Stocks are stumbling as heightened geopolitical tensions muddle the outlook of the Fed’s walk down the monetary policy stairs. Investors are instead scooping up Treasurys, gold bars and oil futures in preparation for a rainy day, as the rate cut trade appears crowded amidst uncertainty regarding the duration and depth of the central bank’s easing cycle. And while equity traders are impatiently awaiting earnings results from AI behemoth Nvidia this week, yield watchers will be analyzing auctions for 2, 5 and 7-year Treasury notes amounting to $183 billion from tomorrow until Thursday. On the economic data front, durable goods orders were propelled by a recovery in aircraft, which countered broad-based weakness in other areas.

Durable Goods Climb, but Business Investment Contracts

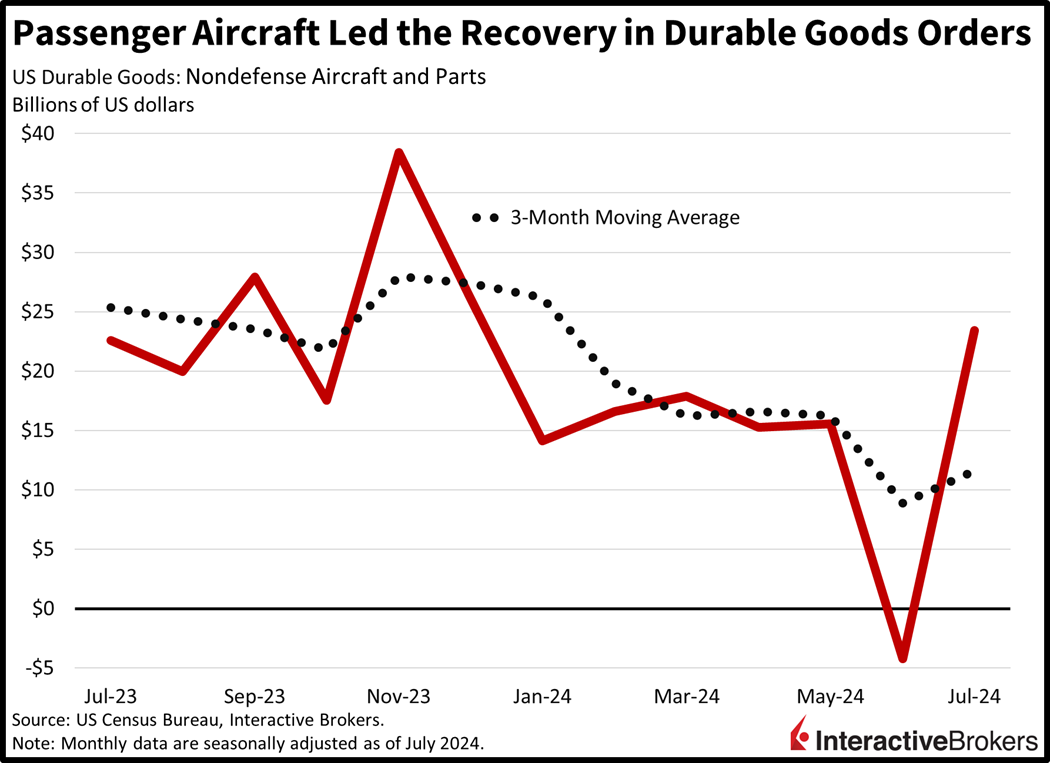

A sharp recovery in jet purchasing fueled substantial progress in durable goods activity in July. Durable goods orders rose 9.9% month over month (m/m) to the loftiest level of the year while exceeding expectations of 5% and the previous period’s 6.9% decline. Driving the recuperation were transactions for passenger airplanes, which turned positive following June’s unfortunate cancelations, jumping from -$4.2 billion to $23.4 billion. Defense aircraft and computers also supported the manufacturing sector, growing orders 12.9% and 3.2% m/m while fabricated metal products and other durable goods helped marginally, increasing 0.2% and 0.1% during the period. Weighing on overall results, however, were the following categories that weakened as noted:

- Automobile and parts, 2.6%

- Communications equipment, 1.1%

- Primary metals, 0.9%

- Electrical equipment components, 0.4%

Finally, nondefense capital goods excluding aircraft, a harbinger for business investment, sunk 0.1% m/m from the previous period’s 0.5% gain.

Trump Trade Shows Signs of Life

Risk-off sentiments are dominating markets today, but there’s some bullish activity occurring within the Trump trade while the Harris side awaits artificial intelligence guidance from Nvidia. Indeed, the Dow Jones Industrial and Russell 2000 benchmarks are both up 0.1%, but the Nasdaq Composite and S&P 500 indices are down 0.8% and 0.3%. Sectoral breadth is positive, however, with just the technology, consumer discretionary and industrials segments comprising the laggards; they’re down 1.1%, 0.6% and 0.1%. Piloting the bulls are utilities, materials and consumer staples, which are all gaining 0.6%. In Treasurys, the 2- and 10-year maturities are changing hands at 3.91% and 3.80%, 1 basis point (bp) lighter for both instruments. The dollar is near its pivotal support index level of 100, and its gauge is bouncing north by 11 bps while looking to further distance itself from the dangerous 141.69 area against the Japanese yen. It was as low as 143.44 earlier this morning but has now recovered to 144.39. The greenback is currently appreciating versus the euro, pound sterling, yen and Aussie dollar but depreciating against the franc, yuan and Canadian dollar. Commodities are mixed with crude oil, copper and gold trading north by 2.9%, 0.2% and 0.1%, while lumber and silver slip 0.8% and 0.2%. WTI crude is trading at $78.10 as Libyan oil production and exports are suspended on the back of a dispute between the Benghazi (Eastern) and Tripoli (Western) governments on who should lead the nation’s central bank. Also threatening the supply of the critical commodity are military aggressions between Israel and Hezbollah as well as continued strikes near the Red Sea.

Investors Wait for a Full Week of Economic Data

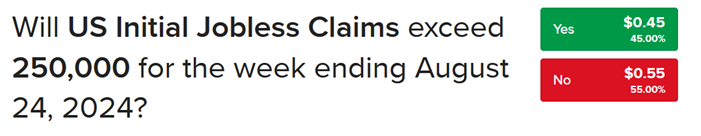

This week’s developments are crucial as we approach the back-to-school season and the potential for stormier market moves on the back of weak seasonals and front-loaded upside. Tomorrow’s consumer confidence figures, Wednesday’s Nvidia earnings, Thursday’s unemployment claims and pending home sales reports and Friday’s Personal Income & Outlays print will certainly move the needle on how far and fast the Fed will go. At the moment, market participants are projecting that the central bank will walk down to between the third and fourth floors but closer to the taller story. The strength of the labor market will certainly dictate the speed at which Powell and the committee take the stairs to lower levels. Finally, initial unemployment claims are being closely followed by the Street on a weekly basis to better understand the trends in staffing conditions. And while the consensus estimate for this week’s figure is at 234,000, IBKR Forecast Traders are pounding the No or the under, which is currently priced at $0.55 on our market’s 250,000 threshold.

To learn more about Forecast Contracts, please view our recent podcast with Wall Street Veteran and ForecastEx CEO David Downey here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.