With pandemic-era travel restrictions behind us and an improving economic landscape ahead, travel stocks are adjusting to a new era of global travel. Consumer travel rates for air travel, hotel bookings and more are rising rapidly. While inflation certainly exerts some downward pressure on global and domestic travel, indicators of decreasing inflation suggest a potential travel surge as we march through 2024. This presents several top travel stocks to buy this year.

These travel stocks represent the best way to leverage this upward momentum with minimal risk. Each company holds a dominant market share in its respective category and is recovering strongly from the pandemic-era downturns, with per-share pricing rebounding toward or surpassing 2019 levels.

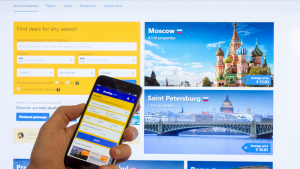

Booking Holdings (BKNG)

Booking Holdings (NASDAQ:BKNG), recognized for its extensive travel services, including Priceline and Kayak, is an all-in-one travel stock set to boom as we enter the summer season. Though shares trade above $3,500, the company’s strong financial performance and a positive sector outlook point to big things ahead. A subdued forecast in February pushed shares down nearly 10%, making today a perfect buying time — if you hurry. In 2023, its free cash flow per share reached $193.66. With huge institutional ownership, Booking Holdings is a cash-cow stock that uses hefty free cash flow to boost share pricing via a robust 8.87% total yield.

Analysts expect Booking Holdings to grow as the global travel market recovers from the pandemic’s impact. The company’s latest earnings report supports this positive outlook, displaying a 16% year-over-year increase in quarterly gross travel bookings and a 24% annual growth in this area. Moreover, annual income jumped by 40% after a 25% rise in revenue, demonstrating management’s ability to navigate higher interest rates and boost profit margins through effective cost control.

Airbnb (ABNB)

Although the heyday of professional Airbnb (NASDAQ:ABNB) hosts might be waning, this shift does not spell disaster for the travel stock giant. Instead, Airbnb’s user base is returning to the platform’s original concept of offering spare space as a budget-friendly alternative to hotels. Despite facing significant challenges, such as a $10 million fine for misleading international customers by listing prices in USD rather than local currencies, Airbnb’s market dominance remains unchallenged.

Airbnb holds a 20% share of the total vacation rental market, a remarkable achievement given its competition with established hotel chains. Additionally, the platform’s listing and booking rates have climbed above their pre-pandemic levels in 2019, demonstrating Airbnb’s effective navigation through the pandemic’s obstacles.

In its most recent earnings report, Airbnb disclosed nearly a 17% increase in revenue year-over-year and a 15% rise in gross booking value. Spurred by the holiday travel surge, this growth is expected to continue as we move into the spring and summer travel seasons.

Trip.com Group (TCOM)

Trip.com Group (NASDAQ:TCOM), a Chinese travel stock, is returning after the government ended its Zero-Covid policies, with a 40% return since January 1st and prices approaching pre-pandemic levels. This recovery positions Trip.com Group for a potential surge as the company serves over half of the Chinese tourism market, including airline ticketing, hotel bookings and general travel planning.

Before the pandemic, the Chinese tourism market was a formidable economic force, with nearly 155 million Chinese tourists traveling internationally in 2019. This number plummeted to around 20 million in 2020. However, by the first half of 2023, nearly 40 million had traveled abroad and this upward trend is expected to continue, potentially driving TCOM’s per-share price to new highs.

Additionally, Trip.com is expanding focus beyond China to capture a larger share of the broader Asian international travel market and explore other global markets. The company is also enhancing its digital and personalized service offerings to meet the changing needs of consumers, aiming to attract and retain attention and build brand loyalty in a highly competitive environment.

On the date of publication, Jeremy Flint held no positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.