- Important earnings season ahead as investors look for positive signs that the US economy can continue to be resilient in 2025

- Q4 S&P 500® EPS growth expected to come in at 11.7%, the highest growth rate in three years

- Banks on deck this week: JPM, WFC, C and GS out on Wednesday

- Peak weeks for Q4 season run from February 3 – 28

With a full week of 2025 trading under our belts investors will have something more to chew on when big banks begin reporting for Q4 2024 later this week. Unlike prior years, the Q4 season begins on an unusual day this year. Wednesday, January 15 will mark the unofficial start of the reporting season when JPMorgan, Citigroup and Wells Fargo release results. Close earnings watchers might be aware this is not the usual Friday kick-off we see each season. In fact, according to our data at Wall Street Horizon, it’s the first time since Q2 2022 that JPM isn’t reporting on the second Friday of the quarter, and the first Q4 report since 2020 that the banks collectively aren’t reporting on a Friday.

New Year, New Sector Leaders?

According to FactSet, S&P 500 EPS growth is expected to come in at 11.7% for Q4, the highest in three years. Revenue is expected to grow approximately 4.7% year-over-year.1

Some of the same winning sectors from Q1-Q3 2024 will continue to lead, including Technology, Communication Services, with the addition of Financials, while Energy, Industrials and Materials trail behind. While sell-side analysts expect Tech to drive EPS growth once again in 2025, following closely behind are some sectors that were beaten down in 2024, including Health Care, Industrials and Materials.2

And while the “Magnificent 7” are still anticipated to report impressive earnings growth of 20+% again in 2025, expectations for the other 493 companies in the S&P 500 index are markedly better at 13% compared to the final growth rate of 4% in CY 2024. These expectations have encouraged broader participation in equity trading outside of just the tech sector.3

Up This Week: Big Banks

In its usual fashion, Q4 earnings season will begin with the big banks. JPMorgan Chase, Citigroup, Wells Fargo and Goldman Sachs are set to report on Wednesday, followed by Bank of America and Morgan Stanley on Thursday.

The Financials sector went into the Q3 season with very muted expectations for -0.4% EPS growth YoY, eventually rising to 7.3% once all the companies had reported. Going into Q4, the Financials sector is anticipated to be the leader of profit growth. Wall Street analysts estimate that the sector will see EPS grow 39.5% for the quarter, and revenue growth of 5.7%.4

Source: Wall Street Horizon

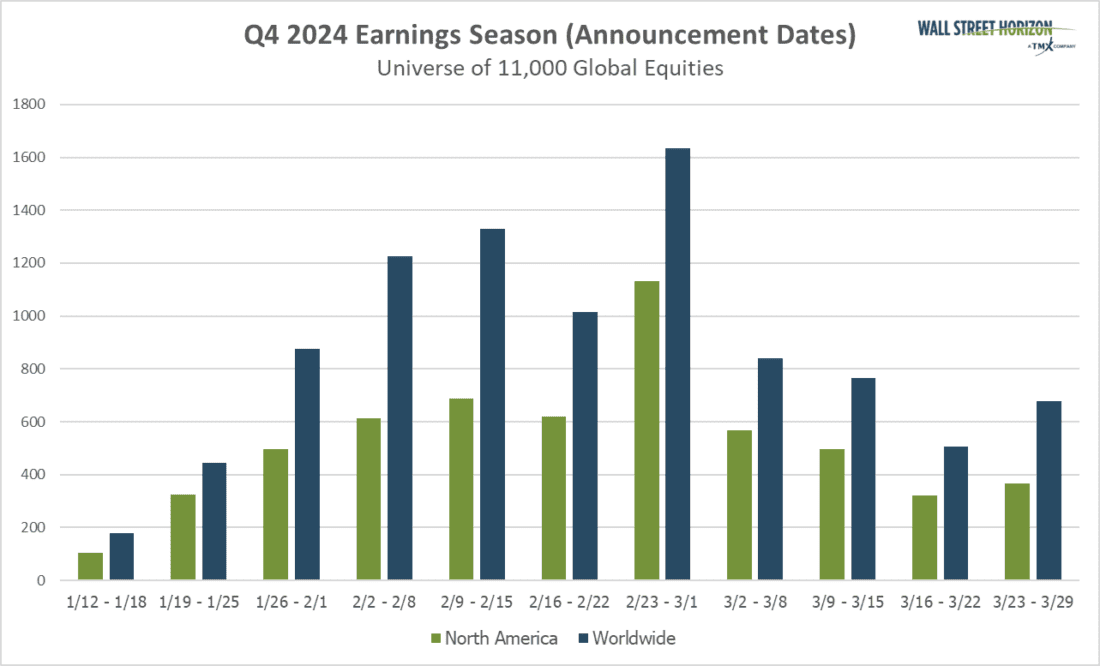

Q4 Earnings Wave

With the Q4 season getting started a little later this year, the peak weeks are expected to fall between February 3 – 28, with each week expected to see over 1,200 reports. Currently, February 27 is predicted to be the most active day with 874 companies anticipated to report. Thus far, only 37% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

1 Earnings Insight, FactSet, John Butters, January 11, 2025, https://advantage.factset.com

2 Earnings Insight, FactSet, John Butters, January 11, 2025, https://advantage.factset.com

3 Earnings Insight, FactSet, John Butters, January 11, 2025, https://advantage.factset.com

4 Earnings Insight, FactSet, John Butters, January 11, 2025, https://advantage.factset.com

—

Originally Posted January 13, 2025 – Q4 2024 Earnings Preview: Banks Kick Off the Season on Wednesday

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.