While the inflation figures tell a story of economic ebbs and flows, the real intrigue lies in how some savvy investments have not just survived but thrived in this landscape. Stay tuned to see how easy it is.

Historical inflation figures

The US inflation rate is cooling down after a two-year spike of historic proportions. The 9.1% inflation rate in July 2022 was the highest reading since the 14.8% peak of “the great inflation” in 1980.

Now back down to 3.1%, the American inflation metric stands within striking distance of normal long-term levels.

According to data from the Bureau of Labor Statistics, the average inflation rate of the last 25 years worked out to 2.6%. Despite a plethora of surges and dips over time, the multidecade level never strays too far from that point. The 50-year average (including the persistent oil crisis of the 1970s) was 4%, and the 100-year average (covering the Great Crash of 1929 and World War II) was 3%.

The relentless grind of inflation takes a serious bite out of your assets over time.

- The $1,000 you stuck under your pillow in 1999 had the same buying power as $1,869 today.

- The same $1,000 cash pile from 1974 is equivalent to $6,589 in current dollars.

- And jumping all the way back to 1924, $1,000 in your pocket in the Roaring Twenties would be worth $17,749 in 2024’s currency.

Luckily, there are many ways to beat the inflationary effect. Those 3% cuts stack up over time, but it’s actually quite easy to preserve your wealth with prudent investments. Let’s have a look at a couple of seemingly boring investments that more than make up for the average rate of inflation.

Beating inflation with dividends

Food and beverage manufacturer Kraft Heinz (KHC -1.71%) may not seem like a good way to protect your wealth against inflation. The stock has seen negative long-term returns since its initial public offering (IPO) in 2015 when the food veterans H.J. Heinz and Kraft Foods merged into a single company. The average annual price change in the Kraft Heinz era stands at a 7.3% loss.

But past results are not a guarantee of future returns, and the plain price move leaves the company’s generous dividend out of the equation. Let’s say that Kraft Heinz took more than enough stock-price damage between 2017 and 2019, and that you expect stable returns on shares bought today. Even if the stock trades sideways with a 0% price gain for the foreseeable future, Kraft Heinz still beats inflation through its robust dividend payouts.

The current dividend yield of 4.2% is actually lower than usual. Kraft Heinz has offered an average yield of 4.9% over the last five years. Either way, a 4.1% dividend yield easily balances out the average inflation pain.

So if you’re a classic income investor, more interested in steady and plentiful dividend checks than rising stock prices, Kraft Heinz could be exactly what you’re looking for. Master investor Warren Buffett’s Berkshire Hathaway (BRK.A 0.20%) (BRK.B 0.28%) still owns 26.5% of the company, pocketing $130 million of dividend payouts per quarter.

Three of Kraft Heinz’s 12 directors work for Berkshire Hathaway or one of its subsidiaries. It’s hard to bet against a Buffett-approved strategy, especially when Berkshire’s large investment gives it a nigh-on controlling influence over the company’s business strategy.

Beating inflation with super-stable ETFs

Buffett also likes exchange-traded funds (ETFs) broadly tracking the stock market. Berkshire holds nearly $38 million in ETFs matching the S&P 500 (^GSPC 0.57%) market index, evenly split between the Vanguard S&P 500 ETF (VOO 0.66%) and SPDR S&P 500 ETF Trust (SPY 0.57%) instruments.

Now, these market-tracking index funds do not beat inflation with dividends alone. Their annual yields stop at 1.4%, or about half of the average yearly inflation rate. But they make up for it with decades of reliable long-term returns and instant diversification.

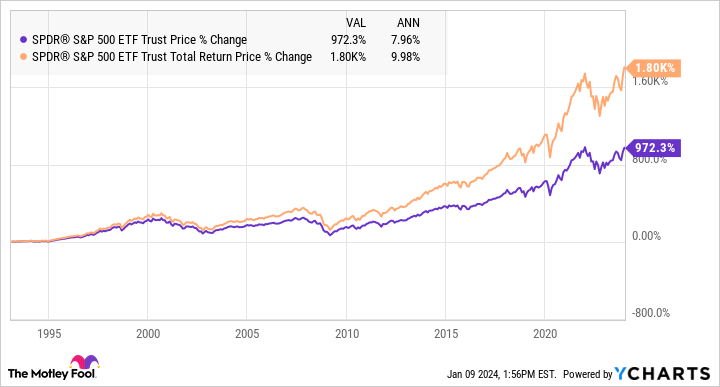

I’ll talk about the SPDR S&P 500 ETF Trust going forward, because it has been around since the 1990s, while the equally robust Vanguard ETF launched in 2010. They are indistinguishable for all intents and purposes, and either one is a fine investment.

A large collection of high-quality companies makes the S&P 500 a paragon of stability and steady returns. Sure, there are temporary dips in times of economic crisis such as the popping of the dot-com bubble, the Great Recession in 2008, or the COVID-19 pandemic with its long-term ripple effects. Still, the index always gets back on its financial feet again, and the long-lasting trend is undeniably wealth building.

The SPDR fund launched at the end of January 1993. Since then, it has offered an average annual return of 8% — or 10% if you reinvested its dividend payments in more ETF shares along the way:

Inflation rates have exceeded the fund’s recent returns from time to time, but the two metrics are worlds apart in a comprehensive long-term analysis. This perspective on stable, long-term investing aligns well with the philosophies of some of the most respected figures in the investment world.

For instance, Buffett’s longtime friend and peer, John Bogle — the head of Vanguard and often regarded as the creator of index funds — championed the idea of ultrastable investing strategies. Bogle’s vision of low-cost, diversified, and long-term-focused investing perfectly complements the essence of what ETFs like the SPDR S&P 500 can offer. His philosophy underscores the value of these types of investments, especially in an era where beating inflation is as much about wise asset allocation as it is about picking individual winners.

Anders Bylund has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Berkshire Hathaway and Vanguard S&P 500 ETF. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.