Summer is here! While you may have planned your vacation and trips to the beach, have you thought about your investments?

The stock market doesn’t take a holiday, but understanding how seasonality affects financial markets can help you make some smart summer moves. Let’s dive into the world of summer stocks, and discover why certain stocks shine brighter during this season.

Why Does Seasonality Happen?

Summer is a prime travel season, boosting demand for travel services and often raising stock prices. Travel stocks are cyclical, influenced by the season and economic trends. Currently, a strong labor market and reduced inflation (from 2022 highs) are keeping consumer travel spending steady.

However, the travel industry is vulnerable to economic shifts. It’s usually one of the first areas where consumers cut spending when finances are tight. If economic worries or rising unemployment occur, travel companies typically feel the impact quickly.

Summer Stocks to Watch

Booking Holdings is a standout. This leader in online travel owns major sites like Booking.com, Priceline, Kayak, and OpenTable, offering comprehensive travel booking services.

Driven by its impressive first-quarter performance, it is expected to reach a price of over $4,000 per share in no time. Furthermore, Booking Holdings announced an $8.75 per share dividend, payable on June 28.

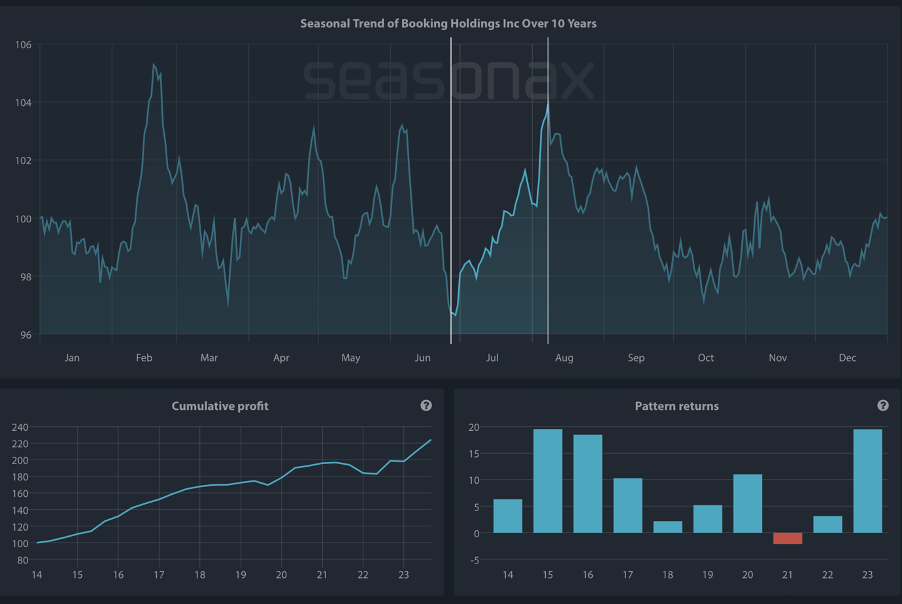

But what do seasonal patterns say? Over the past decade, there’s been a clear upward trend from June 27 to August 8, with Booking Holdings averaging over 9% returns in just 30 trading days. This has occurred 9 out of 10 times since 2014 (see the pattern returns below).

We’ll find out if seasonal trends provide enough momentum to propel it to new heights.

Seasonal Chart of Booking Holdings Inc over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

How to read seasonal charts? *Unlike regular charts, a seasonal chart doesn’t display price over a set time but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

Another stock that looks very promising from a seasonal perspective is Royal Caribbean Cruises.

With more people booking sea vacations, RCL often sees a rise in bookings and stock performance during the summer. Since its March 2020 low of about $24, it has rebounded over 400%, despite a 15-month COVID-19 shutdown, showcasing the company’s resilience.

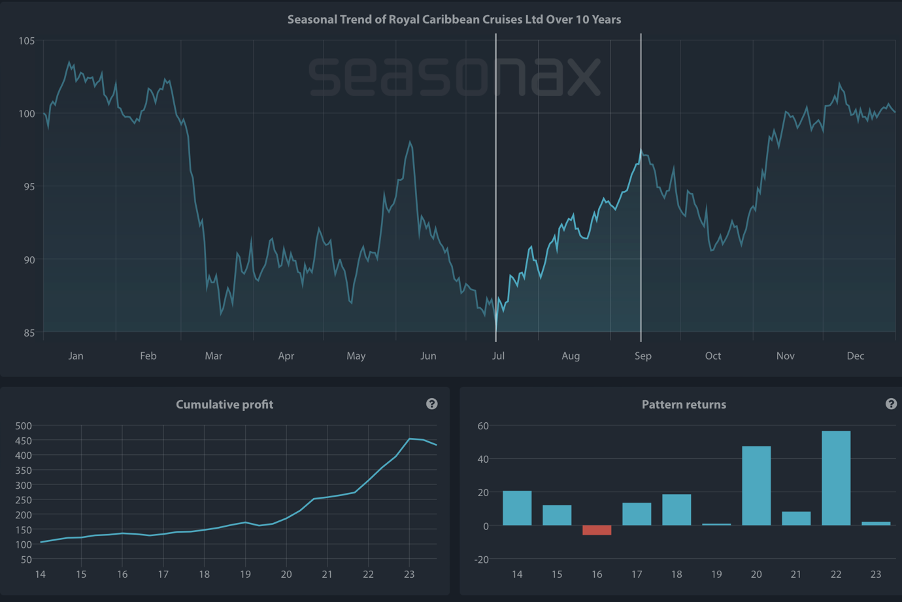

From a seasonal perspective, the period from July 14 to September 14 presents a good market entry point. Over the last decade, Royal Caribbean has averaged nearly 16% returns during this short period.

Will it chart a steady course this summer?

Seasonal Chart of Royal Caribbean Cruises over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

Who is going to profit from the summer party?

This summer, Visa could hit the jackpot on the stock market. With people traveling and shopping more, transaction volumes are expected to soar, leading to big profits for Visa and boosting its stock price.

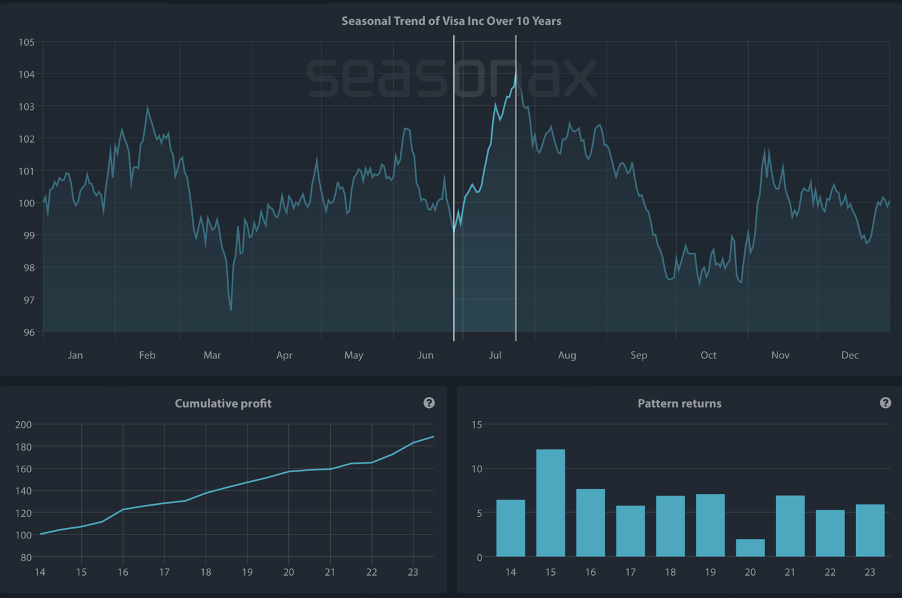

Over the past decade, Visa has delivered strong gains from June 27 to July 24, averaging 6.57% returns. Will the summer spending surge, driven by the Olympics and UEFA Euro 2024, bring further revenue?

Seasonal Chart of Visa Inc over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

More Summer Stocks

While Booking Holdings, Royal Caribbean, and Visa might perform strongly in the summer, other stocks could gain momentum too. Avis Budget Group, Inc., Pool Corporation, and even the Walt Disney Company all fall within this category. Increased consumer spending boosts the earnings of companies in the travel, hospitality, and retail sectors.

Plus with the hot summer weather, don’t forget suncream! A global leader in suncream manufacture is Procter & Gamble, with its Olay and Coppertone brands. For the last 15 years, between June 27 and August 1, Procter & Gamble have had an average return of 4.48%. Other players in the suncream market to consider include Johnson & Johnson (Neutrogena brand) and Beiersdorf (Nivea).

Beware of the Summer Doldrums

Investor behavior during the “summer doldrums” is worth noting. Trading volumes typically decrease in summer as many traders go on vacation. This lower activity can lead to more volatile markets, with prices moving unpredictably.

It is therefore crucial to analyze the performance of each individual stock.

Utilizing tools like Seasonax can help you pinpoint the best times to enter and exit the market, maximizing your potential returns. As you enjoy the summer festivities, let your investments work for you.

Remember, don’t just trade it, Seasonax it!

Test it free for 30 days and explore patterns across various markets, including indices, (crypto)currencies, stocks, and commodities.

—

Originally Posted June 26, 2024 – Stocks for the Hot Summer

Disclosure: Seasonax

Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. Seasonax GmbH neither recommends nor approves of any particular financial instrument, group of securities, segment of industry, analysis interval or any particular idea, approach, strategy or attitude nor provides consulting nor brokerage nor asset management services. Seasonax GmbH hereby excludes any explicit or implied trading recommendation, in particular, any promise, implication or guarantee that profits are earned and losses excluded, provided, however, that in case of doubt, these terms shall be interpreted in abroad sense. Any information provided by Seasonax GmbH or on this website or any other kind of data media shall not be construed as any kind of guarantee, warranty or representation, in particular as set forth in a prospectus. Any user is solely responsible for the results or the trading strategy that is created, developed or applied. Indicators, trading strategies and functions provided by seasonax GmbH or on this website or any other kind of data media may contain logical or other errors leading to unexpected results, faulty trading signals and/or substantial losses. Seasonax GmbH neither warrants nor guarantees the accuracy, completeness, quality, adequacy or content of the information provided by it or on this website or any other kind of data media. Any user is obligated to comply with any applicable capital market rules of the applicable jurisdiction. All published content and images on this website or any other kind of data media are protected by copyright. Any duplication, processing, distribution or any form of utilisation beyond the scope of copyright law shall require the prior written consent of the author or authors in question. Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Seasonax and is being posted with its permission. The views expressed in this material are solely those of the author and/or Seasonax and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.