One of the biggest investment themes in 2023 was artificial intelligence (AI). The “Magnificent Seven” stocks in particular helped fuel gains across major indexes, and the momentum appears to have carried over into 2024 (for now).

As markets move higher, one company looks especially intriguing to me: Palantir Technologies (PLTR -0.67%). The data analytics specialist is not currently a member of the S&P 500 index; however, after four consecutive quarters of profitability on a generally accepted accounting principles (GAAP) basis, inclusion in the index could be getting closer.

The stock is up almost 150% over the past year, and I think there are many reasons why it could surge further in 2024 and beyond. Let’s dig into how Palantir is disrupting the AI market and why the company looks well-suited to dominate over the long term.

An overview of the AI market

When it comes to artificial intelligence (AI), chances are that big tech enterprises such as Microsoft, Amazon, or Alphabet come to mind — and for good reason.

About a year ago, Microsoft kicked off the AI arms race following a multibillion-dollar investment in OpenAI, the developer of ChatGPT. Unsurprisingly, both Alphabet and Amazon swiftly responded with each investing in an OpenAI competitor called Anthropic. Moreover, such companies as Salesforce.com are relentlessly pursuing AI and leveraging a host of prior acquisitions to do so.

Indeed, big tech certainly has a strong pulse on the AI market. However, investors should realize that other companies will likely emerge as leaders as the AI market continues to evolve. While Palantir is still a fraction of the size of its big tech cohorts, the company is seen as one of the best AI software providers out there.

Image source: Getty Images.

What is Palantir doing in AI?

For several years, Palantir’s software platforms were marketed under three monikers: Apollo, Gotham, and Foundry. Moreover, since it was founded nearly two decades ago, the company has fostered strong ties with the U.S. military and its Western allies. For these reasons, many investors viewed the company as a government contractor and were skeptical of its prospects beyond lumpy public sector deal flow.

However, last year Palantir released its latest development among all of the AI hoopla: Palantir Artificial Intelligence Platform (AIP). Thanks to some steps by the company, investors have gotten a pretty solid idea of how AIP is being received.

In order to market the new AI software, Palantir began hosting “boot camps. These immersive seminars allow prospective customers to demo Palantir’s various products and identify specific use-cases for AI and how Palantir can fit into the equation.

So far, this creative lead generation strategy appears to be resonating with customers. Over the last year, Palantir has increased its private sector revenue by 23% — nearly double that of its legacy government business. Moreover, customer count in the commercial sector grew 45% year over year for the trailing-12-month period ended Sept. 30.

While the boot camps have been encouraging, investors should realize that Palantir has yet to truly reap the long-term benefits. Over the long term, the company should have ample opportunities to improve customer unit economics by upselling and cross-selling new products and services. In turn, that should help Palantir’s revenue and profitability.

Should you invest in Palantir stock?

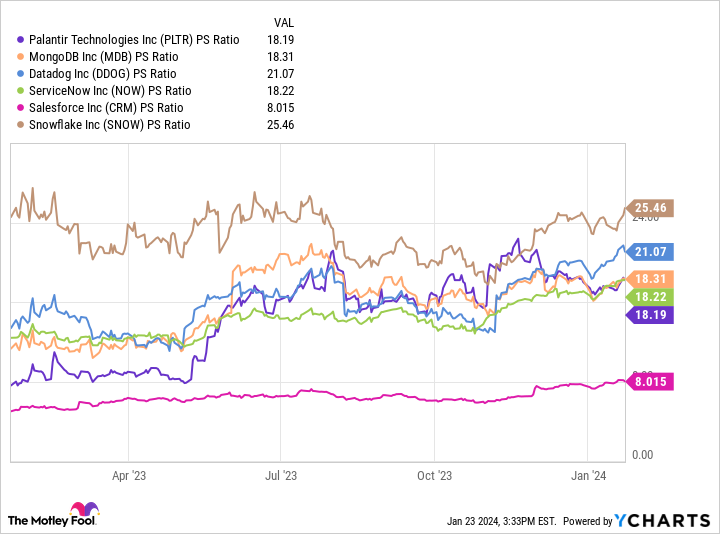

PLTR PS Ratio data by YCharts

The chart above benchmarks Palantir against a cohort of competing enterprise software companies on a price-to-sales (P/S) basis. Investors should note that software-as-a-service (SaaS) growth businesses can prove more volatile than mature blue-chip stocks. Nevertheless, Palantir’s P/S multiple of 18.2 is essentially in the middle of the pack among this peer set — right in line with ServiceNow and MongoDB. Moreover, the company’s current P/S multiple is nearly identical to its long-term average of 18.6.

To me, this valuation is a little curious. Since Palantir’s initial public offering in 2020, its private sector business has grown substantially — quieting concerns over the company’s reliance on government deals. Moreover, its robust free cash flow and liquidity profile have significantly strengthened the company’s balance sheet. This provides Palantir with the financial flexibility to make further investments in research and development (R&D) and release new innovations such as AIP.

And yet, its current valuation has effectively returned the company back in line with historical levels despite meaningful progress on several fronts. Given the demand surrounding various applications in generative AI, coupled with Palantir’s unique position across both the public and private sectors, I see the company as quietly emerging as a leader among enterprise tech. Moreover, with investor enthusiasm captivated by larger tech behemoths, Palantir could be an under-the-radar AI opportunity.

As the markets continue soaring to new highs, secular trends in AI could fuel further gains in the long run. Employing a dollar-cost averaging strategy and building a long-term position in Palantir could prove to be a lucrative move.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Datadog, Microsoft, MongoDB, Palantir Technologies, Salesforce, ServiceNow, and Snowflake. The Motley Fool has a disclosure policy.