Earlier today, in the ECB’s post-meeting press conference President Lagarde stated that “we did not discuss cuts”, yet the Stoxx Europe 600 Index (DJ600) crossed the 500 level for the first time today. Meanwhile, in Senate testimony, Federal Reserve Chair Powell said nothing to indicate that a rate cut cycle was about to begin. Considering the rallies in a wide range of global markets, might the mere prospect of potential cuts be sufficient? For that matter, do equities really need cuts to continue to rally?

As we began the year, one of the reasons for optimism was that global central banks would begin an aggressive rate cutting cycle. In mid-December, the Federal Reserve signaled that they expected three rate cuts during the course of the coming year, and traders responded by pricing in as many as six or seven 25-basis point cuts. Something similar occurred in Europe, where traders began the year with nearly identical expectations. As we noted recently, global equities have rallied even as rate cut expectations have ebbed substantially – three to four cuts are now expected in both Europe and the US.

To be fair, both central bankers’ comments have left open the prospect of cuts sometime later this year. A wide range of post-ECB commentators heard President Lagarde’s comments and decided that a June cut would be forthcoming. That’s nothing new, however. Markets are pricing in a 93% probability for a June cut, which is nearly identical to yesterday’s assumption. Although the FOMC doesn’t meet until two weeks from yesterday, the probability for a June cut is quite similar at 95%.

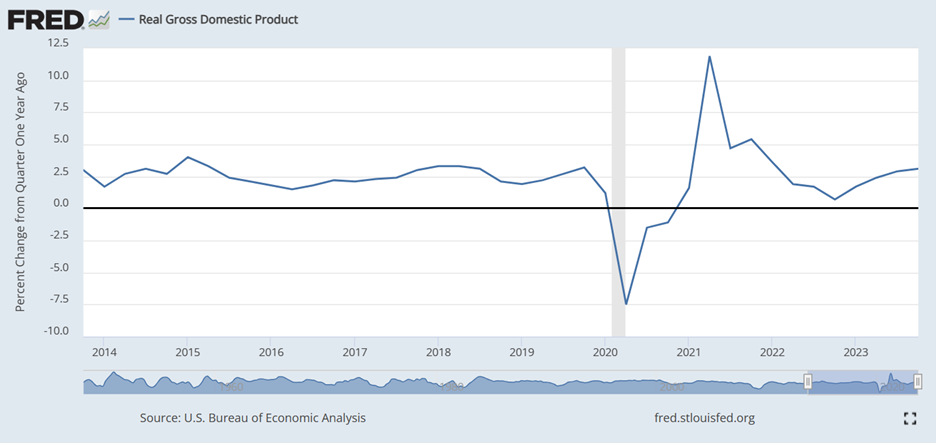

Yet if I was a central banker, I’d be wondering why a rate cut is even necessary, particularly in the US. The economy seems to be doing just fine, with GDP around the 3% levels to which we had become accustomed.

Source: St. Louis Fed

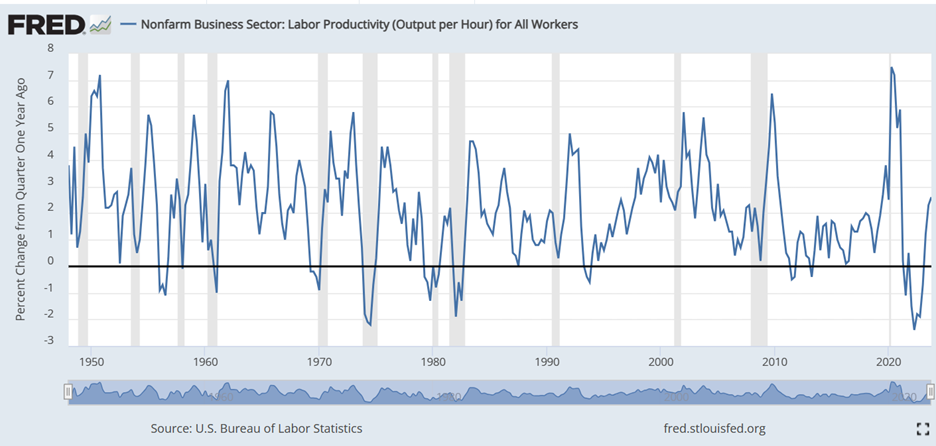

This morning, we received welcome news about Nonfarm Productivity, which matched last quarter’s 3.2% and exceeded the 3.1% consensus estimate, while Unit Labor Costs rose by only 0.4%, less than last month’s 0.5% and below the 0.7% consensus. Pre-market futures, which were already rallying because, well, that’s what they do seemingly every morning, got a boost from the welcome data.

Source: St. Louis Fed

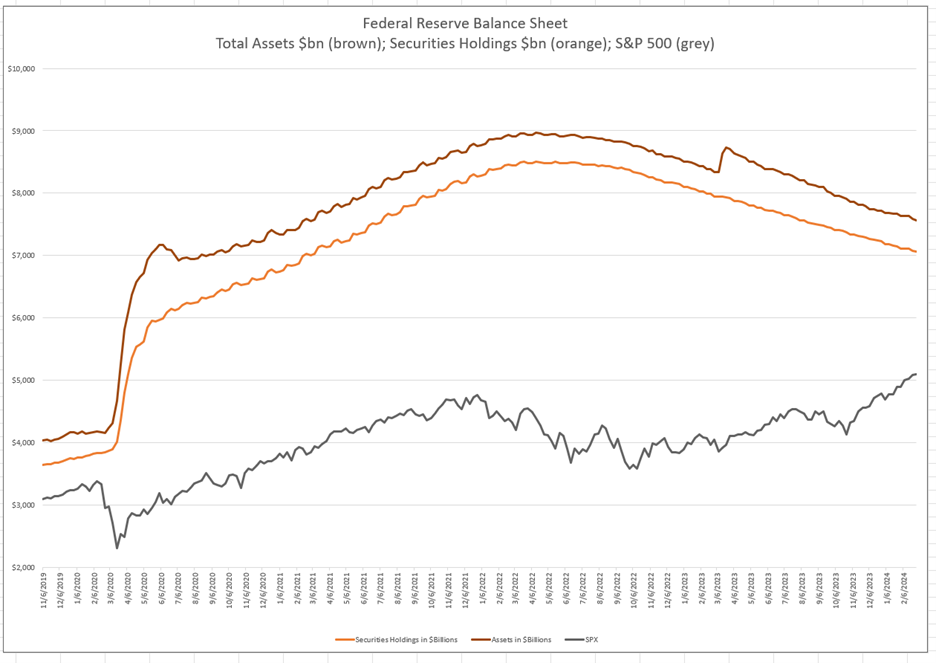

At the same time, the Fed continues to engage in quantitative tightening, reducing the size of its securities holdings, and thus its balance sheet. While that might have had some effect in 2022, equities have paid no mind to the asset shrinkage at the Fed:

Source: Federal Reserve H.4.1 reports, Interactive Brokers

As noted above, if I were a central banker looking at a solid economy, high productivity, and relatively full employment, alongside global stock markets and a wide range of speculative assets like bitcoin at or near all-time highs, why exactly do we need to cut rates? The point of rate cuts is to stimulate an economy, but it’s doing fine with rates where they are. And markets are telling us that they’re doing more than fine with the current status quo, even as expectations for future cuts have shrunk. Is it possible that the Fed an ECB are now simply dangling the prospect of rate cuts in front of eager traders like a carrot in front of a donkey? Heck, that’s what I would do if I ran a central bank right now.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.