The stock is now up over nearly 70% year to date.

Shares of Palantir Technologies (PLTR 2.49%) were rallying after the company once again reported accelerating revenue growth and increased its full-year guidance.

With the stock now up almost 70% year to date, let’s take a closer look at the company’s second-quarter results and whether it’s too late to buy the stock.

Growth continues to accelerate

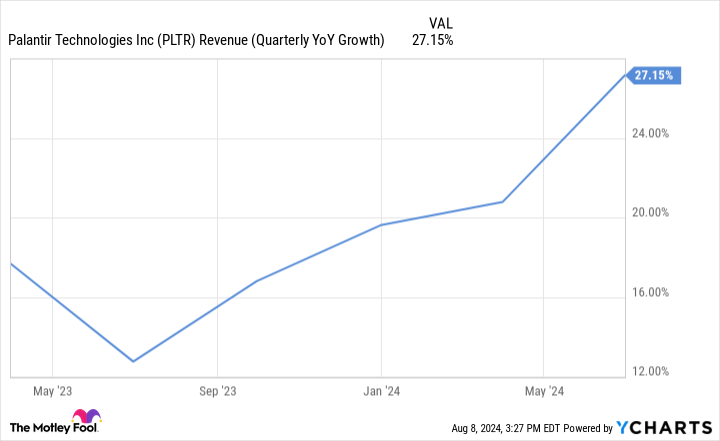

For the fourth-consecutive quarter, Palantir saw its year-over-year revenue growth accelerate to 27%, up from just 13% in the prior-year period.

Data by YCharts.

Breaking the top line down by segment, commercial revenue climbed 33% to $307 million, led by a 55% surge in U.S. commercial revenue to $159 million. Excluding strategic commercial contracts, commercial revenue jumped 40% with U.S. commercial revenue increasing 70%. The company added 33 net new customers in its U.S. commercial business during the quarter.

Palantir’s Artificial Intelligence Platform (AIP) continues to be the primary growth driver in its U.S. commercial business. The company said its “Bootcamps” remain its primary go-to-market strategy, but its biggest opportunity is moving from prototype to production with its customers.

International commercial revenue rose 15% to $148 million but fell 1% sequentially. The company said it continues to see headwinds in Europe, but it was capitalizing on opportunities in Asia and the Middle East.

On the government side of the business, revenue grew 23% to $371 million. U.S. government revenue jumped 24% year over year and 8% sequentially to $278 million. That was a nice improvement from the 12% year-over-year growth it saw last quarter. International government revenue, meanwhile, grew 21% year over year and 18% sequentially to $93 million.

The company said it won several notable contracts in the quarter. This included one from the Department of Defense (DoD) Chief Digital and Artificial Intelligence Office to deploy an AI-enabled operating system across the DoD, as well as another contract to allow third parties and government developers to develop applications and integrations on top of its Maven platform.

Palantir once again increased its full-year revenue guidance. It now expects revenue within a range of $2.742 billion to $2.750 billion. That’s above its prior outlook of $2.677 billion to $2.689 billion. Management’s original full-year guidance had revenue falling between $2.652 billion and $2.668 billion.

The company also raised its full-year adjusted operating-income forecast again, taking it to a range of $966 million to $974 million. That’s significantly higher than the initial outlook of $834 million to $850 million.

For Q3, it expects revenue to come in between $697 million and $701 million, while adjusted income from operations reaches $233 million to $237 million.

Image source: Getty Images.

Is it too late to buy the stock?

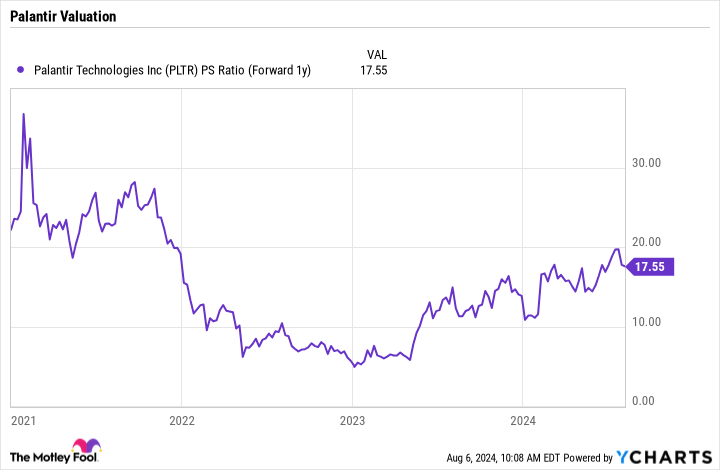

One of the biggest issues surrounding Palantir stock previously was the fact its growth did not match its lofty valuation. However, its streak of top-line acceleration and increased guidance has brought the valuation down.

Data by YCharts.

Trading at a forward price-to-sales (P/S) ratio of about 17.5 as of this writing, the stock is still quite expensive.

AIP continues to hold a lot of promise and clearly is resonating with its U.S. commercial customers. Its Bootcamp strategy is working, and its starting to move customers from prototype to production. At the same time, its U.S. government business has also been seeing some nice improvement as well.

Currently, the company’s guidance implies between 25% and 26% revenue growth next quarter, but if Palantir can beat its Q3 revenue guidance like it did last quarter, growth would land around 30%. The company’s valuation suddenly looks a lot less pricey if it can sustain growth at such levels.

At this point, it’s not too late to buy Palantir stock for long-term investors. That said, I’d still prefer a less expensive valuation. As such, I’d be more inclined to be a buyer on a market pullback.

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.