Stocks sold off sharply this morning as investors evaluated the imminent risks of President Trump’s tariffs against Canada, China and Mexico. But equities are well off their lows now as the head of state of the US’s southern neighbor, Claudia Sheinbaum, acquiesced to Washington’s demands and agreed to send 10,000 Mexican soldiers to the border to help patrol the dividing line. Furthermore, the two leaders agreed to a list of items, which resulted in the Trump tariffs being delayed from tomorrow to at least a month. Still, however, trade risks loom large as other nations, namely Canada and China, may not cooperate with the White House’s requests. Turning to the economic calendar, ISM reported an unexpected manufacturing expansion and recovery and Euro price pressures arrived ahead of estimates, picking up steam on an annualized basis and drifting away from the ECB’s 2% inflation target.

Manufacturing Wakes from Slumber

Strong domestic and foreign demand catapulted the US manufacturing into expansion for the first time since April. The Institute for Supply Management’s (ISM) Purchasing Managers’ Index for manufacturing hit 50.9 in January, exceeding the expansion-contraction threshold of 50, the median estimate of 49.8 and December’s 49.2. Contributing to the beat were new orders, prices, production and exports, which sported scores of 55.1, 54.9, 52.5 and 52.4. Helping at more modest degrees were imports, deliveries and employment. The uptick in transactions allowed goods producers to work down their backlogs as well.

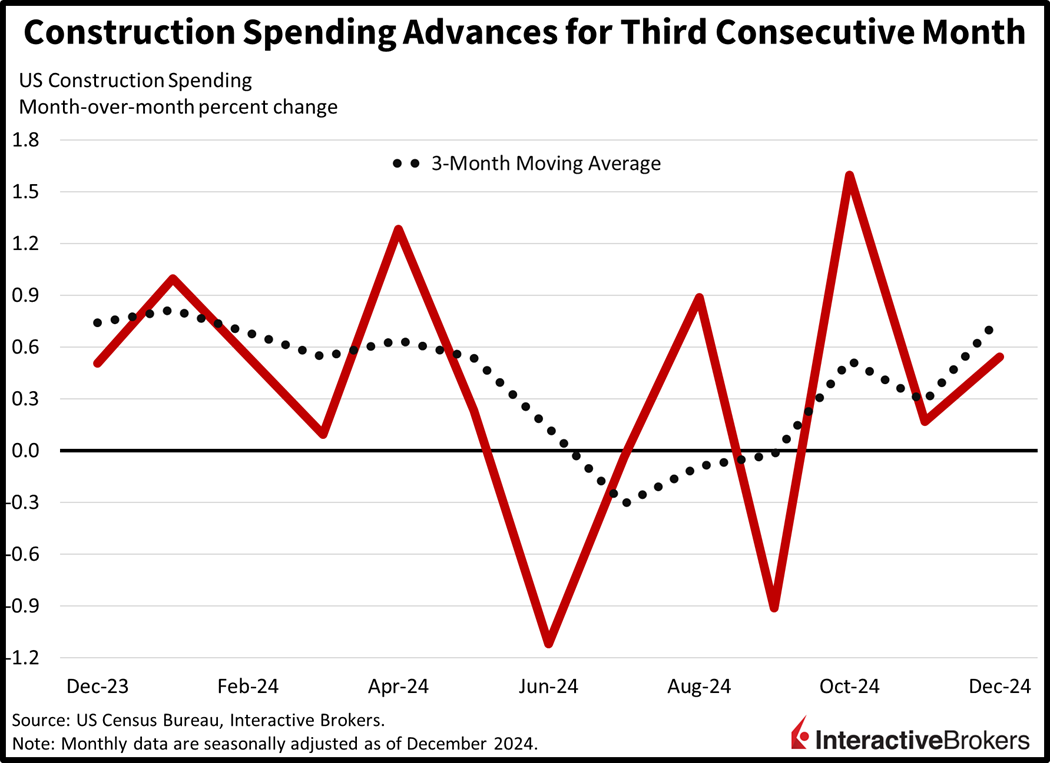

Real Estate Investments Stronger than Expected

New single-family residential investments and office building capital expenditures drove a beat in this morning’s construction spending report from the Census Bureau. December outlays rose 0.5% month over month (m/m), surpassing the 0.2% forecast, which would’ve been unchanged from November. It marked the third-consecutive month of advancement. New single-family investments led the charge, rising 1% m/m and were followed by the office and highway and street segments, which added 0.9% and 0.7%, respectively. The water supply classification, conservation/development category, sewage/waste disposal segment and new multifamily capital expenditures sector weighed on results, however, dropping 2.5%,1.7%, 1.3% and 0.3% m/m.

Europe Prices Decline

EU prices turned south last month as weak demand across the continent led to reduced bargaining power for servicers and manufacturers. Overall and core charges declined 0.3% and 1% m/m in January, slightly above projections. Industrial goods and services led the discounting with costs descending 2.4% and 0.2% m/m, but the energy, unprocessed food and processed food/alcohol/tobacco categories saw prices climb 2.9%, 1% and 0.6%. Annualized figures came in a tenth stronger than expectations, however, with the headline number up 2.5% year over year (y/y) while core arrived at 2.7% compared to 2.4% and 2.7% in December.

South Korean Exports Weaken

Data from the South Korea Ministry of Trade, Industry and Energy reported that January shipments to foreign markets plummeted 10.3% y/y and imports dipped 6.4%. The weak outgoing shipments was caused by the timing of the Lunar New Year trimming the number of business days. Regarding exports, semiconductors bucked the broader trend, improving 8.1% as higher investments in data centers across the globe supported demand for high-band width memory products and other items. Automobile shipments to other countries, in contrast, fell 19.6%.

And Households Crimp Spending

South Korean shoppers tightened their purse strings with retail sales falling 2.2% last year relative to 2023, the largest drop in 21 years, according to Statistics Korea. It was also the third-consecutive year of falling household expenditures. High inflation, political turbulence and elevated uncertainty contributed to both durable and nondurable cash register activities sinking, with food sales leading the decline.

Australia’s Commercial Building Permits Jump

Permits for building detached homes in Australia dropped in December but grew substantially for other forms of residential projects and commercial buildings. The total volume of permits for private sector housing plunged 3% m/m while approvals for dwellings excluding houses, which include row houses, apartment buildings and group homes, headed north by 15.2%. In terms of values, total residential building approvals fell 0.9% while non-residential building climbed 9.7%.

Australia Retailing Sinks

After demonstrating resilience to higher financing costs, consumers trimmed their outlays by 0.1% m/m in December, which was better than the 0.7% decline anticipated by economists. In November, household retail activity climbed 0.7%. The occurrence of Cyber Monday in December helped limit the decline in transactions. Gains in household goods, department stores and food retailing were offset by transaction totals slipping for the clothing, footwear and personal accessory group, the other retailing category and the cafes, restaurants and takeaway food segment.

And Dwelling Prices Weaken

Australian home prices dropped 0.2% in January as measured by the CoreLogic Home Value Index. Most of the decline was driven by individuals being priced out of markets in the region consisting of Melbourne, Canberra and Sydney. Other locations, such as Brisbane, Perth and Adelaide, showed continuing price gains but at a slower pace than recent months.

Hong Kong’s Economy Accelerates

Hong Kong’s economy expanded at a stronger-than-anticipated pace in the final quarter of last year. Real gross domestic product grew 0.8% quarter over quarter on an annualized basis and 2.4% y/y, higher than the -0.1% and 1.9% from the previous three-month time period and expectations of 0.5% and 2.3%. The progress was driven by y/y gains of 1.9% and 1.2% from government consumption expenditures and exports, while declines of 0.9% and 0.2% across the gross domestic fixed capital formation and private consumption expenditure segments alongside a 0.1% increase in imports capped further momentum. The weakness in Hong Kong consumption was also reflected in a separate retail sales report for December. Transactions slid 11.5% y/y, accelerating south from November’s 8.4% drop.

Consumers Go Hog Wild for Meat

Tyson Foods (TSN) posted earnings and revenue that exceeded expectations and raised its full-year guidance, citing carnivores’ increased demand for beef and chicken. Sales during the company’s fiscal-first quarter were 2.3% higher in the same period of 2024 and net income per class A shares soared from $0.31 to $1.03. Sustained demand for eat-at-home products and growing restaurant traffic at both fine-food and fast-dining establishments contributed to the strong results. Tyson guided for full-year sales relative to last year to be flat or up 1% compared to its previous estimate of flat to down 1%.

Relief Rally Strives for Break-Even Point

Markets remain bearish but are performing much better than earlier as equites pare more than half of their morning losses. Similarly, progress on trade has the dollar trimming its gains significantly. Meanwhile, the yield curve is flattening in a bifurcated manner, as IBKR Forecast Traders envision a narrower path to rate cuts on the horizon, but global uncertainty is generating safe haven demand, which is benefiting the long end. Similarly, commodities are catching bids and gold made a fresh all-time high as market participants brace for the potential for a wider scale quarrel.

Source: ForecastEx

All major domestic equity benchmarks are lower with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial trading south by 0.7%, 0.7%, 0.6% and 0.2%. Sector breadth is strongly positive with 7 of the 11 major groups gaining and being led by energy, health care and consumer staples; they’re higher by 0.8%, 0.7% and 0.4%. Technology, consumer discretionary and financials are weighing on results, however. They are lower by 1.4%, 1.1% and 0.4%. We’re seeing a bifurcated flattening across the yield curve, with the 2-year Treasury maturity heavier by 2 basis points while the 10-year is lighter by 4 bps. The Dollar Index is now up just 24 bps from over 100 earlier, as the greenback appreciates against the euro, franc, yuan and Aussie and Canadian tenders. The US currency is depreciating against the pound sterling and yen though. Commodities are tilted to the upside with lumber, silver, copper and gold higher by 2.5%, 1.1%, 0.9% and 0.8%. WTI crude has reversed into the red though; it’s down 1.6% and trading at $72.06 per barrel as the Mexican supply outlook was aided by this morning’s telephone agreements.

Not Out of the Woods Yet

The trio of Trump tariffs would have shaved 1% from US GDP growth and added 1% to annualized price pressure figures. Trade acquiescence is what the US economy needs to skirt turbulence and widen the path towards non-inflationary growth. But a deals with Mexico City and Bogota don’t guarantee an accord with Ottawa, Beijing or whoever is next, perhaps Brussels or Tokyo. Investors must stay vigilant against this backdrop, with many nations already reporting figures consistent with economic contraction while the S&P 500 derives roughly a third of its revenues from foreign sources. A ramp up in trade rhetoric and disagreements concerning global commerce will weigh on revenues, costs and margins, challenging corporate America’s ability to grow earnings.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.