling results of up to 1.3 g/t Au over 28.8m.

2. The Stewart-Abate zone on the Highway Property yielded a 52-tonne bulk sample grading 24 g/t Au.

3. The Hewitt property contains gold-bearing mineralization with grab samples up to 15.7 g/t Au.

The acquisition cost is $150,000 cash and 750,000 Onyx shares, with a 2.0% NSR royalty retained by the vendor.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) ha acquisito un portafoglio di proprietà nella zona di Matheson, a est di Timmins, Ontario, espandendo la sua Proprietà Munro-Croesus del 12% a 10.411 ha. L’acquisizione include quattro proprietà (Highway, Tax, Hewitt e Munro) con molteplici occorrenze di oro a alta legge e tonnellaggio bulk. Punti salienti:

1. La proprietà Highway presenta due strutture aurifere con risultati storici di trivellazione fino a 1,3 g/t Au su 28,8 m.

2. La zona Stewart-Abate sulla Proprietà Highway ha fornito un campione bulk di 52 tonnellate con una gradazione di 24 g/t Au.

3. La proprietà Hewitt contiene mineralizzazione aurifera con campioni da raccolta fino a 15,7 g/t Au.

Il costo di acquisizione è di 150.000 dollari in contante e 750.000 azioni Onyx, con una royalty NSR del 2,0% trattenuta dal venditore.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) ha adquirido un portafolio de propiedades en el área de Matheson, al este de Timmins, Ontario, expandiendo su Propiedad Munro-Croesus en un 12% a 10,411 ha. La adquisición incluye cuatro propiedades (Highway, Tax, Hewitt y Munro) con múltiples ocurrencias de oro de alta ley y tonelares a granel. Aspectos destacados:

1. La propiedad Highway presenta dos estructuras auríferas con resultados de perforación histórica de hasta 1.3 g/t Au sobre 28.8 m.

2. La zona Stewart-Abate en la Propiedad Highway produjo una muestra a granel de 52 toneladas con una graduación de 24 g/t Au.

3. La propiedad Hewitt contiene mineralización aurífera con muestras de recolección de hasta 15.7 g/t Au.

El costo de adquisición es de $150,000 en efectivo y 750,000 acciones de Onyx, con una regalía NSR del 2.0% retenida por el vendedor.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF)는 온타리오주 팀민즈 동부의 마세손 지역에 있는 부동산 포트폴리오를 인수하여 뭰로-크로시스 속성을 12% 증가시켜 10,411 헥타르로 확장했습니다. 이 인수는 여러 고등급 및 대량 금 발생지가 있는 네 개의 부동산(하이웨이, 세금, 휴잇 및 뭰로)을 포함합니다. 주요 사항:

1. 하이웨이 부지는 최대 1.3 g/t Au의 역사적 탐사 결과가 있는 두 개의 금광구조를 보유하고 있습니다.

2. 하이웨이 부지의 스튜어트-아바테 구역에서 24 g/t Au의 등급을 가진 52톤의 대량 샘플이 나왔습니다.

3. 휴잇 부지는 최대 15.7 g/t Au의 채취 샘플이 있는 금 광물화를 포함합니다.

인수 비용은 150,000달러 현금과 750,000개의 Onyx 주식이며 공급자가 2.0% NSR 로열티를 보유합니다.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) a acquis un portefeuille de propriétés dans la région de Matheson, à l’est de Timmins, Ontario, élargissant sa propriété Munro-Croesus de 12 % à 10 411 ha. L’acquisition comprend quatre propriétés (Highway, Tax, Hewitt et Munro) avec plusieurs occurrences d’or de haute teneur et en tonnage massif. Principaux points :

1. La propriété Highway présente deux structures aurifères avec des résultats de forage historiques allant jusqu’à 1,3 g/t Au sur 28,8 m.

2. La zone Stewart-Abate sur la propriété Highway a produit un échantillon en vrac de 52 tonnes avec une teneur de 24 g/t Au.

3. La propriété Hewitt contient une minéralisation aurifère avec des échantillons de collecte allant jusqu’à 15,7 g/t Au.

Le coût de l’acquisition s’élève à 150 000 $ en espèces et 750 000 actions Onyx, avec une redevance NSR de 2,0 % retenue par le vendeur.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) hat ein Portfolio von Grundstücken im Bereich Matheson, östlich von Timmins, Ontario, erworben und die Munro-Croesus-Property um 12% auf 10.411 ha erweitert. Die Akquisition umfasst vier Grundstücke (Highway, Tax, Hewitt und Munro) mit mehreren hochgradigen und bulktonnigen Goldvorkommen. Hauptpunkte:

1. Die Highway-Property hat zwei goldhaltige Strukturen mit historischen Bohrergebnissen von bis zu 1,3 g/t Au über 28,8 m.

2. Die Stewart-Abate-Zone auf der Highway-Property lieferte eine 52-Tonnen-Bulkprobe mit 24 g/t Au.

3. Die Hewitt-Property enthält goldhaltige Mineralisierung mit Grabproben von bis zu 15,7 g/t Au.

Die Akquisekosten betragen 150.000 USD in bar und 750.000 Onyx-Aktien, wobei eine 2,0% NSR-Royalty vom Verkäufer behalten wird.

Positive

- Expansion of Munro-Croesus Property by 12% to 10,411 ha

- Acquisition of properties with multiple high-grade and bulk-tonnage gold occurrences

- Historic drilling results of up to 1.3 g/t Au over 28.8m on the Highway property

- 52-tonne bulk sample grading 24 g/t Au from the Stewart-Abate zone

- Grab samples up to 15.7 g/t Au on the Hewitt property

- Strategic addition to existing project with potential for additional mineral discoveries

Negative

- Cash outlay of $150,000 for the acquisition

- Issuance of 750,000 common shares, potentially diluting existing shareholders

- 2.0% NSR royalty retained by the vendor on the acquired properties

- Potential $1,000,000 bonus payment if a 1,000,000 ounce gold resource is defined within 15 years

Vancouver, British Columbia–(Newsfile Corp. – September 9, 2024) – Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) (“Onyx” or the “Company“) is pleased to announce that it has completed the acquisition of a portfolio of Properties (the “Property“) from an arm’s length party (the “Vendor“) located in the Matheson area, east of Timmins, Ontario.

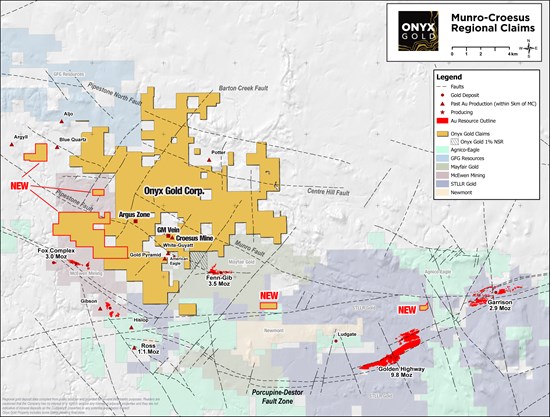

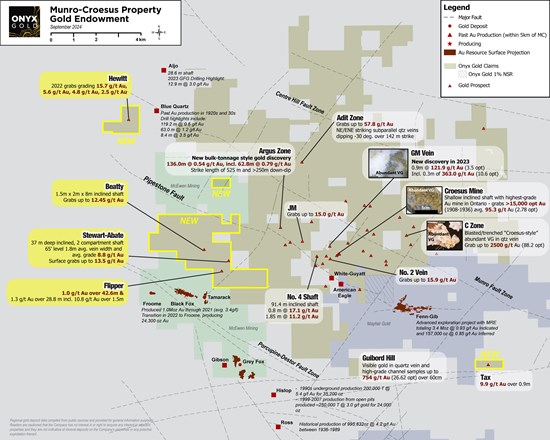

The Matheson portfolio, consisting of four (4) properties (Highway, Tax, Hewitt, and Munro), increases the Munro-Croesus Property (“Munro-Croesus” or the “Project“) to 10,411 ha (104 km2), a 12% increase (Figure 1). This adds substantial exploration potential across this relatively underexplored yet highly prospective section of the Timmins Gold Camp. The Properties are contiguous or proximal with Munro-Croesus and are host to multiple high-grade and bulk-tonnage gold occurrences.

“Acquiring this portfolio of properties is another strategic addition to our Munro-Croesus Project,” said Brock Colterjohn, President & CEO. “It offers excellent potential for additional mineral discoveries adjacent to our emerging Argus Zone and GM discoveries, including key ground on trend to the west along the Pipestone Fault. We believe that there is significant untapped opportunity for both high-grade and bulk-tonnage discoveries on these properties that have seen little to no work in a very long time. In our view, the work completed to date has only scratched the surface of the Properties’ potential, and we look forward to designing and implementing a drill program in the near future.”

Highlights of the Properties:

-

A large (1,150 ha) portfolio of properties (Highway, Tax, Hewitt, and Munro) (Figure 2) contiguous and proximal to Munro-Croesus, McEwen Mining’s Black Fox Mine Complex, Mayfair Gold’s 3.5 Moz Au Fenn-Gib Deposit and STLLR Gold’s >12.0 Moz Au Golden Highway project1.

-

The Highway property includes two known gold-bearing structures: the 50-140m wide and 1,400m long east-west striking Flipper Zone; and the L15 Zone (the NE-SW trending faulted extension of the Flipper Zone). Historic drilling at the Flipper Zone returned 1.0 grams/tonne gold (“g/t Au“) over 42.6m and 1.3 g/t Au over 28.8m, including 10.8 g/t Au over 1.5m, while drilling at the L15 Zone returned 6.0 g/t Au over 1.0m2.

-

At the Stewart-Abate zone on the Highway Property, an old, inclined shaft (37m deep) was sunk during 1915-1941 era and returned a 52 tonne bulk sample grading 24 g/t Au. Historical drilling returned 9.6 g/t Au over 1.2m, along with grab samples of up to 13.5 g/t Au2. Drifting at the 20m level followed the main quartz-carbonate-pyrite-chalcopyrite vein (with rare visible gold and molybdenite) within a sheared diorite body for 67m at an average width of 1.8m and grade of 10.6 g/t Au2. The prospect has not been explored for at least 25 years.

-

The Hewitt property is situated on a northeast-trending secondary fault splay to the Painkiller Fault and contains gold-bearing mineralization with grab samples yielding 15.7 g/t Au, 5.6 g/t Au, 4.8 g/t Au, and 2.5 g/t Au2.

-

Year-round access to the properties is provided via the paved Highway 101 and secondary roads.

Transaction Details

The consideration to be paid by the Company to the Vendor for the Property is $150,000 cash and 750,000 common shares of Onyx. The Vendor will also retain a 2.0% NSR royalty on the Property, which includes a buydown of half of the NSR royalty (1% NSR) for $1,000,000 and a right of first refusal to purchase the residual royalty. In addition, for a period of 15-years from the closing date of the agreement, if a cumulative mineral resource exceeding 1,000,000 ounces of gold in the Measured and Indicated categories is defined on the Property the Company shall make a one-time bonus payment of $1,000,000 to the Vendors.

Figure 1 – Munro-Croesus Property Location With Newly Acquired Properties

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/222772_ad05001064dc4a87_002full.jpg

Figure 2 – Munro-Croesus Property Top Gold Targets (New Targets are Highlighted in Yellow)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9800/222772_ad05001064dc4a87_003full.jpg

About the Munro-Croesus Project

The Munro-Croesus Project is located along Highway 101 in the heart of the Abitibi greenstone belt, Canada’s premier gold mining jurisdiction. This large, 100% owned land package includes the past-producing Croesus Gold Mine, which yielded some of the highest-grade gold ever mined in Ontario. Extensive land consolidation from 2020-2024 has unified the patchwork of patented and unpatented mining claims surrounding the Croesus Gold Mine into one coherent package (Figure 1) and enhanced the exploration potential of the Project.

The Project covers 104 km2 of highly prospective geology within the influence of major gold-bearing structural breaks. Bulk-tonnage gold deposits located in the immediate region include the Fenn-Gib gold project being developed by Mayfair Gold Corp. that contains an Indicated Resource of 3.38 Moz at 0.93 g/t Au and an Inferred Resource of 157 koz at 0.85 g/t Au, and the Tower Gold Project being developed by Moneta Gold Inc. that contains an open pit Indicated Resource of 4.46 Moz at 0.92 g/t Au and an Inferred Resource of 8.29 Moz at 1.09 g/t Au1.

About the Timmins Area Gold Properties

Onyx owns 100% of each of its three Timmins properties. The Munro-Croesus Gold Project is located approximately 75 km east of Timmins, proximal to the Porcupine-Destor and Pipestone Faults, and approximately 2 km northwest and along trend of Mayfair Gold Corp.’s multi-million-ounce Fenn-Gib gold deposit. Mining occurred intermittently at Munro-Croesus between 1915 and 1936. The Golden Mile 140 km2 property is located 9 km northeast of Newmont’s multi-million-ounce Hoyle Pond deposit in Timmins. The Timmins South 187 km2 property is located to the south and southeast of Timmins and surrounds the Shaw dome structure.

About Onyx Gold

Onyx Gold is an exploration company focused on well-established Canadian mining jurisdictions, with assets in Timmins, Ontario, and Yukon Territory. The Company’s extensive portfolio of quality gold projects in the greater Timmins gold camp includes the Munro-Croesus Gold property, renowned for its high-grade mineralization, plus two additional earlier-stage large exploration properties, Golden Mile and Timmins South. Onyx Gold also controls four properties in the Selwyn Basin area of Yukon Territory, which is currently gaining significance due to recent discoveries in the area. Onyx Gold’s experienced board and senior management team are committed to creating shareholder value through the discovery process, careful allocation of capital, and environmentally/socially responsible mineral exploration.

Qualified Person and Quality Assurance

Ian Cunningham-Dunlop, P.Eng., Executive Vice President for Onyx Gold Corp. and a qualified person (“QP“) as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

On Behalf of Onyx Gold Corp.

“Brock Colterjohn“

President & CEO

For further information, please visit the Onyx Gold Corp. website at www.onyxgold.com or contact:

Brock Colterjohn, President & CEO

or

Nicole Hoeller, VP of Corporate Communications

- Fenn-Gib Gold Project and Tower Gold Project mineral resources compiled from public sources and are provided for general information purposes. Readers are cautioned that the Company has no interest in or right to acquire any interest in adjacent properties and they are not indicative of mineral deposits on the Company’s properties or any potential exploration thereof.

- The Company cautions that none of the historical results from the Property, including drill results and underground sampling results from the 1915-1941 era, have been verified. Assay methods and sampling techniques are not disclosed in the historic reports and the QP has been unable to verify any of the historical technical information in this release. Historical results discussed herein are presented more generally as an indication of the potential of the Property to host gold-bearing systems and this information is not necessarily indicative of additional mineralization occurring on the Property.

Forward looking information: This news release includes certain “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively “forward looking statements”).

Forward-looking statements include predictions, projections, and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company’s planned exploration programs and drill programs and potential significance of results including the new high-grade vein structure at the Munro Croesus property described above, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company’s expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital, and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials, and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events, or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate, and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/222772

FAQ

What properties did Onyx Gold Corp. (ONXGF) acquire in Timmins, Ontario?

Onyx Gold Corp. acquired a portfolio of four properties: Highway, Tax, Hewitt, and Munro, located in the Matheson area, east of Timmins, Ontario.

How much did the acquisition expand Onyx Gold’s (ONXGF) Munro-Croesus Property?

The acquisition expanded the Munro-Croesus Property by 12%, increasing it to 10,411 hectares (104 square kilometers).

What were the terms of Onyx Gold’s (ONXGF) property acquisition in Timmins?

Onyx Gold paid $150,000 cash and 750,000 common shares, with the vendor retaining a 2.0% NSR royalty on the acquired properties.

What significant gold grades were reported in the newly acquired properties by Onyx Gold (ONXGF)?

Historic drilling on the Highway property returned up to 1.3 g/t Au over 28.8m, and a bulk sample from the Stewart-Abate zone graded 24 g/t Au. Grab samples from the Hewitt property yielded up to 15.7 g/t Au.