Getting started with algorithmic trading involves several key steps for retail traders. We will discuss all the beginning steps for retail algorithmic trading such as choosing the right trading platform or broker, setting up a trading account and understanding the basic tools and software requirements, such as coding platforms and backtesting tools and navigate useful resources for it. We will also discuss the requirements for establishing a retail algorithmic trading desk.

This blog covers:

- Overview of algorithmic trading and strategies

- Benefits of Algorithmic trading to retail traders

- Getting Started with Retail Algorithmic Trading

- Resources to learn Retail Algorithmic Trading

Overview of algorithmic trading and strategies

Algorithmic trading, also known as algo-trading, uses computer language such as Python, to execute trading strategies at high speeds and volumes, often surpassing human capabilities.

By automating the trading process, algorithms can analyse vast amounts of market data, identify trading opportunities, and execute orders based on pre-defined criteria. This approach leverages quantitative strategies and models, historical data, and mathematical computations to make informed trading decisions, reducing the emotional and psychological biases that can affect human traders.

Also, since the global algorithmic trading market size was valued at $2.03 billion in 2022 and is projected to grow from $2.19 billion in 2023 to $3.56 billion by 2030, it is believed that the algo trading domain is the future. ⁽¹⁾

Also, the strategies employed in algorithmic trading are diverse and can be tailored to various market conditions and goals. Some common strategies include:

- Trend Following: This strategy involves identifying and capitalising on market trends. Algorithms detect price movements and execute trades in the direction of the trend, aiming to profit from sustained market movements.

- Mean Reversion: This strategy is based on the idea that asset prices tend to revert to their historical average. Algorithms identify overbought or oversold conditions and execute trades to profit from price corrections.

- Statistical Arbitrage: This strategy involves complex statistical models to identify and exploit short-term market inefficiencies. Algorithms analyse historical data to find patterns and correlations that suggest profitable trading opportunities.

Algorithmic trading offers several advantages over manual trading. Fast trade execution, accuracy, the ability to discard ‘emotions’ while trading and the ability to follow the trading plan with the decided algorithmic trading strategy are some of the advantages.

Visit QuantInsti to watch a video on building algorithmic trading strategies using Python.

So, should retail traders be doing Algorithmic Trading?

Absolutely! Let us find out what the scenario is like in terms of benefits for retail traders when it comes to algorithmic trading.

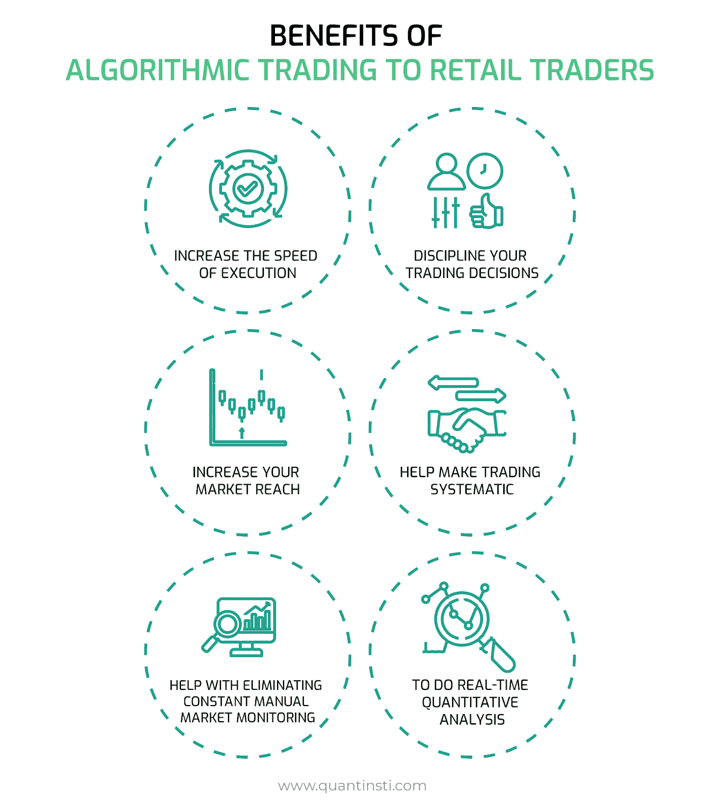

Benefits of Algorithmic trading to retail traders

Retail traders are the ones who have remained deprived of algorithmic trading for a long time. The most important thing is that retail traders must understand that to get into the algo trading world, they need to have a sound knowledge of key skills such as programming, backtesting, mathematical skills etc. Discover the best Algorithmic Trading Platform for your needs.

However, not participating in algorithmic trading may lead to an impact on retail traders because, in the market, algorithmic traders may have the upper hand over manual traders. Algorithmic trading brings several benefits also to retail traders in the financial markets. It is known to: ⁽²⁾

Increase the speed of execution

The main reason is if you are creating a trading strategy, you need to be able to increase the speed of execution to make the returns from the trades happen quickly. In trading, you come out profitable only when your wins compensate for your losses. That too, is enough to account for your efforts and costs. Algorithmic trading is a way to do the same.

Discipline your trading decisions

Another reason is that traditionally retail traders have been trading on the gut feeling based on the ‘feel’ of the market. There is nothing wrong with that especially if you are a seasoned player with a lot of market insights to be put to use. However, the gut feeling often turns out to be wrong, mostly when there is greed and fear involved. When the markets are falling many amateur traders sell quickly as they fear a further crash. Algorithmic trading follows pre-decided entry-exit rules which prevent such emotional trading and hence avoidable losses.

Increase your market reach

Algorithmic trading enables retail traders to access and trade in multiple markets worldwide. Unlike traditional manual trading, where monitoring and trading in different time zones can be challenging, algorithms can operate around the clock, executing trades in international markets as soon as opportunities arise.

Help make trading systematic

With preset conditions like time, price, quantity and some other market conditions being met with algorithmic trading, it is known to make the trading systematic. Systematic trading makes calculative and quantitative methods’ based predictions of stock prices and thus, makes trading more advantageous.

Help with eliminating constant market monitoring

Algorithms can monitor and make decisions and execute trades based on market movements. So, the need to continuously monitor the market manually during trading hours is not required.

To do real-time quantitative analysis

Algorithms can run on past data to help traders in analysing strategy’s performance in terms of profit and loss as well as some popular performance statistics like Sharpe ratio, alpha, beta, etc. The ability to backtest and quantify the strategy’s return over risk helps the traders learn from their own mistakes in a simulated environment before running the strategy in live markets.

Next, we will find out the ways for retail traders to start algorithmic trading.

Getting Started with Retail Algorithmic Trading

To start algorithmic trading, you must have a detailed know-how of certain things.

For that, you must invest your time and efforts in the following:

Knowledge

Getting the knowledge of anything in this world is a must before you take the first step in that particular domain. Once you know about the essentials of algorithmic trading, you will be able to take the best next steps.

To gain the knowledge you need:

- Training, for which you can join an organisation as a trainee or an intern to get familiarised with the work process and ethics.

- You can opt for online courses. Quantra offers many such courses for all levels (beginner, intermediate and expert).

- Books play an essential role since they can be your best guide for starting with algorithmic trading.

To start with algorithmic trading, you must know:

- types of trading instruments (stocks, options, currencies etc.),

- types of strategies (Trend Following, Mean Reversal etc.),

- risk management

Strategies

Algorithmic trading strategies are several types of ideas for conducting the most profitable algorithmic trade. The most popular strategies were mentioned above in the blog, such as trend following, mean reversion etc.

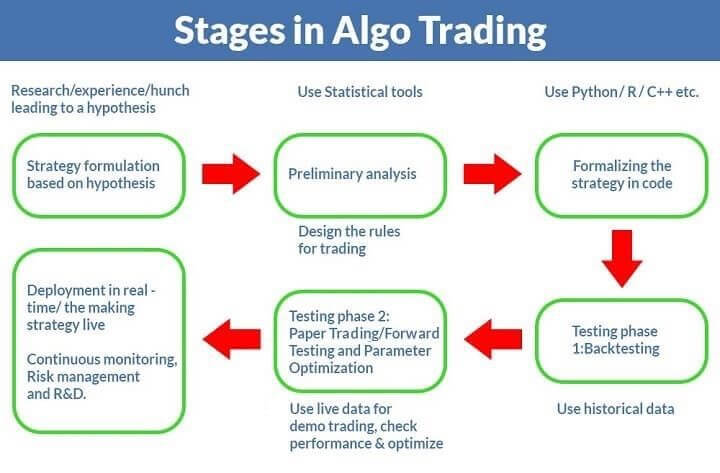

Workflow

This image shows the stages or the workflow of algorithmic trading. The broker you will be associated with can guide you through these steps. Every broker differs about the steps, and thus, you may find a slight difference but the goal is the same.

Suggested reads:

Now, let us move to the resources that can help you learn algorithmic trading.

Resources to learn Retail Algorithmic Trading

It’s true, that it takes a lot of work before you start algo trading, but it’s worth doing it solely because of the advantages and the peace of mind during execution. This algo trading course is a comprehensive certification programme that is taught by leading industry experts in an online classroom format along with a dedicated support manager for faster query resolution. Learn more with these must-read Algorithmic Trading books.

On the other hand, online self-paced and interactive courses by Quantra provide training on each aspect of algorithmic trading. To learn how to automate and execute your trades using the Interactive Brokers platform, you can go to the IBridgePy course. Also, you can learn about algorithmic trading strategies in the course Algorithmic Trading for everyone.

Conclusion

We navigated a thorough overview of algorithmic trading fundamentals, strategies, and the many benefits for retail traders, including improved execution speed, reduced emotional biases, and access to advanced trading techniques.

We explored the critical steps for getting started, from choosing the right trading platform and setting up a trading account to understanding the necessary tools and software. The courses provided in this guide offer valuable learning paths for aspiring algorithmic traders. With the knowledge and tools at hand, retail traders can effectively navigate the algorithmic trading landscape, leveraging technology to achieve their financial goals and compete in markets that were once dominated by institutional players.

If you are a retail trader or someone interested in venturing into algorithmic trading, our Algorithmic Trading course is perfect for you. Taught by industry experts and trading practitioners such as Dr. E. P. Chan and Dr. Euan Sinclair, this course offers invaluable insights and knowledge to help you succeed in the field.

Author: Chainika Thakar (Originally written by Sushant Ratnaparkhi)

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.