Navigating short interest in the corporate bond market can be filled with risk. The lack of transparency and public reporting forces investors to use limited tools while today’s macroeconomic volatility provides prime conditions for short selling. EquiLend Orbisa arms investors with real-time market signals in security-level liquidity, financing cost and approximate short interest to proactively navigate the global credit markets. With access to securities financing data, credit investors can anticipate positive and negative price momentum to better manage their portfolio.

Limitations in Reporting Short Interest

Unlike equities, where heavily delayed short interest reporting is publicly available across most regulatory bodies, fixed income markets lack the same level of transparency. Standard market data includes prices, yields, and liquidity metrics, helping traders assess bond valuation and trading opportunities. Macroeconomic data, such as interest rates, central bank policies, and more recently tariffs, influence borrowing costs and investor sentiment. Credit data, including credit ratings, provides insight into the financial health of issuers. While these data sources are essential for any investor, they do not provide any color into short sentiment.

Securities Finance Data Fills a Gap

Securities finance data plays a crucial role in addressing these limitations, offering actionable insights that enable both long investors and short sellers to make informed decisions. Like the equity market, when a short seller wants to short a fixed income instrument, they must borrow the bond. This is typically done in the securities finance and repo markets and for that reason, securities finance market data serves as a proxy for short interest in bond markets. When a bond is heavily shorted this is reflected in securities finance through increasing borrow quantities, borrow costs and overall market demand.

EquiLend Orbisa leverages exclusive intraday access to the securities finance industry’s richest global dataset from transaction activity across EquiLend’s broad securities financing ecosystem.

Below, we have outlined three examples of where EquiLend Orbisa’s financing data would have helped bond investors make decisions around the trading strategies and portfolio construction.

Short Entry and Exit Signals: Concentrix Corporation

In July 2023, Concentrix Corporate (CNXC US) issued $2.15 billion in senior notes to finance the acquisition of fellow customer experience provider, Webhelp. While the six months following issuance were relatively quiet, Concentrix’s AI-dependent future for its out-sourced call centers gained skepticism among analysts. More recently, Moody’s Investors Services downgraded Concentrix outlook from stable to negative in February 2025 (https://cbonds.com/news/3273063/).

While the common share in the equity market indicates a highly liquid and low cost to borrow security, Concentrix’s bonds tell a different story. Concentrix 6.6% Aug 2, 2028 (US20602DAB73) had limited availability within the securities finance market since late November of 2024 when the borrow demand, percentage of inventory being borrowed, reached 90% and the short interest indicator breached 30%, (percentage of issuance size being borrowed).

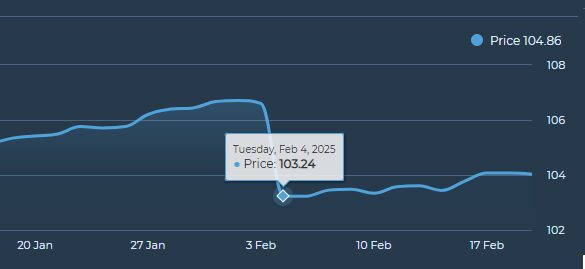

EquiLend Orbisa illustrated that this high borrow demand indicated a strong negative sentiment among investors well before Moody’s revised Concentrix outlook and was an early sign of what eventually happened. On February 4, the short positions profited as the bond’s price fell from $106.60 to $103.24 in a single day. Long investors who did not have access to Orbisa likely saw a hit to their profits as they likely did not close their position due to lack of information.

Shortly after, EquiLend Orbisa observed a significant downturn in the total inventory quantity, or bonds available in the securities finance market, suggesting long holders in the securities finance pool sold out of their positions. The reduced inventory also contributed to financing rates, or the cost to borrow the security, increasing from 200 basis points to just under 900 basis points today. As borrowing costs jumped, the cost to maintain the short position increased.

By using EquiLend Orbisa, long holders would have quickly identified an increased risk from mounting short interest while short sellers would have clear confirmation into their short positions and real time signals into increasing borrow costs.

Overvalued Bonds: Avis Budget Group

Since the beginning of the year, Avis Budget Group (CAR US), among others, fell victim to the sweeping tariffs affecting the automotive industry. While Q4 2024 results included the resignation of a 45-year tenure CEO and a net loss of $2 billion, Avis’s 2025 guidance provided optimism for the year ahead. Since the earnings report on February 11, the tariff impact on automobile fleet prices settled in as the common shares borrowed increased from 2.36 million to 4.96 million on March 19, with the price per share falling by 35%. While short interest for the common share is steadily increasing, shorts in the bond market are accelerating at a higher pace.

Following a mid-March downgrade from BB- to B+, Avis Budget Car Rental 8.25% SNR Jan 15, 2030 (US053773BJ51) approached full inventory saturation in the securities finance market with the short interest indicator doubling from 12% to 23% in two trading days. While the price for the common share fell 35% over the past month, the bond experienced a minor 4% decrease over the same timeframe. However, the drastic and sustained increase in short activity for the bond suggests that further downside exists as deteriorating credit conditions target the auto rental company.

The signals within EquiLend Orbisa identify when shorts are entering and exiting the market in real time. By quickly comparing equity short interest with its credit counterparts, EquiLend Orbisa simplifies research across multiple asset classes.

Market Awareness of Financing Costs and Short Squeezes: Medical Properties Trust

Healthcare REIT, Medical Properties Trust Inc (MPW US) and its bond issuing subsidiary, MPT Operating Partnership, have been under immense pressure since January 2024 as liquidity issues for one of its tenants sparked a chain of events that include lowered dividends, congressional scrutiny, and major increases in short interest for the common shares.

While borrow demand for MPT OPER PARTNERSHIP 5% SNR October 15, 2027 (US55342UAH77) has been over 50% well before 2024, it wasn’t until mid-2024 when the Corporate Crimes Against Health Care act was introduced that the short interest indicator and financing costs began to accelerate. More than 30% of the total issuance was borrowed (Short Interest Indicator) within the securities finance market with financing rates reaching 500 bps. Since October, the liquidity, or total inventory quantity, in the securities finance market decreased by over 20%, driving the cost to short even higher.

However, after a positive earnings announcement in February the bond price is up 11% year to date. The limited liquidity in the securities lending market and high cost to borrow couple with positive price momentum are all early indicators of a short squeeze. By accessing EquiLend Orbisa investors can see these trends before it’s too late and decide whether to close out of a short position before being caught in a possible squeeze.

With the lack of short interest information on corporate bonds, the highly correlated securities finance data found within EquiLend Orbisa provides a level of transparency on availability, borrowing costs, market sentiment, and credit risk trends. By leveraging EquiLend Orbisa, investors can make more informed decisions, manage risks effectively, and optimize trade execution using the most up to date information available. As the corporate bond landscape continues to grow, the role of securities finance data in enhancing market efficiency and transparency will only become more significant.

EquiLend Orbisa Signals for Corporate Bond Investors:

- Borrow Quantity – the total amount currently borrowed for a given asset. This figure is closely tied to Short Interest

- Borrow Demand – a measure of the total borrowed amount over the lendable supply. This ratio is a key figure when determining how difficult a bond may be to locate when putting on a short

- Financing Rate – this figure provides users with what they should expect to pay in borrowing costs

- Short Interest Indicator – a ratio of the total bonds borrowed over the issuance size of the bond

- Total Inventory Quantity – the amount of bonds available within the securities finance market. This figure is a subset of the issuance size and provides a clearer picture of availability

- Real Time Financing Rate – an intraday view into today’s securities finance borrowing costs

- Real Time Net Borrow Positions – an intraday view into borrow quantity changes as they happen in the securities finance market

- Net Available Quantity – quantity of the total inventory that is not currently borrowed. Calculated a total inventory quantity minus the borrow quantity

Bloomberg Terminal users can subscribe to EquiLend’s exclusive Orbisa securities lending data by entering terminal shortcut APPS ORBISA <GO> or clicking the following link: https://on.equilend.com/bloomberg-terminal-page

—

Originally Posted April 4, 2025 – Real-Time Short Interest Data for the Credit Market

Disclosure: Orbisa

ORBISA (the “Firm”) is not registered as an investment advisor or otherwise in any capacity with any securities regulatory authority. The information contained, referenced or linked to herein is proprietary and exclusive to the Firm, does not constitute investment or trading advice, is provided for general information and discussion purposes only and may not be copied or redistributed without the Firm’s prior written consent. The Firm assumes no responsibility or liability for the unauthorized use of any information contained, referenced or linked to herein. © 2023 EquiLend Holdings LLC. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Orbisa and is being posted with its permission. The views expressed in this material are solely those of the author and/or Orbisa and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.