Stocks are recovering from yesterday’s ugly intraday reversal as recession fears take a back seat following this morning’s release of decently anchored unemployment claims. Yesterday’s sharp green to red move was triggered by an awful $42 billion 10-year Treasury note auction which supported higher rates. Furthermore, yields are sustaining upward momentum due to today’s news of a tighter-than-expected labor market. Additionally, Uncle Sam’s steep cash requirements were certainly not satisfied with yesterday’s issuance. Indeed, we have yet another offering this afternoon at 1:00 pm ET, this time for $25 billion of 30-year bonds.

Labor Market Is Stronger Than Feared

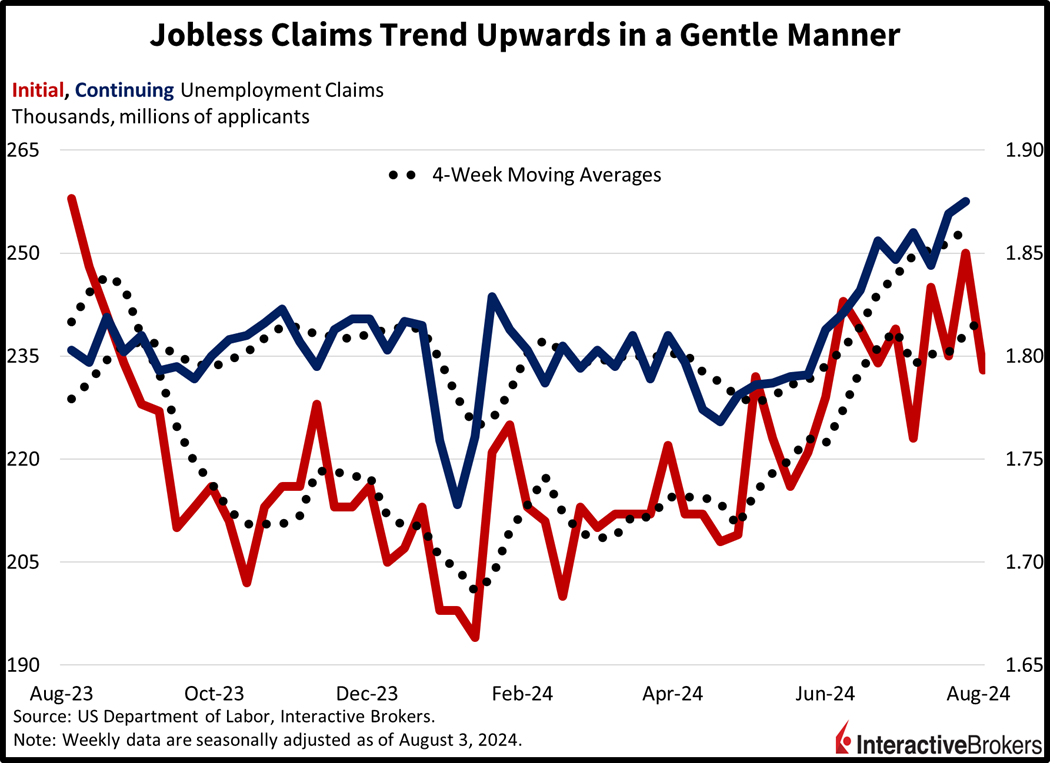

Labor conditions during the past two weeks didn’t deteriorate as badly as anticipated, according to this morning’s Unemployment Claims report. Initial filings for benefits slipped to 233,000 for the week ended August 3, lighter than estimates for 240,000 and the previous period’s 250,000. Continuing claims climbed, but only slightly, rising to 1.875 million from 1.869 million and worse than projections of 1.870 million. Four-week trends did gain momentum on both fronts though, increasing from 238,250 and 1.855 million to 240,750 and 1.862 million. The news has sparked some traders to rush to IBKR Forecast Trader to open yes positions in anticipation of initial claims arriving north of 246,000 seven days from today. Clearly, they believe that the momentum of the labor market is to the downside.

TV Advertising Weakens While Rental Market Surges

The strong trend of marketing moving to digital media continues to ding traditional content providers while record-low home affordability has resulted in revenues increasing dramatically for Zillow Group’s multifamily listing segment. Meanwhile, blockbuster drugs boosted the results of Eli Lilly and products powered by artificial intelligence (AI) helped produce a strong quarter for Datadog.

Consider the following second-quarter results:

- Warner Bros. Discovery (WBD) reported a 6% decline in revenue and a larger loss per share on a year-over-year (y/y) basis. Both metrics missed analyst consensus expectations. As advertisers shift marketing to digital media, the value of the company’s television networks, such as TBS, TNT, Discovery and TLC, have declined, resulting in the company taking a $9.1 billion write-down on the assets. Warner Bros.’ second-quarter network revenue sunk 8% but its streaming Max business continued to grow and moved closer to profitability with advertising revenue climbing considerably. Sales of content to third-party platforms, however, weakened. Shares of WBD declined more than 9% in after-hours trading last night.

- Zillow Group’s (Z) revenue exceeded the analyst consensus expectation and jumped 13% from the year-ago period while its loss per share was smaller than anticipated. The second-quarter results benefited from revenue from residential rental listings jumping 29% y/y. Within that category, revenue from multifamily rentals climbed 44%. Going forward, the company will have its touring scheduling platform, ShowingTime, reinstated by certain multi-listing services following a legal settlement resulting from the company’s litigation alleging antitrust practices. The company’s mortgage revenue also jumped 42%.

- Eli Lilly’s (LLY) strong sales of weight-loss medication Zepbound and diabetes treatment Mounjaro resulted in the company’s earnings per share and revenue substantially surpassing analyst expectations and climbing 68% and 36%, respectively. A handful of other products also supported total sales. The strong quarterly results prompted the company to raise its guidance, sparking a more than 11% rally in its stock price. In addition to strong demand for the medications, Eli Lilly increased production, and it also cracked down on competitors selling counterfeit versions of the drugs by filing numerous lawsuits. The company also increased its realized prices 15% and revenue 42% in the US. Revenue outside the US also grew substantially, despite a headwind of unfavorable currency exchange rates.

- Datadog (DDOG), a cybersecurity firm that provides a platform for cloud monitoring, reported revenue and earnings that jumped 27% and 48%, respectively, y/y, a result of strong demand for its AI-powered cybersecurity services and new offerings. Both metrics exceeded analysts’ expectations. Datadog also upgraded its adjusted-profit guidance for both the current quarter and full-year. Its stock climbed more than 3% following the earnings release.

Investors Shrug Off Soaring Fear Index

Equities are soaring even as the captain of the aircraft (VIX), told passengers in recent days to buckle up due to inclement weather for the foreseeable future. Keep in mind that yesterday’s early 2% gain became a sharp 1% loss in just a few hours. After-market moves were also turbulent, with several panicking customers calling me to ask if their 515, 516, 517 and 518 short puts would get assigned despite the SPDR S&P 500 ETF finishing at 518.66. That’s what happens when volatility is elevated—wild moves become increasingly common and assignment/expiration risks are uplifted.

All major US stock benchmarks are in the green with the Nasdaq Composite, S&P 500, Russell 2000 and Dow Jones Industrial indices gaining 2.3%, 1.8%, 1.6% and 1.4%. Sectoral breadth is perfect with all segments higher by a good amount. Piloting the bulls are the technology, industrials and consumer discretionary components, which are travelling north by 2.7%, 2% and 1.9%. Treasurys are getting pounded though as the recession bid dries up. The 2- and 10-year maturities are changing hands at 4.05% and 3.99%, 8 and 5 basis points (bps) loftier on the session. The dollar is getting its cue from rates and an incrementally tighter Fed outlook; it’s appreciating relative to the euro, franc and yen but depreciating versus the pound sterling, yuan and Aussie and Canadian dollars. Commodity land is quite buoyant except for lumber, as the real estate outlook depends more on mortgage costs rather than economic performance. Lumber is down 1.5% but silver, gold, copper and crude oil are higher by 3.1%, 1.4%, 1.1% and 0.9%. WTI crude is trading at $76.41 on supply concerns stemming from geopolitical tensions featuring a potential strike at Jerusalem by Tehran.

More Downside Ahead

August and September are typically challenging for stock investors from a seasonal perspective. But an important consideration is that September is typically much worse than August. A significant question investors should ask themselves is whether these upside recoveries are creating space for a deeper trough next month, similar to how Chicago Bulls #23 used to tantalize the defense by dribbling towards the hoop only to fadeaway backwards and swoosh, nothing but net. The bottom isn’t in ladies and gentlemen and I believe we are going below 5,000 this year as market players are tossing the basketball from left hand to right hand, similar to how they become worried about recession, then inflation. Back and forth, back and forth in rocking chair motion.

Arbitrage Opportunities in ForecastEx

Finally, investors can take refuge in one of our new and exciting products that was just approved by the federal government. Specifically, I’m seeing an arbitrage opportunity in the No ForecastEx question on whether the fed funds rate will exceed 4.875% in September, because the odds in the futures market point to 41% but the IBKR Forecast Trader prices it at 56%. Furthermore, the futures market is much more dovish than ours. If you’re an inflation hawk, like me, then it’s a no-brainer. If you’re a spread trader, go have fun. In conclusion, seeing favorable odds for the No in July Consumer Prices above 2.5%, Yes for the National Debt above $35 trillion by fiscal year 2024 (we’re already there), and no for building permits above 1.5 million in July 2024, because housing inventory is skyrocketing and builders aren’t going to add because they’re afraid new units won’t sell.

Folks, if you have any questions on Forecast Contracts and/or ForecastEx, please do not hesitate to reach out to me via email or telephone.

Please watch the Traders’ Academy video on Forecast Contracts here.

José Torres

Senior Economist, Interactive Brokers

Mobile: 347.860.3095

Email: jtorres@interactivebrokers.com

777 S. Flagler Drive Suite 1001

West Palm Beach, FL 33401

Subscribe to Our Market Commentary

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.