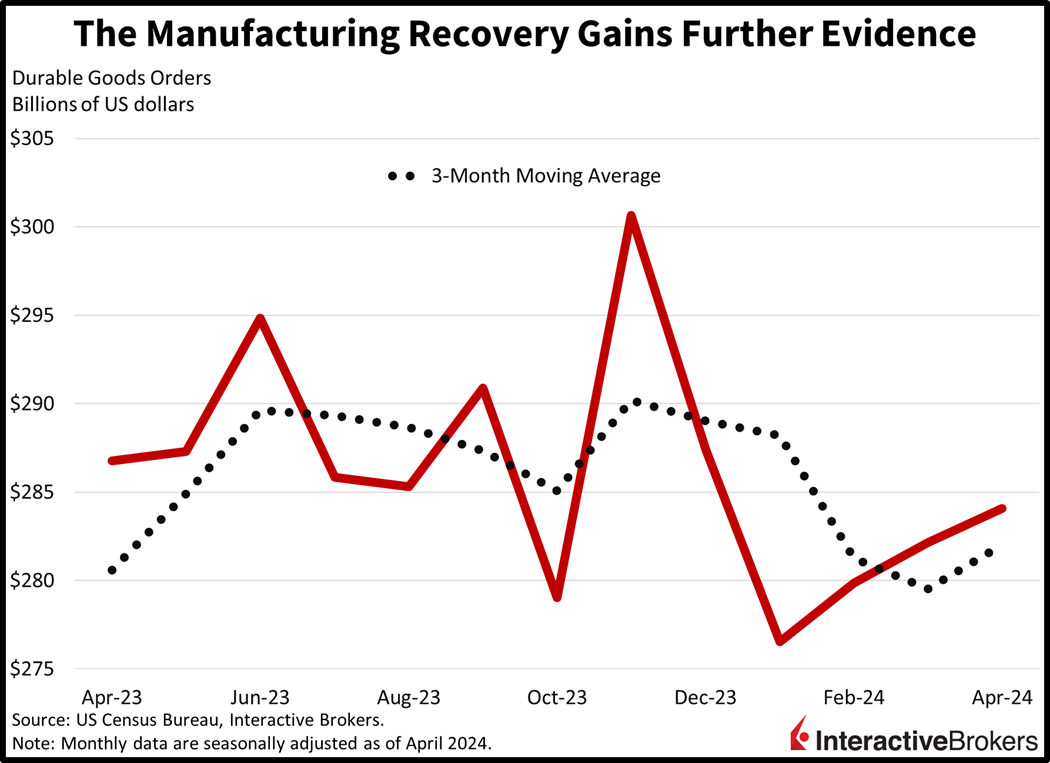

Equities are rebounding from yesterday’s selloff with this morning’s downwardly revised inflation expectations from the University of Michigan supporting investor optimism. Headline consumer sentiment for this month, meanwhile, was revised upward, which together with lighter price pressure projections is providing fuel to the soft-landing trade. Additionally, durable goods figures, released earlier in the morning, provided yet another signal of the manufacturing sector’s comeback following yesterday’s sizable PMI beats.

Durable Goods Score Three-Month Growth Streak

Durable goods orders grew for the third consecutive month in April, according to this morning’s US Census Bureau publication. Last month’s durable goods purchases rose 0.7% month-over-month (m/m) despite forecasters anticipating a decline of 0.8%. April’s growth decelerated slightly from 0.8% in March, however. In April, transactions were supported by most segments with computers, communications equipment, defense aircraft, automobiles and primary metals sporting m/m progress of 3.9%, 3.3%, 2.5%, 1.5% and 1.3%. The electric equipment, machinery and fabricated metal products categories saw softer momentum, with sales rising less than 1% m/m. Dampening some of the gains were the passenger aircraft and other segments, with declines of 8% and 0.2%. Nondefense capital goods excluding aircraft, an indicator of corporate capital expenditures, increased 0.3% m/m, recovering from March’s 0.1% decline.

Consumers More Upbeat Than Previously Reported

In a separate University of Michigan report, this month’s consumer sentiment headline figure was revised from the 67.1 level reported on May 10 to 69.1, while 1- and 5-year inflation expectations were adjusted downward from 3.5% and 3.1%, respectively, to 3.3% and 3%.

Certain Retail Strategies Thrive, But Hiring Trends Weigh on Tech

During the recent quarter, strong footwear brands produced encouraging results for Decker Brands and off-price retailing supported revenue of Ross Stores. A slowdown in hiring, however, is weighing on the performance of Workday, while weak box office sales were a headwind for Lionsgate. The following are highlights from the companies’ recent earnings reports:

- Deckers Brands, which makes UGG, Teva and Hoka footwear, generated earnings and revenue that significantly beat analysts’ expectations, bucking a trend of retailers reporting weak consumer spending. Its fiscal fourth-quarter earnings and revenue climbed 43% and 21.25% year over year (y/y). Deckers’ fiscal-year 2025 revenue guidance, however, only met the analyst consensus expectations while earnings guidance fell below estimates. President and CEO Dave Powers attributed the strong results to the company’s focus on profits and the strength of the company’s brands. The share price of Deckers Brands bounced more than 12% following the earnings release.

- Ross Stores also posted earnings and revenue that surpassed analyst consensus forecasts. The company operates off-price retailers Dress for Less and dd’s Discounts. While its revenue grew 8.1% y/y, same store sales increased only 3%, with the company explaining that its low-to-moderate income customer base is pressured by inflation and other macroeconomic factors. On the earnings front, lower expenses for incentives, distribution and shipping costs were tailwinds. The company anticipates same store sales increasing 2% to 3% y/y in the current quarter. The company’s share price climbed more than 8% following the quarterly report.

- Workday earnings and revenue beat analyst consensus estimates, but its guidance fell short of expectations. The company provides software for payroll and human resources and its recent-quarter revenue climbed 18.8% y/y, but it expects its hiring among its customers to slow, which will dampen demand for its products. It previously said revenue for fiscal-year 2025 would reach or exceed $7.73 billion. It has since said its potential range of revenue isn’t likely to exceed that figure. Workday’s share price dropped more than 9% following the earnings release.

- Lionsgate grew revenue 3% y/y and cut its operating loss in half, with strong results from television and its library of more than 20,000 films and TV content. However, motion picture revenue declined, a result of soft box office sales at the beginning of the year. Despite the weak motion picture results, Lionsgate earnings and revenue exceeded analyst consensus expectations.

Equities Launch a Recovery

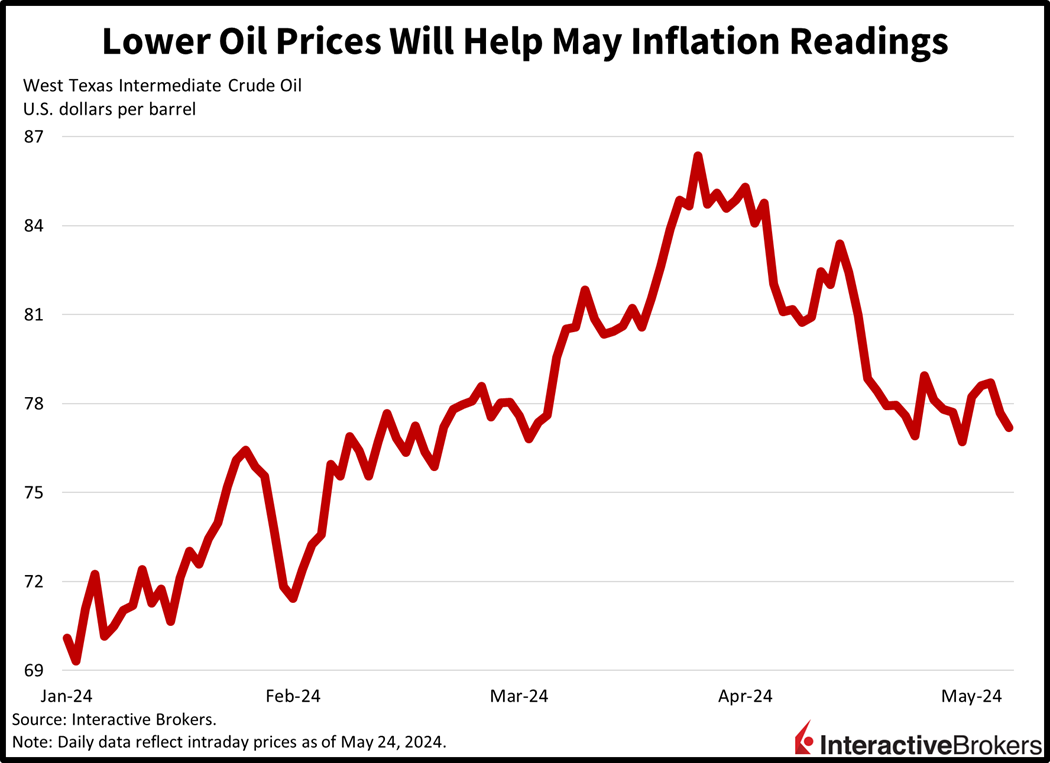

Stocks are recuperating from yesterday’s bruising while the dollar travels south and yields are near the flatline. All major US equity indices are higher with the Russell 2000 and Nasdaq Composite benchmarks leading; they’re up 1.2% and 1%. The S&P 500 and Dow Jones Industrial gauges are increasing at more tempered rates of 0.8% and 0.4%. Sectoral breadth is green—every sector is up. Communication services, utilities and consumer discretionary are leading the pack; they’re up 1.4%, 1.4% and 1.2%. The 2- and 10-year Treasury maturities are changing hands at 4.94% and 4.47% while the Dollar Index depreciates by 34 basis points. The greenback is losing ground relative to the euro, pound sterling, franc and Aussie and Canadian dollars. It is up versus the yen and yuan, however. Things are relatively quiet in commodity land, with gold up 0.3%, copper unchanged and crude oil bouncing off a 3-month low with WTI trading at $77.09 per barrel, 0.5%, or $0.35 loftier in trading so far.

A Time of Remembrance

Market trading volumes are light today as we gear up for the long weekend and the unofficial start of summer. Across the country, civic leaders and organizations will hold events to honor and remember those brave individuals who were lost in military conflicts. In closing, we hope the three-day weekend will be a restful respite from the daily grind of work and more importantly, a time for meaningful reflection regarding fellow Americans lost in battle.

Visit Traders’ Academy to Learn More About Durable Goods and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.