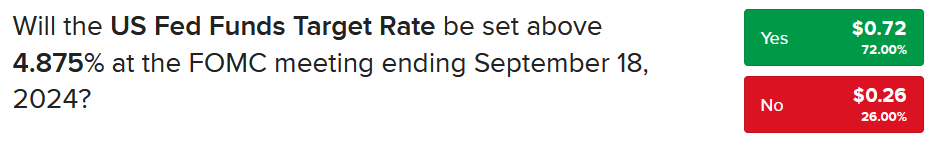

Stocks are up for a seventh consecutive day as market bulls celebrate the start of the Fed’s easing cycle. Indeed, the journey across the monetary policy bridge ends tomorrow afternoon, but rate watchers remain unsure about whether the central bank will trim borrowing costs by a quarter point or a half. Participants across exchanges and markets are confounded, with Fed Funds futures once again at odds relative to our IBKR Forecast Trader, which is much more hawkish and expecting 25 rather than 50. My expectation lies with our market, as I expect Chair Powell and the committee to commit to a tempered and gradual pace down the monetary policy stairs at the press conference as well as with the dots. Sure, there are risks of the labor market cooling further, but I see the reignition of price pressures as a graver danger.

25 is My Out-of-Consensus Call

The Fed is likely to reduce its key benchmark rate 25 basis points (bps) tomorrow as Powell reiterates the need for a patient and cautious approach on the way down. Reasons to adjust policy defensively rather than aggressively include robust consumer spending, subdued unemployment, elevated services inflation, accelerating shelter costs and continued fiscal stimulus. A 50-bp reduction would probably spook the market and generate a fierce bull-steepening across the yield curve, sparking uncertainty during an already tumultuous election season. Folks would wonder if the central bank knows something we don’t, especially since the authority analyzes confidential data related to the banking system. Finally, inflation is still regarded as one of the top issues plaguing lower- and middle-income Americans, who focus more on how much cash is leaving their pocketbooks and the numbers on the stickers, rather than the year-over-year (y/y) price pressure figures Wall Street concentrates on.

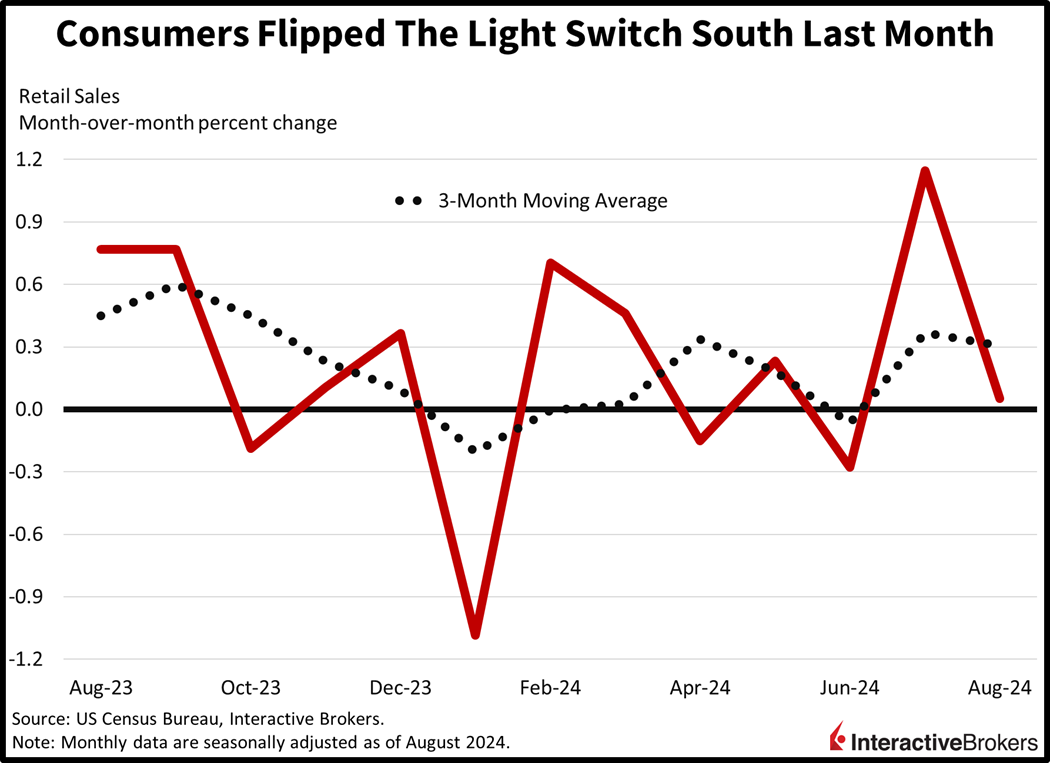

Consumers Flip the Light Switch South

Consumer spending slowed down last month as elevated costs, tall interest rates and reduced credit availability weighed on spending. Retail sales grew just 0.1% month over month (m/m), defying the analyst expectation for a 0.2% decline but trailing the monthly inflation rate and moderating from July’s revised 1.1% increase. The barely positive result comes after a recent trend involving shoppers alternating monthly between splurging and crimping to manage lofty charges and heavy financing costs. After excluding automobiles and gasoline, outlays were firmer, but only slightly, with a 0.2% gain, which surpassed expectations by 10 bps while failing to outpace July’s 0.4% rise. Sales across retail components, furthermore, narrowed relative to July, when 10 of 13 segments were positive. In August, only five categories could boast strengthening revenues, led by miscellaneous retailers and ecommerce, which advanced 1.7% and 1.4%, respectively, and accounted for the lion’s share of the headline number’s advance. Other positive segments and their growth were as follows:

- Health and personal care stores, 0.7%

- Sporting goods retailers, 0.3%

- Building materials and garden equipment suppliers, 0.1%

Sales at dining establishment and drinking parlors were unchanged from July while the following categories, along with their rates of decline, hampered the overall result:

- Gasoline stations, 1.2%

- Electronics and appliance showrooms, 1.1%

- Clothing shops, 0.7%

- Food and beverage markets, 0.7%

- General merchandise destinations, 0.3%

- Motor vehicle and parts dealers, 0.1%

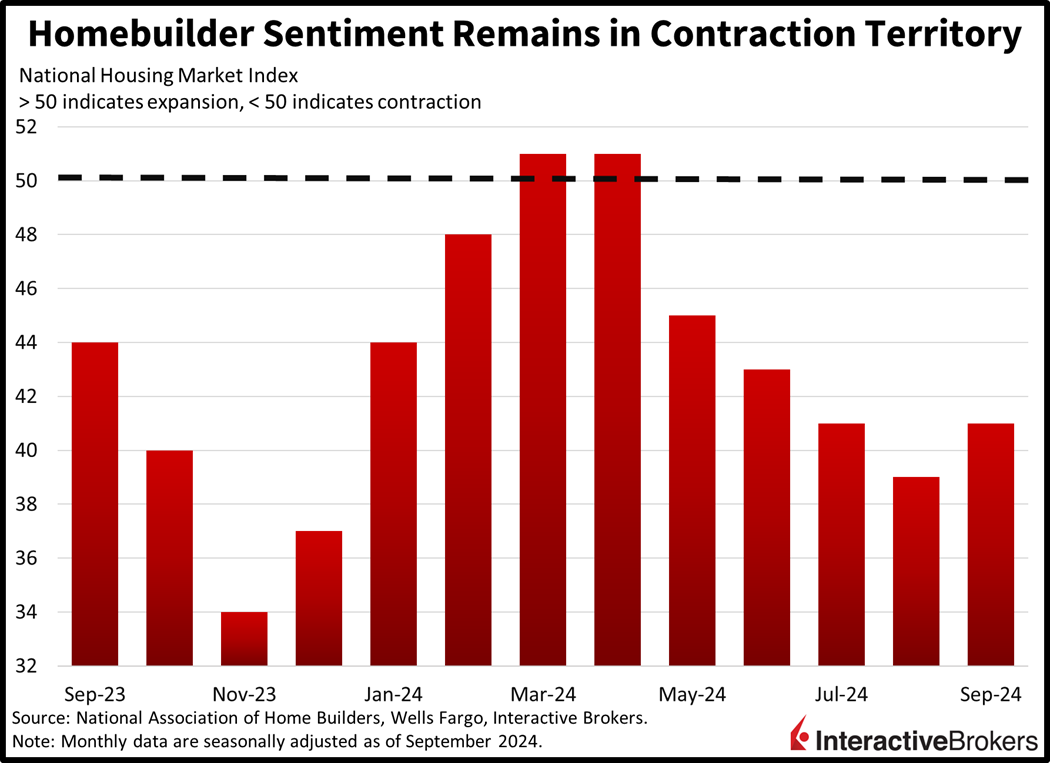

Builders’ Outlook Improves Marginally

After four consecutive months of declines, sentiment among home construction companies finally inched upward this month, but it still has a long way to go before hitting positive territory, or a score above 50. This morning’s NAHB/Wells Fargo Homebuilder Sentiment index moved from 39 in August to 41 and matched Wall Street expectations. Within the benchmark, all three major components climbed with the outlook for single-family transactions in the next six months leading. It posted a gain of four points from August’s score of 49. Traffic of prospective buyers strengthened two points to 27 while current sales conditions rose only one point to 45. While improvements in sentiment were modest, other factors were encouraging, with the percentage of builders reducing prices dropping one point to 32%, the first such decline since April. The size of the average price reduction and the use of sales incentives also moved south. Additionally, all four regions improved m/m as follows:

- Northeast, 46 to 55

- Midwest, 38 to 42

- South, 39 to 40

- West, 37 to 42

Equities Hit All-Time Highs

Markets are bullish ahead of tomorrow’s big Fed Day, with stocks, commodities and the dollar adding to gains amidst modest upticks in yields. All major US equity benchmarks are in the green with the Russell 2000, Nasdaq Composite, S&P 500 and Dow Jones Industrial indices up 1.4%, 0.8%, 0.5% and 0.4%. The Dow Jones Industrial Average and the S&P 500 reached fresh all-time highs earlier. Sectoral breadth is positive with 7 out of 11 groups traveling north and led by consumer discretionary, energy and materials; they’re advancing by 1.3%, 1.1% and 0.8%. The laggards comprise health care, consumer staples, and real estate, which are losing 0.4%, 0.2% and 0.1%. Turning to fixed-income, currencies and commodities, Treasurys are being sold at the margins with the 2- and 10-year maturities changing hands at 3.6% and 3.46%, 5 and 3 bps heavier on the session. The greenback is up 14 bps in response as it appreciates versus most of its counterparts, including the euro, pound sterling, franc, yen, yuan and Canadian dollar, but it is depreciating versus the Aussie tender. Commodities are experiencing bullish buying activity with crude oil, lumber, copper and silver higher by 0.8%, 0.6%, 0.5% and 0.5%, but gold is lower by 0.3%. WTI crude is trading at $71.11 per barrel on the back of production troubles near the Gulf of Mexico due to Hurricane Francine.

As Fed Cuts Start, Focus Shifts

With the fed funds curve pricing 250 bps of cuts from tomorrow until the end of 2025, much of investors’ attention will be on the Summary of Economic projections detailing where the committee thinks the central bank will land. Against this backdrop, investors will scrutinize voting members’ forecasts in terms of economic growth, unemployment and inflation going forward. I’m expecting price pressures to reappear as the committee begins to walk down the monetary policy stairs, because automobile deflation has been extreme, services inflation remains problematic and housing expenses are already accelerating as we approach the institution’s first reduction in borrowing costs. In conclusion, tomorrow marks the official turn of the marketplace’s focus from inflation and rates to economic growth, employment and earnings.

To learn more about ForecastEx, view our Traders’ Academy video here

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.