Quantum computing has been on the horizon for what feels like decades. But with the explosion of artificial intelligence (AI) over the past year or so, the quantum computing future could be upon us. In 2025, there are several stocks that could benefit. Some are big tech businesses; others are specialty start-ups focused on a particular niche.

But if you want to maximize your portfolio’s growth potential with quantum computing stocks, there’s one company that tops the list.

This is why quantum computing will change the game

If you’re not familiar with quantum computing, AI certainly has changed the game already, even though the AI revolution has really only just begun. But when quantum computing goes mainstream, it will be like nothing we’ve ever seen before.

As its name suggests, it uses the principles of quantum mechanics to manipulate atoms and electrons. Traditional computers process data with bits — long strings of zeros and ones. Quantum computers, meanwhile, use something called qubits, which can be either a one or a zero simultaneously.

The takeaway is that while the science behind the technology has been difficult to scale up, quantum computers can process data significantly faster than conventional computers. How much faster? In 2019, Alphabet‘s Sycamore quantum processor solved a complex task in 200 seconds. At the time, the world’s fastest supercomputer would have needed 10,000 years to perform the same task.

How close are we to scaling up this technology across every sector and geography, similar to what many AI technologies achieved in 2024? Estimates vary, but many experts believe 2025 could be a breakthrough year.

This doesn’t mean you’ll be using a quantum computer at home anytime soon. However, in 2025 and the years that follow, we should start to see more commercial and industrial applications, especially in areas that require high-speed data analysis or pattern detection in large datasets.

As we’ve seen with the adoption of AI, a single breakthrough can unleash a wave of adoption and innovation that can be hard to stop. Everything from drug discovery to airline route planning will be affected, and in theory be significantly more efficient.

One stock I’m keeping my eye on

If you want to bet big on quantum computing, look no further than D-Wave Quantum (QBTS -8.37%). There is arguably no other company that has its future so directly tied to the success of quantum computing technologies. And with a market cap of just $1.8 billion, your upside potential will be significantly higher than by investing in tech giants like Nvidia and Alphabet.

In 2017, D-Wave became the first company to commercially sell quantum computers. While this is impressive, much of the innovation in the space has been completed by tech giants, often with an eye on internal consumption versus commercial sales.

Still, D-Wave’s technology is impressive. The company specializes in quantum annealing, as opposed to gate-based quantum computing. While this approach has its drawbacks, the simple explanation is that quantum annealing allows for more immediate real-world applications such as finding the best possible solution out of millions of potential options. Optimizing the route patterns for a global airline is just one example.

Despite its small size, D-Wave is no scrappy start-up. It has partnerships with Alphabet and NASA, and it has sold its products to many other Fortune 500 companies and government agencies.

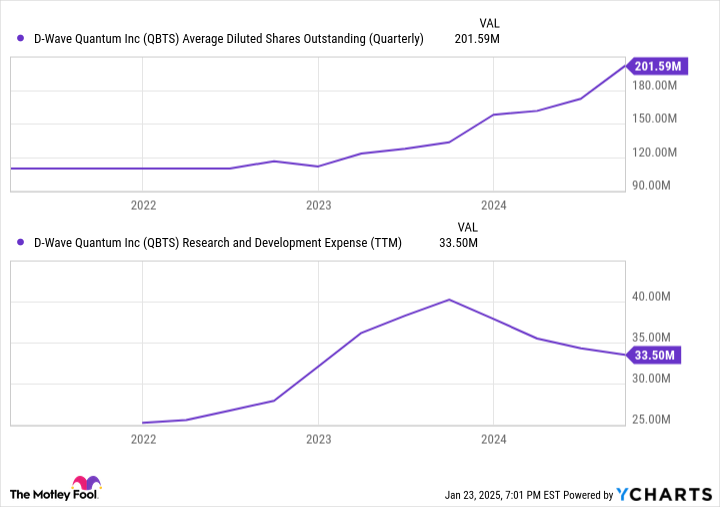

Still, there’s no doubt that D-Wave is outmatched when it comes to potential spending on research and development (R&D). From 2022 through 2024, its R&D budget only increased from around $25 million to $34 million, while its outstanding share count nearly doubled.

QBTS average diluted shares outstanding (quarterly), data by YCharts; TTM = trailing 12 months.

The quantum computing sector could eventually add trillions of dollars to the global economy. And D-Wave has an early lead when it comes to selling into commercial markets. Its products are arguably the most commercially viable options today for businesses looking to incorporate quantum computing into their tech stack. In comparison to gate-based systems, D-Wave’s platform requires less specialized tech expertise, supporting multiple programming languages. These advantages have given the company an early edge when it comes to building out its customer case and vetting its platform across many industries. Its systems have already helped companies like Volkswagen optimize urban traffic flow, grocery store chains including Save-On-Foods optimize their supply chains, and several pharmaceutical businesses accelerate drug discovery.

I wouldn’t put all my chips on D-Wave given its relative lack of funding versus its Big Tech competitors, but the company clearly has traction with a commercialization strategy ahead of the competition. If quantum computing becomes the biggest AI trend of 2025, D-Wave stock will likely benefit.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.