Federal Reserve Chairman Jerome Powell told this morning’s Jackson Hole audience that it’s time to walk down the monetary policy stairs. Markets rejoiced initially, but the mighty bears are energized and motivated during a seasonal period that’s traditionally brought choppy, turbulent waters. Powell said that the timing and pace of reductions would depend on the incoming data, and just as he was speaking, New Home Sales hit the wire at 10 am Eastern Time. The result was a monumental surge in transactions that is undoubtedly inflationary as lighter financing costs push folks from all around the world to clamor for the American Dream. After all, the lofty bar for homeownership has been persistently moved further north generation after generation. As I recently explained in a Yahoo Finance interview, the nightmare for the Fed, however, could be a continued increase in housing costs that bolsters price pressures well above the central bank’s target.

Powell Proclaims Enough is Enough

Fed Chair Jerome Powell acknowledged this morning that it’s time for rate cuts and said the central bank believes that the labor market has weakened enough to help thwart a rebound in inflation. Perhaps more significantly, during his Jackson Hole presentation, he explained that policymakers would not “welcome further cooling in labor market conditions,” pointing to a sense of urgency in making monetary policy less restrictive. Inflation doves maintain that Powell and his fellow policymakers have good reason for fretting, with the unemployment rate having climbed from 3.4% in April of 2023 to 4.3% as of last month. While part of the increase resulted from a higher labor participation rate, other signs of weakness exist, including job creation being led by non-cyclical sectors and the BLS recently lowering the number of jobs created during the 12-month period ended March 2024 by 818,000.

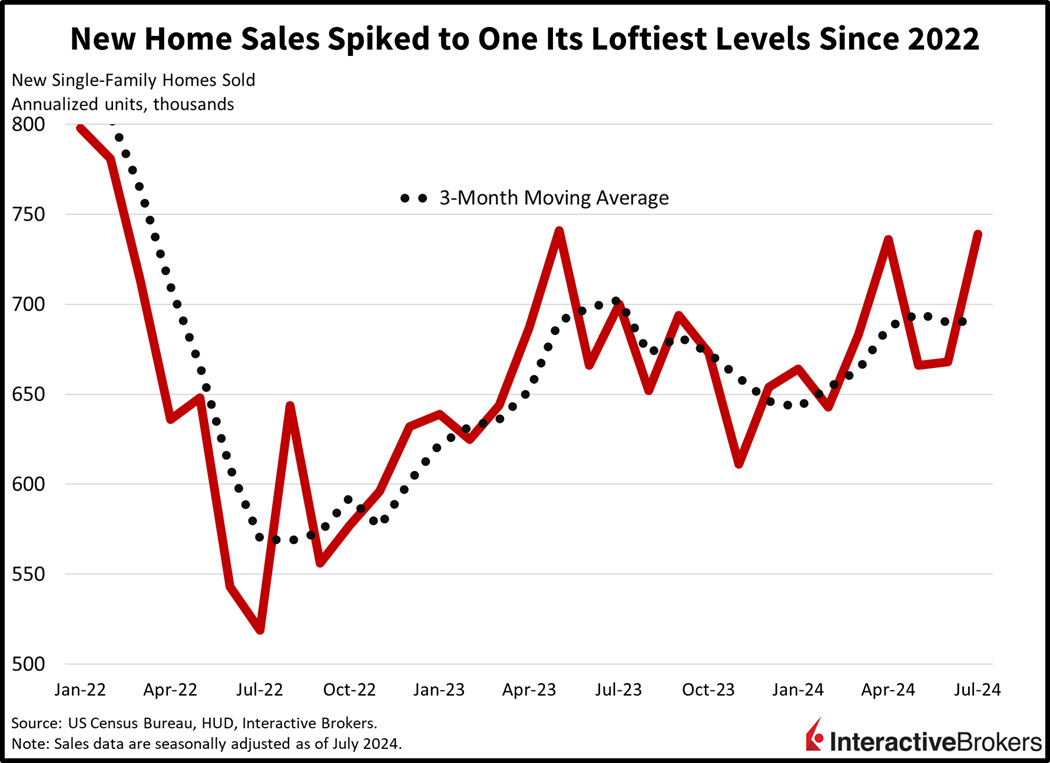

New Home Sales Jump

New home sales in July jumped to one of their tallest levels in over two years as mortgage rate relief brought in hungry, prospective buyers. Transactions jumped to 739,000 seasonally adjusted annualized units, a whopping 10.6% month-over-month (m/m) leap despite median estimates hovering at 630,000, which would’ve been 1% higher than June. We saw broad-based growth from sea to shining sea with the West, Midwest, Northeast and South sporting m/m progress of 33.8%, 9.9%, 6.9% and 2.9%. The median sales price also climbed, its second-consecutive monthly gain, moving to $429,800 from $416,700.

Artificial Intelligence Fuels Earnings Optimism

Artificial intelligence (AI) has led to Intuit providing an optimistic outlook, but in the retail segment, discount-store operator Ross is cautious regarding the spending clout of low-to-middle income customers. On a positive note, Mediterranean restaurant operator Cava has increased its guidance following a strong quarter. Consider the following earnings highlights:

- Intuit (INTU) reported making progress with developing its AI program and announced results for its final-fiscal year quarter that exceeded analyst expectations for both sales and revenue. Its shares climbed 3% in after-hours trading yesterday. Overall revenue for the quarter ended July 31, 2024, increased 17% year over year (y/y), with the company’s small business and self-employment segment experiencing an even faster growth rate, a result of higher prices, customer growth and a more favorable product mix. The category includes Intuit’s QuickBooks Online Accounting service. However, revenue from Intuit’s Consumer Group declined, but was still in the low double digits. CEO Sasan Goodarzi says the company has “made meaningful progress with our AI-driven expert platform strategy that positions the company for durable growth in the future.” The service is intended to answer questions from Intuit software customers.

- Ross Stores (ROST) posted sales and earnings that exceeded analyst consensus expectations with revenue climbing 7% y/y. The company, which operates discount apparel brands Ross Dress for Less and dd’s Discounts, also generated same-store sales growth of 4%, surpassing the 2.9% rate anticipated by analysts. CEO Barbara Rentler, in a press release, struck a cautious tone with the following statement: “Our low-to-moderate income customers continue to face persistently high costs on necessities, pressuring their discretionary spending. In addition, our prior year sales comparisons become more challenging during the second half of the year amidst an external environment that is uncertain and volatile. As such, we continue to maintain a cautious approach to forecasting our sales.” Despite the cautious outlook, Ross Stores increased its annual earnings guidance. ROST shares jumped nearly 12% in premarket trading.

- CAVA Group (CAVA) shares rallied more than 16% this morning after the company posted second-quarter earnings and revenue that exceeded analyst expectations with results driven by a 14.4% y/y increase in same-restaurant sales, or nearly twice the rate anticipated by Wall Street. Net sales increased 35% and traffic to Cava locations grew at almost a double-digit rate. Among other factors, the introduction of a grilled-steak main dish has enticed customers to return to Cava restaurants, says Co-Founder and CEO Brett Schulman. The company increased its guidance for same-restaurant sales and the number of locations it expects to open this year.

The Game Ain’t Over Until the Fat Lady Sings

Markets are buoyant at the moment, but the game ain’t over until the fat lady sings. All equity indices are trading north but ladies and gentlemen, we haven’t touched all-time highs in over a month, can you believe that? Technically, what we’re seeing are lower highs in a weak seasonal period, which raises the odds of a retest of the early August lows. Remember, September is the worst month for equities on a historical basis but please keep in mind that history doesn’t repeat itself but if often rhymes. Thanks Mark Twain.

The Russell 2000, Nasdaq Composite, Dow Jones Industrial and S&P 500 benchmarks are up 3.4%, 1.4%, 1.1% and 0.8%. Every sector is participating with real estate, consumer discretionary and technology higher by 2.1%, 1.9% and 1.6%. Rates are plunging in a steepening fashion with the 2- and 10-year Treasury maturities changing hands at 3.93% and 3.81%, 8 and 5 basis points (bps) south on the session. The dollar is suffering as a result with its gauge lower by 73 bps as the greenback depreciates to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollar. Commodities are bullish, however, as financing relief helps the demand outlook with silver, crude oil, copper and gold higher by 2.6%, 2.4%, 1.7% and 1.1%. Lumber is probably much higher as well, but price quotes are frozen on several fronts so I can’t verify.

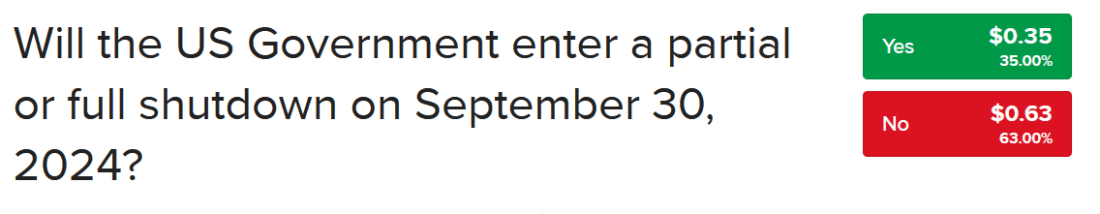

Here Comes Government Shutdown Anxiety

Another consideration for September volatility lies in the risk of a government shutdown. With Trump declining in the polls since Harris became the blue candidate, there’s elevated uncertainty regarding this event as Republicans may try to stir the pot. The good news is that you can hedge this out directly without worrying about erratic market reactions and focusing on the event itself. The Yes Forecast Contract looks attractive to me at $0.35.

Increased Focus on Earnings as Easing Cycle Starts

As the easing cycle starts next month, Wall Street will shift its focus from interest rates to fundamentals. Earnings performances will be critical, and we’re seeing fading momentum in profit projections on the back of expectations of margin compression. Consumers and corporates alike are balking at elevated prices and cost pressures are still tall as commodity and labor expenses build, putting pressure on profitability. Finally, Nvidia’s report next week will be pivotal to examine whether AI is going to be an economic growth driver right here, right now and not in the distant future. In conclusion, I’d like to point to yesterday’s commentary from the firm’s Chief Strategist Steve Sosnick on equity performance following past Jackson Hole symposiums.

To learn more about Forecast Contracts, please view our recent podcast with Wall Street Veteran and ForecastEx CEO David Downey here.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.