How a reshored manufacturing base will look? … the math behind onshoring … Luke Lango’s “MAGA 7” stocks … will China blink first? … tariffs begin to bite

As we’re going to press, news is breaking that the United States has reached a trade agreement with an unspecified country.

From Commerce Secretary Howard Lutnick:

I have a deal done, done, done, done, but I need to wait for their prime minister and their parliament to give its approval, which I expect shortly.

Given our publishing deadline, we’ll have to bring you more on this tomorrow, but the market is jumping as I write. All three major indexes are higher, led by the Dow, up 0.80%.

The U.S. worker is fat, lazy, and deeply unfulfilled…

According to China.

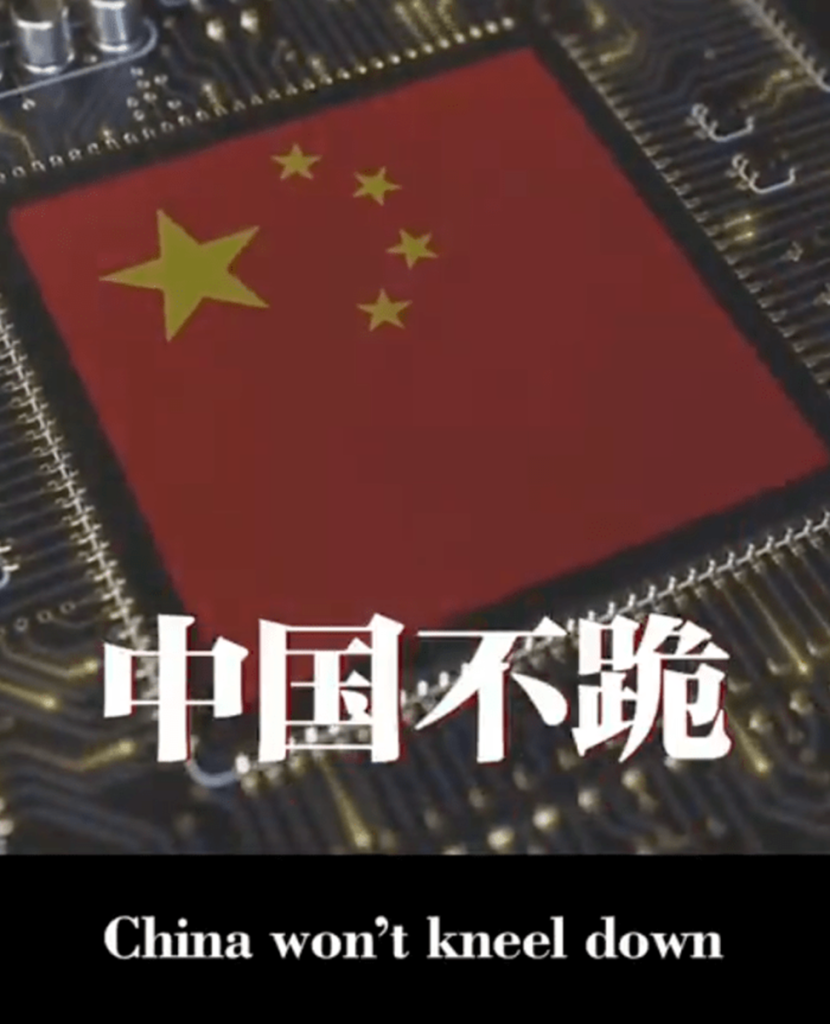

About two weeks ago, Chinese state media released a video mocking the idea of a revitalized U.S. manufacturing base, operated by American workers.

Here’s a screenshot:

The reality is far different.

If the Trump Administration is to reshore millions of manufacturing jobs successfully, the coming labor force will appear nothing like what Beijing suggests.

Let’s go to our technology expert Luke Lango:

Trump’s industrial renaissance only works if robots build it.

The 21st-century American factory will not look like Detroit in the 1950s. It will look like Tesla Inc.’s (TSLA) Gigafactory, multiplied across industries.

There will be fewer humans working inside them, replaced instead by dozens of industrial arms, autonomous material handling, machine vision-based quality-assurance systems, and zero-light warehouses.

The goal may be to replace Chinese or Indian labor with American labor. The reality is that we’ll replace foreign humans with domestic machines.

Regular Digest readers know that I’ve been hammering this same point in recent weeks

In our April 16 Digest, we zeroed in on “the Real Winner of Trump’s Onshoring Push,” which was:

The companies that leverage robotics, and the investors who saw the writing on the wall.

This conclusion is driven by basic corporate finance.

Reshoring requires far greater payroll expense, real estate costs, and electricity/energy expense (among other costs). If cost-averse CEOs don’t reshore and eat such expenses, it appears they’ll face new tariff costs.

Damned if you do, damned if you don’t.

This leaves corporate managers facing a lose/lose tradeoff where Option 1 erodes profit margins, and Option 2 weighs on revenues from cost-conscious consumers.

CEOs will opt for a third option: Replacing human workers with robots.

This makes for a much easier comparison…

Humans: massive salary expense, benefits expense, sick days, vacation days, human error on the job…

Robots: one time CapEx expense, marginal yearly maintenance expense, perfect job execution with no need for rest/breaks/benefits/and so on…

Bottom line: Onshoring will accelerate the transition to robotics/humanoids.

Luke again:

That is why our team sees physical AI — robots, automation systems, machine vision — as the next leg of the AI Revolution.

Until now, most of the AI hype has revolved around language models, chatbots, and digital copilots. Those software breakthroughs have been transformative for knowledge work.

But the next frontier is the physical world:

- Factory robots that can see, learn, and adapt.

- Warehouse pick-and-pack bots powered by machine vision models.

- Autonomous forklifts and mobile platforms.

- AI-driven robotic arms that can manufacture, weld, and inspect.

In the Digest last week, I recommended the largest AI/robotics ETFs as the most conservative way to play robotics. But I added that I would “be bringing you some of the top ideas from our experts.”

Well, here’s our first batch of those top ideas.

This Thursday at 7 PM Eastern, Luke will unveil his “MAGA 7” stocks

MAGA is not a reference to President Trump’s “Make America Great Again” slogan; it’s Luke’s twist on the concept…

Make AI Great in America

On Thursday, Luke will discuss a small basket of AI/robotics leaders and why he believes they’re about to be on the receiving end of a wave of “panic” buying.

In short, it has to do with an event Luke sees occurring on May 7 that will spur a frantic dash into physical AI stocks.

Back to Luke:

If I’m right, May 7 could mark the start of a melt-up — one in which physical-AI winners become the new titans of American industry.

That is the sort of opportunity often described as “generational wealth.” It is not about adding a few percentage points to a portfolio. It is about potentially changing a family’s balance sheet for decades.

This is not merely a policy trend. It is an investment megatrend.

- The economic math points to automation.

- Political momentum points to domestic buildout.

- The AI infrastructure build points to a physical AI supercycle.

To join Luke this Thursday for more on these MAGA 7 stocks, the following link will automatically register you to attend. Click here to instantly sign up.

More on this tomorrow.

“It is a full-blown crisis already”

So says Peter Friedmann, executive director of the Agriculture Transportation Coalition (AgTC), a leading export trade group for farmers.

Friedmann is referencing the U.S. farming industry, which is dealing with the fallout of the trade war. China’s sudden cancellation of huge volumes of agricultural products is resulting in what the AgTC calls “massive” financial losses.

Here’s CNBC:

Data released by the U.S. Department of Agriculture on Thursday revealed China made its biggest cancellation of pork orders since 2020, halting a shipment of 12,000 tons of pork…

A wood pulp and paperboard exporter reported to the trade group the immediate cancellation or hold of 6,400 metric tons in a warehouse and a hold of 15 railcars sitting in what is known in the supply chain as “demurrage,” when fees are charged for delayed movement of goods.

Meanwhile, the exporter said there are 9,000 metric tons on the water to China expected to arrive on May 13 and facing the threat of costly diversion to Chinese bonded warehouses or to other countries as Chinese buyers may refuse the cargo and abandon it at port.

One grass seed exporter told AgTC it received two weeks notice that eight loads were being canceled by Chinese customers despite vessels bookings already being in place.

The shipping traffic from China to U.S. shows a dramatic slowdown.

According to Vizion Global Ocean Bookings Tracker, China-to-U.S. vessel traffic has fallen 22.2% over the last two weeks. On a year-over-year basis, it’s off 44%.

Here’s a Vizion spokesperson:

What we’ve seen in the last two weeks is a continued correction in booking demand for U.S. imports, especially U.S. imports from China.

We are now seeing this translate to a drop in departures as well.

This morning, news broke that the Port of Los Angeles predicts shipments from China will fall 35% next week as tariffs begin to bite.

From Gene Seroka, the executive director of the Port of Los Angeles:

Realistically speaking, until some accord or framework can be reached with China, the volume coming out of there — save a couple of different commodities — will be very light at best.

This trade-war escalation has investors asking a key question…

Who will blink first between the U.S. and China?

According to Treasury Secretary Scott Bessent, it must be China:

I believe that it’s up to China to de-escalate, because they sell five times more to us than we sell to them, and so these 120%, 145% tariffs are unsustainable.

This is likely to be challenging.

Chinese culture places a major emphasis on “saving face.”

History buffs will recall the “Century of Humiliation” (1839–1949), during which Western powers imposed treaties on China that they found humiliating. The modern-day impact is that Beijing remains especially sensitive to any deals that appear one-sided. Appearances are critical.

We saw shades of this in the 2019 trade war. From President Xi Jinping at that time:

In the West, you have the notion that if somebody hits you on the cheek, you turn the other cheek.

In our culture, we push back.

This morning brought another example when The Wall Street Journal reported that the Chinese Ministry of Foreign Affairs posted a video to social media saying, “China won’t kneel down.”

So, what might China do instead of blinking? Here are a few ideas off the top of my head:

- Eliminate all exports of critical rare earth minerals, which are essential for various technologies

- Increase imports from countries like Brazil and Argentina to replace U.S. products

- Completely suspend imports from certain U.S. companies to apply financial pressure in an effort to get them to lobby President Trump for change

- Increase spending, issue new bonds, and provide consumer subsidies to stimulate domestic demand to offset the economic pain

- Use the People’s Bank of China to cut interest rate cuts and reduce bank reserve requirements to support growth

“Jeff, China can’t handle losing the U.S. as a trading partner. We’re too big. Our loss would cripple them. They’ll blink”

You’re right. We could inflict enormous economic damage on China.

However, China’s political climate isn’t like ours…

Unlike the United States, where public opinion quickly influences elections, China’s authoritarian system allows its leadership to impose economic austerity without immediate political cost.

The Chinese Communist Party faces no free elections. State-controlled media can frame economic sacrifices as patriotic struggles.

Translation – Beijing can implement wildly unpopular economic policies, saving political face at the expense of its people.

Not so much in Washington…

U.S. administrations must quickly respond to voter dissatisfaction, limiting their ability to sustain painful trade policies over time.

Take this morning’s news that Amazon was reportedly planning to display the cost hike associated with President Trump’s trade war.

Knowing what this could do in the court of public opinion, White House press secretary Karoline Leavitt told reporters, “This is a hostile and political act by Amazon.”

Just a few hours later, Amazon backed away from the idea, with a spokesperson saying, that the plan “was never approved and not going to happen.”

We also see this sensitivity to voters and appearances in the investment markets.

Though President Trump insisted that the aggressive bond selloff from earlier this month did not prompt his “pause” on reciprocal tariffs, that feels highly unlikely.

It’s more realistic that Trump was well aware of escalating market turmoil – particularly in the bond market – and his advisors warned that a lack of action would implode the market, and the surging 10-year Treasury yield (at that time) would kneecap the economy.

So, we hope Bessent is right about China blinking first. But as we just saw, they don’t like to “kneel down.”

Seeing the big picture

If the trade war escalates and drags on, it will drive prices higher.

While that will cause economic pain for U.S. companies and consumers, it will also spark what adversity often does: innovation.

One likely outcome will be the accelerated adoption of AI and robotics as businesses look for ways to cut input costs and blunt the impact of rising trade-related expenses.

And that brings us full circle to Luke and his event this Thursday: the 2025 Summer Panic Summit at 7 PM Eastern. Here’s that one-click, instant/automatic sign-up link again.

Here’s Luke with the final word:

President Trump wants to bring manufacturing back to America, but only robots can make the math work.

That is why this coming Thursday, May 1, at 7 p.m. Eastern, I’m hosting an urgent strategy online session. During the event I’ll show you how we can not only protect our portfolios this summer… but also see triple-digit gains in the coming years.

I’ll detail seven new opportunities – the “MAGA 7” – at the center of this historic Summer Panic.

Hope to see you there.

Have a good evening,

Jeff Remsburg