Equities are gaining further ground following the Thanksgiving holiday as stateside shoppers visit storefronts to enjoy Black Friday discounts. Consumers are also finding good deals online ahead of Cyber Monday, which is just 3 nights away on December 2. And while the US Economic calendar is empty today, we did receive inflation reports from Tokyo and the European Union. The Japanese CPI print, which arrived ahead of expectations, is strengthening odds for a 25-bp hike to the BoJ’s key benchmark next month, and it’s simultaneously marking the end of the greenback’s 8-week run, as its pacific counterpart rallies strongly. Meanwhile, Euro results arrived largely as expected, and ECB watchers are thinking about how low the ECB can go amidst deteriorating consumption trends.

Tokyo CPI Sparks BOJ Worries

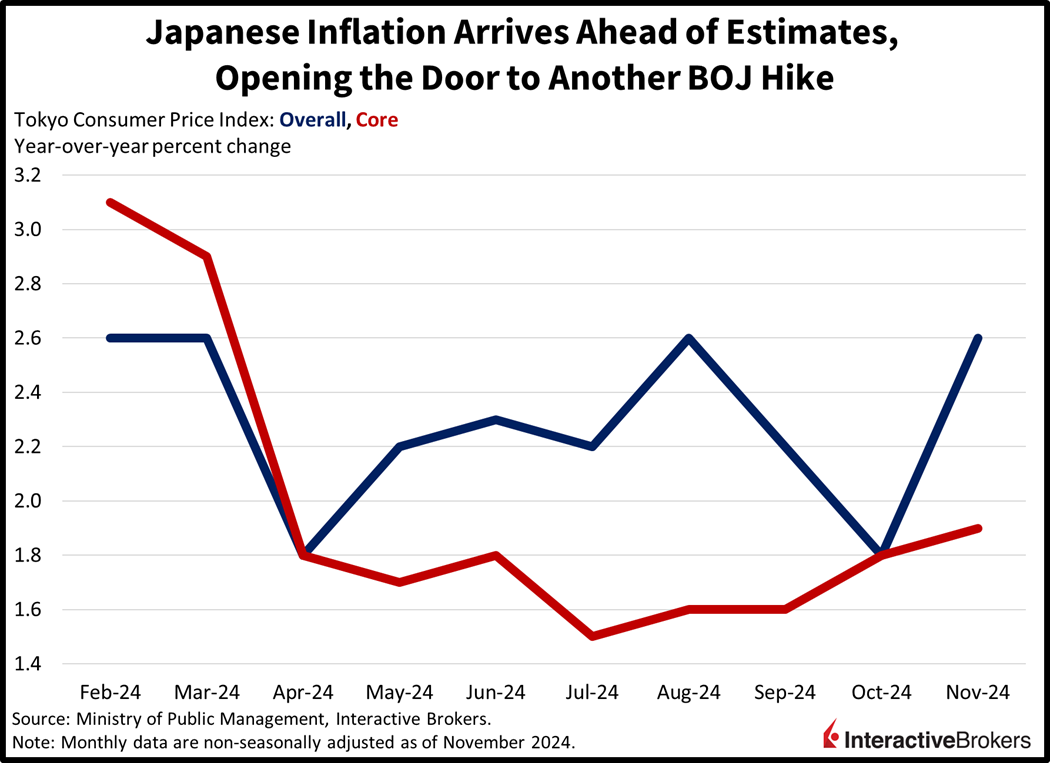

An acceleration in Tokyo price pressures has rate watchers bracing for a potential Bank of Japan (BoJ) hike next month. Charges in the capital city increased 2.6% this month, surpassing the median estimate of 2.5% and picking up steam from October’s 1.8% increase. Similarly, core costs, which exclude fresh food and fuel, increased 1.9%, despite the median projection anticipating an unchanged 1.8% from the previous period. The hotter-than-expected readings are driven by strong consumer demand, continued increases in food prices and an uptick in fuel and utility expenses following a rollback in energy subsidies.

Euro Slips into Monthly Deflation

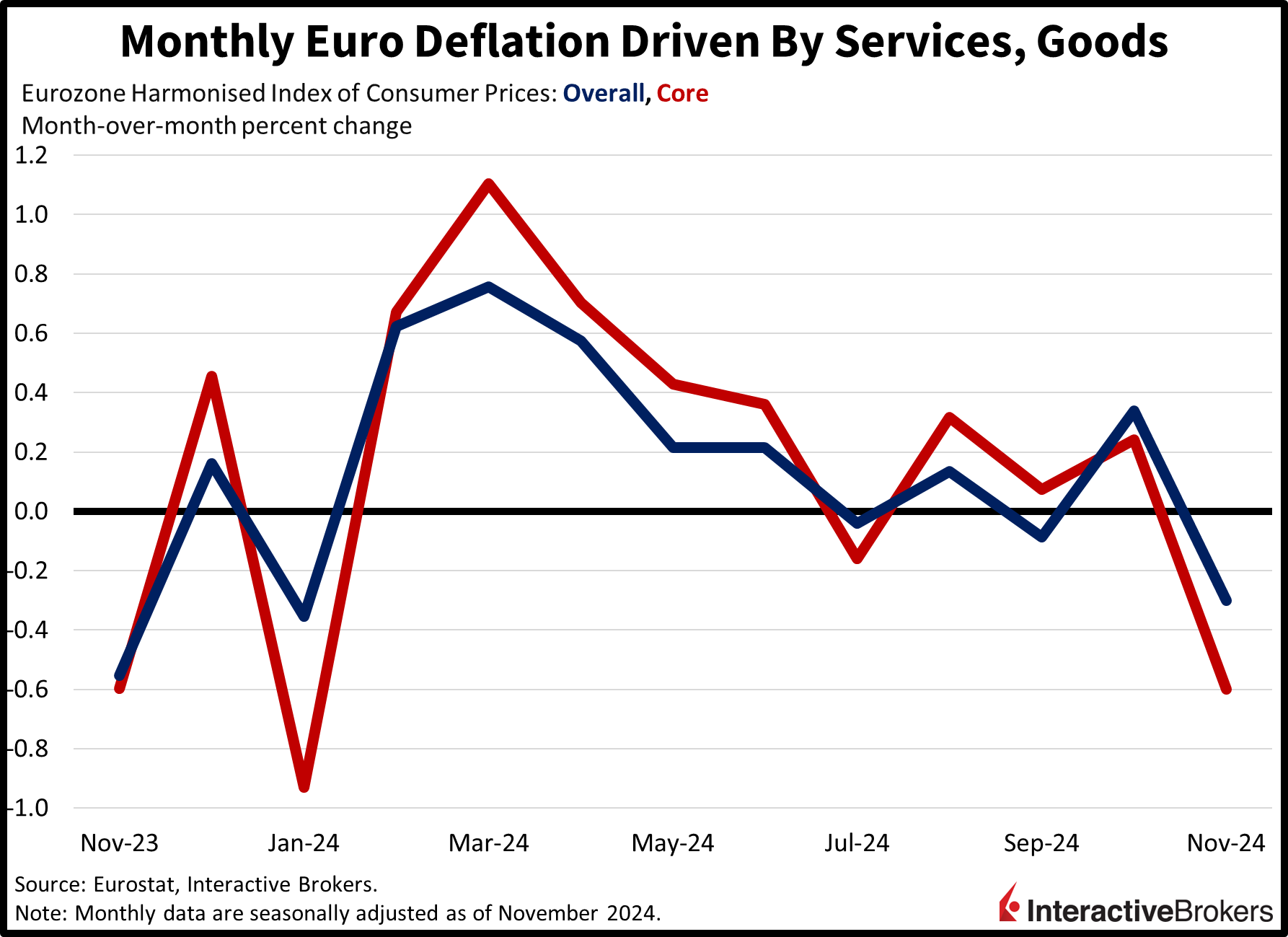

A sharp decline in services charges and steady goods costs contributed to a month of deflation in the euro area. November prices retreated 0.3% month over month (m/m) but advanced 2.3% year over year (y/y), arriving exactly as expected. The results compare to increases of 0.3% m/m and 2% y/y in October. Core prices, which exclude food, energy, alcohol and tobacco, fell 0.6% m/m while growing at 2.7% y/y, its third consecutive month holding the annualized figure. Services saw a significant 0.9% m/m drop in prices, while goods were unchanged during the period. Hampering progress on the disinflation front, however, were the energy and food, alcohol and tobacco categories, which saw price levels expand by 0.6% and 0.3%. The decline in services charges coincides with weak European consumption, as the continent faces the risk of recession in the coming months.

S&P 500 Hits Fresh All-Time High

Markets are rallying with investors scooping up shares in every equity sector, and they’re also grabbing Treasurys across the entire curve. All major domestic stock benchmarks are trading higher with the Nasdaq 100, Russell 2000, S&P 500 and Dow Jones Industrial indices up 0.7%, 0.5%, 0.5% and 0.4%. The upside is being charged by the technology, industrials and consumer discretionary segments, which are gaining 0.9%, 0.6% and 0.5%. Treasurys are catching bids as well, with the 2- and 10-year maturities changing hands at 4.22%, and 4.19%, 3 and 4 basis points (bps) lighter on the session. The Dollar Index is down 18 bps as the greenback depreciates to most of its major counterparts including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian tenders. Commodities are mostly bullish with silver, gold, crude oil and copper up 1.3%, 0.6%, 0.6% and 0.3%, but lumber is bucking the trend modestly; it’s down 0.2%. WTI crude is trading at $69.27 per barrel on rumors that OPEC+ will delay its announced supply increases by 3 months. Furthermore, the coalition, originally scheduled to meet this Sunday, pushed back its gathering to this Thursday, December 5, where a virtual assembly will take its place.

Tis the Season to Be Jolly

As we turn over our calendar to the month of December this weekend, optimism regarding the arrival of Santa Claus won’t be limited to the children. The trip down the chimney also coincides with one of the best seasonal periods of the year for investors. Against the backdrop, next week will offer no shortage of economic data, with Wall Street gearing up for ISM PMIs on manufacturing and services, construction spending, job openings and labor turnover, ADP employment, BLS jobs Friday, consumer sentiment and more. Occurring concurrently, will be a flurry of central bank commentary including from Fed members Powell, Waller, Kugler, Bowman, Hammack, Golsbee, Barkin, Williams and Musalem, as well as the ECB’s Lagarde, Cipollone, and Montagner. Finally, market participants will look for clues on the path down the monetary policy stairs, and top of mind will be how far current benchmark rates are from neutral as well as how low they can go from here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.